Payers of Nonemployee Compensation of $600+ in services to independent contractors and self-employed small business owners related to a trade or business complete IRS Form 1099-NEC to report payments. 1099-NEC also reports certain attorney fees. The 1099-NEC lets you check a box for direct sales of $5,000 or more of consumer goods to a recipient for resale (Box 2) that aren’t reported instead on 1099-MISC.

Form 1099-NEC is a new form issued by the IRS beginning with the tax year 2020. In a prior year, non-employee compensation was reported on Form 1099-MISC. IRS Form 1099-MISC was redesigned to remove non-employee compensation but is still used to report other Miscellaneous Information, certain miscellaneous income payments, and any backup withholding of federal income tax.

This article isn’t intended to give you tax or legal advice. Consult your CPA or attorney and read Form 1099-NEC instructions, including filing requirements, on the Internal Revenue Service website at irs.gov.

IRS Form 1099-NEC for Reporting Prior Calendar Year Nonemployee Compensation

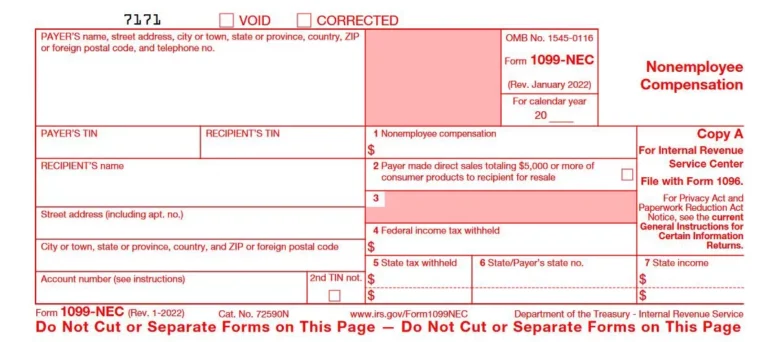

A screenshot of IRS Form 1099-NEC (Copy A for the IRS) – information-only version, is shown below to help you understand the 1099-NEC instructions:

The sample Form 1099-NEC is used to report Nonemployee Compensation payments made by businesses in the prior calendar year. For example, if you are completing Form 1099-NEC in January 2024, you will indicate the form is “For calendar year” 2023.

The 1099 form is a combined federal/state information return, with a copy furnished to the recipient payee.

The 1099-NEC information return for the tax year 2023 has a 2024 due date. Payees must file Form 1099-NEC by January 31, 2024, whether filing electronically or on paper.

Form 1099-NEC Information Not Included in Numbered Boxes

Form 1099-NEC requires the payer’s and recipient’s name, contact information, taxpayer identification number (TIN), and an account number. The payer assigns an account number to identify the recipient in their system uniquely.

The IRS issues some TINs like an employer identification number (EIN) and individual taxpayer identification number (ITIN) for resident aliens receiving Form 1099-NEC (and nonresident aliens) after they submit Form W-7. The Social Security Administration issues the social security number (SSN) used as a TIN by an individual U.S. citizen.

For security purposes, the 1099-NEC filer may present only the last digit of the TIN except on the IRS copy, which includes all TIN digits.

Form 1099-NEC includes four checkboxes. If a Form 1099-NEC is Void or Corrected, check the applicable box at the top of the form. Check the appropriate box if the 2nd TIN Notice applies. In Box 2, you will check the box if “Payer made direct sales totaling $5,000 or more of consumer products to recipient for resale.”

The “2nd TIN not.” box may be checked when the IRS sent the filer notice twice in the last three calendar years that the payee used an incorrect TIN.

But don’t check the 2nd TIN Notice box if you received the two notices from the IRS in the same year or if you received notices in different years for information tax returns for the same year. When you check the box, the IRS will stop sending you notices about the payee’s account.

Filers are assessed per-form penalties by the IRS for a missing or incorrect TIN (or missing name). But they may be able to reverse the penalties by promptly notifying the IRS of a good reason that’s not willful neglect and correcting the form(s).

Form 1099-NEC Information in Numbered Boxes

The numbered Form 1099-NEC boxes are:

- Nonemployee compensation

- Payer made direct sales totaling $5,000 or more of consumer products to recipient for resale

- Not used

- Federal income tax withheld

- State tax withheld

- State/Payer’s state no. (number)

- State income

Form 1099-NEC Box 1 – Nonemployee compensation

Report nonemployee compensation of $600 for services (including any parts and materials) or more in Box 1 of Form 1099-NEC. Also, report certain attorney fees, other professional services fees, expert witness fees, and other types of items specified in the IRS instructions.

Payments in Box 1 are generally subject to self-employment tax to be paid by the recipient to the IRS.

Form 1099-NEC Box 2 – Payer made direct sales totaling $5,000 or more of consumer products to recipient for resale

Check the X in Box 2 to indicate that the payer filing Form 1099-NEC made these direct sale payments of at least $5,000. Don’t include the payment amount. For this item, you can choose to use Form 1099-MISC instead of this box on Form 1099-NEC.

Form 1099-NEC Box 4 – Federal income tax withheld

In Box 4 of Form 1099-NEC, report any amount of federal income tax withheld under the backup withholding rules for any payment amount.

Form 1099-NEC Box 5 – State tax withheld

Enter state income tax withheld in Box 5.

