Table of Contents

Understanding financial statements is essential for accounting and finance team members, CEOs, business owners, creditors, and shareholders. This article provides financial statement basics and some more advanced concepts for complex companies.

What is a Financial Statement ?

A financial statement is a documented record that shows the financial activities and performance of a business. Financial statements are prepared from the general ledger and include documents such as income statements, assets, liabilities, stockholders’ equity on a balance sheet, and cash flows. Financial statements are used by government agencies, accountants or firms to perform audits related to taxes, financing or investing.

Businesses usually prepare their financial statements on an accrual basis instead of a cash basis to comply with generally accepted accounting principles (GAAP) in the United States. An indirect cash flow statement reconciles accrual accounting to cash basis accounting. Business financial statements are prepared or summarized on a monthly, quarterly, and annual basis.

The accrual basis of accounting is grounded in the matching principle, which assigns revenues and related expenses to the accounting period they apply rather than when cash is received or paid.

The U.S. Securities and Exchange Commission (SEC) provides additional accounting requirements for publicly-traded companies. The SEC also requires public company financial statements and internal control certifications by the CEO and CFO. Auditors include their financial statement audit opinion in financial reports.

Both GAAP financial accounting and SEC reporting require disclosures either on the face of a financial statement or as a note to the financial statements as an integral part of financial statement reporting.

Financial statements may be prepared as of the end of a calendar year or the fiscal year that a business chooses to adopt. If a company uses a fiscal year-end, the income statement reports financial results for the twelve months ended on the fiscal year-end date and any comparable years.

Some businesses choose a fiscal year-end as a month when inventories are at a lower point so that the physical inventory count is easier to conduct. The fiscal year-end is either at a month-end or a few days earlier than the month-end.

4 Types of Financial Statements

4 types of core financial statements are:

- Income statement

- Balance sheet

- Cash flow statement

- Statement of shareholders’ equity

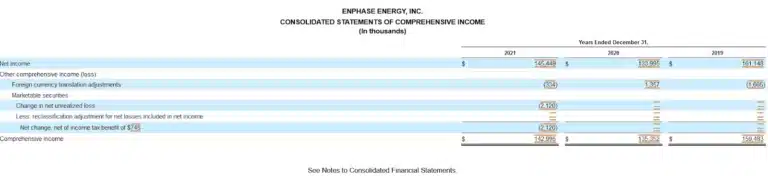

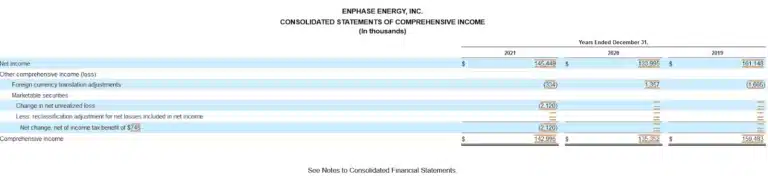

The income statement, balance sheet, and cash flow statement are considered 3 basic financial statements. Some companies may provide a 5th type of financial statement called a statement of comprehensive income.

An example image of a statement of comprehensive income is shown below. Example images for an income statement, balance sheet, statement of shareholders’ equity, and cash flow statement are included in each designated section below.

Source: Enphase Energy, Inc.10-K annual report SEC company filing for the Year Ended December 31, 2021.

Income Statement

The income statement measures sales and other revenues, cost of goods, operating expenses, net interest income (loss), and income tax expense to report net income. The income statement can also be called a profit and loss statement or statement of operations.

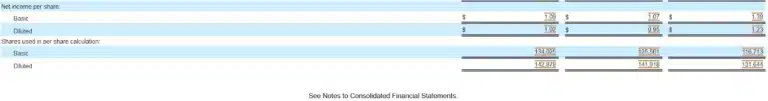

For some companies, the income statement shows basic and diluted net income per share and the number of shares included in each earnings per share (EPS) calculation.

If companies have discontinued operations, the results are shown on the income statement below the operational results from current operations.

Income Statement Formula

The income statement formula is:

Revenues – Cost of Goods Sold or Cost of Revenues = Gross Profit – Operating Expenses = Income (Loss) from Operations +/- Net Interest Income/Expense = Net Income (Loss) Before Taxes – Income Tax Expense = Net Income

Income Statement Line Items

The following income statement line items are explained below.

Revenues, net

Revenues include the sale of products and the performance of services invoiced to a customer or paid upfront by cash, credit card, or debit card. Revenues are recorded at a net amount after subtracting sales allowances, discounts, and returns.

