Accounts Payable Research Finds that Fraud, Data Security Among Top Concerns as Cross-Border Payments Rise to 83%

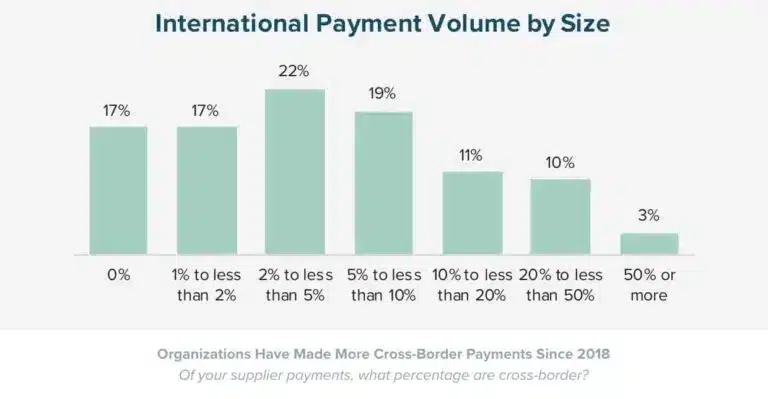

San Mateo, CA – December 11, 2019: A new independent study on the state of accounts payable conducted by Levvel Research and commissioned by Tipalti, the leading global payables automation solution, highlights the ongoing challenges in dealing with fraud as cross-border payments increase in frequency. Levvel Research found that the majority of companies (83%) made cross-border payments in 2019 – a 10% increase over the prior year. However, fraud remains a top concern as firms expand their global reach.

“There’s no denying that cross-border payment processing are on the rise and that they are more complex than domestic transactions,” explained Anna Barnett, Director of Research, Levvel. “Businesses are realizing that they are exposed to fraud risk unless they put in place new controls.”

Surveying more than 450 professionals from North American organizations across a variety of industries and market segments, Levvel Research found that 33% of businesses are worried about fraud. Other notable concerns include data security (26%), local tax and regulatory requirements (26%), the challenge of monitoring supplier information for regulatory compliance (23%), and the growing volume of international payments (19%).

“The more international payments a business processes, the more likely it is to endure increasing pain points, including significant increases in AP workload, higher payment error rates, and increased tax and fraud risk exposure,” said Chen Amit, CEO of Tipalti. “Strong international payments policies and processes not only address these challenges but also help to protect an organization from various issues, including financial, data security, and reputational risks.”

Additional research findings include:

- Most Popular Payment Methods: Most organizations make their international payments through wire transfers (69%), which remain attractive despite having very high transaction costs and fast-growing fraud risks. This is followed by PayPal (38%), local ACH transfers / Global ACH (29%), checks (29%), and prepaid debit cards (17%), the latter of which incurs a high number of errors.

- ePayments: Electronic payments (ePayments) solutions not only bring down the costs of cross-border payments, they also help organizations properly manage them. This allows enterprises to keep up with global expansion as their international operations mature.

- Domestic vs. Cross-Border: Nearly one-fourth (24%) of businesses recognize that they have a knowledge gap regarding international payments processes, while 26% say they have a challenge meeting local tax and regulatory requirements

“Many AP departments are struggling to keep up with a globalizing market and the changing state of their supply chain,” Amit added. “To survive, organizations need a more modern, efficient approach that eliminates wasted time, manual labor, and errors while putting controls in place that minimize risk exposure.”

About Levvel

Levvel helps clients transform their business with strategic consulting and technical execution services. We work with your IT organization, product groups, and innovation teams to design and deliver on your technical priorities, from digital strategy to implementation. Levvel Research, formerly PayStream Advisors, is Levvel’s market research and advisory group focused on many areas of innovative technology, including electronic payments, Procure-to-Pay, and other business process automation areas. Levvel Research’s reports, white papers, webinars, and tools are available free of charge at www.levvel.io