Any business, big or small, has recurring payments. Whether it’s paper for the office or raw materials for construction, there is a need to consistently buy the same items, over and over again. It can be a timely and costly process, especially if you’re running a small operation.

The good news is there are mechanisms in place to simplify the logistics and planning for everyone involved. One of them is called a blanket purchase order, and it exists to make your job a little easier.

Key Takeaways

- A blanket purchase order is a long-term contract for recurring orders with multiple payments.

- A BPO should include important details like quantity, date, PO number, and description.

- A blanket purchase order is for an extended period, while a single PO is for a one-off.

- Less time, lower costs, and fixed prices are all advantages of BPOs.

- Changing market value, decreased demand, and poor vendor performance are all disadvantages of BPOs.

What is a Blanket Purchase Order (BPO)?

A blanket purchase order (or standing purchase order) is a long-term contract between a supplier and an organization that states the supplier will provide goods or services at a set price over a specific time period.

This allows a group of invoices to be categorized under a single PO number, which results in less time for invoice processing and a more consistent delivery schedule.

When creating a blanket purchase order, both sides must agree on a set price and time period. This way, the buyer can take advantage of the same unit price during the contract, while the seller is guaranteed sales throughout the extended period.

This minimizes the risk of price fluctuation and helps with better planning. Once shipments are underway, as long as the quality and quantity are correct, the BPO continues without disruption.

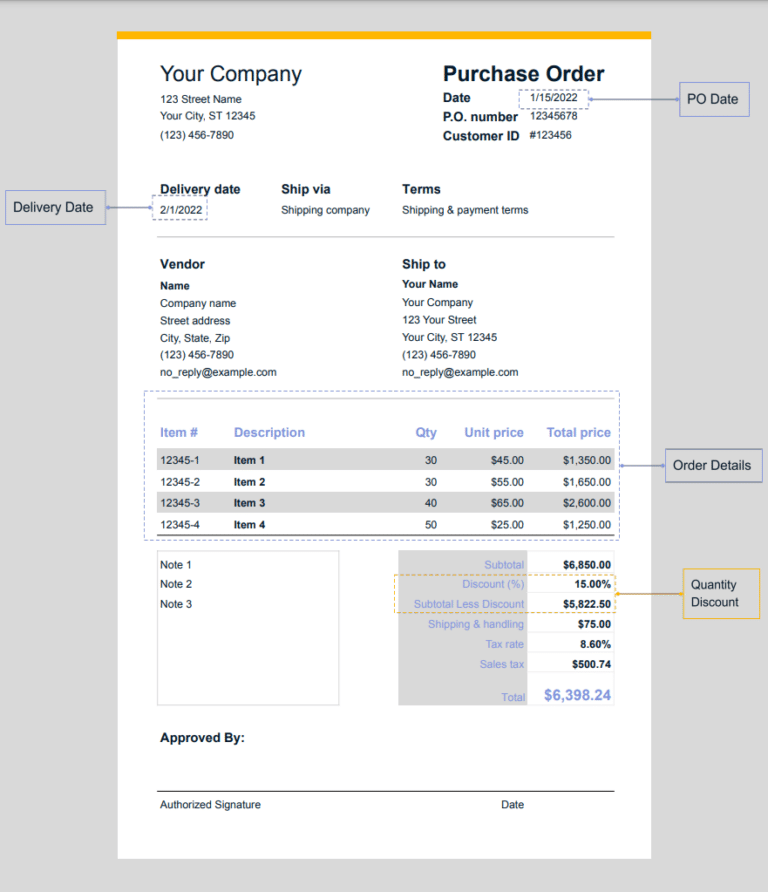

Template Example of a Blanket Purchase Order

Examples of some common BPOs include:

- Standing purchase orders

- Maintenance contracts

- Service contracts

- Open orders

Blanket purchase orders are used by a variety of organizations, from municipalities to commercial companies, universities, and small businesses. Many of the larger enterprises have protocols in place for exactly how blanket purchase orders are used.

What’s Included in a Blanket Purchase Order?

A blanket purchase order is not exactly the same as a contract. In the beginning, it’s closer to a requisition order. It’s an offer from a client to buy from a supplier and marks the start of the purchasing process. Once accepted by the vendor, it then becomes a binding contract and a legal document.

Given that, a BPO must lay out several important contract terms, like:

- Contract period – start and end dates

- Product quantity and quality

- Specific purchase order number

- A fixed price for the shipments

- Specified time and location of delivery

- Preferred method of invoicing and payment

- Cancellation policy

These are just the basics. You can customize a blanket purchase order according to contract negotiations, specific circumstances, project needs, the list goes on.

Different Purchase Orders vs Blanket Purchase Order

B2B transactions require a paper trail, detailed planning, and concise communication for auditing and compliance purposes. Hence the need for purchase orders. They help to verify the details of what’s being procured, the amount, vendor details, how delivery will be handled, and much more.

