Table of Contents

For businesses and consumers, online marketplaces play high-speed matchmaker for services and products. However, one challenging aspect of online marketplace payments persists: the need to compensate for the continuing and increasingly global stream of service providers and suppliers.

There are more marketplace payment solutions than ever in 2024. Learn about online marketplace payments and how to choose the best payment gateway with functionality for your business needs.

Popular Online Marketplaces in 2024

Online marketplace businesses are multi-sided, with participating product sellers, creatives, or service providers, and buyers or other participants like hirers or donors. Popular online marketplaces in 2024 include eCommerce platforms for products like Amazon Marketplace, eBay, Walmart.com Marketplace, Facebook Marketplace, and Etsy. Other popular online marketplaces include Indeed, Uber, Fiverr, Skillshare, Omnia Media, and GoFundMe.

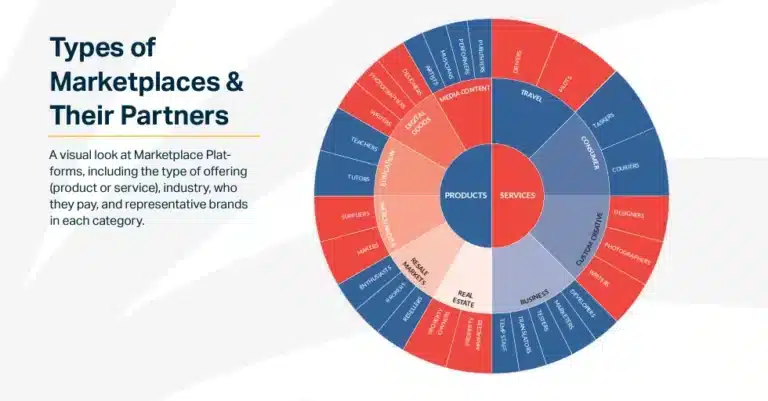

The following market landscape graphic, Types of Marketplaces & Their Partners, can be used to visualize markets by the type of offering (product or service), the industry or type, and who they pay.

[updated image]

What are Marketplace Payments?

Marketplace payments are cash disbursements, payment processing, and payment acceptance made through a payment gateway between a multi-sided platform intermediary and suppliers and buyers of products, digital ad impressions, or services offered through the online platform.

The buyer establishes a verified payment method for the intermediary to use through a payment processor or payment gateway, like a prepaid debit or a credit card, ACH, or global ACH bank transfer. The seller, service provider, publisher, royalty holder, or influencer receives the funds from the payment processor to deposit in their merchant account.

Marketplace payment processing companies must have PCI compliance for credit card and debit card payments.

Top Marketplace Solutions in 2024

We compare some of the top online marketplace payment solutions. Not all of the following online marketplace payment platforms/payment gateways are available for use in all countries.

7 top online marketplace payment solutions in 2024 are:

- Tipalti

- Trolley

- Hyperwallet

- Stripe Connect

- MANGOPAY

- Adyen

- Dwolla

Tipalti

Tipalti provides an online marketplace payment solution with its mass payments software that integrates with your performance marketing system and can also sync with your ERP system or accounting software to process payables and make online payments. The Tipalti finance automation software not only focuses on the needs of paying your marketplace partners but can also be used as a total payment solution for your business when it pays all of its suppliers.

Tipalti provides enterprise-grade security and performs screening checks for automated global regulatory compliance. Tipalti is available in multiple languages.

Tipalti collects partner contact and preferred payment information plus W-9 or W-8BEN and W-8BEN-E forms data through its white-branded self-service partner onboarding portal before making the first payment. And it tracks payments. Tipalti provides 1099 and 1042-S reports that make 1099 and 1042-S tax form preparation easier. Or you can subscribe to a partner’s integrated tax software for automatic eFiling. You’ll import Tipalti payments data for 12 calendar months to eFile 1099-NEC and 1099-MISC information returns with the IRS and applicable states and automatically distribute copies to recipients.

Tipalti partner payment methods include:

- ACH

- Global ACH

- Wire transfer

- PayPal

- Prepaid debit cards

- Live paper check

In addition to giving a choice of payment methods, Tipalti offers a virtual card, Tipalti Card, for cash-back rebates on your company’s pre-approved online card spend. Tipalti reconciles large batch payments with multiple payment methods in real-time and can speed your monthly close by 25%.