Cost of goods sold

Cost of goods sold or cost of revenues includes the cost of items sold for resellers and the cost of raw materials purchased, work-in-process, and finished goods related to manufacturing company sales.

Gross profit (loss)

Gross profit (loss) is the calculation of net revenues minus cost of goods sold (COGS).

Operating expenses

Operating expenses include line items for research & development, sales & marketing, and general & administrative expenses. Some companies may include an additional line item in operating expenses for restructuring expenses. Total operating expenses are shown on the balance sheet as a line item.

Income (loss) from operations

Income (loss) from operations is calculated as Gross profit (loss) minus total operating expenses.

Other income (expense), net

Other income (expense) lists by line item types of net other income or expense and then totals all other income (expense).

Examples of line items to include in other income (expense) are:

- Interest income

- Interest expense

- Other income (expense), net

- Loss on partial settlement of convertible notes

- Change in fair value of derivatives.

Income before income taxes

Income before income taxes is calculated as income (loss) from operations minus other income (expense), net.

Income tax expense

Income tax expense is listed here as a line item.

Net income (loss)

Net income (loss) is income before income taxes minus income tax expense. Net income is the bottom line profit or loss after all costs and expenses and gains or losses have been deducted from revenues.

Example Income Statement

Source: Enphase Energy, Inc.10-K annual report SEC company filing for the Year Ended December 31, 2021.

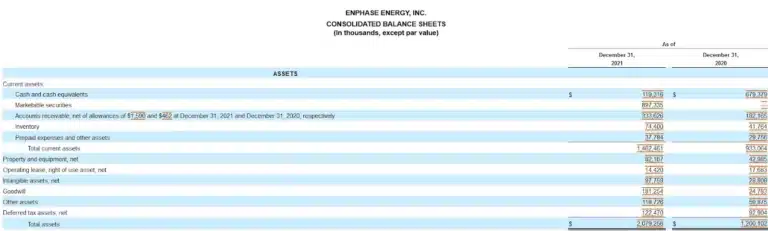

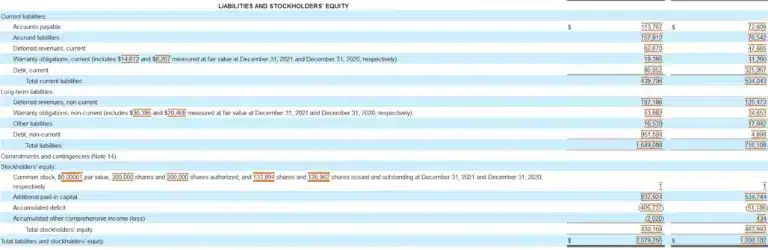

Balance Sheet

The balance sheet (statement of financial position or statement of financial condition) provides a snapshot of a company’s assets, liabilities, and shareholders’ equity (stakeholders’ equity or owners’ equity) at the end of an accounting period.

Balance Sheet Formula

The balance sheet formula is:

Assets = Liabilities + Shareholders’ Equity

Balance Sheet Line Items

Balance sheet line items are divided into sections for assets, liabilities, and shareholders’ equity. Assets and liabilities are categorized (classified) as short-term or long-term. Line items shown on the balance sheet are listed below.

Assets

Assets are controlled resources and ownership interests of an entity that are a present right to an economic benefit.

The above definition is derived from the FASB Conceptual Framework, Statement of Financial Accounting Concepts, No. 8, dated December 2021.

Current Assets

Current assets are cash and cash equivalents or other short-term assets convertible into cash within one year (or the company’s operating cycle if longer).

Marketable investments may be sold or mature to receive cash. Accounts receivable are collected from customers, and inventory is sold to convert these current assets to cash. Prepaid expenses like insurance premiums are transferred to expenses over time, and intangible assets are amortized over time or adjusted for impairment (loss of value).

Cash and cash equivalents

Cash is an asset in one or more company bank accounts or held by another financial institution as its custodian. Cash also includes petty cash funds used to reimburse employee expenses for small purchases.

Cash equivalents are short-term investments in marketable securities with maturity dates of 90 days or less. They include bank CDs (certificates of deposit), Treasury bills, bankers’ acceptances, commercial paper, and money market instruments.

Marketable securities

Marketable securities are liquid short-term investments that are readily convertible into cash, including Treasury bills, commercial paper, and money market instruments. Marketable securities don’t include any balance of marketable investments with maturities of 90 days or less that are included in cash and cash equivalents on the balance sheet.

