SWIFT (Society for Worldwide Interbank Financial Telecommunications) is a global member-owned cooperative that functions as a huge messaging system.

Members (banks and other financial institutions) use it to quickly, accurately, and securely send and receive information, primarily money transfer instructions. Essentially, it is a sophisticated conduit for international electronic funds transfers (EFTs).

Understanding SWIFT

SWIFT is not a financial institution or a banking system. It doesn’t move money. Instead, it’s a messaging system that sets up the transfer of money between member banks and other member financial institutions.

It’s essentially a payment network that allows individuals and businesses to take electronic or card payments, even if the customer or vendor uses a different bank than the payee. Members pay a one-time fee to join plus annual support charges according to member classification.

The SWIFT messaging network has become a crucial part of the global financial infrastructure. In 2021 alone, more than 11,000 global SWIFT member institutions sent an average of 42 million messages per day through the network. That represented an 11.4% increase over 2020.

While SWIFT retains its dominant position in the processing of global payments, it has begun expanding into other areas. Among them are reporting utilities and data for business intelligence. Over the next two years, SWIFT plans to extend beyond financial messaging to provide a platform for transaction management services.

How Does SWIFT Work?

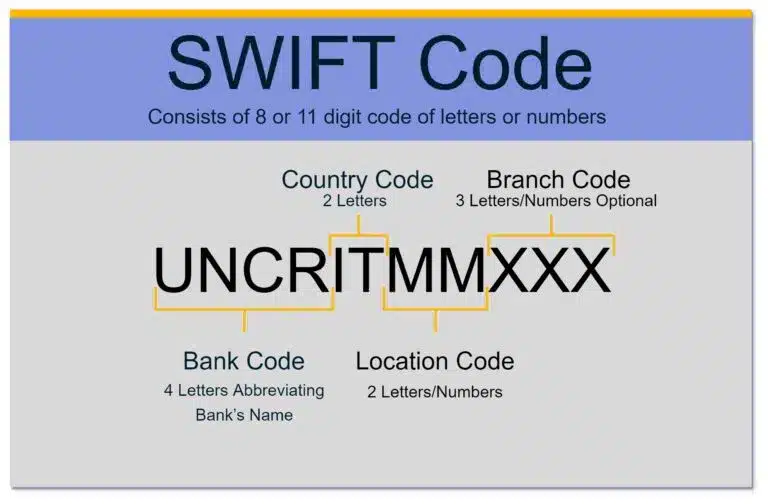

SWIFT uses codes to facilitate money exchanges. It assigns each member organization a unique code that has either eight or 11 characters.

That code goes by any one of the following names:

- The bank identifier code (BIC)

- SWIFT code

- SWIFT ID or ISO 9362 code

Example of a SWIFT Code

For example, the code for the Italian bank UniCredit Banca based in Milan is UNCRITMM.

- First four characters comprise the institute code – UNCR for UniCredit Bank

- Next two characters represent the country code – IT for Italy

- Last two are the city where the bank is located – MM for Milan

There is no specific branch code in this case, so the funds will be made available in the Milan headquarters bank.

What is SWIFTNet?

To facilitate transactions, members use a proprietary messaging platform called SWIFTNet. Due to the increasingly complex and diverse requirements of its members, SWIFTNet offers four messaging services that each allows seamless “straight-through” processing:

FIN

This is SWIFT’s original messaging service that enables the exchange of messages formatted with SWIFT’s traditional MT standards. Those are widely accepted and used by the financial community.

InterAct

Like FIN, this enables the exchange of messages on a message-by-message basis and supports the exchange of proprietary formats between market infrastructures and their customers. InterAct offers more flexibility including store-and-forward messaging, real-time messaging, and real-time query-and-response options. It also allows the exchange of MX message types, which were developed in accordance with industry 2022 standard methodology.

FileAct

This enables the transfer of large batches of messages such as bulk payment files, very large reports, and operational data.

WebAccess

This allows SWIFTNet users the freedom to browse securely on financial websites available on SWIFTNet using standard Internet technologies and protocols.

Customers can connect to the SWIFT environment in different ways:

- Directly via permanent leased lines

- The Internet

- SWIFT’s cloud service (Lite2)

- Directly via their appointed partners

SWIFT also offers a range of interfaces that provide seamless links between users’ internal systems and the SWIFT environment.

Power your entire partner payouts operations

98%

Customer Satisfaction

$60B+

Annual Transactions

4M+

Partners

4,000+

Customers

99%

Customer Retention

Example of SWIFT Transaction

As sophisticated as SWIFT payment technology is, using it is pretty straightforward.

For example, suppose a Bank of America branch customer in New York wants to send money to a friend who banks at the UniCredit Banca branch in Venice, Italy. The New York customer can walk into a Bank of America branch with the friend’s account number and UniCredit Banca’s unique SWIFT code for its Venice branch.

Bank of America will send a payment transfer SWIFT message to the UniCredit Banca branch over the secure SWIFT network. When UniCredit receives the SWIFT message about the incoming payment, it will clear and credit the money to the Italian friend’s account.

It’s as simple as that for the user.

Brief History of SWIFT

Before SWIFT, Telex was the only way international wire transfers could be confirmed. Low speed, security finance concerns, and a free message format undermined its effectiveness.

Moreover, it had no unified system of codes that could name banks and financial institutions. Telex senders had to describe every transaction in sentences that the receiver then had to interpret. Human error, plus slower processing times, hampered this approach.

In 1973, 239 banks from 15 countries came together to collaborate on a better way to handle communications for international payments. The central banks formed a cooperative utility called the Society for Worldwide Interbank Financial Telecommunication (SWIFT), headquartered in Belgium.

