Table of Contents

Invoice processing is part of the accounts payable cycle that involves the receiving, approving and payment of supplier invoices, along with any remittance advice, ultimately documented in the general ledger.

One of the most efficient ways to improve your bottom line is to decrease the cost of operations. That way, you can direct resources toward strategic, revenue-generating initiatives. A lot of this starts with getting a handle on open invoices and refining your invoice processing.

When vendor invoices aren’t paid on time, it can interrupt your stream of supplies and seriously damage business relationships. Suppliers will take action to protect their own balance sheets. This is why optimizing your procedures for invoice processing is critical to business success.

In this article, we’ll look at the very basic system of invoice processing, what’s involved, benefits, pitfalls, and how to improve your entire accounts payable lifecycle.

What is Invoice Processing?

Invoice processing is a basic business function that involves the tracking, management, and payment of supplier invoices and is carried out by the accounts payable department. It is a crucial component in the procure-to-pay (P2P) process and the final step in procurement. The process starts when an invoice is received, and ends when the payment is recorded in a general ledger. Today, invoice processing is typically performed with invoice automation software.

Key Steps in the Invoice Process

What is an invoice? It’s a formal, written request and requires a specific process to address the document. After a vendor sends an invoice, there are steps an accounts payable department must take in order to process and manage it accordingly.

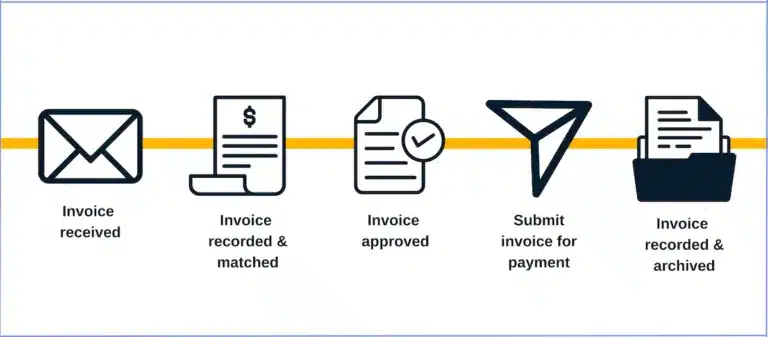

The invoice management cycle is a workflow that includes the following sequential steps:

- The invoice is received

- The invoice is recorded and matched

- The invoice is approved

- The invoice is submitted for payment and processed

- The invoice data is recorded and archived

Traditionally, these steps were carried out manually and could take weeks to process. AP (acccounts payable) automation software shortens this workflow and streamlines the entire system.

Importance of Invoice Processing

It’s incredibly important for a business to optimize the invoice process and organize payments. This ensures a vendor gets paid on time. In fact, with early payment discounts, a business stands to earn cash back on money owed. Streamlining the invoice process guarantees the supply chain as a whole, remains healthy.

Developing a systemic plan for invoice processing leads to improved:

Cash Flow Management

The proper handling of incoming invoices is an essential component of successful cash flow management. Optimizing the workflow enables a business to stay within budget and keep track of any outstanding debts. This means a business can spend smarter and invest wisely.

Improved Vendor Relationships

The earlier you pay your bills, the happier your vendors will be. Improving invoice performance boosts efficiency and shows your suppliers you value their time. A better system can lead to professional benefits when engaging with a vendor, as it’s easier to guarantee the bills are paid when due.

Faster Payment Times

Implementing an invoice processing system makes it simpler to move invoices through the processing structure. This means bills get paid on time and everyone is happy.

Reduced Labor

Developing a more efficient invoice processing system allows a business to reduce the manual workload of its labor force. You can then redirect these resources to other value-based duties, leading to a happier and more productive staff. Additionally, according to the Institute of Financial Management (IOFM), accounts payable is the #1 most time-consuming function in finance, so automating it should be an essential element of any CFO’s strategy to modernize the finance organization.

Invoice Processing Workflow

As mentioned above, there is a certain workflow the invoice process must follow to ensure your records are accurate and payments go out in a timely fashion. Here, we dive into what each of these steps are:

The Invoice is Received

As soon as accounts payable receives an invoice, the procedure begins. This formal request is also called an invoice to pay.