Strengths

- White-branded, self-service portal for marketplace partner onboarding

- Offers a choice of global payment methods in 196 countries and 120 currencies

- Saves up to 50% of payouts processing time, including real-time payment reconciliations

- Automatically performs tax and global regulatory compliance, including tax ID and blacklists screening with 26,000+ algorithmic rules for payment validation

- Substantially reduces fraud risk and errors by 60%

- Has money transmitter licenses (MTL)

Tipalti has a 99% customer retention rate and a 98% customer satisfaction rate.

Pricing

Tipalti’s pricing is affordable for SMBs and midmarket companies, offering two pricing packages. SaaS pricing starts at $149 per month for the platform fee. Tipalti automation software scales as your business grows. Request a quote for a Tipalti software package that will meet your specific business needs now or later.

Decide which Tipalti features you need immediately. Tipalti lets you add features over time. When your business needs to pay foreign marketplace payees, your company can add Tipalti features for W-8 tax forms, international tax IDs, advanced FX (foreign exchange), and multi-entity payables.

Tipalti charges transaction fees for payments, but has fee splitting capabilities that allows payers to incent payees to adopt safer, more efficient payment methods for your business. .

Marketplace Case Study

Omnia Media is a company that provides a marketplace for online video monetization. Omnia Media has been a Tipalti mass payments software customer since 2014, highlighted in a Tipalti case study which includes testimonials.

Omnia Media’s achievements with Tipalti include:

- Reduced partner onboarding, compliance, and payment workload by 95%

- Eliminated need to hire additional back office resources

- Partners self-serving payment method and currency preferences

“The sheer amount of data we have to deal with to pay out this amount of money to all our partners every month is massive. We use Tipalti with a network of 1,400 partners who garner over three billion views a month on YouTube. We’re paying out multimillions of dollars a month to these partners, and it’s relatively effortless.”

—Greg Kampanis, SVP Operations and Business Development, Omnia Media

Trolley

Trolley (formerly Payment Rails) is a solution for marketplace payouts. Trolley serves worldwide global payment markets in more than 215 countries or regions.

Trolley payout methods include:

- Bank transfer ACH to United States

- Bank transfer EFT to Canada

- International ACH to 75 countries on local banking rails

- Paper checks to U.S. mail

- Domestic and international SWIFT bank wires to over 135 countries where no local banking rails

- PayPal instant payments using existing PayPal accounts (PayPal fees apply)

Trolley bank transfer methods take 24 to 48 hours for delivery.

Strengths

- Self-service onboarding, including W-9 and W-8BEN tax form collection

- Payments to over 215 countries/regions with a choice of over 135 currencies

- 1099-NEC, 1099-MISC, 1099-K, and 1042-S tax reporting with eFiling

- Automatic TIN validation

- Automatic calculations for foreign persons tax withholding

- Low FX rates

Pricing

Trolley pricing includes three plan levels:

- Grow Plan $49 per month

- Platform Plan $199 per month

- Enterprise Plan – Request a quote from Sales

Each Trolley plan offers unlimited users, recipients, and payments. Payments have additional transaction fees. The Grow Plan doesn’t include multiple currency balances and tax features including W-9 and W-8 tax form collection and end-of-year tax statements and eFiling. End-of-year tax statements have an additional fee in other Trolley plans.

Hyperwallet

Hyperwallet (a PayPal Service) specializes in marketplace payout capabilities, serving over 200 global markets. Braintree, another PayPal company, offers marketplace payment solutions through Hyperwallet. PayPal acquired Hyperwallet in November 2018.

Hyperwallet payment methods for marketplace payouts include:

- Bank account for wire transfers or local direct deposits

- Credit card, debit card, or prepaid debit card

- PayPal transfer method

- Paper check

The PayPal transfer method used with Hyperwallet is available in a limited number of regions, countries, and currencies. PayPal transfers are supported by Hyperwallet’s straight-through payout model as a Pay Portal payout experience or Embedded Payout experience.

