Get Faster Invoice Processing With AI Invoice Automation

AI invoice processing software that eliminates manual AP work – intelligent agents capture, match, and reconcile invoices so you don’t have to.

- AI agents handle invoice capture, PO matching, approvals and ERP sync

- AI assistant delivers real-time insights and on-demand reporting

- End-to-end AP automation eliminates manual steps from intake to invoice and payment

Book a demo

Complete the form below, and we’ll contact you to schedule your tailored demo.

Tipalti AI Agents

AI Invoice Automation and Beyond – Power Every AP Workflow Behind the Scenes

From capture to coding and reconciliation, Tipalti AI Agents automate the work your finance team shouldn’t have to do—so you can scale with confidence.

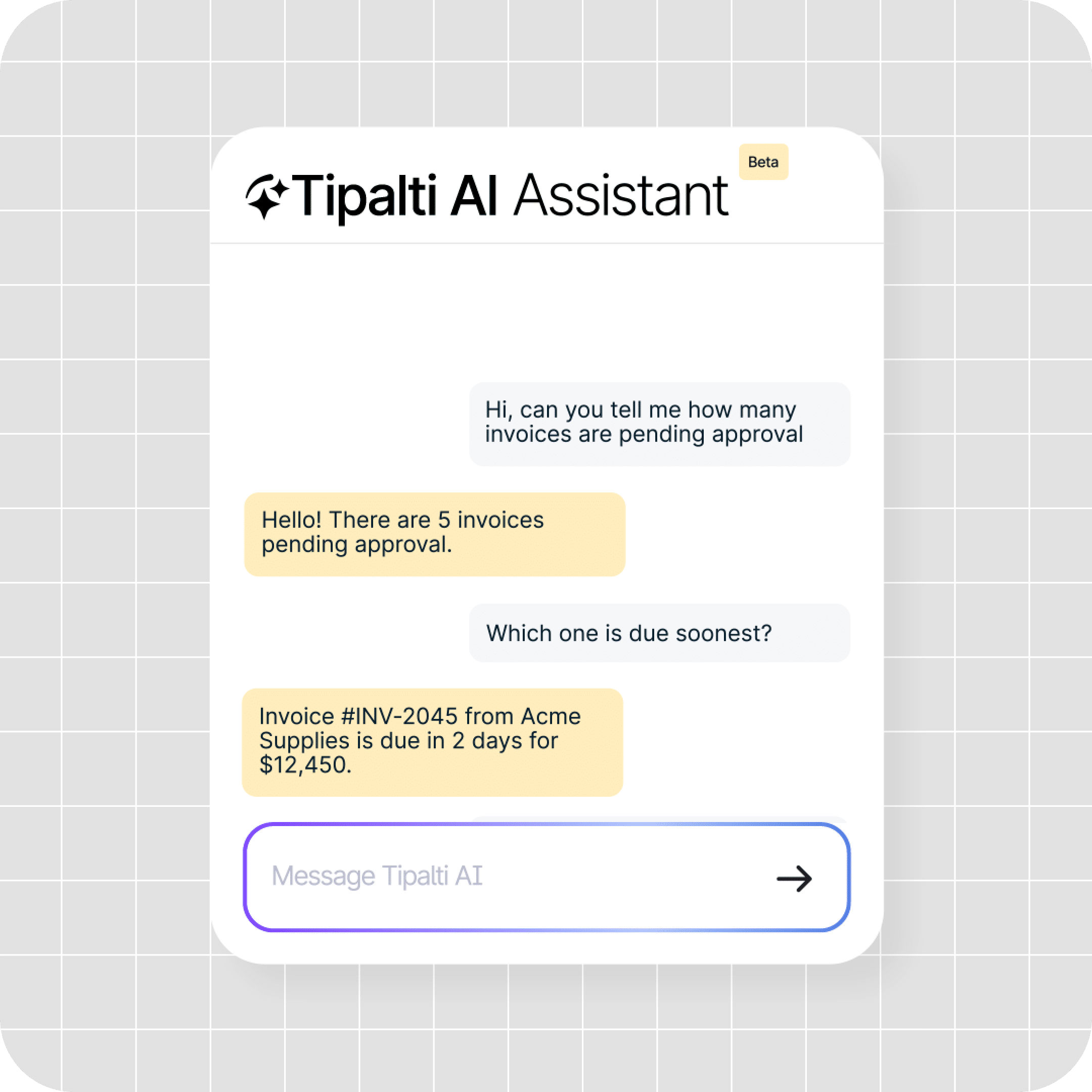

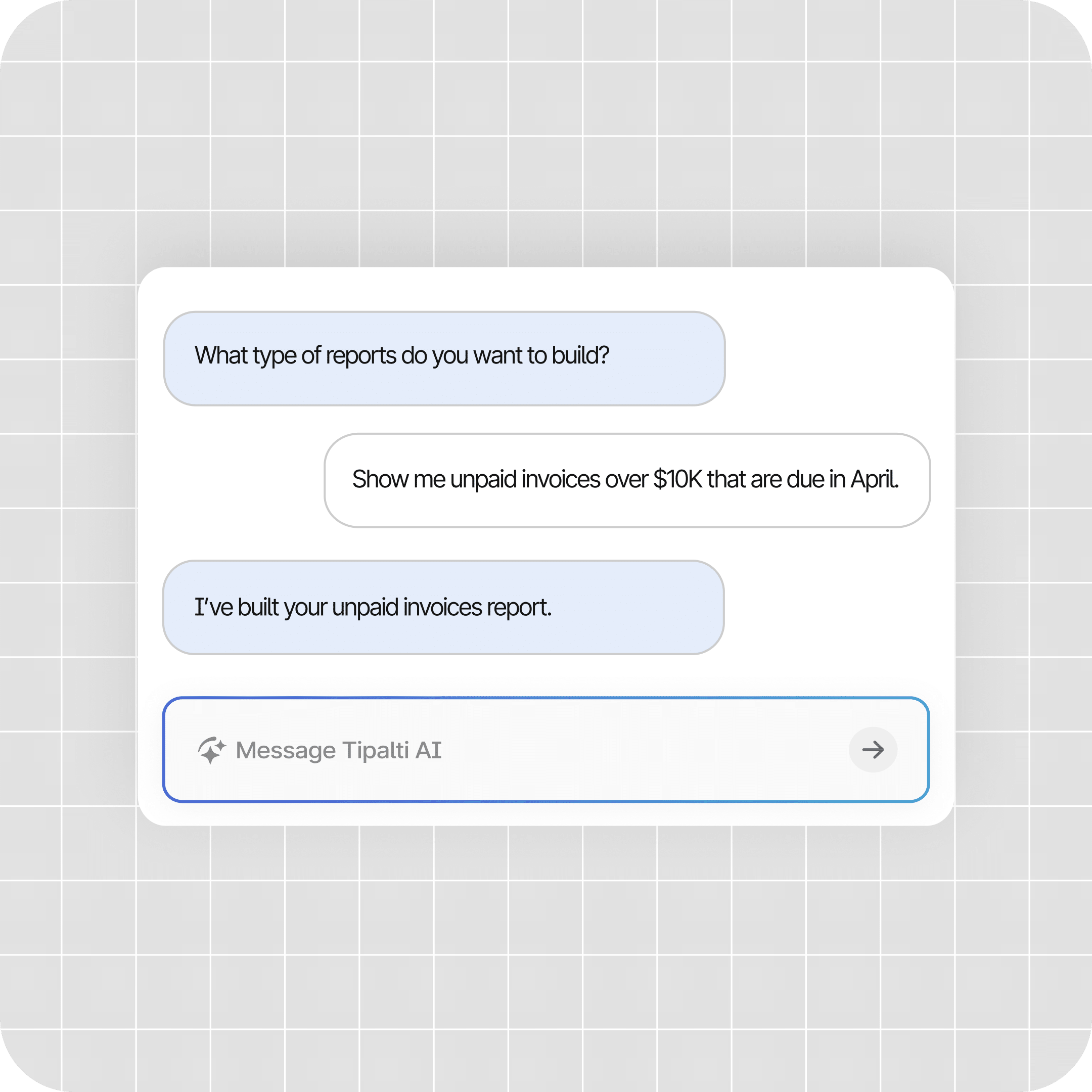

AI Assistant

24/7 conversational tool for financial insights, reporting, and product tips.

