What is a 1099 Form?

A 1099 form is an IRS tax information return for reporting business-related nonemployee compensation paid, certain other payments, including royalties, miscellaneous information including any backup withholding, and interest and dividends. 1099 tax forms report retirement distributions, government payments like unemployment insurance, barter, real estate, and investment transactions.

Who Gets a 1099 Form?

Independent contractors receiving more than $600 in nonemployee compensation for business-related services or miscellaneous income payments and payees receiving over $10 in royalties, dividends, or interest receive an IRS 1099 form from the payer. Certain non-employees with backup withholding of federal income taxes also get a 1099 form.

We explain who gets a 1099 form MISC and NEC in more detail.

Recipients also receive 1099s for other types of income (taxable or non-taxable), including payment card and third party network transactions, retirement distributions, investment transactions, broker and barter exchange transactions, and real estate transactions from the payer for tax preparation.

Each business payer sends a copy of required 1099 forms to the IRS, state governments with income taxes, and the payee to use the tax documents to prepare their income tax return(s) for tax filing.

The IRS and state government agencies compare 1099 payments and miscellaneous information to a payee’s taxable income on their federal tax or state income tax return.

Types of 1099 Forms

1099-MISC

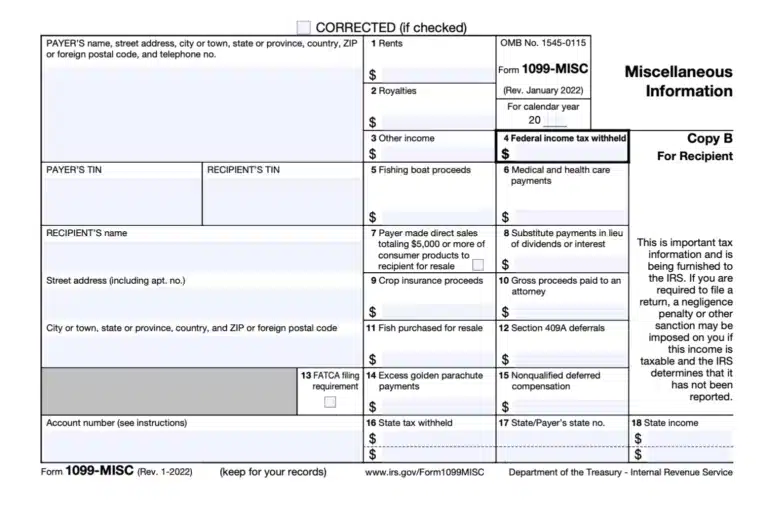

The definition of What is Form 1099-MISC (Miscellaneous Information), who should receive form 1099-MISC, and a link to 1099-MISC instructions for filling out the form follow.

What is IRS Form 1099-MISC?

Form 1099-MISC is used by payers in business to report specified miscellaneous payments other than nonemployee compensation (that are mostly $600 or more). Form 1099-MISC includes multiple boxes with the information required by the payee to file a U.S. tax return.

1099-MISC (or a different applicable 1099 form) is prepared for any person for which backup withholding for federal income taxes occurs (box 4). 1099-MISC – box 7 (or 1099-NEC – box 2) is used for payments of $5,000 or more for direct sales of consumer goods.

Form 1099-MISC is used to report royalties or broker payments instead of dividends or tax-exempt interest if the amount is at least $10.

Gross proceeds paid to attorneys for claims are still reported on Form 1099-MISC, instead of Form 1099-NEC, without separately reporting the attorney’s fees deducted from the claim proceeds.

Who Should Receive Form 1099-MISC?

U.S. payees filing a Form W-9 with the vendor should receive Form 1099-MISC for certain miscellaneous business payments received totaling at least $600, excluding nonemployee compensation (which is reported separately by the payer on Form 1099-NEC), and for other specified transactions described in IRS Form 1099-MISC instructions.

1099-MISC Instructions

Refer to IRS 1099-MISC instructions for specific reporting requirements.

1099-NEC

The definition of What is Form 1099-NEC (Nonemployee Compensation), who should receive form 1099-NEC, and a link to 1099-NEC instructions for filling out the form follow.

What is IRS Form 1099-NEC?

Form 1099-NEC is used by payers to report $600 or more paid in nonemployee compensation for business services. The IRS issued Form 1099-NEC for use beginning with tax year 2020 instead of Form 1099-MISC. Payers fill out the form, send it to independent contractors and attorneys paid at least $600 for services in a calendar year, and file a copy with the IRS. Report backup withholding for non-employee compensation in box 4 of Form 1099-NEC.

Who Should Receive Form 1099-NEC?

