Income statements play a critical role in determining a company’s financial health. Businesses monitor revenues and expenses from the income statement against plans and budgets and forecast financial performance.

Table of Contents

What is an Income Statement?

An income statement is a core financial statement that shows you the company’s revenues, costs and expenses, net income or loss, and other comprehensive income (loss) for a period of time used in accounting. An income statement is used alongside the balance sheet and cash flow statement to paint a clear picture of a company’s financial health.

An income statement showing net profit or loss is also called a profit and loss statement. It may also present basic and diluted earnings per share (EPS) and weighted shares outstanding for a corporation with shareholders.

Understanding an Income Statement

To understand an income statement, consider it in the context of financial statements. An Income statement is one of three core financial statements. The other main financial statements are the balance sheet and cash flow statement.

Income statements in the U.S. are usually prepared using GAAP (generally accepted accounting principles). GAAP requires accrual accounting and following codified FASB accounting standards. Financial statements in other countries follow IFRS (international financial reporting standards), which have differences from GAAP reporting.

An important GAAP standard covers revenue recognition, which records a company’s revenues when performance obligations are reached. The income statement reports net sales instead of gross sales revenue. Returns and allowances reduce the gross sales to equal net sales.

Operating revenues are reported in the operating income section, separately from net income from discontinued operations.

Sometimes a small business may choose to prepare tax basis income statements that don’t comply with GAAP.

Most businesses use a multi step income statement which is more detailed than a single step or simple income statement. Preparing multi step income statements is easy when generated automatically with accounting software and ERP system reports.

A multi step income statement shows more classifications with subtotals, including revenue, cost of goods sold, gross profit, operating expenses by functional area and operating gains or losses, operating income (loss), non-operating expenses and gains or losses, profit before taxes, income tax expense, and net income (loss).

The income statement also shows the details of other comprehensive income (loss), which may be presented as part of the income statement or as a separate financial statement.

Publicly-traded and most privately-held companies present detailed financial statements prepared following GAAP. These financial statements include sections for revenues, cost of goods sold (COGS) or cost of services, and a gross profit subtotal in the income statement, before listing expenses and calculating operating income (loss) and net income (loss).

Net income (loss) flows to retained earnings (deficit) in the shareholders’ equity section of the balance sheet.

Another type of multistep income statement prepared by management accountants in a company for internal financial analysis separates direct and indirect expenses or variable and fixed expenses to compute contribution margin for product profitability calculations and pricing decisions.

Components of an Income Statement

Components of an income statement include:

- Revenues

- Cost of goods sold or cost of services

- Gross profit

- Operating expenses and gains (losses)

- Operating income (loss)

- Other expenses and gains (losses)

- Net income before taxes

- Income tax expense

- Net income

- Other comprehensive income (loss)

Functional area operating expenses, often listed as line items on an income statement, include general and administrative expenses, sales and marketing expenses, and research and development expenses. These items are combined as total expenses from operations.

To avoid giving too much information to competitors (from financial statements), general & administrative and sales expenses are sometimes combined as selling, general & administrative expenses (SG&A).

Fixed assets on the balance sheet are reduced by accumulated depreciation, with depreciation expense included in the income statement. Certain assets like patents are amortized, with amortization expense flowing to the income statement. Depreciation and amortization are non-cash expenses.

For companies not in the lending business, interest income and interest expense are netted and shown in the Other expenses section of an income statement, between Operating income and Net income before taxes.

Formula Used for Income Statements

The simplest formula used for income statements is:

Revenue – Expenses = Net Income

Multi step income statements have a more detailed formula:

Revenue – Cost of Goods Sold = Gross Profit – Operating Expenses and Costs = Operating Income – Non-operating Expenses and Costs = Net Income

Gains or losses are also considered when calculating operating income and net income.

Example of an Income Statement

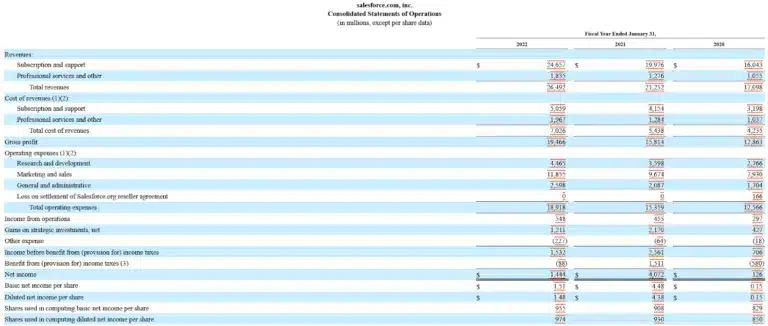

Salesforce Consolidated Statements of Operations and Consolidated Statements of Comprehensive Income (income statements) from the company’s 10-K annual report filing with the SEC dated March 11, 2022, are shown below (excluding the notes).

The Salesforce consolidated statement of operations shows the financial statement line items used to calculate operating income and net income in a multi step income statement. This financial statement also shows basic and diluted earnings per share (EPS) and the weighted number of shares used for each EPS calculation.