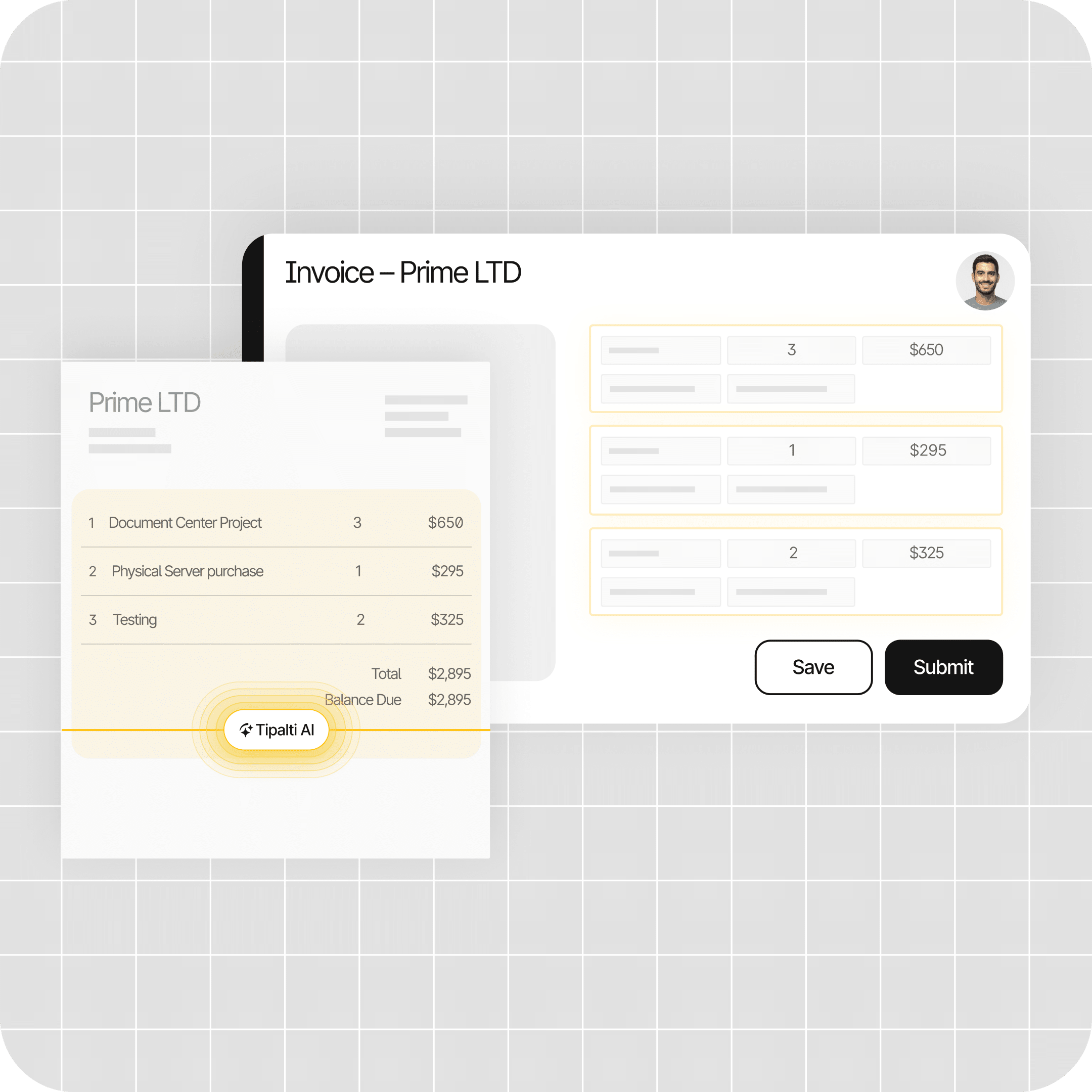

Invoice Capture Agent

Reads and codes invoices automatically, no manual entry.