Invoices can be received in a number of ways, including:

- Paper documents through the mail

- Email with an attachment

- Faxed document

- Electronic document received through AP software

No matter how they are received, you should have a centralized system for processing all invoices the same. Disparate workflows will not only drive down efficiency, but increase human errors and lead to more confusion.

It’s important that you also have a business process to quickly and accurately capture the data from these invoices as they come in. The AP team should be checking off data like:

- The invoice date

- Contact details for both parties

- Description of product/service

- Amount of product/service

- Pricing and total amount owed

The invoice may also contain other payment specifics, like the terms or shipping details. All of this information must then be cross-referenced with other documents to verify the accuracy of the invoice before it can move on to the next step. If something doesn’t match, AP must immediately contact the vendor.

It should be noted that some vendors send what is known as a pro forma invoice. This is not processed in the same way as a regular invoice and is more of a quote for sales than anything else.

The Invoice is Recorded and Matched

The next step in the process involves recording the invoice data and matching it with the right paperwork needed for the approvers to give it the green. The invoice must be assigned a general ledger (GL) code and linked with the corresponding purchase order, delivery receipt, and/or inspection report where applicable.

The amount billed must match the amount on the original purchase order. If there is a discrepancy in the amount charged (compared to the purchase order) the issue has to be resolved with the vendor prior to entering the approval process. When it comes to a purchase order vs invoice, the PO came first and is therefore more accurate.

Invoices must be formally verified to avoid duplicate payments or fraud. The accounts payable team is looking to record:

Fees, Totals, and Taxes

Verification of these details ensures the invoice amounts owed are correctly calculated, including tax amounts, shipping, tax rates, and other listed fees. The total amount of all the calculations is also checked, and the general ledger coding is entered along with the appropriate accounting period.

Verifying the Order

AP will also verify the content of the invoice to determine whether the product being billed for has actually been ordered and received. They will check the number of items, quality, and the agreed-upon price.

Detecting Fraud

Lastly, every invoice undergoes an examination for fraud. The vendor must be validated and preapproved. AP should also check whether the invoice has been sent more than once, and if the line items appear on just that invoice alone, or on multiple invoices.

Additional information to verify includes:

- Vendor information

- Payment terms

- What the invoice is for

- Category codes required for the books

If a business is still processing invoices manually, an orderly file system should be set up that makes it easy to retrieve bills. Always have several copies of the invoice in case there are any vendor discrepancies down the road.

Keep in mind, manual data entry frequently results in typos, errors, and data duplication. The approach is inefficient and costly compared to digital solutions. To realize a higher level of efficiency, companies should optimize the invoice verification component of accounting whenever possible.

The Invoice is Approved

Once all the invoice information is verified, it’s time to get it approved. AP processes for invoice approval will vary by company, industry, invoice type, and policy. Some invoices can be approved automatically, while others may need final approval before submitting payment. Depending on the company’s size, sometimes two or three executives are permitted to approve or deny a payment.

In the past, the invoice approval process was sluggish, resulting in penalties and late payments. Paper invoices were sent via interoffice mail to someone’s physical inbox. Then came email; where invoices are attached as a digital document and sent to a virtual inbox. Neither of these approaches is very productive, and both leave a lot of room for documents to get lost, misunderstandings to occur, or people to drag their feet.

The AP invoice approval process works best when automated. It keeps approval workflows in the invoice processing system and creates a definitive timeline for when everything needs to occur. The transparency enables the AP department to see how long an invoice has been in process, if someone has been sitting on the document, and what needs to be done to get it paid.

The Invoice is Submitted for Payment and Processed

Once the invoice is approved, it’s time to pay the vendor. In order to process the payment, an accounts payable representative needs:

- The total owed

- Vendor information

- Payment identifiers (like account number or invoice number)

- Types of payment accepted

The most common method of sending payment used to be via check. These days, ACH or wire transfers are the preferred way. This is especially the case for a company with international business.

Approved invoices are set for payment based on the terms that are negotiated with the vendor. In some cases, your business may choose to pay an invoice early to take advantage of a discount.

For example, 1% net 10 means that if you pay that vendor within 10 days of receiving the invoice, you can deduct 1% off the total amount owed. An AP automation solution can shore up this entire process and create more opportunities for a business to take advantage of early-payment discounts.

