AUTOMATION FOR Quickbooks

Accounts Payable Automation for QuickBooks Online & Desktop

Wipe out 80% of your payables workload and easily extend the functionality of QuickBooks with end-to-end global payables automation.

Helping QuickBooks Clients Strengthen Controls, Accelerate Visibility, and Easily Scale with Greater Efficiency

QuickBooks versions we support: QuickBooks Online Advanced, Quickbooks Online Plus, QuickBooks Online Essentials, and QuickBooks Desktop

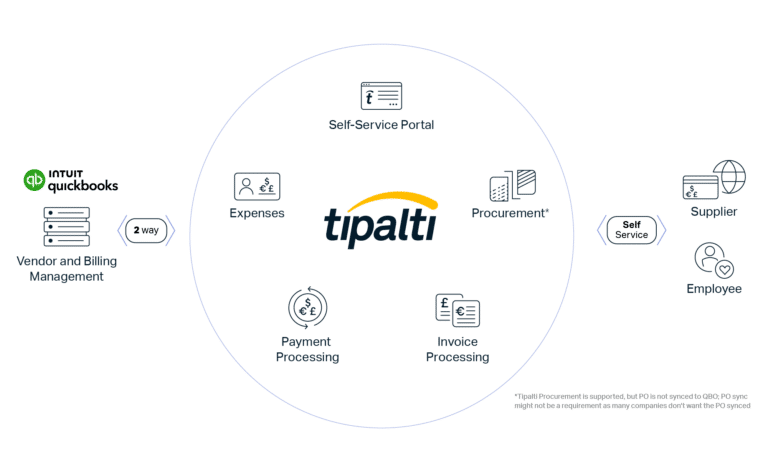

How Tipalti Integrates with QuickBooks

Tipalti extends existing QuickBooks capabilities by providing full management and automated execution of global procurement and payables, including supplier management, purchase order management, invoice management, payment scheduling, global remittance, card spend, communicating with suppliers, and real-time reconciliation of payment details with invoices and billing. Advanced sync logic ensures clean data is synced accurately, eliminating manual reconciliation in Intacct while accelerating financial close by 25%+.

See Why the World’s Most Innovative Companies

Choose Tipalti

Related Content

Let’s get more productive

Book a demo today and learn how you can take control of your payables.