Introduction

Finding ways to efficiently manage your business and identify cost-saving opportunities is essential, especially during difficult economic times. AP automation solutions work to streamline financial workflows, tighten controls, and enable efficient payment processing without breaking a sweat.

Adding advanced automation technology to your payables workflow saves significant time and money. It allows your team to focus on strategic initiatives and frees them from manual and inefficient day-to-day processes. When business transaction volumes increase and new complexities are introduced, payables automation software is built to support continual growth.

In this guide, we compare Airbase vs. Tipalti, narrowing in on AP automation, purchase order management, and corporate card spend.

Features of Tipalti vs. Airbase

Airbase built its spend management platform with an initial focus on corporate cards; later adding bill payments and reimbursements. Tipalti started with AP automation and global payments and later added procurement and corporate card capabilities.

Although Airbase and Tipalti both help companies automate AP processes, each platform incorporates different features and solutions for finance teams. Here’s a look at some of the differences between Tipalti and Airbase.

| Functionality |  |  |

|---|---|---|

| *Limited functionality | ||

| Global Payments | Paying to 196 countries in 120 currencies with 12 different payment methods. | Comparable country and currency reach. No Global ACH, PayPal, or Prepaid Debit payment methods. |

| Reliable Payment Infrastructure | Regulated MSB with MTLs across US. E-Money license in UK with FCA. Blue-chip bank partners Citi, JP Morgan Chase & Wells Fargo (plus Visa & PayPal) with built-in redundancy for quick fund disbursement | No MTLs or regulatory licenses. Partnered with SVB leading to delayed bill payments & reimbursements amidst the recent crisis. |

| PO Management | Integrated PO and payables solution, helping streamline company purchases, improve spend controls, and reduce AP processing time. Integrated with Slack to accelerate approvals | Purchase requisitions follow the same routines as expense request workflows, requester notes there will be a PO associated with the transaction. Workflow builder added cost. |

| Touchless Invoice Processing & PO-Matching | OCR (Header and line level scan and capture), Machine Learning, Managed services; 2&3-way PO-Matching. Direct from email approval workflows (no login needed – no added approver costs) | OCR but no machine learning or managed services. 2&3-way PO matching in NetSuite only but no tolerance thresholds. $9-12 / month per approver (login required to view invoice details) |

| Supplier Onboarding and Vetting | Vendor management is effortless. Onboard suppliers with a client-branded portal, preferred payment method, currency, and payment thresholds. 26K+ rules validate payments, screen against OFAC/SDN lists. Fee splitting capabilities. | Supplier portal. Validation process takes 3 days – No built-in 26k validation rules. No screening suppliers against OFAC/SDN lists. No fee splitting to incent suppliers to adopt safer, more efficient payment methods |

| Multi-Entity Payable Reconciliation | Manage multiple entities in a single instance with a consolidated view; instant reconciliation across entities and payables workflows | Available in NetSuite only. No control of independent branding, payment methods, tax onboarding flows, partner communications, reconciliation, reporting, etc. per entity |

| ERP Integrations | Native API integrations with major ERPs (NetSuite, Intacct, and QuickBooks Online & Xero). Integration with all other ERPs via pre-built connectors using no-code, drag-and-drop interface | ERP integrations with QuickBooks, Xero, Intacct, and NetSuite |

| Customer Support | US-based phone and email support. Avg. first response time | Customer support teams are based out of the Philippines |

| Tax Compliance | KPMG approved tax engine; collect W9 & W8 tax forms, collect and validate IRS and VAT tax IDs, 1099 & 1042 prep reports, auto calculated withholdings, and eFiling. Validates against 3,000+ rules | Collect W-9s only. No validation of uploaded documents. No W-8s. No KPMG-approved tax compliance capability. No digital tax form capture, validation & withholdings calculations. No 1099 & 1042-s tax prep reports and eFiling. |

| FX Solutions | Advanced FX solutions, intercompany bank transfers, FX hedging, payee FX | No advanced FX solutions |

| Cards | Manage and reconcile card spend, gain visibility, and receive cash-back with automatic reconciliation | Comparable capability |

