A discounted cash flow analysis considers the (time-adjusted) present value of future cash flows to determine the value of an investment and choose business projects under consideration, M&A buyout candidates, or securities investments.

Table of Contents

What is Discounted Cash Flow?

Discounted cash flow is a financial analysis computing future years’ forecasted cash flows at today’s lower value. The DCF formula considers a time period, the time value of money, and risk with a selected discount rate. Businesses and investors use DCF to assess potential projects, the value of a company for M&A, and the expected return from securities investments.

Discounted Cash Flow Formula

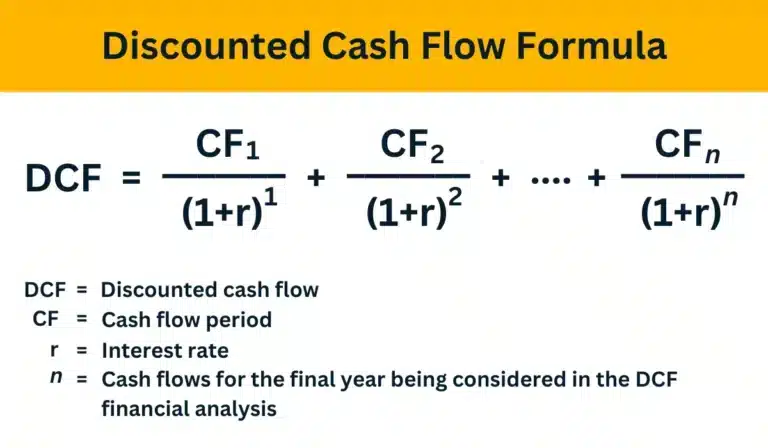

The discounted cash flow (DCF) formula is:

DCF = CF1 + CF2 + … + CFn

(1+r)1 (1+r)2 (1+r)n

The discounted cash flow formula uses a cash flow forecast for future years, discounted back to the equivalent value if received in today’s dollars, then sums the discounted value for every year projected. CF1 is cash flows for year 1, CF2 is cash flows for year 2. Cash flows for the final year being considered in the DCF financial analysis are denoted as n.

The discount factor (discount rate) in the denominator is 1+ a risk rate adjusted above the risk-free cost of capital, the rate of return expected from other competing investments, or the company’s weighted average cost of capital (WACC).

Cash flow is different than business profit, which is revenue minus expenses.

You can use a Google Sheet, Excel spreadsheet, or an online discounted cash flow calculator to compute discounted cash flow.

Try using this online calculator (discounted payback) to calculate discounted cash flow. Set the Initial Investment to $0 (because discounted cash flow doesn’t consider it) and provide Cash Flow per year (year 1), Increase in cash flow, Number of Years, and Discount Rate.

If you do this correctly, you’ll get the same result as the discounted cash flow example below that was calculated using a spreadsheet. The example assumes year 1 cash flow of $225,000, a 10% increase in cash flow per year, 5 as the number of years, and an 8% discount rate.

Purpose of Discounted Cash Flow

Discounted cash flow analysis is applied in different areas, including business investment project selection, M&A valuation, and investors determining the market value of stock and other investments.

Business Investment Project Selection

Businesses often use their weighted average cost of capital (WACC) rate as the risk rate to justify investment projects.

The investment project evaluated should produce positive cash flows at their present value and yield a return of at least the company’s hurdle rate for the investment. The terminal value (residual value) of a project in the year of project completion is also included in the DCF financial model.

A considered project should be ranked compared to other potential investment projects competing for funding. The terminal value (residual value) of a project in the year of project completion is also included in the DCF financial model.

Another discounted cash flow methodology that businesses and commercial real estate companies use to select a project for investment is the internal rate of return (IRR).

M&A DCF Valuation

In investment banking and corporate finance, M&A analysts use discounted cash flow as one method to determine the value of a business.

M&A teams also set the enterprise value using company comparables for other recent deals in the industry. Public companies have a higher per-share valuation price than private companies. Privately-held companies are discounted to a lower fair value due to a lack of share marketability and higher risk profiles.

Equity Value Assessment by Investors

Investors use discounted cash flow as one method of analyzing potential stock investments and their estimated market value.

HBO released a documentary in 2022 titled Icahn: The Restless Billionaire that mentions the use of discounted cash flow. Carl Icahn, an activist investor and chairman of Icahn Enterprises LP (IEP), uses a DCF model and other analyses as valuation methods to identify underperforming companies with low equity value that could be improved. Icahn or a team member takes a Board of Directors position after buying a substantial stock position in an undervalued publicly-traded company or acquiring the company.