Strengths

- Global payouts, including cross-border, that may be multi-currency

- Financial strength through PayPal ownership

- Scales for small payment runs or mass payouts of 10,000 payments

- Doesn’t require recipient to have a bank account

- Reporting and compliance with global regulations for payments

Pricing

Hyperwallet has no monthly fee, but charges cash out fees starting at $0.95 (depending on selected payout method) and a monthly funds storage fee of $2.95 if funds received in the Payout Portal aren’t cashed out within 90 days.

Stripe Connect

Stripe Connect provides a payment system for worldwide marketplaces and platforms, including onboarding, KYC compliance, and global payouts. Stripe lets your business split payments of funds between multiple users. With the Stripe Dashboard, you can make payouts, issue refunds, and handle chargebacks.

Stripe Connect methods for payouts include:

- Major debit cards and credit cards

- ACH

Strengths

- KYC and global payments compliance

- Includes point-of-sale checkout transactions, subscriptions, and invoicing

- 1099 tax reporting

- Instant payouts or linked bank account payouts (including crypto payouts), payment acceptance, and virtual spending cards

Pricing

Stripe Connect business model pricing offers Standard (for platforms), Express (for marketplaces), and Custom (white label) pricing plans. Standard has no platform specific fees. The Express plan charges $2 per monthly active account and 0.25% + 25 cents per payout sent. The Custom plan has the same pricing as Express and allows platforms or marketplaces to mark up the buy rate pricing on transactions for payment options.

MANGOPAY

MANGOPAY provides modular payment infrastructure software for marketplaces and platforms. The modules offered are Identity, eWallets, Payout, and Payments, with upcoming modules for Fraud, Dashboard, FX, Orchestration, and Integration. MANGOPAY customers can choose which modules they need. MANGOPAY is used globally by over 2,500 marketplaces and platforms from small business to large enterprise. With MANGOPAY, your business can accept payments, make payouts in 15 currencies, and onboard sellers.

For marketplaces, MANGOPAY currently provides solutions for C2C (consumer-to-consumer) and B2C (business-to-consumer) marketplaces and plans to soon add Rental Marketplaces, Retail Marketplaces, and Crowdfunding. MANGOPAY also provides software solutions for B2B (business-to-business) platforms.

MANGOPAY local and global payment methods include:

- Bank transfer

- SEPA

- SWIFT

- Faster Payments

- PayPal

Both Faster Payments and PayPal payments through MANGOPAY are instant payments. Bank transfer and SEPA (a type of global ACH for 35 SEPA member companies in Europe) are received in 1-5 business days; SWIFT payments are received in 3-5 business days.

Strengths

- Choice of payment methods, including instant payments

- Specializes in marketplaces and platforms

- Secure with KYC, KYB, and AML compliance verification and sanctions screening

- Workflow automation

- Large batch or real-time payments

- EU-licensed and regulated financial institution

Pricing

MANGOPAY offers standard pricing and custom volume pricing (get quote).

Standard pricing in euros for MANGOPAY starts from:

- Pay-in: 1.4% + €0.25

- Platform fee: €49 per month

- Payout: €0.20

- Identity: KYC: 1€ KYB: 5€

The actual MANGO pricing will depend on payment method.

Adyen

Adyen is a payment gateway and payments platform for accepting online and in-person payments, using all worldwide popular payment methods. These payment methods, which use a payment processor, include PayPal digital wallets, Apple Pay, VISA, Mastercard, American Express (AMEX), GooglePay, AmazonPay, AliPay, and Klarna. Use cases of Adyen includes payments for marketplaces.

Strengths

- Lets your business customers choose their preferred payment method available in their location

- Includes local currency payments with a local connection

- Offers digital wallets, buy now, pay later (BNPL), and vouchers

Pricing

Adyen pricing is per transaction, with no setup fees or monthly fees. Each transaction fee includes a fixed processing fee of 0.10 Euro plus a fee determined by the payment method. Using other Adyen products, besides payment methods, also has a cost.

Dwolla

Dwolla is an open banking platform for account to account payments, with use cases including marketplace payments. Businesses use Dwolla to collect, disburse, or facilitate marketplace platform transactions between users. Dwolla has a partnership with Currencycloud to enable global cross-border payments.

