Table of Contents

What is an Intermediary Bank?

An intermediary bank is a bank that acts on behalf of the bank sending money in order to facilitate international financial transactions. You must provide the details of the beneficiary (or receiving) bank–not the intermediary bank–for the details of your final payment, to make sure the funds are correctly sent to the beneficiary.

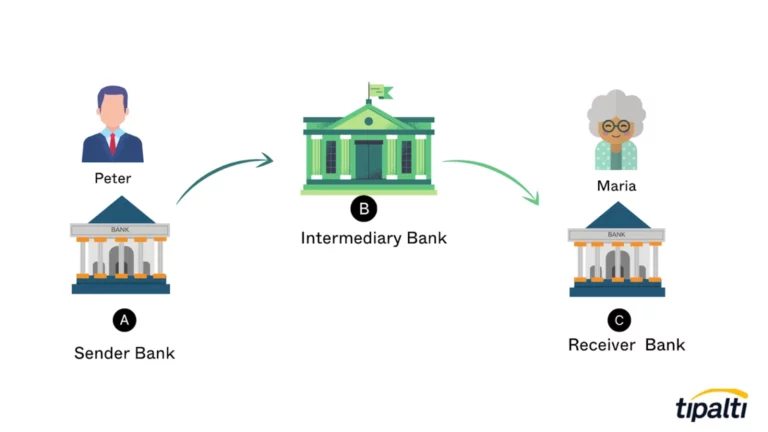

Example of an Intermediary Bank

To illustrate this, let’s use the example of Peter, a trader based in New York, who wants to purchase from a souvenir dealer, Maria, in the Philippines. This example is a cross-border transaction with international payment between different countries.

He instructs his bank (A) to send money to Maria’s bank (C). Since his bank does not have an account with Bank C, it must route the funds through an intermediary (B) to facilitate the transaction to transfer money.

Understanding Intermediary Banks

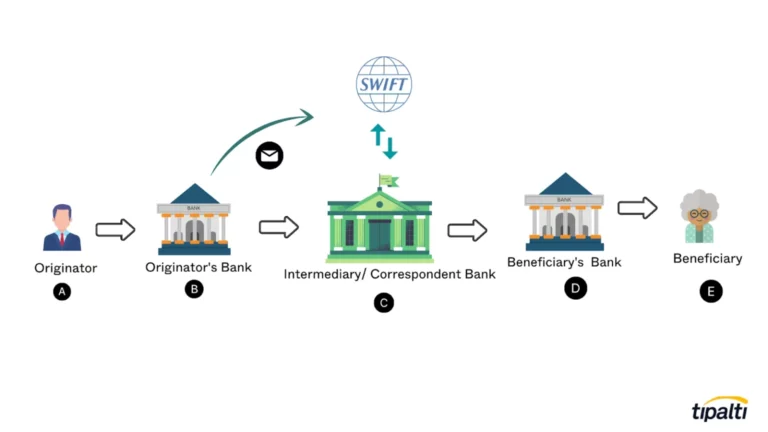

During an international money transfer, intermediary banks play a crucial role. This ecosystem has five critical players:

- Originator– A person or a business entity that initiates the transfer.

- Beneficiary – The ultimate party to be paid or credited.

- Originator’s Bank/sender bank – Receives instruction from the originator to transfer funds to the beneficiary.

- Beneficiary’s bank/receiving bank – Pays the beneficiary.

- Third-party financial institutions – Other financial institutions that might be needed to complete the transitions. Examples include intermediary banks or correspondent banks.

In an ideal situation, the originator and beneficiary bank have an account with each other. In this case, the transaction will be quick. However, in its absence, the intermediary bank comes in to act on behalf of the originator’s bank in facilitating the transaction.

It is not uncommon to have more than one intermediary bank in a transfer before finally arriving at the beneficiary bank account.

Power your entire partner payouts operations

98%

Customer Satisfaction

$60B+

Annual Transactions

4M+

Partners

4,000+

Customers

99%

Customer Retention

When is an Intermediary Bank Required?