Investors can also determine the intrinsic value of a stock or a company valuation based on the present value of future dividends with a perpetual growth rate by using the Gordon Growth Model (GGM). The Gordon Growth Model is a dividend discount model to determine stock price or enterprise valuation with a simpler formula. GGM has been proven using a discounted cash flow calculation.

Discounted Cash Flow vs. Net Present Value

The main difference between discounted cash flow vs. net present value is that net present value subtracts upfront year 0 costs (in actual dollars estimated) from the sum of the present value of the cash flows. The discounted cash flow method doesn’t subtract these initial costs that include capital expenditures.

Example of DCF Discounted Cash Flow vs. Net Present Value

Cash flow projections by year for the forecast period and the risk rate selected as an appropriate discount rate to determine the present value of these cash flows are used for both NPV and DCF calculations in the examples below.

The expected cash flow growth rate is forecast at 10% per year. The company’s weighted average cost of capital of 8% is used in this calculation as the discount rate in the present value table. The present value discount factors are from a Present Value of 1 table.

Only the net present value example assumes and deducts the initial costs in year 0 of $150,000. The table below shows the initial investment cost ($150,000) as a negative cash flow.

In the financial modeling examples for the DCF method and NPV below, the terminal value or cash salvage value from selling used investment project equipment is assumed to be zero. (Any salvage value or residual value received at the project termination would be discounted back to year 0.)

| Year | Cash Flow Forecast | Present Value Discount Factor @ 8% rate | Discounted Cash Flow by Year |

|---|---|---|---|

| 0 | ($150,000) | Not applicable to year 0 | ($150,000) |

| 1 | $225,000 | 0.9259 | $208,328 |

| 2 | $247,500 | 0.8573 | $212,182 |

| 3 | $272,250 | 0.7938 | $216,112 |

| 4 | $299,475 | 0.7350 | $220,114 |

| 5 | $329,423 | 0.6806 | $224,205 |

Discounted Cash Flow Calculation Example

DCF = ($208,328 + $212,182 + $216,112 + $220,114 + $224,205)

DCF = $1,080,941

Net Present Value (NPV) Calculation Example

Net Present Value = – $150,000 + ($208,328 + $212,182 + $216,112 + $220,114 + $224,205)

Net Present Value = – $150,000 + $1,080,941

Net Present Value = $ 930,941

Difference Between DCF and NPV Calculations

The difference between discounted cash flow and net present value equals the initial cost as an estimated upfront cash investment in year 0.

Reconciliation of discounted cash flow and net present value calculations:

Discounted cash flow $1,080,941

Net present value $ 930,941

Difference = $ – 150,000

When is DCF Analysis Most Useful?

DCF analysis is most useful when future cash flows are predictable, an appropriate discount rate for risk is used, and objectivity is needed to select the best potential investment.

Constraints of DCF

Constraints of DCF (discounted cash flow) include the use of estimates and the variability in forecasting future cash flows. Both external and internal factors can impact cash flows.

Possible cash flow impacts affecting forecast accuracy include:

- Economic recessions or improved business cycles

- Inflation rate increases

- Unanticipated effects of interest rate hikes

- Geopolitical events

- Sales forecast, cost estimates, and cash conversion cycle inaccuracy

- New competitors entering the market or taking market share

The corporate finance team often prepares cash forecasts in businesses with scenarios for best case, expected case, and worst case. Then the analyst and management select one scenario. Is it the right case for evaluating an investment?

The discounted cash flow calculation can also be affected by using the wrong risk rate, also known as the discount rate.

If the estimated cash flows used in the calculation of DCF are too high vs. realistic estimates that can be achieved, an investment may be selected that will underperform expectations. Conversely, if the forecast cash flows are erroneously too low, the company may miss an investment opportunity that should have been selected.

Takeaways

- Discounted cash flow (DCF) financial models are used as cash flow valuations to value and select investments.

- Discounted cash flow analysis uses projected future cash flows from an investment for a selected time period. It discounts them to the present value by incorporating a risk rate then sums the present values of cash flows. Projected cash flows are the net inflows and outflows of cash for a year.

- Investments may have a salvage value of equipment sold or residual value that produces cash flow when the project ends. The terminal value is also discounted to its present value.

- A risk rate often used by businesses for calculating the discounted cash flow of investment projects is the weighted average cost of capital (WACC). Other risk rates, including alternative project returns, may be used in evaluating investments with the DCF metric.

- The difference between discounted cash flow and net present value is that net present value (NPV) subtracts the initial cash investment, but DCF doesn’t.

- Discounted cash flow models may produce incorrect valuation results if forecast cash flows or the risk rate are inaccurate. The result is missed projects for underestimated cash flows or acceptance of underperforming projects if cash flow estimates are too high.