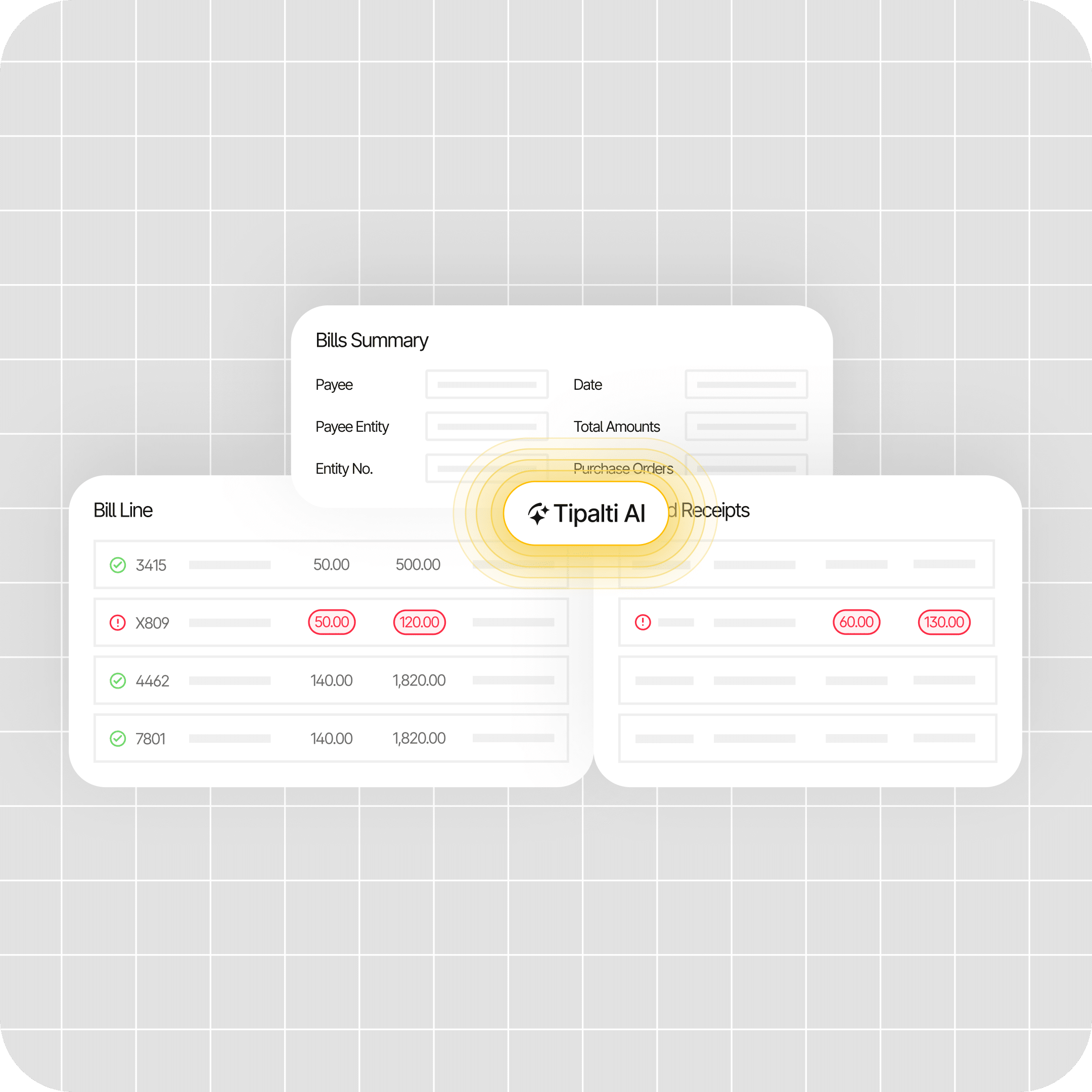

PO Matching Agent

Reduce manual matching work—AI interprets descriptions and automatically aligns bills and POs.