Which Solution Works Best for Your Business (and Why)

Selecting an AP automation solution that best fits your business needs is an important choice, especially for growing teams needing to scale quickly. Consider these scenarios to help you choose Tipalti or Airbase as an AP automation partner:

When to Choose Tipalti

You require mature and sophisticated invoice management capabilities

Tipalti enables a complete touchless invoice processing workflow with machine learning (ML) powered OCR technology that captures the header and line-level details. Custom fields and expense accounts are also auto-filled based on predictive smart logic using artificial intelligence.

2-way and 3-way PO matching (with tolerance thresholds) allows for automated syncing of POs and GRNs. This completes the PO match flow, helping to eliminate overspend and strengthen financial controls.

Invoice Workflow

Once an invoice is submitted for approval, Tipalti’s Advanced Approval workflow starts the bill approval sequence, referencing patterns from historical invoices, including different approval assignments per entity, location, department, etc. If a company uses specific approval rules, they can be configured in the Tipalti system as well, even at the entity level.

Automatic email approval notifications are routed to the appropriate parties who can approve, update the GL account, send the invoice back to AP, or dispute the bill directly from the email— all without the need to login to the platform.

Built-in Messaging

If questions arise, bill approvers, submitters, and AP staff can attach relevant documents, send messages, and tag users via the platform’s built-in messaging feature, resulting in reduced processing times and enhanced collaboration.

Teams can also reply to messages directly from the messaging notification emails without logging into the system to accelerate communication.

Tipalti has been perfecting its invoice management solution since 2016, adding 150+ new features to its solutions each year. Airbase is a cards-centric spend management platform that launched its bill payments product as a standalone offering in June 2021.

You struggle with managing suppliers and meeting tax requirements

Tipalti helps streamline the supplier onboarding process with a self-service portal, enabling faster, more accurate payee data collection and verification.

The system automatically validates supplier payment data in real-time using 26,000 global banking rules, proactively reducing payment errors by 66%. Tipalti’s supplier portal is accessible 24/7 and available in multiple languages.

Suppliers can access the self-service portal to check on invoice and payment status. The portal also sends payment status emails to reduce supplier inquiries. With Airbase, supplier validation takes 3 days and its platform does not have any built-in payment validation rules.

While Airbase collects W-9 tax forms during onboarding, Tipalti has advanced global tax compliance capabilities that include:

- Collecting, validating, and maintaining W-9, and W-8 series forms and VAT details

- Generating 1099/1042-S preparation reports

- Calculating any necessary withholdings

- eFiling services are also available

Our tax capability meets IRS requirements, as prescribed by KPMG.

You are a high velocity business with growing payables needs

Whether growing domestically, internationally, or both, you need software with scalability to future-proof your payables operations.

As your company expands, your AP workflow complexities increase, including paying global suppliers, handling multi-subsidiary business payables, and processing a growing amount of payments. You also need to offer a wide range of localized payment methods to pay your domestic and global suppliers in their preferred methods and currencies.

Multiple Entities

Tipalti’s end-to-end accounts payable platform future-proofs your payables operations, so you don’t need to keep investing more resources as you grow. With Tipalti Multi-Entity, you can manage several business entities with different AP processes and workflows within a single instance.

The platform boasts multi-entity capabilities that will help your business centralize financial controls, while providing visibility into operations at both the entity and consolidated business levels. Airbase offers multi-entity capabilities in NetSuite only and it cannot offer features like custom branding and unique onboarding workflows per entity.

Tipalti can also execute fast global payments to 196 countries in 120 currencies, supporting multiple international payment methods, including:

- Global ACH

- Wire transfer

- PayPal

- Prepaid debit card

- Check

You can also streamline your FX conversion workflow with advanced FX capabilities such as Multi-FX, FX hedging, and Payee FX optimization. Airbase does not have advanced FX capabilities.