Dwolla account to account payment methods include:

- Standard, next day, and same day ACH bank transfers

- Account to account transfers between verified payer and payee with a Dwolla Network balance sent through the Dwolla Platform

- Real-time transfers within the RTP® Network

- Incoming and outgoing wire transfers at an additional cost

Strengths

- Fast start-up time with API and prebuilt components

- Streamlined integration with a payment service provider

- Security features for electronic account to account payments

- Scaleable for millions of users and thousands of at-once payments

Pricing

Dwolla offers both Base Pricing and Scale Pricing. If Dwolla meets your company’s needs, contact Dwolla sales for a quote.

Payment Challenges for Online Marketplaces

What partner payment challenges do online marketplaces face? Here are a few.

- Partner Onboarding – your partners – such as freelancers, contractors, creators, streamers, affiliates, or publishers – are transient with limited loyalty. This requires that marketplaces quickly and accurately onboard new, eager partners.

- Scale Business – To grow the marketplace into a recognizable and reliable brand, businesses need to employ economies of scale. That requires a lean operating methodology and high productivity.

- Partner Experience – Most marketplace operations are focused on one side of the marketplace: customers. But this neglects the entire supply side of the platform. Marketplaces can look to create a great partner experience to inspire loyalty and avoid costly partner churn.

- Payment Infrastructure – Visionary marketplaces with a long view on their survival know that they cannot use PayPal alone to pay their partners. They look to put in place an adequate partner payment infrastructure to meet the needs of a diverse, increasingly global partner base.

How can your business improve its online marketplace payments globally?

Download our eBook, “Top Strategies for Online Marketplaces” to learn how your growing business can make its global marketplace payments better.

Use mass payments software with self-service partner onboarding and verification to promptly pay marketplace partners in efficient large batches, while reducing errors and fraud risk and achieving global regulatory and tax compliance.

Requirements for Automating Online Marketplace Payments

Automating online marketplace payments requires a comprehensive approach that covers the entire life of the partner engagement. Here are recommendations for how marketplace payments should be automated.

Partner Onboarding

- Payment method and currency selection

- Banking or PayPal details collection

- Tax ID collection

Fraud and Risk Controls

- Tax ID validation

- Government blacklist screening

- Internal “do-not-pay” screening

- Two-factor authentication

- Accuracy Controls, including: Bank or PayPal account verification and Wire/SWIFT/IFSC coding verification

Remittance Processing

- Internal, multi-tier role-based approvals

- Multiple payment method controls (e.g. wire transfers, domestic ACH, international ACH, PayPal, prepaid debit, paper check, etc.)

- Choice of currency and payment thresholds

Partner Communications

- Notification system

- Issue resolution processes

- Self-service portal for account changes, payment history and status

Payment Reconciliation

- Real-time, discrete reporting on past and pending transactions

- Details of any fees leveed, including currency conversion

- Rich, auditable history of transactions

Manageable Infrastructure

- Updates for changing bank dynamics

- Ongoing diligence on tax and regulatory compliance issues

- Customized branding for partner interactions

- Integration to performance marketing systems

- High traffic, high availability server backend

Tips for Choosing a Payment Solution

Six tips for choosing an online marketplace payment solution are:

- Use a best-in-class payment solution to attract and keep the best marketplace partners in hundreds of countries.

- Only consider payment platforms that excel at mass payments, both domestically and internationally.

- Use a payment solution that scales with business growth and enables large batch payments with real-time reconciliation.

- Select a platform that offers automated global regulatory compliance and supplier tax compliance, with automated error and fraud detection.

- Use a marketplace payment platform that lets your business efficiently pay its partners on time, with their cost-effective choice of country-available payment method and currency.

- Choose a marketplace payment solution that also works for paying other types of suppliers that your business routinely pays.

Summing it Up

Marketplace payments are foundational to establishing a loyal, growth-oriented, motivated, and valuable network. Marketplaces must pay their partners efficiently while mitigating risk, reducing compliance burdens, and maintaining profitability.

Tipalti mass payments software provides a top-rated online platform solution for making timely, efficient, and cost-effective marketplace payments in 2024. Download our recording, “Delivering a Best-in-Class Partner Payments Experience for Crowdsourcing and Online Marketplaces.”