No matter the size of a business, success is generally measured by the difference between the expenditure and revenue cycle. When it comes to expenditure and purchasing, having an efficient accounts payable process is vital to tracking performance. In the business process known as “procure to pay” or P2P, accounts payable is a critical component. It encompasses the whole cycle an AP department goes through to complete and archive a purchase.

Without this setup, a business will fall behind on bills, straining relationships and negatively affecting revenue. Thus, it’s important to understand what the full cycle accounts payable process involves and how to streamline it at every corner.

In this article, we’ll look at what a full cycle accounts payable process entails, a useful accounts payable process flow chart, challenges faced in the AP cycle, and how automation is the future for accounts payable.

What is the Full Cycle Accounts Payable Process?

Full cycle accounts payable, as the name implies, is the complete cycle that an accounts payable department goes through to complete and archive a purchase. From receiving and approving invoices to paying vendors and suppliers for their goods and services, the AP process is critical to any business. It is part of the procure-to-pay business process and mainly centers around effective invoice management.

The end-to-end AP process includes:

- Documenting and transmitting the purchase order

- Approval process

- Invoice processing

- Two-way or three-way match (PO and receiving report)

- Invoice coding

- Transferring funds to pay invoices

- Recording all transactions

At the end of the day, the main AP process can be broken down into four categories: invoice capture, invoice approval, payment authorization, and payment execution.

The AP team largely deals with:

- The approval and processing of invoices

- Ensuring that the business is able to pay off its debts

- Showing creditors that you can organize your payment plans properly, boosting your reputation

Protecting against inaccurate or illegitimate invoices by verifying them against purchase orders. (For instance, what the business receives from a vendor might differ from what is listed on the invoice, either in price or in quality.)

Although the bookkeeping for all of this paperwork may sound like an arduous task, especially in high-volume offices, today’s accounting software significantly reduces the burden and streamlines invoice payments for an AP team. Automation software can easily match invoices and eliminate data entry, speeding up the payable workflow and allowing staff to focus more on business growth.

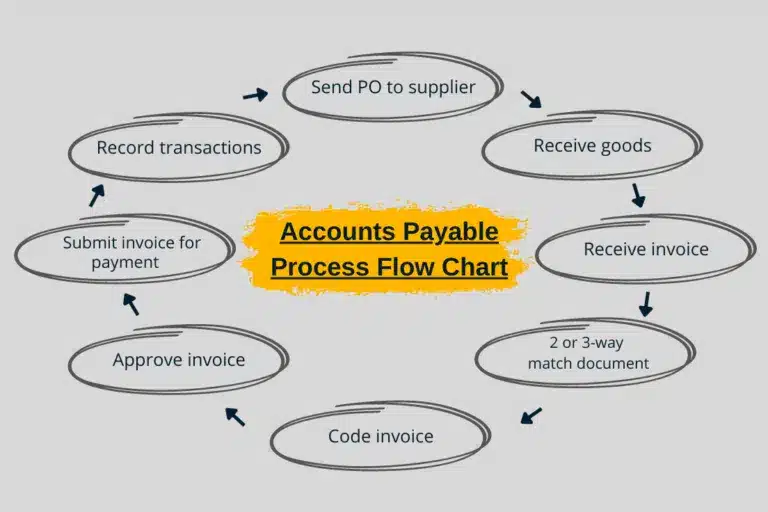

Accounts Payable Process Flow Chart

Here are the key steps in an accounts payable process flow chart:

- Send purchase order to the supplier

- Receive and inspect goods

- Receive invoice

- Match document 2 or 3 ways

- Code invoice

- Route invoice for approval

- Submit invoice for payment

- Record all transactions in the GL

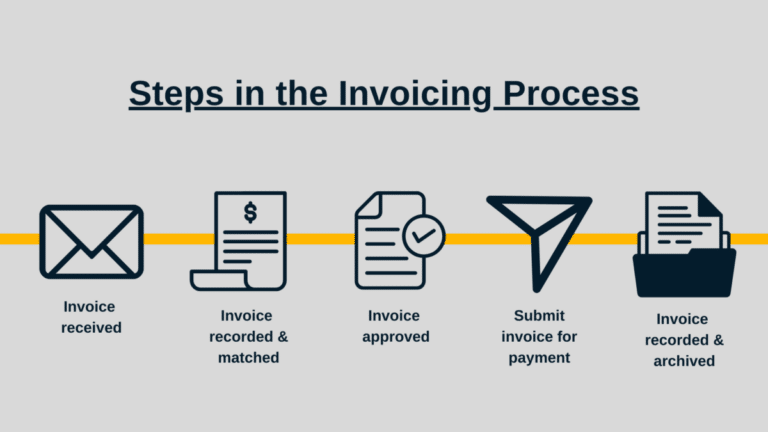

Invoice Processing Flow Chart

Here are the key steps in an invoice processing flow chart:

- Receive supplier invoices

- Match document 2 or 3 ways

- Route invoice for approval

- Submit invoice for payment

- Record all transactions in the GL

The Three-Way Match

The 3-way match is the manual way to ensure the original purchase order is in line with the final payment made to the vendor. AP compares the PO, the receiving report, and the vendor invoice.

- The purchase order details what your organization has ordered and the expected cost of the goods.

- The receiving report is what your organization has actually received from the vendor. The information is used to verify that the client has received the correct quantity of product and that the delivery is in acceptable condition.

- The vendor’s invoice comes from the supplier and shows what that vendor has billed your business.

Accounts payable compares these sources and checks whether any serious financial errors have been committed. Issues like overpayment and transaction problems are flagged early on, and auditing is easy now that the bookkeeping is already finished.

Sometimes a business might opt for a 2-way or 4-way match instead. 2-way matching only involves the invoice and purchase order, while a 4-way match adds an additional step to the Three-Way Match: inspection and verification post-delivery.

A 4-way match is naturally the more secure method that takes extra time, but it’s ideal in situations where compliance and strong controls are necessary. A 2-way match is more common in smaller companies making less important transactions and where a PO isn’t required for maverick spend.

However, the Three-Way Match generally offers the best balance between integrity and efficiency. It relies on the AP team’s ability to track down and analyze the required documentation quickly and accurately, as any delays can delay shipments and annoy suppliers.

How can your business improve accounts payable processes globally?

Download our white paper, “The Holy Grail of Accounts Payable,” to learn how your growing business can gain the benefits of AP automation.

For your end-to-end accounts payable process, use AP automation software with self-service supplier onboarding, accounts payable invoice processing, and global payments to simplify global regulatory and tax compliance and reduce fraud risk and errors.

The Flow of Full Cycle Accounts Payable

You can think of AP as the bridge between procurement and payment. This “P2P pipeline” goes both ways: handling “upstream” and “downstream” workflows to keep inventory stocked up and vendors satisfied with your payment terms.

The full cycle accounts payable process (“P2P pipeline”) can be thought of as flowing in two directions, upstream and downstream.

- Upstream. This is where procurement takes place. In this phase, the business will conduct strategic sourcing, supply chain management, and negotiate contracts. Payment terms are negotiated during this first part, and purchases can be monitored for risk. Procurement steps are taken to find the right vendors, the ideal contract terms for both parties, and the most beneficial vendor relationships.

- Downstream. “Downstream” refers to everything that happens after the transaction. In this second directional process, goods and services are received with an invoice that is verified and paid. The accounts payable system still needs to track the products and services received and compare the invoice data with the original purchase order. Not having a good accounts payable system for the job may result in missed payment due dates and even late fees.

Almost every purchase a business makes is the responsibility of the AP process with the only exception of payroll. The team handles not only the transaction but also the search for potential savings and discount opportunities.

In both streams, it’s important to continually strive to reduce human error, maximize efficiency, and incorporate modifications to achieve greater productivity and stronger internal controls. In both the Upstream and Downstream phases, risk management is a crucial component.

Challenges of the Accounts Payable Cycle

The AP department is a busy place and is typically awash in manual processes, whether that’s cash management, paper invoices, data entry, or double-checking due dates. There are many challenges presented and a variety of systems working in tandem to process payment.