When to Choose Airbase

Your primary focus is managing corporate card spend

Airbase is a cards-centric spend management platform, and its core competency is corporate cards. The company charges SaaS subscription fees for its spend management software and returns some interchange fees from card-based spend back to customers via cash-back rewards. Despite its strengths in corporate cards, Airbase has recently been reducing the cashback rates it offers to customers and it also deprecated its charge card program and now only offers pre-funded cards to its customers.

Alternatively, Tipalti offers a virtual card solution that complements its core AP automation and procurement offerings. The Tipalti Card is a simple, convenient, flexible, and secure virtual credit (charge) and debit (pre-funded) card solution, offering cash-back rebates. It is integrated into the most comprehensive global payables automation platform bringing complete financial controls into card spend with automatic reconciliation.

Tipalti Card is completely free to use for customers using other Tipalti solutions.

You only require basic financial controls

Both Airbase and Tipalti have strong security policies in place for their cloud platforms. Airbase is a SOC 2 Type II and SOC 1 Type II compliant company. Tipalti is SSAE 18 and ISAE 3402 SOC 1 Type II and SOC 2 Type I certified, and GDPR compliant. However, Tipalti offers much stronger financial controls to users of its platform.

Validation Process

Airbase has a 3-day payment data validation process for suppliers whereas Tipalti has 26,000 payment validation rules built-in to its supplier onboarding engine, reducing payment errors by 66%.

Airbase collects W-9s without any document validation. Tipalti offers KPMG-approved digital tax form collection (W-9s, W-8s, etc.) and TIN validation, automatic withholdings calculations, 1099 & 1042-S prep reports, and eFiling services to help you with your tax compliance.

Fraud Prevention

Airbase does not screen suppliers against OFAC/SDN lists before each payment like Tipalti. Tipalti Detect also prevents fraud with detailed payee monitoring. Airbase does not have any proactive fraud prevention available today for non-card payments.

Data Access Controls

Tipalti offers 20+ role-based permissions to help enforce the segregation of duties by configuring who can initiate disbursements, fund accounts, create approval flows, run reports, etc. Airbase has duty segregation challenges. For example, all GL accounts are visible to administrators and there is no ability to change that.

You are OK with some risks in your global financial operations

Airbase partnered with Silicon Valley Bank (SVB) for ACH payments and corporate card integrations. As a result, its customers experienced delays in bill payments to their suppliers & reimbursements to their employees amidst the crisis at SVB. Can you afford the same risk?

Money transmission is a highly regulated activity under both federal and state laws. Tipalti is regulated as a money services business (MSB) and has its US money transmitter licenses (MTLs) in every state that requires them. Businesses must be aware of the risks involved in partnering with a single bank or non-regulated payments provider, as this can jeopardize their funds, reputation, and operations. Being a licensed Money Transmitter is an important distinction between Tipalti and other payout providers like Airbase. We partner with blue-chip banks Citi, JP Morgan Chase & Wells Fargo and have redundancy built-in facilitating quick fund disbursement around the globe.

Tipalti’s MTLs help to ensure there are not any disruptions to your payout operations, to provide you with the best customer experience possible, and to eliminate the risk of fines and penalties for improper payouts. As a licensed money transmitter, Tipalti also controls the compliance review process. This means the brand can approve you in days once provided the appropriate documentation. Payout providers without MTLs, like Airbase, are at the mercy of the bank’s timeline for the due diligence process. Sometimes this can take months.

Tipalti is a credible and reliable partner you can trust to handle all of your payment needs!

The Ultimate Payables Survival Guide

Finance has more responsibilities than ever!

What Does Tipalti Do?

Tipalti is the provider of first-rate AP automation software that integrates your entire accounts payable lifecycle and payment management into a single, cloud-based solution.

Tipalti Product Capabilities Overview

Tipalti provides an award-winning AP automation and global payments solution across your entire enterprise, from business entities to subsidiaries and international divisions. The platform provides granular control over the payable process to protect your company from fraud and boasts features like:

- Purchase order management

- Self-service supplier onboarding

- Tax and regulatory compliance

- Invoice management

- Corporate cards

Tipalti software improves business efficiency. It offers scalability to expand through internal growth and acquisitions, while minimizing extra headcount. The software saves your company money, processing transactions in 12 different payment methods, across 196 countries, in 120 currencies.