Types of Purchase Orders

There are many types of purchase orders a business works with, including:

Regular Purchase Order (PO)

A regular purchase order generally covers one-time transactions and any sudden demands that must be fulfilled short-term. The details of a regular PO are very specific since you’re only covering a single purchase. This includes exact costs, quantities, and fulfillment schedules.

Blanket Purchase Orders (BPO)

Referred to by many names, like standing orders or BPOs, blanket purchase orders are used when a company needs the same goods or services, on a recurring basis, over a specific period of time (like a quarter or year). In this case, the delivery schedule may or may not be set ahead of time.

Planned Purchase Orders (PPO)

These documents function similarly to regular purchase orders, except that the date and time of the delivery isn’t usually specified. The buyer merely waits until the need arises, then asks for the delivery to be released.

function similarly to a regular purchase order except that the date and time of the delivery is not specified. The buying company merely waits until the need arises and then asks for the delivery to be released.

Contract Purchase Orders (CPO)

This type of purchase order doesn’t outline the exact items involved in the transaction. It merely works as a legal template for future orders.

Key Differences

The biggest difference between a regular purchase order and a blanket purchase order is the time frame. While a regular PO is used for a short period of time, a blanket purchase order lasts for an extended period, with a definitive start and end date.

The key difference between the two include:

Details

For a single PO, a business should specify as much as possible about the order. On the other hand, a blanket purchase order with multiple deliveries can afford to be broad. Purchase orders will describe specifics like part numbers while a BPO is more likely to describe a high-level need.

Length

A BPO is a long-term agreement with a supplier, with a start and end date, rather than a single contract for a one-time purchase. Blanket orders are typically created annually or quarterly.

It’s making a long-term agreement with a supplier that includes a set start and end date, rather than a single contract for a one-off purchase.

Volume

The volume of orders changes with a BPO because a business is buying more than they would from a single PO.

Deliverable

Blanket purchase orders are more often used for services, rather than products. That’s because there’s more of a recurring demand for services.

Amount

Every purchase order has a set amount, whereas a BPO might not. It can remain open.

Don’t select software for basic requirements.

You need to dig deeper and find a solution with complete AP efficiency

When Should a Blanket Purchase Order Be Used?

Every type of purchase order starts with a genuine need for products and/or services and a good supplier you can trust. A blanket purchase order is created when those same products/services are needed for an extended period of time.

When the unit cost can be well defined, details specified, and a single vendor capable of delivering, it’s a good time to consider a blanket purchase order.

There are certain circumstances in which using a BPO is ideal, including (but not limited to):

- Parties can decide on a set unit cost

- You can trust a single vendor to handle the entire need

- Bulk discounts can be applied to large orders

- Building long-term supplier relationships is important

- You need to make separate purchases with multiple payments

- When a projected need will stay consistent throughout a period of time

When a Blanket Purchase Order Shouldn’t Be Used

If you are considering a BPO, but aren’t sure it’s a good fit, don’t use them in these circumstances:

- The pricing may fluctuate or lower in the future

- The vendor is not reliable and may deliver late or not at all

- The need for the product/service may change soon

If in doubt, don’t create the BPO and use a single one.

The Blanket Purchase Order Process

The exact workflow for a BPO process will differ depending on the business, but here’s a general guide on what happens:

#1) Do Your Research

Before jumping into a long-term agreement with any vendor, a little research is in order. Try making a list of all the pros, cons, and use cases to decide whether a BPO is an ideal contract for the present circumstances.

Once the supplier has been located, it’s time to define exactly what is needed, and the terms and conditions for repetitive purchases. This is essentially a commitment to buy for a long period of time.

#2) Create the Blanket Purchase Order

Before you ask for permission, you have to create a document to present to stakeholders. At this point, the paperwork is developed with all of the necessary data mentioned earlier. Don’t forget the price, quantity, start/end date, and purchase order number.

In some cases, you may need a requisition first. A purchase requisition vs a purchase order are two different things, so it’s always good to start with company policies before creating anything.

#3) Getting Approval

Just like a single purchase order, a blanket purchase order needs to be approved by upper management and stakeholders.

It can be a little tougher than a simple PO because you’re typically asking for more money, over a longer time period. This requires a greater commitment to the vendor and a lot more trust.

#4) Fulfilling the Contract

After the blanket purchase order is sent to the supplier, they will use the information to issue invoices as the order is fulfilled. It’s up to the buyer to confirm that every shipment has the right quantity and quality, as with any services provided.

Regular communication between all parties involved helps to avoid any mistakes and facilitates spend management.

#5) Invoice Matching

At this point, the shipments will start coming in and the services rendered. Your business should review each invoice as it arrives for accuracy. The invoice is then matched with the BPO and payment is issued.