Accounts receivable

Accounts receivable is the balance of uncollected customer invoices (open invoices) with credit terms, expected to be turned into cash, reduced by the allowance for doubtful accounts. The allowance for doubtful accounts estimates total accounts receivable amounts not expected to be collected from customers.

A business records customer invoices as sales revenue and accounts receivable. The accounts receivable aging report generated by the accounting system is detailed by customer, invoice, due date, and days outstanding. The accounts receivable aging report is summarized by the total for each column, including total accounts receivable.

Inventory

Inventory is goods purchased or manufactured by a business to sell to customers. Manufacturing companies have (purchased) raw materials, work in process, and finished goods inventory. Retailers, including eCommerce companies, and wholesalers purchase merchandising inventory for resale to customers. Service companies may have inventories of parts and supplies used for performing customer repairs & maintenance.

Prepaid expenses and other assets

Prepaid expenses include insurance premiums and quarterly or annual subscriptions paid in advance and expensed over more than one month. Other assets included in current assets are miscellaneous assets.

Non-Current Assets

Non-current assets have a longer life than current assets. Non-current assets include:

Property, plant, and equipment (net of accumulated depreciation)

Property, plant, and equipment are also known as fixed assets. If the business doesn’t own its plant facility, the balance sheet line item can be shortened to Property and Equipment. The property and equipment balance is the amount after subtracting accumulated depreciation from these existing fixed assets.

Capitalized operating leases (net)

A revised GAAP standard (ASC 842) for lease accounting, requires certain operating leases to be capitalized (net of accumulated amortization) on the balance sheet as non-current assets. These capitalized operating leases aren’t short-term leases of less than twelve months. The operating leases relate to leased property with the right-of-use (ROU) that the company doesn’t own.

Capitalized operating leases are recorded on a net basis, which subtracts the accumulated amortization of the leased asset(s) beginning from each lease date.

Intangible assets, net

Intangible assets include patents, trademarks, and other types of intellectual property. Intangible assets are included on the balance sheet net after subtracting accumulated amortization (that writes off the asset to expense over its expected life).

Goodwill

Goodwill is recorded after the purchase of another company through mergers & acquisitions (M&A). Goodwill represents the price paid over the value of its net identifiable assets. Goodwill is computed as the excess of the purchase price over identifiable assets minus liabilities. Goodwill represents additional value received from the acquisition of a company.

Goodwill was initially amortized under GAAP accounting, but a FASB rule change for goodwill on company purchases after 2001 changed accounting to an annual impairment test for loss of value instead of amortizing it.

Other assets

Other assets classified as non-current assets are miscellaneous assets with a life of over twelve months.

Deferred tax assets, net

Deferred tax assets, net of deferred tax liabilities, are tax reductions that can be used in the future to reduce the amount of a company’s income taxes owed.

Liabilities

Liabilities are company obligations for amounts owed, including probable and reasonably estimable contingent liabilities (like lawsuit damages or product warranty expenses expected to be paid) and deferred revenue (which represents the amount of customer prepayments on future sales revenue for which the company must still deliver products or services).

Current Liabilities

Current liabilities include short-term obligations (within twelve months) for amounts owed, contingent liabilities, and deferred revenue.

Accounts payable

Accounts payable is a liability for invoice amounts payable to suppliers or vendors for goods and services purchased on account with credit terms under one year.

Accrued liabilities

Accrued liabilities are short-term obligations payable, including employee payroll and benefits, non-income taxes payable, and miscellaneous other liabilities.

Deferred revenues, current

Deferred revenues, current is the amount of customer prepayments received in advance of a sale or service that still requires performance by the company to earn the revenues within twelve months.

Warranty obligations, current

Warranty obligations are the current portion of estimated customer warranty expenses related to products sold.

Debt, current

Debt included in current liabilities is the current portion payable within twelve months. Debt includes notes payable.

Long-Term Liabilities

The following long-term liabilities are defined in the same way as equivalent line items for current liabilities. But the expected payment date or delivery date for long-term obligations excludes amounts due within twelve months.

Long-term liabilities include:

Deferred revenues, non-current

Warranty obligations, non-current

Other liabilities

Debt, Non-Current

Stockholders’ Equity

Stockholders’ equity, stakeholders’ equity, or owners’ equity includes preferred stock at par value, common stock at par value, additional paid-in capital (line items for preferred stock and common stock), retained earnings or accumulated deficit, accumulated other comprehensive income (loss), and treasury stock.