The Invoice Data is Recorded and Archived

Once the payment is processed, all of the final data can be captured and archived. At this point, general ledger entries for the payment debits and any other relevant accounting can be made.

Additionally, invoice images and supporting documents, like purchase orders or shipping receipts, can be saved in a secure and searchable document repository. This ensures a convenient audit trail that’s easily accessed whenever needed.

Accurate data on accounts payables is critical to producing a balance sheet that is correct. An automation system allows a business to make important GL entries with a few clicks of the mouse, instead of the 10-key system that’s highly susceptible to errors.

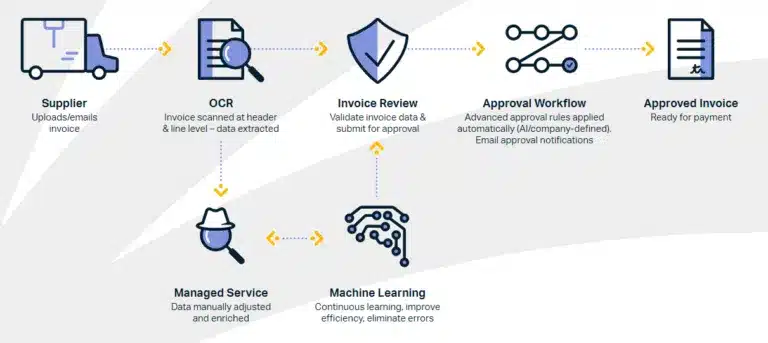

Invoice Processing Workflow with Tipalti

Tipalti enables businesses to take advantage of its best-in-class touchless invoice workflow. By combining our Supplier Hub, Optical Character Recognition (OCR) Technology, Machine Learning, Managed Services, and Advanced Approval workflow, your team is freed from dealing with one of the most mundane data-entry tasks in the business world. Learn more about Tipalti’s invoice management and bill processing system for AP.

Who Uses Invoice Processing?

Invoice processing is performed by the accounts payable department and is used by any business that needs to pay suppliers. Without the ability to process invoices, people will stop selling you things on credit. This will lead to bottlenecked cash flow, diminished working capital, and strained vendor relationships.

It’s not enough to pay people. They must be paid on time, and consistently. There is a specific series of steps a business follows for managing supplier invoices, from receipt to payment and recordkeeping.

Challenges Faced in Invoice Processing

The more vendors a business deals with, the more complex the invoice process. As your business grows, the need for an efficient system becomes apparent. Without it, here are some common challenges you may face:

Missing Documents

The number one chink in the chain of invoice processing is losing important documents you need to pay the vendor. This typically becomes an issue when a business is growing rapidly and has several different suppliers to pay, in a variety of ways. There must be a means of consolidating all of the paper copies, PDFs, word files, etc. Otherwise, the workflow becomes…almost unworkable.

Inaccurate Data

An invoice contains important payment data that is needed for processing, like tax IDs, prices, delivery times, and so on. When invoices are received in different formats, it makes it that much harder to extract all the essential data.

When it comes to invoice processing, common blunders include:

- Using the wrong client name

- Failure to clearly itemize products/services

- No invoice details for the deadline

- Failure to use the correct currency

- Bad math or incorrect calculations

Vendors may also fail to specify a discount or extra fees that apply. Any missing or inaccurate data means the invoice needs to go back to the vendor for editing, and the entire process starts over.

Invoice Status Unknown

The present status of an invoice in the processing schema is frequently unknown, particularly when there are several stakeholders involved in the process. Where is it located? Who is going to approve it? When are the funds being sent out? These are all questions that emerge when there isn’t transparency in the workflow.

Routing Errors

Every day, you may be getting invoices from different vendors. After an initial review, each invoice is placed in the routing queue. However, even the most efficient AP team can make an error in the routing process.

In this case, an invoice may languish on the wrong desk or unopened in someone’s inbox. When an invoice is incorrectly routed, it undergoes repetitive procedures, wasting time and effort. This high-touch circumstance can be incredibly demanding, especially since the AP team needs to close books on a monthly basis.