Form 1099-NEC Box 6 – State/Payer’s state no. (number)

“In box 6, enter the abbreviated name of the state and the payer’s state identification number. The state number is the payer’s identification number assigned by the individual state” for state filing.

Form 1099-NEC Box 7 – State income

Enter state income in box 7.

How can your business reach nonemployee tax compliance?

Find out how to “Maintain Year-Round Corporate Tax Compliance with Automation,” including IRS nonemployee compensation reporting.

Form 1099-NEC FAQs

How Do You Use IRS Form W-9 to Complete Form 1099-NEC?

A payee submits Form W-9 (not Form W-2 used for employees) to the payer for preparing Form 1099-NEC to report nonemployee compensation. The payee is a U.S. person taxpayer using the 1099 information to prepare their income tax return for federal income tax and state tax form, if applicable, and calculate and pay self-employment taxes.

What is Considered a Trade or Business for Form 1099-NEC Reporting?

Businesses that operate intending to make gains or profits are considered a trade or business. Trade or business also includes nonprofit organizations and other organizations specified by the IRS Instructions for Form 1099-NEC. Filers shouldn’t include personal payments on Form 1099-NEC.

According to the IRS Form 1099-NEC instructions:

“Other organizations subject to these reporting requirements include trusts of qualified pension or profit-sharing plans of employers, certain organizations exempt from tax under section 501(c) or 501(d), farmers’ cooperatives that are exempt from tax under section 521, and widely held fixed investment trusts. Payments by federal, state, or local government agencies are also reportable.”

What are IRS Exceptions for Reporting Payments on Form 1099-NEC?

The IRS general Instructions for Form 1099-NEC provide the following exceptions for reporting payments on Form 1099-NEC:

“Payments for which a Form 1099-NEC is not required include all of the following.

• Generally, payments to a corporation (including a limited liability company (LLC) that is treated as a C or S corporation). However, see Reportable payments to corporations, later.

Generally, payments to a corporation (including a limited liability company (LLC) that is treated as a C or S corporation). However, see Reportable payments to corporations, later.

• Payments for merchandise, telegrams, telephone, freight, storage, and similar items.

• Payments of rent to real estate agents or property managers. However, the real estate agent or property manager must use Form 1099-MISC to report the rent paid over to the property owner. See Regulations sections 1.6041-3(d), 1.6041-1(e)(5), Example 5, and the instructions for box 1.

• Wages, any bonuses, prizes, and awards paid to employees (report on Form W-2, Wage and Tax Statement).

• Military differential wage payments made to employees while they are on active duty in the Armed Forces or other uniformed services (report on Form W-2).

• Business travel allowances paid to employees (may be reportable on Form W-2).

• Cost of current life insurance protection (report on Form W-2 or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.).

• Payments to a tax-exempt organization including tax-exempt trusts (IRAs, HSAs, Archer MSAs, Coverdell ESAs, and ABLE (529A) accounts), the United States, a state, the District of Columbia, a U.S. possession, or a foreign government.

• Payments made to or for homeowners from the HFA Hardest Hit Fund or similar state program (report on Form 1098-MA).

• Compensation for injuries or sickness by the Department of Justice as a public safety officer disability or survivor’s benefit, or under a state program that provides benefits for surviving dependents of a public safety officer who has died as the direct and proximate result of a personal injury sustained in the line of duty.

• Compensation for wrongful incarceration for any criminal offense for which there was a conviction under federal or state law. See section 139F, Certain amounts received by wrongfully incarcerated individuals.”

Difficulty-of-care payments are excludable from the recipient’s gross income unless amounts are paid for more than ten children under age 19 or more than five other individuals under age 19. Other exceptions may apply related to Medicaid, classified as difficulty-of-care payments.

How Do Payers Distribute and Submit IRS Form 1099-NEC?

Payers send a copy of the completed 1099 information returns to the payee, the IRS, and states with income tax. The payers batch all paper 1099-NEC returns completed using transmittal form 1096 when they file form 1099-NEC with the IRS. Form 1096 is titled Annual Summary and Transmittal of U.S. Information Returns.

Efiling vs. scannable paper 1099 forms

Effective in 2024, for reporting 2023 calendar year payments, the IRS and Treasury Department have changed eFiling vs. paper filing requirements for 1099 forms. With this change, if a threshold of 10 or more 1099 forms are being filed, instead of 250 1099 forms as a threshold, eFiling is required instead of paper 1099 form filing. The IRS has a new portal for eFiling. Use e-filing (electronic filing) Form 1099-NEC when required to avoid penalties.

Your tax software may have a feature for completing form 1099s for electronic or paper filing. If you choose to use printable forms, order scannable official forms online (with red IRS copy A) for 1099-NEC from the IRS website.

Downloading 1099 forms from the IRS website isn’t allowed because they’re not scannable. The IRS can impose a penalty on payers for filing non-scannable 1099s.

What Should a Recipient Do if the Information on Form 1099-NEC is Incorrect?

The recipient should request a corrected Form 1099-NEC from the payer filing the Form 1099-NEC. If the payer doesn’t issue a corrected form, the recipient should use the correct information and attach a note of explanation when submitting the tax return(s).

Summary

Payers like your business fill out Form 1099-NEC for Nonemployee Compensation using the W-9 or W-8 Forms submitted by payees. It’s important to track independent contractor payments and other payments requiring reporting on IRS Form 1099-NEC. Discover related content about global supplier tax compliance rules.