Will your company have enough profits (and cash generated) from business operations to pay all interest expense due on its debt in the next year? Use the times interest earned ratio (TIE), also known as interest coverage ratio (ICR), to make an assessment.

What is Times Interest Earned Ratio (TIE)?

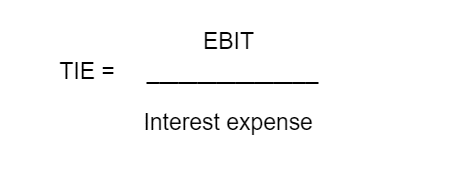

Times interest earned ratio (TIE) is a solvency ratio indicating the ability to pay all interest on business debt obligations. TIE is calculated as EBIT (earnings before interest and taxes) divided by total interest expense. The higher the times interest earned ratio, the more likely the company can pay interest on its debts. Times interest earned is also called interest coverage ratio (ICR).

The Purpose of TIE Ratio

The purpose of the TIE ratio, also known as the interest coverage ratio (ICR), is to evaluate whether a business can pay the interest expense on its debt obligations in the next year. In the context of times interest earned, debt means loans, including notes payable, credit lines, and bond obligations.

In an article, LeaseQuery, a software company that automates ASC 842 GAAP lease accounting, explains lease interest expense calculation, classification, and reporting. According to LeaseQuery, financial leases have interest expense but it’s not considered an operating expense, and, therefore, not included in the calculation of EBITDA [and EBIT]. And companies report interest expense related to operating leases as part of lease expense rather than as interest expense.

In a Federal Reserve study, Interest Coverage Ratios: Assessing Vulnerabilities in Nonfinancial Corporate Credit, reported in its FEDS Notes on December 3, 2020, the Federal Reserve asserts:

“The projected evolution of the ICR index serves as a vulnerability indicator as lower ratios are associated with higher probabilities of default and financial distress”.

This Fed study means that the TIE ratio (ICR ratio) can also predict the probability of overall “default and financial distress” of a business, not only its ability to pay interest on debt obligations. But you can rely on other ratios too that analyze the payment of both interest expense and principal on debt.

The times interest earned ratio (interest coverage ratio) can be used in combination with a net debt-to-EBITDA ratio to indicate a company’s ability for debt repayment. EBITDA is earnings before interest, taxes, depreciation, and amortization.

To assess a company’s ability to pay principal plus interest on debt, you can also use the debt service coverage ratio. The debt service coverage ratio (DSCR) is net operating income divided by debt service, which includes principal and interest.

The balances of the amount of debt borrowed from financial lenders or created through bond issuance, less repaid amounts, are included in separate line items in the liabilities section of the balance sheet. Include both short-term debt due within one year and long-term debt. The combined total debt can be used to calculate a debt ratio.

Although times interest earned doesn’t use cash flow from working capital in the formula, it helps your company approximate its ability to pay interest on debts by using EBIT, which is a company’s earnings from operations, also called operating income.

Times Interest Earned Formula

The times interest earned ratio formula is:

where,

EBIT is earnings before interest and taxes (operating income)

Taxes are income taxes

Interest expense is total annual interest expense on debt obligations

How to Calculate TIE

To calculate TIE (times interest earned), use a multi-step income statement or general ledger to find EBIT (earnings before interest and taxes) and interest expense relating to debt financing. Divide EBIT by interest expense to determine how many times interest expense is covered by EBIT to assess the level of risk for making interest payments on debt financing.

Perhaps your accounting software or ERP system automatically calculates ratios from financial statements data. These automatic ratio calculations could include the times interest earned ratio (which may be called interest coverage ratio) from the company’s income statement data.

What’s an Example of TIE?

As a TIE financial ratio example, a company’s TIE ratio is computed as EBIT (earnings before interest and taxes) divided by annual interest expense on debt. The times interest earned ratio (TIE) is calculated as 2.15 when dividing EBIT of $515,000 by annual interest expense of $240,000.

| Net income before income taxes | $275,000 |

| Add back: Interest expense | $240,000 |

| __________ | |

| EBIT | $515,000 |

| Divided by annual interest expense on debt | $240,000 |

| Times interest earned ratio (TIE) = | 2.15 |

A times interest earned ratio of 2.15 is considered good because the company’s EBIT is about two times its annual interest expense. This means that the business has a high probability of paying interest expense on its debt in the next year.

Frequently Asked Questions

The following FAQs provide answers to questions about the TIE/ICR ratio, including times interest earned ratio interpretation.

What’s the range of ICR/TIE ratios for public non-financial companies?

A December 3, 2020 FEDS Notes, issued by the Federal Reserve, summarizes S&P Global, Compustat, and Capital IQ data in Table 2 for public non-financial companies. The reported range of ICR/TIE ratios is less than zero to 13.38, with 1.59 as the median for 1,677 companies.

The distribution of calculated ICR – interest coverage ratios (the same as times interest earned ratio) in publicly listed non-financial companies, is as follows:

-10th percentile: <0

-25th percentile : 0

-Median: 1.59

-75th percentile: 5.78

-90th percentile: 13.38

A negative times interest earned or ICR ratio means that the company will have difficulty paying its interest expense in the next year unless it finds ways to increase cash inflows either through additional debt borrowing or internal sources.

What’s Considered a Good TIE?

A good TIE ratio is at least 2 or 3, especially in economic times when EBIT can fall due to revenue drops and cost inflation effects, and interest expense rises on variable rate debt as the Fed raises rates. The relatively high TIE ratio means the company’s EBIT is 2 to 3 times its annual interest expense, which is a margin of safety for the risk of making interest payments on debt.

What’s a TIE Ratio of 2.5 Mean?

A TIE ratio (times interest earned ratio) of 2.5 means that EBIT, a company’s operating earnings before interest and income taxes, is two and one-half times the amount of its interest expense. The interpretation is that the company is within its debt capacity with a low risk of not paying interest on its debt. A times interest earned ratio of at least 2.0 is considered acceptable.

Importance of Times Interest Earned Ratio

The times interest earned ratio (TIE), also known as the interest coverage ratio (ICR), is an important metric. A company’s ability to pay all interest expense on its debt obligations is likely when it has a high times interest earned ratio. The TIE ratio is based on your company’s recent current income for the latest year reported compared to interest expense on debt.

Besides being able to pay interest obligations on debt from financial lenders that a higher times interest earned ratio measures, be sure that your company can pay its interest-free accounts payable on time for good vendor management and supplier relationships.

In an economic environment of rising interest rates, calculating the times interest earned ratio at least monthly during the accounting cycle will help your company keep informed about its ability to meet interest obligations, including those with changing interest rates on variable business loans. For this internal financial management purpose, you can use trailing 12-month totals to approximate an annual interest expense.