The Advantages of Blanket POs

A blanket purchase order makes the most sense when you have a regular demand and a trusted vendor. Advantages to a BPO include:

Less Time

When you only have one purchase order to cover multiple shipments, a company saves time on the ordering process. A blanket PO is also considerably less detailed than a single purchase order, which means less manpower spent on the development process.

Lower Costs

When buying in bulk, some suppliers will give you deep discounts. Streamlining vendor management with fewer suppliers also saves on resources. A company doesn’t spend money frequently onboarding new vendors.

Fixed Pricing

Prices are also pre-set during the negotiation process. That means the price will be fixed from the time the BPO starts, until the time it ends. Even if the market value goes up, your price will stay the same. This makes it easier to budget compared to variable dollar amounts.

Consolidated Purchasing

Smart procurement departments can consolidate different orders from multiple teams into a blanket purchase agreement (BPA). Inventory management becomes simplified as well, since it’s up to the supplier to deliver on a regular basis.

Potential Challenges of Blanket Purchase Orders

Usually, a blanket purchase order makes a lot of sense, but there are some cases where it may affect your business negatively. Here are a few examples:

Falling Market Value

Even though fixed pricing is recognized as an advantage, set prices can also work against you. If the market value of what you’re buying goes down during the contract terms, you’ll be stuck paying more than anyone else.

Predicting Demand

Are you sure you’ll still need the same amount of products in a year that you do now? How good is the business at predicting demand? While some vendors do allow for a certain degree of adjustment, forecasting demand is still an important part of getting the most out of BPOs.

Ensuring Accuracy

Procurement departments must go through an approval process that ensures all deliveries do not exceed the maximum amount on the BPO. This means teams need a robust method of quickly and efficiently matching invoices to enforce contract compliance.

Additionally, a buyer’s review is essential for financial auditing. That’s because matching a single invoice to a blanket purchase order isn’t always easy. A multi-matching system is typically required when working with BPOs.

Best Practices for Blanket Purchase Orders

Once you understand what a blanket purchase order is and how to use one, it’s also good to check best practices, which includes:

Staff Training

Even teams outside of procurement and finance should be aware of how blanket POs work. Identify who in the company is most likely to issue repeat purchases, and train them regularly.

Accurate Approval

Not everyone should have the authority to instigate a BPO. Limit the ability of authorization to only those who need it.

Have an End Date

It’s not wise to leave a BPO sitting open. Limit the contract terms to a year at most. Consider even aligning terms with the end of the fiscal year for easier management.

Regular Reviews

Either annually, or bi-annually, blanket purchase orders should be reviewed to ensure they are still relevant and the demand is still the same. Otherwise, you can run into rogue spending.

Constant Compliance

Data security is in high demand. When working with BPOs, redact personal data and bank account information whenever necessary to protect vendors.

Communicate Efficiently

The supplier must know about the blanket purchase order to avoid any confusion. Be very clear about the estimated amounts and PO numbers whenever working directly with suppliers.

Use Technology

Smart financial management is the key to a successful BPO process. Automation is necessary to match large amounts of invoices to a single PO number. An efficient invoice approval protocol is simply part of getting the job done.

FAQs

What is the difference between a Purchase Order (PO) and a Blanket Purchase Order (BPO)?

The main difference between a PO and BPO is that a regular purchase order is used for a shorter time frame, while a blanket purchase order is used for recurring purchases, over a longer period of time, with a concrete start and end date.

Is a blanket purchase order binding?

Once the blanket purchase order is accepted by the vendor, it is considered a binding agreement. It is a commitment from the buyer to spend with the supplier. The idea behind blanket orders is that it allows for flexible spending without getting approvals for every purchase.

There is some wiggle room depending on your relationship with the supplier, and the market value of what you’re buying. It never hurts to ask.

When should a blanket purchase order be used?

A blanket purchase order (BPO) should be used when your need for an item or service will remain consistent throughout a set period of time. You should also trust the supplier to repeatedly fulfill that need.

How do you process a blanket purchase order?

Much like a regular PO, it must be matched with the invoices sent over from the vendor. It is highly recommended for BPOs that cover many invoices, to use an automated system with 3-way matching.

How do I make a blanket purchase order?

There are a lot of free templates online that you can download. A BPO doesn’t have to start from scratch. As long as it has all the essential details and the vendor agrees to it, it’s considered a contract.

Summing it Up

A blanket purchase order works in your favor the majority of the time, as long as the procurement process is strategically planned and organized. If the market value is volatile on products or services you provide, then recurring needs won’t matter, because you cannot forecast the cost.

If you have a strong relationship with a vendor and find yourself buying the same thing every month (like a subscription or maid service) then BPOs work beautifully. They save time for accounts payable, lower administrative costs, create fixed pricing, and ensure future supplies, even when you forget to order!

In high-growth companies, every accounting task is inexplicably tied to investment versus reward. Download our latest ebook, The Ultimate Accounts Payable Survival Guide, to help strategize your own move.