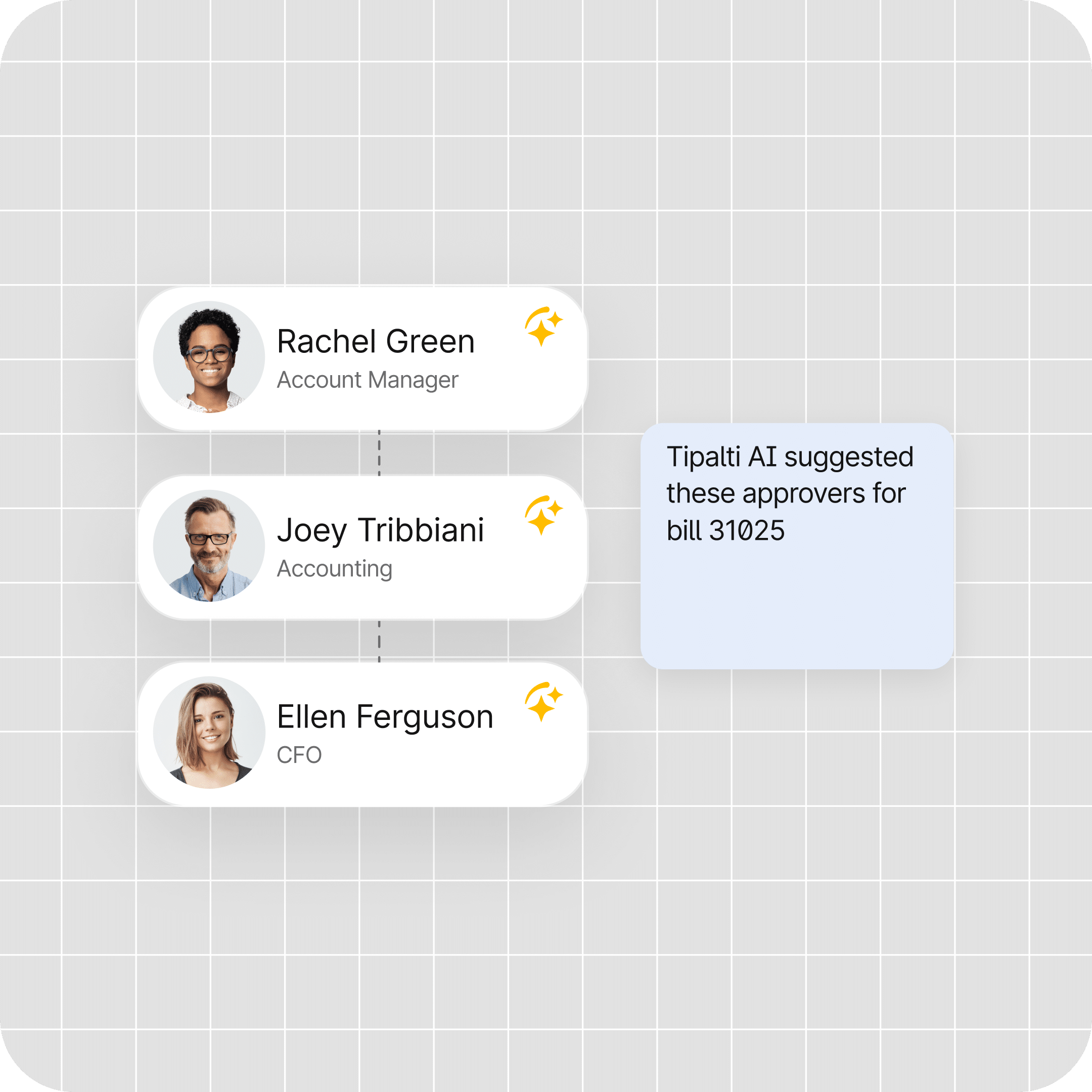

Bill Approvers Agent

Eliminate approval bottlenecks. The system predicts and recommends the right approver—fast.

Reporting Agent

Access real-time spend insights at your fingertips. Instantly create custom reports using natural language.