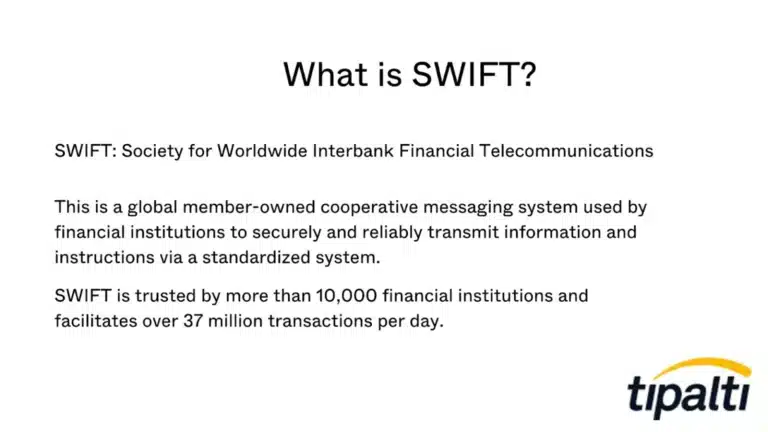

An intermediary bank is required when making international funds transfers between the originator bank and the beneficiary bank. This only happens when the banks don’t have an established relationship, such as an account that would otherwise facilitate a direct deposit in a SWIFT network.

This is particularly important when funds in the bank transfer need to be converted from U.S. dollars or another currency to the beneficiary’s local currency.

What’s the Difference Between Intermediary and Correspondent Banks?

In many parts of the world, there is a fine line between intermediary and correspondent banks, which are U.S.-based or international banks. For starters, both enable the international transfer of money from the originator bank to the beneficiary bank. However, the difference lies in the number of currencies they support.

Intermediary banks send money to complete a request done in a single currency, usually domestic. Whereas, correspondent banks support multiple foreign currency transactions.

Another distinguishing feature is the scope. A correspondent bank can also be involved in currency exchange, wire transfers, check clearing, and settlements through Nostro Account or Vostro Account. They enter into arrangements to offer banking services on behalf of a local bank in a foreign jurisdiction.

What Fees are Associated with Intermediary Banks?

Intermediary banks charge no standard fees, resulting in a lack of transparency. However, the intermediary bank fees vary, depending on the currency and other fixed charges levied.

On average, intermediary fees are between $15 – $30 per transaction. This is often frustrating to clients as it can be costly—especially if more than one intermediary bank is involved and charges are not specified before initiating a transaction.

SWIFT Fees and Intermediary Banks

The parties involved can pay fees using a standard SWIFT form; field 71A “Details of Charges” using the following options: (“OUR”), (“BEN”), or (“SHA”).

Options defined:

- “OUR“- The originator pays all the transaction fees. The beneficiary receives the full amount.

Example: Originator sends $500 to the beneficiary. The originator bank charges $10 in fees, and the intermediary banks charge $30. The originator account will pay the full transfer fee of $40. The beneficiary receives $500.

- “SHA” (Shared) – The transaction costs are divided between the originator and the beneficiary. The originator bank charges a senders fee to their account, while the beneficiary pays the intermediary fees.

Other charges can also be levied by the beneficiary bank. Usually, the intermediary charges are automatically deducted from the amount transferred.

Example: Originator sends $500 to the beneficiary. The bank charges transfer fees of $10, and intermediary banks charge $30. The amount deducted from the originator account will be $510, while the beneficiary receives $470.

- “BEN” (Beneficiary) – The originator does not incur any charges. All charges, including intermediary and beneficiary banks, will be the responsibility of the receiver.

Example: Originator sends $500 to the beneficiary. The bank charges transfer fees of $10, and intermediary banks charge $30. The amount deducted from the originator account will be $500, while the beneficiary receives $460.

How Do You Find Intermediary Bank Information?

A sender is not required to know intermediary bank information. This is knowledge shared between banks. Only the beneficiary bank information, including a SWIFT code and the bank account number for the beneficiary account, is needed.

An originator bank can enter into an agreement with an intermediary bank based on several reasons, including regulatory requirements, convenience, and location. As is often the case, the originator bank offers the best route to minimize delays and costs. This information can be revealed to the sender before initiating a funds transfer.

Importance of Intermediary Banks

Intermediary banks are important because they streamline international transfers from the originator bank to the beneficiary.

These banks form an international banking network that supports the seamless movement of funds across the world. They also help banks consolidate account and branch locations.

Intermediary banks are needed to conduct due diligence to avoid fraud, money laundering, and other illegal activities.

Summing it Up

If two banks use an intermediary, it’s going to cost you. The more transfers you make, the more it racks up. Frequent international wire transfers through an intermediary can be expensive.

When in doubt, you should always contact your bank directly to ask if and how much they charge for initiating the transfer of your funds and currency exchange rate fees.