Independent contractors, like freelancers and real estate agents, in the U.S. (citizens or non-resident aliens) filing a Form W-9 and other business service providers not on the payroll (receiving Form W-2) should expect to receive Form 1099-NEC from each client exceeding the $600 or more reporting threshold. They should use Form 1099-NEC to file their U.S. federal income tax and state tax returns (usually on Schedule C).

Independent contractors are self-employed small business owners. To receive a 1099-NEC, these contractors need to provide client vendors with their taxpayer identification number (TIN), which is either a social security number (SSN) or employee identification number (EIN) for a U.S. individual or ITIN for a non-resident alien. These numbers, other than SSN, are issued by the Internal Revenue Service (IRS).

1099 NEC instructions

Refer to IRS 1099-NEC instructions for specific reporting requirements. 1099-NEC instructions cover which payments need to be reported on the Form 1099-NEC information return and which types of payments are not required. These instructions explain reporting payments to an attorney and note that services payments to non-employees of at least $600 include parts and materials.

1099-INT

Form 1099-INT is an IRS information return prepared by a financial institution like a bank or brokerage firm to report Interest Income of $10 or more paid to a recipient, foreign taxes withheld and paid on interest income, and any backup withholding of federal income taxes.

1099-DIV

Form 1099-DIV is an information return for Dividends and Distributions that financial institutions use to report at least $10 in dividends paid to recipients, capital gain distributions, and certain other investment-related items.

1099-G

Form 1099-G, Certain Government Payments, is used by U.S. government entities at the federal, state, and local levels to report specific types of payments made, including unemployment compensation, and also payments received by governments on a Commodity Credit Corporation (CCC) loan.

Types of government payments reported on a 1099-G IRS information return include:

- Unemployment compensation.

- State or local income tax refunds, credits, or offsets

- Reemployment trade adjustment assistance (RTAA) payments

- Taxable grants

- Agricultural payments

1099-K

Form 1099-K, Payment Card and Third Party Network Transactions, has stricter payment reporting threshold requirements. Although it was originally scheduled to begin with the 2022 calendar year, the IRS delayed implementation by two years to the 2024 calendar year’s payments (proposing a $5,000 transitional threshold instead of $600 for the 2024 calendar year) for smoother compliance. The IRS intent of the rule change is to capture payments for goods or services as taxable income that may have been previously unreported by taxpayers when they didn’t receive a 1099 form.

The 2024 and beyond revised IRS rule for completing form 1099-K requires reporting the amount of income-related third party network transactions by third party networks like PayPal, Venmo, or eBay for any number of transactions with cumulative amounts exceeding $600, except transitionally IRS is proposing a $5,000 threshold for calendar 2024 payments. The previous 1099-K reporting requirement was more than 200 business transactions with a combined total exceeding $20,000.

1099-R

Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., is an information return completed by businesses making distributions of $10 or more (or treated as distributions) to persons who are the payment recipients.

1099-R distributions are made from a recipient’s:

- Profit-sharing or retirement plans

- Any individual retirement arrangements (IRAs)

- Annuities, pensions, insurance contracts, survivor income benefit plans

- Permanent and total disability payments under life insurance contracts

- Charitable gift annuities, etc.

1099-B

Form 1099-B is used to report Proceeds from Broker or Barter Exchange Transactions. A broker or barter exchange uses form 1099-B to report these transactions to the recipient, the IRS, and state governments levying income taxes.

1099-S

IRS Form 1099-S is used to report Proceeds from Real Estate Transactions, including the sale or exchange of real estate.

1099 NEC vs 1099 MISC

Forms 1099 NEC vs 1099 MISC are IRS information returns. Payers use Form 1099-NEC to report business-related nonemployee compensation paid to independent contractors and backup withholding of federal income taxes. Payers use Form 1099-MISC to report Miscellaneous Information, certain payments, and any amount of backup withholding of federal income taxes.

When are Form 1099-MISC and Form 1099-NEC Due?

2024 Due Dates for 2023 Year

Forms 1099-NEC are due on January 31, 2024 (if filed either electronically or on paper). For the tax year 2023, Form 1099-MISC is due on February 28th, 2024 if filed on paper or April 1, 2024 if filed electronically. Payers no longer get an automatic 30-day extension. Payers are required to send the 1099-NEC and 1099-MISC forms to the payee by January 31, 2024 or send the 1099-MISC forms to the payee recipient by February 15, 2024 if amounts are reported in boxes 8 or 10.

Get automatic 1099 eFiling for your company.

Tipalti has optional Zenwork 1099 Tax eFiling integration for automatic eFiling of your 1099-MISC and 1099-NECs, using the last 12 calendar months of Tipalti payments data.