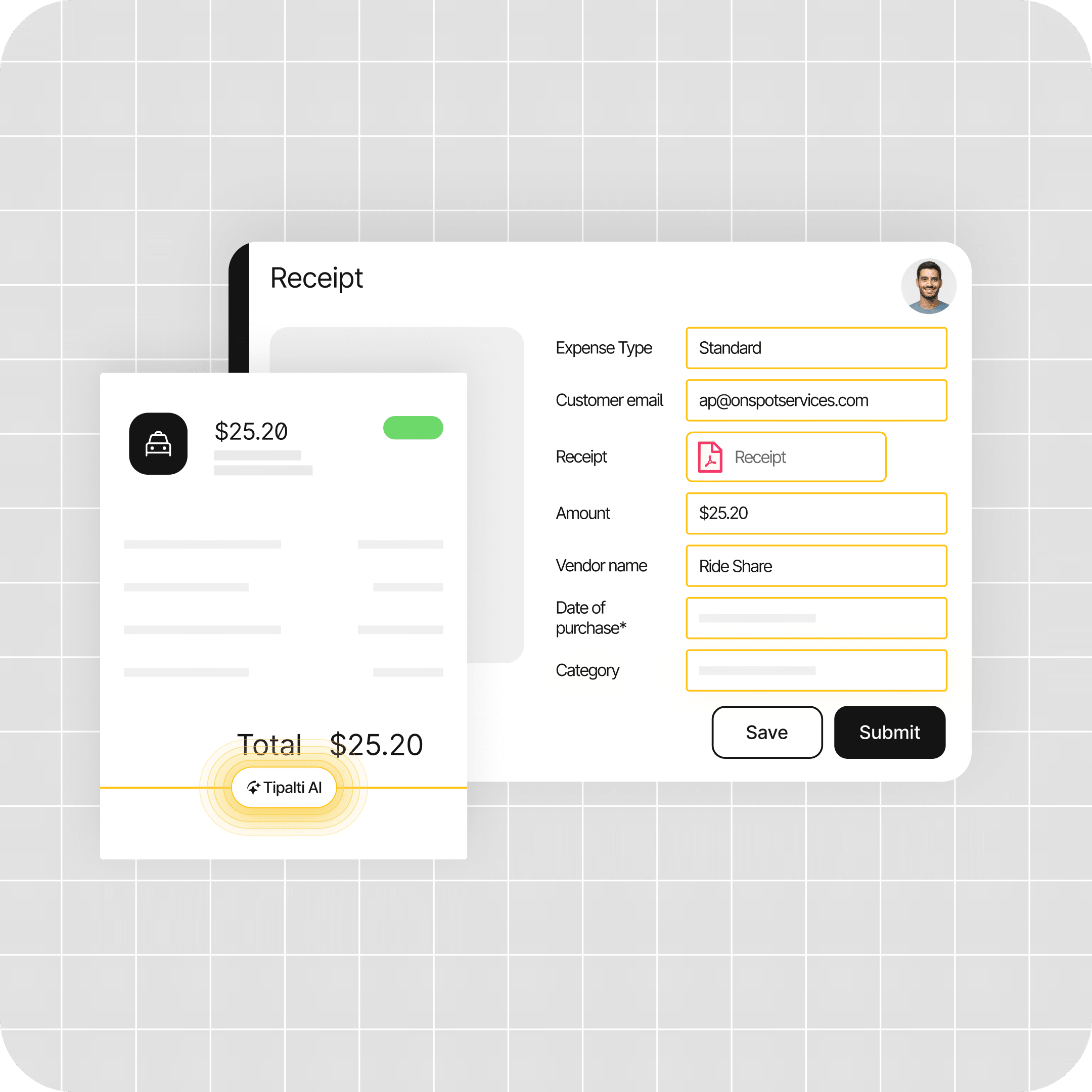

Expense Report Agent

Capture employee expenses effortlessly with automation that extracts receipt data and accelerates expense reporting submission.

Integrate with your existing software

Easily extend and simplify your workflows with Tipalti’s pre-built integrations and powerful APIs for your:

- ERPs

- Accounting systems

- Credit cards

- HRIS

- SSO

- Slack

- and more

Tipalti AI Assistant

Get real-time invoice data at your fingertips

AP Automation Features

5,000 businesses trust Tipalti’s AI invoice processing software

Tipalti combines powerful AI-driven invoice and AP features, global payments to 200+ countries and territories, multi-entity support, and self-service supplier onboarding—making it the go-to choice for finance teams ready to reduce manual work and accelerate growth.

Mitigate risk of fraud and overpayments

Prevent fraud and overpayments as Tipalti AI strengthens AP controls by flagging duplicate invoices and anomalies early.

Never key in another invoice

Let advanced AI invoice capture help scan, capture, match, and process invoice data at header and line level.

Enable self-service supplier management

Our multi-language, self-service supplier portal allows you to capture accurate supplier details, reduce status enquiries, and gain complete visibility. Completely white-labelled with your branding for a seamless experience.

Make overpayments a thing of the past

Automated 2- & 3-way PO matching means reducing waste, eliminating fraud, ensuring audit preparedness, and saving time.

Send global payments in just a few clicks

