The Internal Revenue Service (IRS) requires several types of 1099 forms to be completed and distributed by a business payer as information returns to the payee and federal and state taxing authorities.

This guide focuses on Form 1099-NEC for Nonemployee Compensation payments to independent contractors and Form 1099-MISC to report Miscellaneous Income payments with a reporting threshold of at least $600 in most cases. These reportable payments are made in the course of your trade or business.

This article should not be relied on for tax return preparation or advice. Consult your CPA and attorney and read the IRS Instructions on its website.

To Which Calendar Year Does Form 1099 Reporting Apply for 2024?

1099 forms due in 2024 apply to payments made in the calendar year 2023.

What is the Business Process for Form 1099 Rules Compliance for 2023?

To comply with IRS 1099 rules for 2023, businesses should:

- Review 2023 IRS 1099-NEC and 1099-MISC Instructions.

- Decide whether your business needs to file other types of Form 1099.

- Determine who needs to submit an IRS form W-9 (or foreign equivalent) to the company.

- Confirm that all required W-9 forms have been received for preparing 1099-NEC forms and 1099-MISC forms.

- Remember to report backup withholding of income taxes on Form 1099s.

- Review 2024 tax compliance deadlines and e-file requirements, including eFiling requirement changes beginning January 1, 2024.

- Order official IRS 1099 forms online If your business uses paper filing instead of e-filing.

- Determine that 1099 amounts tracking is adequate or make corrections.

- Distribute copies of 1099s to the payees, the IRS, and any state with income taxes (using required IRS transmittal forms for paper copies).

- Meet IRS deadlines and requirements to avoid fines and penalties for non-compliance and late filing.

What are IRS Form 1099 Rules for 2023?

1099 rules for businesses in 2023 cover:

- Types of 1099 Items to report

- Types of Payees for 1099 forms

- Exemptions for Filing 1099 forms

- 1099 filing deadlines in 2024 for 2023

- 1099 fines and penalties in 2023

- How to distribute and file IRS Form 1099

Types of 1099 Items to Report for 2023 in 2024

The 1099 rules for types of items to report for 2023 in 2024 on Form 1099-MISC and 1099-NEC per IRS Instructions generally apply to income payments of at least $600 and backup withholding of federal and state income taxes.

Special rules apply to payments made to attorneys or law firms and how to report legal settlements vs legal services on Form 1099.

There are differences in some types of items to report on the 1099-NEC vs 1099-MISC forms, so they are detailed separately below.

Form 1099-MISC Rules for Reporting Items

The 2023 IRS 1099 rules for Form 1099-MISC (for 2024 filings) require business payers to report payments of $600 or more for specified types of income and other payments, at least $10 in royalty payments, backup withholding of income taxes, and if your business made direct sales of at least $5,000 of consumer products to a buyer without a permanent retail establishment for resale.

The IRS lists miscellaneous types of payments of at least $600 to include on Form 1099-MISC as:

- “Rents.

- Prizes and awards.

- Other income payments.

- Medical and health care payments.

- Crop insurance proceeds.

- Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish.

- Generally, the cash paid from a notional principal contract to an individual, partnership, or estate.

- Payments to an attorney.

- Any fishing boat proceeds.”

Besides royalties, the $10 floor for reporting on Form 1099-MISC applies to broker payments in lieu of dividends or tax-exempt interest.