Preferred stock

Preferred stock is listed as a line item before common stock because it has liquidation preference over common stock and pays dividends before common shareholders are entitled to dividends. Preferred stock line item amounts are divided into par value amounts (with the number of shares outstanding) and paid-in capital for the amount paid over the par value.

Convertible preferred stock that is a mandatorily redeemable financial instrument that is certain to be converted at a specific date or upon the occurrence of an event is classified as a debt liability rather than stockholders’ equity on the balance sheet.

Common stock

Common stock at par value with the number of shares outstanding is a balance sheet line item.

Paid-in capital

Additional amounts over par valued paid for the preferred stock or common stock are separately listed as balance sheet line items for paid-in capital.

Retained earnings or Accumulated deficit

Retained earnings (accumulated deficit) is the accumulated total of net income or net loss to date for all accounting periods since inception. If the total is a loss during this period of time, it’s called accumulated deficit.

Accumulated other comprehensive income (loss)

Accumulated other comprehensive income (loss) is calculated and shown in the balance sheet according to generally accepted accounting principles (GAAP). Components of other comprehensive income (loss) include unrealized investment gains(losses) from debt or equity securities categorized as available for sale, foreign currency translation gains(losses), and pension fund gains or losses.

Treasury stock

If a company bought back shares of its stock as treasury stock, it would be included as a negative cost amount in stockholder’s equity on the balance sheet as a negative amount.

Example Balance Sheet

Source: Enphase Energy, Inc.10-K annual report SEC company filing for the Year Ended December 31, 2021.

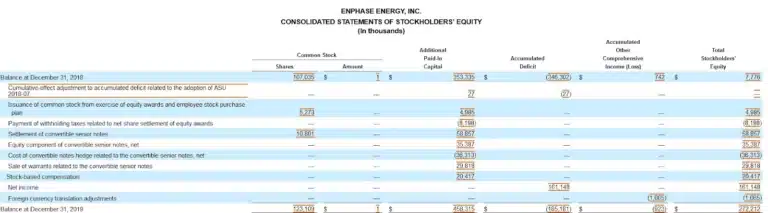

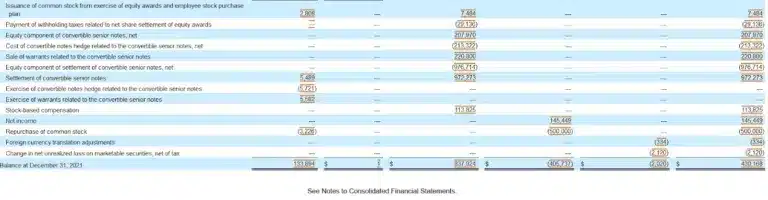

Statement of Shareholders’ Equity

The statement of shareholders’ equity (stakeholders’ equity or owners’ equity) starts with the shareholders’ equity balance at the end of the year before those years included in the financial statement report. That end-of-year shareholders’ equity balance is equivalent to the beginning balance for the following year.

Adjustments for transactions by category affecting the shareholder’s equity balance are detailed as line items. These items are added to the balance at the end of the prior year to equal the balance of shareholders’ equity as of the end of the following year. This serves as a reconciliation of the shareholders’ equity balance.

The process is repeated for any additional years presented in the shareholders’ equity statement.

Statement of Shareholders’ Equity Formula

The statement of shareholders’ equity formula uses the same formula as the balance sheet formula, but it solves for shareholders’ equity by rearranging the terms of that formula.

The statement of shareholders’ equity formula is:

Shareholders’ Equity = Assets minus Liabilities

Statement of Shareholders’ Equity Line items

Line items on the statement of shareholders’ equity vary by company. The number of line items affecting the shareholders’ equity balance increases for larger and more complex companies.

Examples of statement of shareholders’ equity line items include:

- Net income (loss)

- Cumulative effect adjustments made to retained earnings or accumulated deficit from adopting certain new financial accounting standards

- Issuing common stock for exercise of equity awards and the employee purchase plan

- Payment of withholding taxes related to net share settlement of equity awards

- Stock-based compensation

- Certain transactions related to convertible notes

- Foreign currency translation adjustments

- Change in unrealized loss on marketable securities, net of tax

- Repurchase of common stock (treasury shares).

Example Statement of Shareholders’ Equity

Source: Enphase Energy, Inc.10-K annual report SEC company filing for the Year Ended December 31, 2021.