Ensure fast, accurate mass payments across 200 countries and territories in 120 currencies and 50 different payment methods. 26,000+ built-in rules proactively eliminate errors for peace of mind. Alongside unique multi-entity structures, Tipalti is the first choice for growing global businesses.

Take the work out of tax compliance

Eliminate time and energy spent manually collecting tax information—ensure international tax compliance and reduce risk with a KPMG approved tax engine.

#1 award-winning AI invoice automation

Don’t just take our word for it, see what Tipalti customers are saying

“The amount of time that’s been saved from moving to an automation process is very significant. We’ve removed 90% of the manual elements from the process, and we’re making it super easy for everyone at each stage to understand what’s going on.”

“Zola maintained a 2-person AP team where they would otherwise need a staff of 10. New vendors are seamlessly onboarded with no addition to workload.”

“When we automated, we had an accounts payable person who was spending 40 hours a week doing accounts payable. Now that the system is automated, the accounts payable time is probably in the five to 10 hours per week arena.”

“When we started looking at providers, we had about a 20-day close. Now, [with Tipalti], we’re down to an 8-day business close.”

“By gaining AP automation, I’ve saved 2 days a week of manual work.”

Get Up and Running in Weeks, Not Months

Book a demo to get started today and take control of your invoice processing with Tipalt AI

FAQs

Still have

questions about AI in your AP process?

What is Tipalti AI?