Using Automated Invoice Processing

Processing invoices manually is not only time-consuming, but it can be prone to errors. A recent report estimates that 50% of companies have yet to automate their invoicing, while 24% scan and email invoices, and 23% rely completely on manual processes. The fees associated with manual invoice processing are steep, with an average cost of $10 per invoice. This expense plummets to just $2.07 when you have automated invoice processing.

Invoice processing automation uses software to mechanize steps in the invoice lifecycle, like data capture and the approval process. This can either be run by a human user or completely automated through AI systems. This type of solution will automatically extract invoice data (through features like OCR processing) and digitize sending out supplier payments.

Ready to embrace the strategic revolution of accounts payable?

Check out our eBook: Accounts Payable: Embracing the Strategic Evolution

Automation seamlessly inputs data into your ERP or accounts payable system, enabling payments to be made in minutes, rather than days. It allows AP teams to take a “hands-off” approach, freeing them up to focus on more growth-based tasks.

Some key features of invoice processing software include:

- Standardized coding

- Invoice scanning and data capture

- Automated approval workflows

- Collaborative dashboards for transparency

- Integrations with ERP platforms and other apps

The dashboard will show a business who has been paid, real-time invoice status, what is set to go out, and which invoices are awaiting approval. Direct integrations with ERP systems help to increase the accuracy and timeliness of payments, as well as simplify the entire accounts payable process. This works to improve cash management and expedite financial close.

Benefits of Automated Invoice Processing

Effective invoice processing ensures all of your vendor payment information is accessible in a convenient repository and that everyone you’re doing business with, is getting paid on time. The following are a few key benefits of streamlining our invoice process:

Real-time Information

When invoice processing is automated, every invoice is entered with a timestamp. No changes can be made once it has been authorized, which standardizes the accounting process. It also provides a wealth of information in real-time on how your business is performing, in terms of sales and cash flow.

Digital Data Storage

Automated invoice processing ensures valuable sales invoices are kept digitally and can be used to quickly consolidate receivables. It enables a team to monitor cash flow from anywhere, at any time.

Additionally, when you digitize bills, you no longer need a large physical space to keep files. This provides superior security as well, since a business can encrypt data and preserve backups virtually.

Centralized Dashboard

Invoice data can be kept in a central location, giving AP the ability to access consolidated accounting information across space and time. Invoicing payment software can also help to reduce duplicate invoices and payments.

Efficient Reporting

Automating the AP process ensures vital information is systemically recorded in a centralized database. This can be used for different comparisons, reporting tasks, trending, and even sales forecasting.

Management also has access to real-world data with tracking functionality, including taxation and legal requirements. It adds more control over internal processing and cuts down on error rates.

Save Time and Money

Invoice process software speeds up the approval process and reduces processing time. It also helps to save on labor costs, as staff has more opportunities to focus on business-critical tasks.

It also allows a business to better position itself for early payment discounts and avoid late payment fees. It completely slashes the cost of manually processing invoices (like postage and paper).

The Quest to Keep Improving

The less money a business can spend on non-revenue-generating tasks, the better opportunity it has for growth. Accounts payable has never been a profit center, so you must examine other ways to deliver value. Every aspect of the company needs to carefully consider its technology stack, not just sales and marketing. Finance is a team that greatly benefits from automation; adding more control over internal processes and expediting workflows.

To an AP team, efficiency means the ability to cut down on the invoice backlog, create real-time visibility for cash flow, reduce errors, and eliminate repetitive tasks. The faster they can accomplish these goals, the easier it will be to build the business.

Leadership can still maintain current processes, while entertaining smarter functionality like optical character recognition, automated approval routing, and instant reconciliation. The key to adding value is to reduce operating expenses, increase efficiency, and save time. Automation serves as the answer to all of these challenges, and then some.

Moving Toward Touchless Invoice Processing

Tipalti’s touchless invoice processing includes high-quality OCR data capture combined with continuous machine learning and managed services, including advanced approval routing workflow, all integrated with Tipalti’s unified global supplier payments solution, so that the end-to-end core AP processes are managed seamlessly in one place. Tipalti’s AP capabilities include global supplier management, self-service supplier onboarding, payments data validation, sanctions screening, KPMG-approved tax compliance, invoice processing, PO matching, global supplier remittance, early payments, foreign exchange conversion, AP reporting, and payment reconciliation with various ERP systems. Request a free product tour and learn more here.