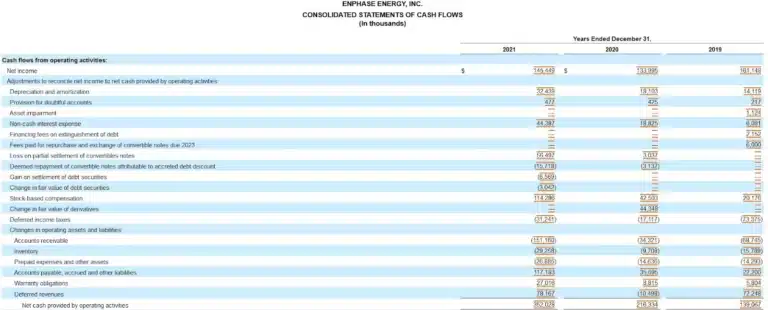

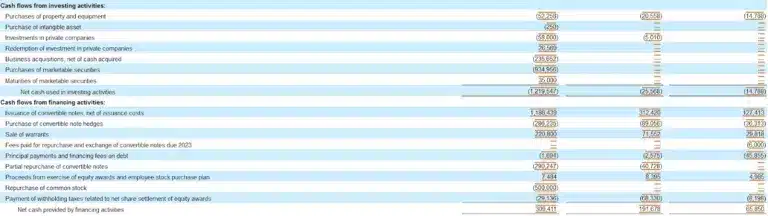

Cash Flow Statement

The cash flow statement is prepared on either an indirect basis that reconciles net income to cash provided by operating activities or a direct basis that shows total summarized cash inflows and outflows without a reconciliation. Most companies use the indirect method to prepare the cash flow statement.

Items Listed on Cash Flow Statement

Besides presenting cash inflows and outflows, the statement of cash flows includes line items for beginning cash, cash equivalents, and restricted cash balance, ending cash, cash equivalents, and restricted cash balance, and certain required GAAP supplemental disclosures to include on the face of the statement.

The cash flow statement categorizes cash inflows and outflows as:

- Cash flows from operating activities

- Cash flows from investing activities

- Cash flows from financing activities.

For more details, read our linked cash flow statement article.

The supplemental disclosures on the face of the cash flow statement include line items for cash paid for interest and income taxes and line items for non-cash investing and financing activities. These supplemental disclosures are labeled by type.

Supplemental disclosures required for cash items include:

- Cash paid for interest

- Cash paid for income taxes

Examples of supplemental disclosures required for non-cash investing and financing activity items include:

- Purchases of fixed assets included in accounts payable

- Contingent consideration in connection with an acquisition

- Accrued interest payable upon exchange of convertible notes due in a future year

Understanding Cash Flow Statement Data

Understanding the cash flow statement data gives you an idea of how cash inflows are generated and used for operating, investing, and financing activities and how cash, cash equivalents, and restricted cash balances change for the period. The total cash, cash equivalents, and restricted cash balances are a combined total from the balance sheet.

The indirect cash flow statement reconciles net income or loss to cash. It includes line items adjusting for depreciation, amortization, and other non-cash amounts included in net income and changes in each type of working capital balance from a prior year to the next year.

Example Statement of Cash Flows

Source: Enphase Energy, Inc.10-K annual report SEC company filing for the Year Ended December 31, 2021.

Who Uses Financial Statements?

Businesses use financial statements internally to manage the business and externally through financial reporting to inform stakeholders, including shareholders and creditors. Corporate businesses also prepare tax-basis financial statements as part of their income tax return.

Potential borrowers making bank loan applications may be required to submit a business or personal financial statement to justify loan approval or rejection. A personal financial statement includes line items for an individual’s assets and liabilities. The difference between total assets and liabilities is net worth, which is indicated on the personal financial statement.

The financial planning & analysis (FP&A) staff or accounting team analyzes financial ratios calculated from financial statement information to determine liquidity, the financial health of a company, and the effects of elements of financial performance.

Importance of Financial Statements

Financial statements are important because they provide financial information that measures financial performance, resources, and liquidity. Financial statements let users review the historical cash flow of the business and significant disclosures, including Management’s Discussion and Analysis (MD&A). Financial statements aid in decision-making.

The analysis of financial statement trends provides insights to a company’s management and shareholders. Creditors and lenders use financial statements to assess the creditworthiness of potential and existing customers and borrowers.

Management and the Board of Directors of a company review financial statements as part of their fiduciary duty.