Who Doesn’t Need to Receive a Form 1099-MISC or 1099-NEC?

Generally, C corporations, S Corporations, and LLCs formed as corporations or S Corps don’t need to receive a 1099-NEC or 1099-MISC. On irs.gov, check the 1099-NEC instructions and 1099-MISC instructions for exceptions on when you are required to issue a 1099.

As an exception, attorneys should receive a 1099-NEC for services (except if deducted from a legal claim payment) and a 1099-MISC for legal settlement proceeds paid to attorneys, even if the attorney’s firm is a corporation. And certain healthcare payments should also still be reported for corporations and S-Corps on 1099 forms.

Generally, a 1099 is not required to be issued for international vendors who are foreign vendors.

Individuals living outside the United States who qualify to file an IRS Form W-8BEN as foreign persons/foreign contractors, and don’t perform services in the United States, don’t get a Form 1099-NEC. Form W-8BEN is Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals).

Beneficial owners in foreign countries complete different forms, depending on whether they perform personal services, which are Form W-8ECI or Form 8233 or Form W-4.

Foreign entities qualified to use Form W-8BEN-E don’t need to get a Form 1099-NEC for services performed or 1099-MISC, which includes interest and dividend income.

Forms W-8BEN and W-8-BEN-E also exempt foreign filers of certain other forms, including intermediaries that file Form W-8-IMY, from receiving a Form 1099-NEC and Form 1099-MISC.

1099 Rules

IRS Instructions for each type of 1099 form include 1099 rules for filing and types of transactions or information to include. Business-related non-employee compensation of at least $600, interest income, dividend income, and royalties payments to recipients of $10+, and any amount of backup withholding of federal income taxes are reported on a Form 1099.

W9 vs 1099

What is the difference between IRS Form W9 vs 1099? Form W9 is completed by independent contractors or other relevant U.S. persons and resident aliens and submitted to payers of business-related services or transactions. The payer uses form W-9 to file 1099-NEC and 1099-MISC forms.

1099 Form FAQs

Who needs a 1099 form?

Non-employee vendors like independent contractors paid for performing business-related services of $600+ or certain types of miscellaneous payments, having any amount of backup tax withholding, receive a 1099 form. The IRS and states with income taxes also receive Form 1099 from the payer. Payees use a 1099 to prepare their tax return(s).

1099 forms are sent by payers to recipients with interest income or dividend income of $10+, participating in investments, barter, and real estate transactions, or receiving retirement distributions, government payments like unemployment insurance, or state and local tax refunds. Third-party networks and credit card companies also issue form 1099-K for gross income totaling over $20,000 until the reporting of calendar year 2025 payments, a transitional threshold of $5,000 proposed by the IRS for calendar 2024, and with a $600 for all annual transactions in years after 2024 when the threshold change is fully implemented by the IRS. Copies of 1099 forms are also sent by the payer to federal and state tax agencies.

How do I get a 1099 form from the IRS?

Click here to order printed 1099 information return forms from the IRS.

Note that the red Copy A of a form 1099 sent to the IRS must be scannable. The IRS will impose a penalty if payers file a non-scannable Form 1099 Copy A with the IRS that’s downloaded from the IRS website.

What is a 1099 form used for?

A 1099 form is used as an information return prepared by a payer to report certain payments made to taxpayers and other required tax information. The payee recipient uses the information to file their federal and state tax return(s). The IRS receives a copy to verify the information on a tax return filed by the taxpayer.

Can I print my own 1099 forms?

You can’t print your own blank 1099 forms from the internet because Copy A of a form 1099 sent to the IRS must be scannable. You must use official IRS forms. Order each type of printable 1099 form that you need online from the IRS.

For 1099 filings beginning January 1, 2024, for the 2023 calendar year, the requirement threshold for filing 1099s electronically (instead of on paper) was reduced from 250 forms to only 10 forms.

You can use tax software to print 1099s on the official IRS 1099 forms or file 1099 forms electronically.

Is there a new 1099 form?

1099 forms were changed to make separate 1099-NEC and 1099-MISC forms, beginning with the 2020 tax year. In prior years, these 1099 forms were combined. The 1099-NEC and 1099-MISC forms were revised in January 2022, with some box or line changes and a heading space to indicate the prior calendar year for which payments are being reported.

Summary

1099 Forms are IRS information returns used to report information to the IRS and states for multiple purposes. For commonly used IRS forms like 1099-MISC and 1099-NEC, we provide more detailed information in other articles.

We also provide articles about Form W-9 and various W-8 forms that global suppliers complete for payers to use in preparing their form 1099s to report calendar year payments. To understand global supplier tax compliance, access the white paper.