Modern AP automation and global payments software for invoice management replaces manual paper invoice processing with streamlined and efficient electronic invoice processing, including validation, approval, and simple global invoice payment and reconciliation.

Improve the efficiency of your business invoice capture, payables, and payment processes with this guide to optimizing invoice management.

Table of Contents

What is Invoice Management?

Invoice management is invoice processing from invoice receipt to payment. Invoice management spans invoice receiving and storing, validating suppliers and invoice amounts for goods or services ordered and received, approving invoices for payment, paying invoices, and recording and reconciling transactions.

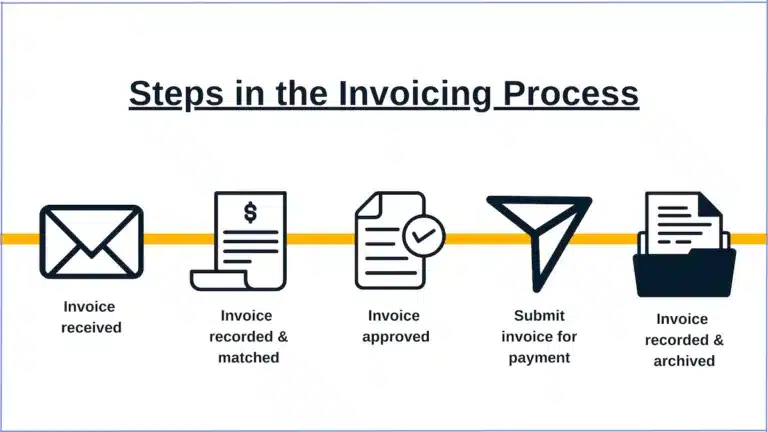

Key steps in invoice management/invoice processing are:

- Receive invoice

- Record and match invoice

- Approve invoice

- Submit invoice for payment and processing

- Record and archive invoice

Goals for invoice management include preventing fraud and errors and achieving tax and global regulatory compliance.

Why is Invoice Management Important?

Invoice management is important because it streamlines invoice processing and payment and creates an audit trail. Automated invoice management reduces fraud, duplicate payments, and other errors. Invoice management includes a repository of invoice documents matched with purchase orders and receiving documents. It includes exceptions notifications and payment status communications.

How can your business improve invoice management?

Download our eBook, “The Ultimate Accounts Payable Survival Guide” to learn how your growing business can optimize invoice management.

Use AP automation software and mass payments software to automate every step of the invoice management process. Eliminate paper invoices and manual workflows to increase operational efficiency, improve your business cost structure, and strengthen financial controls.

Traditional Invoice Management Processes

Traditional invoice management processes include receiving paper documents, temporary filing, 3-way matching, verifying invoice accuracy, recording invoices and payments through manual data entry, approving invoices, performing time-consuming communications to follow-up on supplier payment inquiries, and writing and mailing paper checks.

Detailed steps included in traditional supplier or vendor invoice management include:

- Receiving paper or emailed invoices

- Verifying the legitimacy of suppliers and accuracy of invoices, including recalculating totals

- Coding invoices for accounting and recording accounts payable

- Matching invoices with purchase orders from procurement and receiving documents

- Approving or rejecting invoices for payment

- Paying approved invoices (with the goal of only once)

- Recording and reconciling invoice payments

- Storing paid invoices in cartons of paper files or scanned invoice archives

Pitfalls of Manual Invoice Processing

Manual invoice processing has many pitfalls relating to time and staffing costs, loss of early payment discounts, supplier and customer relationships, and a risk of inventory shipment cut-offs by the supply chain. When paid paper invoices are stored off-site, they may be lost by misplacing them or by fire, destroying the disbursements and accounts payable audit trail and tax return receipt documentation.

Traditional invoice management processes performed by the payable team are too expensive. Human error can result in duplicate invoice payments, paying fraudulent invoices, paying the wrong amount, or getting IRS TIN numbers wrong. For 1099 tax compliance, small businesses with outdated systems may be using inefficient Google or Excel spreadsheets to track supplier payments. Bottlenecks and extra communications are frustrating for the AP team relying solely on manual processes.

The cost of manual invoice processing and payment averages $12 per invoice, although this invoice management cost can range from $5 to $15-$20 per invoice. Tipalti provides an invoice processing and payment calculator. Use it to calculate the estimated invoice processing cost for your business before switching to Tipalti AP automation software.