Tipalti also offers advanced FX solutions, like hedging and intercompany transfers.

Tipalti integrates with all ERPs and accounting systems for easy reconciliation and reporting. This includes brands like:

- Oracle NetSuite

- Sage Intacct and Sage ERPs

- Microsoft Dynamics ERPs

- QuickBooks

- Xero

- SAP ERPs

- Oracle ERP

- Workday

Setting up Tipalti is simple, and implementation can be completed in as little as 30 days.

Accounts Payable Software in 2023 out of 423 products in their AP software directory.

Tipalti Pricing

Tipalti uses a SaaS subscription pricing model starting at $149 per month for the platform fee. To upgrade from the basic plan, you can add advanced functionality, like multi-entity payables, as your business grows.

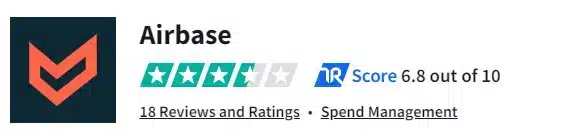

What Does Airbase Do?

Airbase is a spend management platform for corporate cards, bill payments, and employee expense reimbursements. Features purport to cover all non-payroll spend. The company targets venture-funded, midmarket customers, mostly in the software and technology sector. Airbase’s primary focus is on card-based spending.

Airbase Product Capabilities Overview

Airbase is a spend management software platform that integrates with ERPs, third-party card programs, and HRIS systems. The cloud software handles card spend management, supplier payments, and employee reimbursements, centralizing company spend in a singular platform.

Airbase’s main products include:

- Bill Payments

- Corporate Cards

- Reimbursements

Other add-on modules include:

- Amortization

- Purchase Orders

- Advanced Approvals

- User Management

- NetSuite Custom Fields

- Workflow Builder (Requisition Forms)

Airbase Pricing

Airbase offers three packages with varying features:

- Standard

- Premium

- Enterprise

Certain features, such as purchase orders, multi-subsidiary support, customizable approval workflow forms, etc., are only available in higher-tier packages.

Customers pay a flat annual fee for access to the Airbase platform that includes a certain level of bandwidth for individual products (e.g. Bill Pay for up to 100 bills/month). Products can be purchased modularly. Overage fees apply, and customers have the option to add bandwidth or additional products when needed.

What Our Customers Say

Tipalti streamlined international payments and compliance. As we continue to acquire companies, we can maximize these investments without compromising scalability or needing new approaches or technology.

Phill Newell | Director of Finance IT, GoDaddy

Tipalti helps you do the right [vendor] background checks, making sure there’s no issue with the bank accounts, and helps collect the necessary tax information which is really beneficial when doing 1099s at the end of the year.

Becca Simmons | Head of Finance, EMEA, Vivino

We are a distributed multinational organization and it was important for us that we empower our regional accounts payable functions to approve invoices for payment. Tipalti gives us a sense of security with internal controls at the core of the system that we implemented.

Roger Simon | CFO, Branch International

Save Time and Money with Accounts Payable Automation

In our recent global accounts payable teams survey based on IFOL research, we discovered that nearly half of the participants spend over five days each month manually processing invoices.

41% of all respondents plan to automate their AP processes within a year. By using accounts payable automation technology, you’ll shift a significant amount of time from data entry to strategic finance, contributing value, business growth, and cost reduction. You’ll also generate a precise audit trail.

Although both Tipalti and Airbase offer user-friendly AP automation and global payment solutions, these capabilities are Tipalti’s core competency.

Consider an in depth evaluation of Tipalti vs Airbase to decide which AP automation solution is the better fit for your business needs and budget. Tipalti can handle the requirements of any sized company and will scale with you as you grow.

Get started with a free demo of Tipalti today.