These Salesforce financial statements are considered income statements. They show separate lines for revenues and cost of revenues (also called cost of sales) by type, subtotals for Total Revenues and Total cost of revenues, then a subtotal for Gross profit.

Operating expenses follow. Line items for operating expenses include:

- Research and development

- Marketing and sales

- General and administrative

- Loss on settlement of Salesforce.org reseller agreement

These operating expense line items are subtotaled on a Total operating expenses line.

The following line subtracts Total operating expenses from Gross Profit. The result is called Income from Operations.

Non-operating gains or losses and expenses follow on the next two line items. In this case, they’re not labeled as non-operating items. These line items are Gains on strategic investments, net, and Other expenses. These gains are added, and the other expenses are subtracted to calculate the next subtotal.

In Salesforce’s income statement, the subtotal is Benefit from (provision for) income taxes, followed by a total line for Net income.

Following net income are four separate line items for Basic net income per share, Diluted net income per share, Shares used in computing basic net income per share, and Shares used in computing diluted net income per share.

Notes to the financial statements follow.

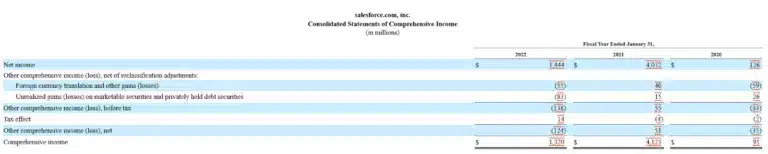

Instead of continuing to show Other Comprehensive Income (Loss) in its income statement, Salesforce chooses to present a separate statement named Consolidated Statements of Comprehensive Income.

This financial statement begins with a Net Income line, which is the same as shown in the Consolidated Statements of Operations.

The following section is Other comprehensive income (loss), net of reclassification adjustments. Two line items are included in this section, then subtotaled:

- Foreign currency translation and other gains (losses)

- Unrealized gains (losses) on marketable securities and privately held debt securities

The subtotal is called Other comprehensive income (loss), before tax.

The next line item is Tax effect, followed by a subtotal line for Other comprehensive income (loss), net.

The final line in this Salesforce Consolidated Statements of Financial Income portion of the income statement is Comprehensive income. Comprehensive income combines totals for Net income and Other comprehensive income (loss), before tax.

How Do You Create an Income Statement?

How to create an income statement:

- Complete the trial balance and post to the general ledger.

- Select the report format and accounting period from your accounting software.

- Generate the income statement report.

- Review and analyze the income statement.

- Distribute the income statement within the company.

- Prepare external financial statements for stakeholders, including the income statement.

Bookkeepers and accountants create financial statements, with accountants having more advanced training to comply with GAAP accounting standards.

Today, it’s rare and inefficient to create an income statement manually without financial accounting software. If you’re an outlier choosing to prepare a manual income statement, refer to this article’s Components of an Income Statement section.

When Should an Income Statement Be Prepared?

An income statement should be prepared monthly at the end of each accounting period, quarterly, and year-end for financial reporting. A projected (forecast) income statement for future accounting periods should be prepared when business plans, cash flow forecasts, or other financial models are needed.

An annual income statement is prepared for the fiscal or calendar year ended on a company’s selected year-end date.

Income Statement vs Multi Step Income Statement

Income statement vs multi step income statement means the difference between a simple and a detailed income statement showing revenue, cost of goods sold, and gross profit and separating operating and non-operating expenses and gain or loss to compute operating income(loss) and net income (loss) in steps.

Net income, called the bottom line, is included in both income statement formats.

Another definition of a multi step income statement for internal use by management accountants is an income statement that presents direct costs and indirect costs separately. Or an internal multi-step income statement breaks down costs into fixed and variable costs to compute contribution margin. The contribution margin is used to analyze a company’s break-even point and product profitability.

Importance of Income Statements

Income statements are important for assessing a company’s financial performance. Businesses can manage revenue and expenses in the financial plan and budget with variance analysis. Companies use Income statement projections to model and set financial goals.

Businesses calculate gross margin (gross profit margin) as a percentage of gross profit to revenues to analyze profitability at the cost of sales level, then monitor these income statement trends over time.

Financial analysts and investment banking firms use EBITDA (earnings before interest, taxes, depreciation, and amortization), calculated from the income statement, in M&A to determine the valuation of target companies they consider buying. Other comps are also considered. EBITDA converts EBIT (earnings before interest and taxes) to a cash basis by adding back the non-cash expenses depreciation and amortization.

Businesses analyze income statements using ratios (also using amounts from the balance sheet) to calculate many metrics. Companies can track ratios each reporting period and performance trends with KPIs (key performance indicators).

Metrics include several profitability ratios, including the rate of return on investment (ROI). The DuPont ratio multiplies net profitability, asset turnover, and financial leverage to compute return on equity (ROE).

Using income statements, ratios, and other financial statements, businesses can benchmark their financial results to other companies in the industry to gauge their relative performance and make improvements.