With slow manual invoice processing, the accounts payable department spends unnecessary time:

- Chasing down missing or lost paper invoices, purchase orders, and receiving reports

- Recalculating invoice line items and totals as a verification test

- Requesting corrected invoices from suppliers

- Expediting approval workflows through their human efforts

- Printing, stuffing envelopes, and mailing paper checks to numerous suppliers or vendors

A major pitfall of manual invoice processing is that invoices may not be processed in time to take lucrative early payment discounts on invoices, like 2/10 net 30 payment terms. Not taking early payment discounts means your company is leaving lots of money on the table.

If manual invoice processes are broken and not just really slow, your unpaid vendors/suppliers may decide to stop making new inventory shipments to your business until the bills that are due are paid. Significantly late payments not only negatively impact supplier relationships. These late payments will also hurt your customer relationships if customer orders can’t be shipped on time when raw materials or finished goods inventory is out-of-stock.

Can You Automate Invoice Management?

Yes, your business can save money and gain efficiency compared to manual invoice management when you automate invoice management using specialized AP automation and mass payments software integrated with your ERP system or accounting software. Automated invoice management begins with supplier onboarding and invoice data capture by OCR scanning, email, or supplier portal uploads.

Perks of an Automated Invoice Management Process

Perks or benefits of an automated invoice management process are:

- Saving time by streamlining and automating the entire invoice processing workflow, including intelligent invoice approval workflows and communications

- Reducing costs and improving cash flow with fewer hires and invoice processing in time to take early payment discounts

- Automatically screening for global regulatory compliance

- Automating tax compliance

- Making global payments more efficient with more cost-effective choices of payment methods and currencies

- Shifting the workload to more valuable projects to improve operational efficiency and analyze strategies to increase revenue

Automated tax compliance achievable through best invoice management practices includes:

- Collecting W-9 or W-8 forms data through a self-service supplier portal

- Automatically generating 1099 tax compliance reports or optionally eFiling 1099s using your company’s tracked supplier payments data

- Proper handling of VAT requirements automatically

AP Automation + Invoice Management

Using AP automation and mass payments software as an invoice management platform is a solution that:

- Provides time and cost-saving benefits from the automated AP process, guided invoice approval process, and payments process

- Strengthens financial controls and enterprise risk management

- Improves tax and global regulatory compliance

- Improves visibility of payables processes and supplier payments

Tipalti software is cloud-based. The Tipalti SaaS add-on app is connected to your ERP system or accounting software through API or flat-file integration. Tipalti integrates with most accounting and ERP systems, including Sage Intacct, NetSuite, Acumatica, Microsoft Dynamics 365, and QuickBooks Online and Desktop.

With Tipalti AP automation software, your company and AP department will operate leaner and achieve better results. Your finance, accounting, and AP team can spend more of their time on other projects to add value to the business.

Results from using Tipalti AP automation software features for automated invoice processing are:

- End bottlenecks by streamlining AP, invoice automation, and payment processes

- Replace time-wasting manual workflow with efficient automation to reduce payables processing time by 80%

- Reduce errors by 66% and mitigate fraud risk

- Automatically achieve global regulatory compliance

- Get IRS 1099 reporting or optionally eFile 1099s using partnered software with Tipalti payments data

- Simplify global payments, use FX options, and increase payment method and currency choices with Tipalti mass payments software

- Automate payment reconciliations to accounting systems for large batches in real-time

- Gain real-time multi-entity and consolidated company visibility into payables and metrics

Tipalti AP automation software lets your business complete the invoice management process in time to take valuable early payment discounts, substantially reducing the cost of purchases. Although Tipalti calls its software AP automation and mass payments, you can think of it as automated invoice management software. To add purchase order management automation (part of the procure to pay cycle), you can select the Tipalti Approve SaaS software product.

When you get and use the Tipalti Card (a virtual credit card or debit payment card) your business earns cash-back rebates on its transactions. The Tipalti card sets employee spend limits, vendor limits, and pre-approved categories, helping your company achieve better spend control.

Summing It Up

Invoice management, also called invoice processing, includes all business processes from receiving the supplier invoice to paying it. Your business needs to modernize its existing manual and paper-based systems for invoice management to achieve the benefits of digital transformation.

Business process automation for payables processing and payments yields significant time and cost savings and reduces errors and fraud risk. It strengthens financial controls, tax compliance, and global regulatory compliance. Get started with a new supplier invoice management system by requesting a demo of Tipalti automation software.