CFOs 2.0: Building Efficiency Through Uncertainty

The only constant in life may very well be change—but today’s increasing rate of uncertainty is exerting new pressure on the finance function to move beyond transactional activities and offer strategic guidance on companywide initiatives.

While digitization will certainly help, technology is more of a partner. The finance function and all its players must embrace new mindsets around the department’s role in an organization. They must develop new skills to work within these new expectations.

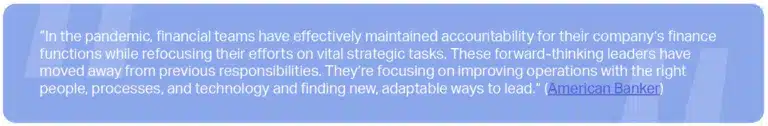

Many finance leaders have risen to the challenge, drawing upon their experience and repositioning the finance function to add even greater value to the entirety of the organization.

As the business environment continues to change, finance leaders are solidifying their position as strategic value drivers at the departmental and organizational level for not just the near future but 10 years down the line

The Finance Evolution

Many factors have been contributing to the changes happening in finance, but three, in particular, have resulted in its increased pace:

Factor One: The Great Resignation

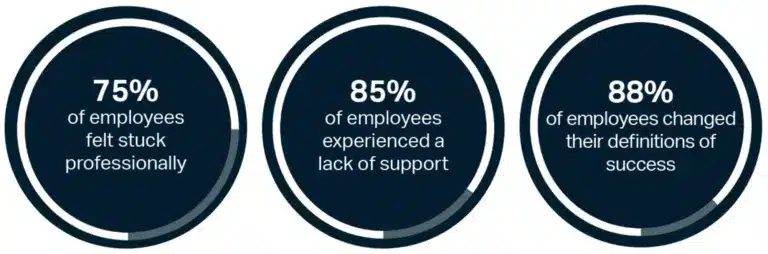

Starting in spring 2021, U.S. workers began quitting at an unprecedented rate. (Oracle) Why?

Underneath these sentiments was another factor at play: the nature of work. Employees, particularly younger ones, no longer have time for the mundane. (Oracle)

Factor Two: Remote Work

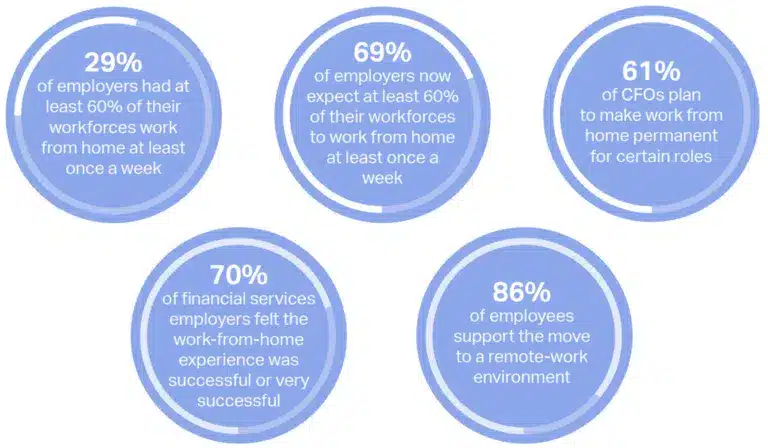

Prior to the pandemic, remote work was the exception, not the rule. Today, the reverse is now true. (PwC, PwC)

Factor Three: Digital Transformation

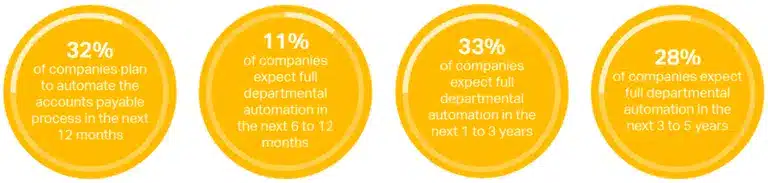

Digital transformation has made its way to the finance function, providing room for teams to focus on an increasing number of value-added activities. (ACARP)

Building Efficiency for the Future

With increased uncertainty, many challenges still lie ahead as companies navigate beyond this period. Finance leaders have a critical role as valuable partners in their organizations to improve operations and build efficiency through unpredictability. With technology, they’re stabilizing their companies for sustainable success.

The Modern Finance Guide to Driving Efficiency Across Your Organization

Download our eBook for more expert insights.