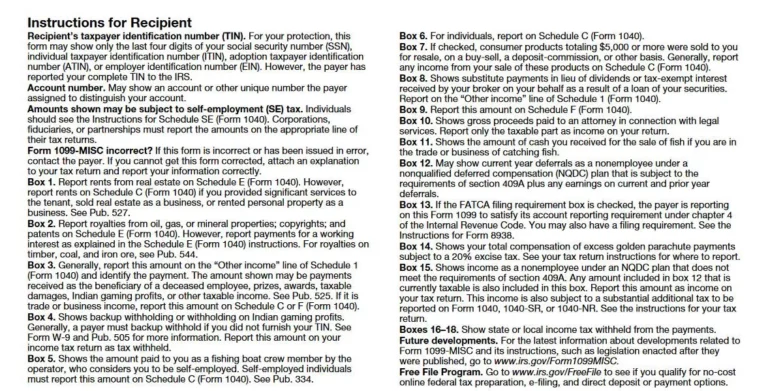

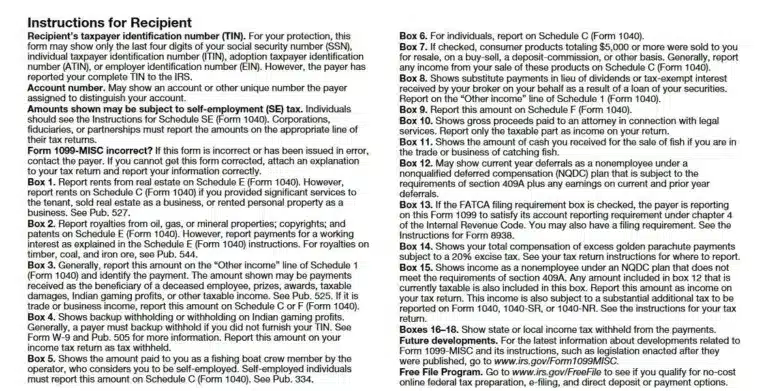

For more detailed 1099 rules, the Instructions for Recipient for 2023 Form 1099-MISC (form revised 1-2022) are shown in the screenshot below:

Form 1099-NEC Rules for Reporting Items

The 2022 IRS 1099 rules for tax form 1099-NEC require business payers to report payments of $600 or more for income payments to nonemployees, if your business made direct sales of at least $5,000 of consumer products to a buyer without a permanent retail establishment for resale, and the amounts of backup withholding for federal income taxes and state tax.

Examples of nonemployees include self-employed independent contractors like freelancers and most real estate agents completing real estate transactions (unless they’re an employee).

Nonemployees that qualify as independent contractors use Form W-9 instead of Form W-2 for employees to report their information, including Taxpayer Identification Number (TIN) and mailing address. The TIN may be a Social Security Number (SSN) or Employer Identification Number (EIN). The TIN must be correct on each 1099 filed by the business.

Who is Exempt from Issuing a 1099 Form?

If businesses don’t have any recipient’s payments totaling at least $600 for most item categories or $10 for royalties), haven’t made backup withholding of income taxes from payments of any amount, or don’t need to report specified form items, they are exempt from issuing and filing Form 1099 MISC and 1099-NEC.

If a foreign contractor is a non-U.S. person and performs all work outside the U.S., then a form 1099 may not be required by your business. But get them to file a Form W-8BEN to certify that they’re not a U.S. taxpayer.

Does your business automate global supplier taxes?

Find out how automation can improve your business productivity for completing 1099 forms and reduce risks in handling payables.

Types of Payees for 1099 Forms for 2024 Filings

Types of payees are different for IRS Form 1099-MISC and 1099-NEC forms filed in 2024 for calendar 2023 payments. Although both 1099 forms apply to business-related payments in the course of conducting a trade or business, form 1099-MISC applies to payees in general, while Form 1099-NEC applies to nonemployees like independent contractors and attorneys.

The IRS issues specific 1099 rules on what qualifies as a 1099 vendor. Consult the 2023 IRS Instructions for each particular 1099 form prepared.

1099 Filing Deadlines in 2024

For 2023 payments, 1099 filing deadlines for the issuer of Form 1099-MISC and 1099-NEC are different.

According to the IRS 2023 General Instructions for Certain Information Returns:

“File and furnish a copy of Form 1099-NEC on paper or electronically by January 31, 2024. File Form 1099-MISC with the IRS by February 28, 2024, if you file on paper, or April 1, 2024, if you file electronically.”

Business payers must issue 1099s on Form 1099-MISC to recipients by January 31, 2024, or February 15, 2024, if amounts are reported in boxes 8 or 10. Payers must issue Form 1099-NEC to recipients by January 31, 2024. The recipient taxpayers use form 1099 to complete their income tax return(s).

Before 2023 tax returns filed beginning January 1, 2024, filers of 250 or more information returns (including 1099s) of each specific type must file electronically, as described in IRS Topic No. 801to avoid fines and penalties (although they may choose to file 249 of the forms on paper). But beginning with 2023 year 1099 returns, the threshold for electronic filing has been changed from 250 to only 10 returns filed.

According to IRS 2022 General Instructions for Certain Information Returns, revised February 8, 2022:

“The Taxpayer First Act of 2019, enacted July 1, 2019, authorized the Department of the Treasury and the IRS to issue regulations that reduce the 250-return requirement for 2022 tax returns. If final regulations are issued and effective for 2022 tax returns required to be filed in 2023, we will post an article at IRS.gov explaining the change. Until final regulations are issued, however, the number remains at 250, as reflected in these instructions.”