For many companies, both small businesses and larger enterprises, AP goals face a multitude of obstacles like outdated equipment, limited staff, lack of planning, cash flow issues, and manual bottlenecks. Other challenges include:

- Duplicate payments or double-entry

- Lost/missing vendor invoices

- Diluted approval process

- Inaccurate balance sheet

- Late payments and late fees

Like a clock, the accounting process relies on a variety of gears to operate seamlessly and function properly. Any small slip-up can result in strained relationships, late payments, and loss of discounts.

That’s why many organizations and small business owners are turning to AP automation to eliminate discrepancies, shorten invoice approval, make timely payments, and ensure efficiency.

Automation: The Answer You’ve Been Looking For

For analyzing financial statements, expense reports, and the general ledger, a small business typically turns to a spreadsheet for tracking.

However, accounts payable automation makes every single aspect of the process simpler. Your team will no longer be scrambling for signatures, wasting valuable time with manual data entry tasks, or devoting company money (and intangible human resources like creativity) to largely repetitive, unnecessary processes.

A company is also helping the environment (and saving money on office supplies), as an automated AP process allows you to go entirely paperless. Today, many manual tasks have been consolidated thanks to advanced automation solutions that simplify a variety of jobs.

With an ERP system set up, you’ll be able to automatically match invoices to purchase orders and enter them into your system without any human intervention. Invoice data capture can become an instant process with the use of online supplier portals. These days, AP doesn’t even have to scan a supplier invoice if they have the right equipment.

The end result of all of this is that every vendor invoice that comes through your business becomes an electronic invoice. The dependence on physical paper (and many aspects of office supplies) has been eliminated to create a leaner department. It allows for a new surplus of resources to redirect to more profitable areas.

Accounting Software for Full Cycle Accounts Payable

Invoicing, data entry, cash flow tracking, and other functions in the payable process today are facilitated by advanced digital tools; performing a wide variety of tasks that were unthinkable just a few decades ago.

In its most basic form, a digital accounting system for a full cycle accounts payable office could be an Excel spreadsheet. For analyzing expense reports, financial statements, and the general ledger, a spreadsheet works well for a small AP office.

A larger business will need much more. It will need something to manage multiple vendor relationships, vendor payments, performance metrics, and your payable team. That’s where powerful AP platforms come in.

Quickbooks

Intuit’s Quickbooks offers several accounting features that spreadsheets can’t deliver. For example:

- Audit Trail: This tool displays a history of all changes made to a transaction, including when the edits were made, who made the modifications, and what the specific changes were.

- Roles and permissions: It’s possible to establish custom permissions for various types of employees. For example, you can create a custom login for accountants.

Tipalti

For ERP integration and global payments capability, Tipalti offers a suite of software tools that can accomplish many tasks. These include:

- Ability to send payments to suppliers in over 180 countries.

- Invoice processing with optical character recognition (OCR).

- VAT and tax compliance with multiple tax forms.

- Compatibility with Quickbooks.

Accounts Payable vs. Accounts Receivable

The difference between accounts payable and accounts receivable is that accounts payable is short-term debts your business owes to suppliers. Accounts receivable deals with monies the business expects to receive from customers or partners on credit. In short, accounts payable is money your business owes, and accounts receivable is money your business is owed.

Accounts payable works whenever the organization orders from suppliers or service providers; it handles all the money owed by the company. Accounts receivable goes the other way; it covers the products and services your own business sells to customers on credit.AP and AR exist because the moment you choose to purchase products rarely happens at the same time as the moment you set down the money and receive the goods. Because spending and receiving money happens on a schedule, ensuring that you are never stuck without enough to make a payment requires finance, AP and AR to work together and coordinate budgeting, cash flow management, and working capital management.

Summing It Up

In many companies today, AP has become a bottleneck and a drain on valuable time and resources. Automation through AP software makes every invoice an e-invoice. Vendor payments are quick and efficient, which solidifies vendor relationships and streamlines the payment process.

A business can save vital employee time and boost productivity, while investing in the mission of building a better, more successful company.

Although end-to-end accounts payable entails a great deal of red tape, it doesn’t have to be a tedious process. With adequate knowledge, experience, and tools, every AP office can efficiently manage cash flow and payment processing. All it takes are the right tools, and that starts with an intelligent AP automation system. Download our eBook,“The Ultimate Accounts Payable Survival Guide” to learn more about AP automation software.