SWIFT went live with its messaging services in 1977, replacing the cumbersome Telex technology. It rapidly became a reliable global partner for institutions worldwide. SWIFT now spans every continent, 200+ countries and territories, and services more than 11,000 institutions around the world.

The main components of the original services included:

- A messaging platform

- A computer system to validate and route messages

- A set of message standards

The standards were developed to:

a) allow for a common understanding of the data across linguistic and systems boundaries; and

b) permit the seamless, automated transmission, receipt, and processing of communications exchanged between users.

What Can SWIFT Be Used For?

Today, over 40 years since its inception, SWIFT’s integration and messaging management solutions support a broad range of applications. They include the complex high-volume messaging needs of the world’s largest institutions to the lower-volume, cost-sensitive needs of smaller banks (like the one in the example above) and corporate entities.

SWIFT products and services are as varied as the financial industry itself:

- Offers a range of access options

- Produces messaging management software packages

- Carries out macro-economic analyses

- Enables back-office automation

- Supports financial crime compliance and standards implementation

- Offers professional training

- Helps users enhance their security and resilience

In addition, SWIFT connections offer access to many valuable applications such as real-time instruction matching for treasury and foreign exchange (forex) transactions. Access also extends to securities market infrastructure for processing clearing and settlement instructions for payments, securities, forex and derivatives transactions.

Recently SWIFT introduced dashboards and reporting utilities that give clients a real-time view to monitor messages, activity, trade flow, and export reporting. Users can then filter this information based on region, country, message types, and related parameters.

SWIFT even offers utilities and reporting for “Know Your Customer” (KYC) identity verification, anti-money laundering (AML), and sanctions.

Who Uses SWIFT?

SWIFT founders designed the network to facilitate communications about treasury and correspondent transactions only. The system is so robust that SWIFT has been able to gradually expand beyond its original mission. It now offers services to:

- Banks

- Corporate businesses

- Foreign exchanges

- Clearing systems

- Asset management companies

- Money brokers

- Non-bank financial institutions

- Depositories

Why is SWIFT Dominant?

While message systems and apps such as Fedwire, Ripple, and Clearing House Interbank Payments System (CHIPS) have evolved, SWIFT continues to rank as the world’s leading financial messaging system.

How? Possibly because it regularly adds new message codes to transmit different financial transactions and enhance the security finance capabilities of its platform.

SWIFT is also expanding its scope. Although started primarily for simple payment instructions, SWIFT now sends trillions of messages for actions ranging from security and treasury transactions, to trade and system transactions.

A SWIFT report from early this year showed that only 44.5% of SWIFT traffic is still for payment-based messages, while 50.6% represents security transactions. The remaining traffic flows to treasury, trade and system transactions.

IBAN vs. SWIFT

IBAN, short for International Bank Account Number, is used to identify an individual account across national borders. IBAN is used for transfers between banks and financial institutions, while SWIFT is used by banks, service providers, clearinghouses, corporate business houses, brokers, and even more.

Costs are essentially the same for both (bank transfer fees, commissions, exchange rates), and sometimes both codes are required for an international transaction.

Political Influence – SWIFT Sanctions

SWIFT is so large, and has so many clients now, that it has become significant in the world of geopolitics. As early as 2012, for instance, the European Union passed a sanction against Iran that forced SWIFT to disconnect sanctioned Iranian banks.

In February of this year, after Russia’s attack on Ukraine, SWIFT disconnected seven Russian banks and three Belarusian entities from its financial messaging system in compliance with instructions from the European Union (EU).

Although Russia still has the SPFS system, this had dire consequences on major cities like Moscow and the actions of Putin. Altogether, the United States, all of the EU, Canada, and Japan removed selected Russian banks from SWIFT due to the invasion of Ukraine.

SWIFT and World Finance

By now it’s clear that SWIFT is the primary communications channel used for international money exchange. That exchange only runs smoothly as long as all member countries actively participate.

When sanctions are imposed against SWIFT by a country’s government, problems arise for all members. The reason: Even though a sanction might be warranted — as many countries agreed with the Ukrainian invasion — the sanction does more than force a country to find other ways to move money. It also prevents countries owed money by the sanctioned country to receive payments.

Higher inflation is one possible result of the global reliance on SWIFT. Even worse, lack of availability of SWIFT exchanges could open the way for Russia and/or China to develop their own exchanges.

Currently, China runs a program that has adopted the SWIFT messaging system. It’s called the cross-border interbank payment system (CIPS) and is mainly a settlement system for renminbi transactions, with some communication functions.

Despite these consequences, SWIFT’s shared worldwide messaging services and common language to implement them has created a broadly accepted standard for global financial messaging and reference data standards.

Today financial players routinely send structured electronic messages to one another via SWIFT to perform common business processes, such as make payments or confirm trades.

In addition, the SWIFT Standards group works with the financial community to define standards that:

- Identify the data elements that can be included in messages

- Document the meaning and format of those data elements

- Specify which data elements are mandatory, which are optional, and which are only required for specific business scenarios

SWIFT Standards are so highly respected that the International Organization for Standardization (ISO) has appointed it a “Registration Authority” (RA). This designation ensures the integrity of universal codes for common data items (called reference data) defined by ISO standards. Acting as an RA, SWIFT also publishes the data in an accessible form for the benefit of its user community.

In the relatively short time that SWIFT has existed, it has clearly become essential to world finance. As SWIFT continues to expand its services internationally, it will undoubtedly solidify its standing as the backbone for global financial communications.