1099 Penalties in 2024 for 2023

IRS penalties for untimely, incorrect, incomplete, or non-filing of 1099 returns and other information returns are specified in the Internal Revenue Code sections IRC 6721, IRC 6722, and IRC 6723. The penalties apply to each 1099 form, and the total amounts can be quite large.

The 1099 penalties or fines applying to filing Form 1099s for 2022, according to IRS General Instructions for Certain Information Returns (2023), are:

“The amount of the penalty is based on when you file the correct information return. The penalty is as follows.

- $60 per information return if you correctly file within 30 days (by March 30 if the due date is February 28); maximum penalty $630,500 per year ($220,500 for small businesses, defined below).

- $120 per information return if you correctly file more than 30 days after the due date but by August 1; maximum penalty $1,891,500 per year ($630,500 for small businesses).

- $290 per information return if you file after August 1 or you do not file required information returns; maximum penalty $3,783,000 per year ($1,261,000 for small businesses).

If you do not file corrections and you do not meet any of the exceptions to the penalty described later, the penalty is $310 per information return.”

In the same General Instructions, the IRS defines small businesses as:

“Small businesses—lower maximum penalties.

You are a small business if your average annual gross receipts for the 3 most recent tax years (or for the period you were in existence, if shorter) ending before the calendar year in which the information returns were due are $5 million or less.”

The IRS specifies some exceptions to these penalties. A penalty doesn’t apply to any failure due to reasonable cause and not willful neglect or inconsequential errors or omissions. Penalties won’t be charged on a certain number of returns if the de minimis rule applies.

However, the IRS increases per information return penalties (applying to 1099s) and removes the maximum penalty in the case of intentional disregard of filing requirements.

According to the IRS General Instructions for Information Returns:

“If any failure to file a correct information return is due to intentional disregard of the filing or correct information requirements, the penalty is at least $630 per information return with no maximum penalty.”

How to Distribute and File IRS Form 1099s for 2023

IRS instructions and 1099 form copies indicate who is required to receive a 1099 form and which copy they receive. Recipients include the payee, the IRS, and any state levying income taxes.

By the 2024 deadline for the year 2023, attach an official IRS transmittal Form 1096 to send paper-copy 1099 forms to the IRS. No transmittal form is required to file electronically.

Other Types of 1099s for 2023

Although our focus is on Forms 1099-MISC and 1099-NEC, businesses may need to file other types of form 1099 as information returns.

Refer to IRS 2023 General Instructions for Certain Information Returns to find a complete list of types of 1099 forms for businesses. Then look at the specific instructions for that form to discover its IRS 1099 rules, including reporting requirements.

Other types of 1099 forms include 1099-DIV, 1099-INT, and 1099-B to report interest and dividend payments and investment or barter proceeds, and Form 1099-K.

Form 1099-K is for Payment Card and Third Party Network Transactions reporting. Form 1099-K applies to credit cards and other types of payment card processing for which the business receives proceeds. Companies like PayPal, Venmo, and eBay may be used for making taxable payments to independent contractors and others.

A big change beginning with the calendar year 2024 (after a two-year implementation delay by the IRS for smoother implementation) is that PayPal and other third-party networks are required to report any taxable transactions totaling at least $600 for the calendar year starting for 2025 payments and a transitional threshold of $5,000 proposed by the IRS for 2024 payments. (For years up to 2023 payments, the Form 1099-K reporting requirement is for payees with over 200 transactions totaling over $20,000.)

Consult your CPA about requesting a corrected Form 1099-K from the issuing third-party network like PayPal and handling any required corrections to your 1099-K form and tax return reporting if the reported 1099-K transactions include non-taxable amounts or have other errors.

You’ll find more types of 1099s and extensive Form 1099 information return information provided by the IRS on their website, https://www.irs.gov.

Can Your Business Automate 1099 Tax Compliance in 2024?

To gain efficiency in 2024 reporting for the 2023 calendar year, consider whether your accounting software or ERP system can handle Form W-9 and 1099 reporting efficiently. With add-on AP automation and global mass payments software integrating with your accounting software or ERP, your company can shift part of the workload to the supplier. Automation software also checks supplier tax IDs against a database for authenticity and accuracy and helps prevent payments fraud.

If required to submit a W-9, the supplier uploads IRS Form W-9 (or foreign equivalent) through a supplier portal before they receive their first payment. This automated process eliminates the need to request missing W-9 forms later and increases accuracy. To improve global supplier tax compliance, access white paper.