Tipalti AI powers Tipalti AI Agents and the conversational agent Tipalti AI Assistant. Tipalti AI is embedded throughout Tipalti financial automation solutions—accounts payable, global payouts, procurement, employee expenses, supplier management, and tax compliance. It streamlines and automates manual workflows or processes, such as invoice automation, purchase order matching, tax compliance, and ERP system sync resolution.

It is designed with an agentic focus in mind to automate tasks where needed and collaborate with finance teams to accomplish more complex work and higher business needs across their financial operations.

How is AI used in accounts payable?

AI transforms accounts payable from manual, error-prone tasks, into faster, smarter, and more reliable workflows. By applying automation and intelligence across the AP finance lifecycle, AI can help with the following:

- AI Invoice automation to streamline invoice capture and coding

Use optical character recognition (OCR) software and natural language processing (NLP) to automatically extract data from invoices, match them to POs, and assign the correct GL codes—reducing manual entry and errors. - Accelerate approvals and workflows

Route invoices to the right stakeholders for approval based on rules and context. AI also learns from past activity to recommend faster, more accurate approval paths. - Enhance fraud detection and compliance

Flag duplicate invoices, unusual vendor activity, or out-of-policy spend in real time, helping finance teams reduce risk and stay compliant. - Enable self-service and support

AI assistants can instantly answer questions like “How many invoices are pending approval?” or “When will Vendor X be paid?” This empowers finance teams and reduces AP help-desk workload. - Generate Custom reports

With simple natural language prompts like “Show me unpaid invoices from the past 30 days,” advanced AI finance assistants can query AP systems directly, saving significant time and helping finance teams make faster decisions. -

How does AI improve the efficiency of AP workflow?

AI makes accounts payable processes faster and more scalable by reducing manual work and errors for finance professionals. AP departments use it to do the following, for example:

- Automates repetitive tasks like data entry and invoice matching, cutting processing times by days.

- Reduces exception handling and manual approvals, so teams can handle higher invoice volumes without adding headcount.

- Improves accuracy and compliance, minimizing rework and audit risk.

- Provides real-time insights into cash flow and payment status, helping finance teams make quicker, smarter decisions.

- Streamline AP processes by automatically extracting invoice data, validating information, and coding invoices with greater accuracy. AI invoice automation helps to process invoices faster.

- Automates ERP integration sync to help streamline operations and overall finance bookkeeping.

How do AI agents work in the context of AP automation?

AI Agents in AP automation are specialized, task-focused AI models that autonomously handle routine processes across the accounts payable lifecycle – covering invoices, approvals, fraud detection, tax compliance, and reporting. Unlike generic AI tools, they’re designed to execute specific jobs and tasks reliably and at scale for finance teams.

Tipalti AI Agents are available within Tipalti Accounts Payable solution.

Examples include:

- Invoice Capture Agent: captures, validates, and codes invoices automatically.

- Bill Approvers Agent: routes requests to the right stakeholders, learning from past activity to speed up approvals.

- PO Matching Agent: matches invoices with purchase orders by analyzing contextual descriptions

- Reporting Agent: generates real-time spend or payment reports from natural language prompts.

What is the difference between AI invoice automation, accounts payable AI, and AI-powered AP automation?

- AI Invoice Automation is the most specific term. It refers to the use of AI to automate the processing of invoices, including tasks like data capture, validation, and matching.

- AI-Powered AP Automation is a broader term. It encompasses AI invoice automation but also includes other AI-driven features across the entire AP workflow, such as intelligent approval routing, fraud detection, and predictive analytics for cash flow. This describes a complete solution that uses AI from start to finish.

- Accounts Payable AI is the most general term. It refers to the overall concept and application of artificial intelligence within the AP function or AP solutions.

Can AI improve global compliance and reduce fraud in AP?

Yes. AI can proactively detect duplicate invoices, flag unusual vendor activity, validate tax forms, and enforce approval workflows. If AI is built into these finance workflows, these checks can reduce fraud risks and improve audit readiness.