AP Automation: Cut Chaos, Not Corners

Eliminate manual work, errors, and time-consuming reconciliation with an end-to-end solution that simplifies workflows, tracks with precision, and delivers rock-solid compliance and reporting.

AP Automation Features

From Manual to Modern

With our end-to-end automation capabilities, AP automation processes aren’t just manageable; they’re seamless—from self-service supplier onboarding and automated invoice management to fast global payments.

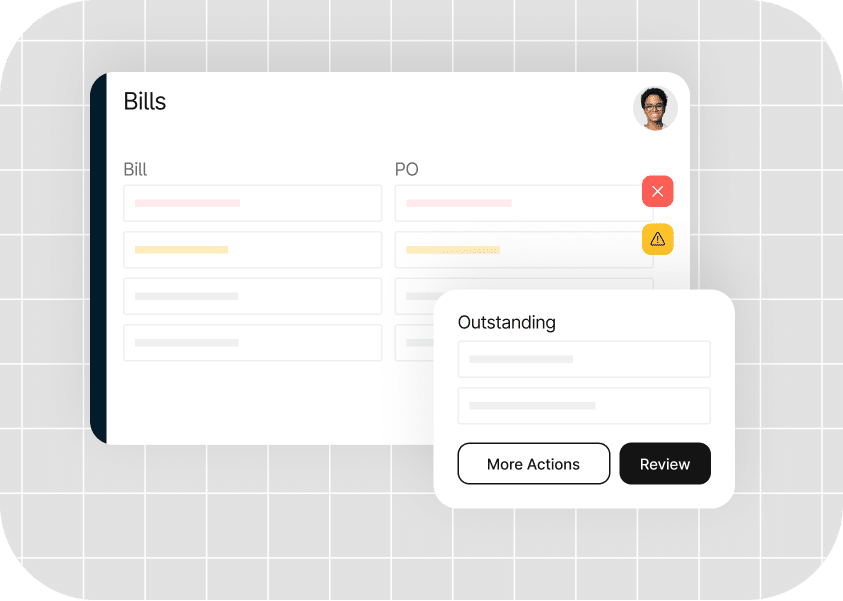

Automated Invoice Management

Manual processes and data entry are time-consuming and prone to errors. Our automated invoice processing uses AI to capture accurate invoice details, match them to POs, route for approval, and avoid duplicate bills.

Self-Service Supplier Management

Our multi-language, self-service supplier onboarding means you’ll capture accurate supplier details, reduce status inquiries, and gain complete visibility.

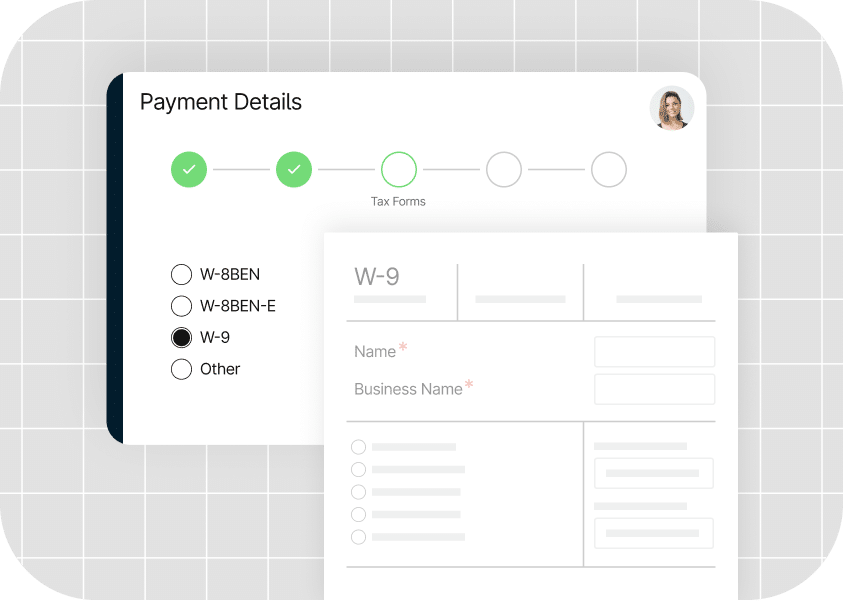

Built-In Tax Compliance

With our KPMG-approved tax engine, you’re always up-to-date with US tax laws. Instantly capture supplier tax information and validate against 3,000+ US and global rules to reduce errors.

Two- and Three-Way PO Matching

Say farewell to overpayments. Two- and three-way PO matching slashes waste, eliminates fraud, saves time, reduces bottlenecks, and ensures you’re audit-ready.

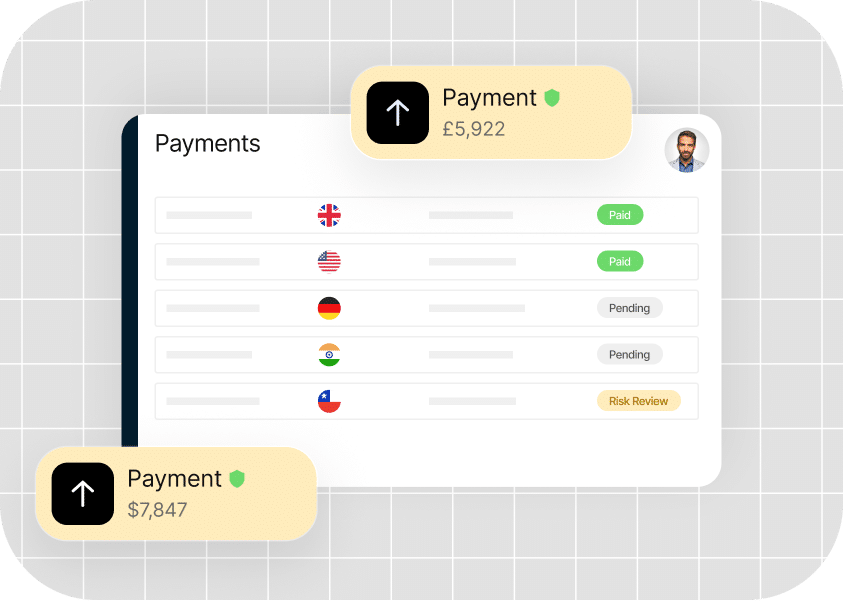

Lightning-Fast Payments

Quick and easy payments across 196 countries in 120 currencies and 50+ different payment methods. Proactively eliminate payment errors with 26,000+ built-in rules.

More Features

Payment Reconciliation

Close your books 25% faster by integrating real-time, accurate spend data integrated with your ERP.

Expenses and Reimbursements

Review, approve, and reconcile expenses—and quickly reimburse employees globally—in one platform that scales with you.

Corporate Cards

An employee-friendly and powerful solution to manage and reconcile physical and virtual corporate card spend.

Platform Features

Work smarter, not harder

With AI and machine learning capabilities, an intuitive UX, and quick and easy global payments, you can drive unprecedented efficiency.

Integrations

Pre-built connections to extend automated workflows

Easily extend and simplify your workflows with pre-built integrations and powerful APIs for your ERPs, accounting systems, performance marketing platforms, HRIS, SSO, Slack, credit cards, and more.

Customer Stories

Don’t just take our word for it,

see what our customers are saying

Create Music Group

Learn how this independent music, distribution, and publishing giant saved critical time by eliminating 36 days of payments work annually.

Noom

Read how this pioneering health app brought finance entirely in-house and eliminated the need for outsourced accounting help.

Therabody

Discover how this leading manufacturer of wellness products reduced processing costs and eliminated 60 hours of AP work each month.

Vivino

Find out how the world’s largest online wine retailer reimagined its vendor onboarding and approval process, reducing its multi-country, multi-currency payment process from hours to minutes.

Realwear

Learn how this AI-powered smartglasses pioneer streamlined its payment workload by 20% and cut its financial close cycle in half.

How It Works

Up and running in weeks, not months

Collaborative customer support with customized onboarding to get you operational quickly

Step 1

Plan

Kickstart your success with a comprehensive setup call that reviews your manual AP workflow, outlines the onboarding plan, validates technical configurations, and prepares for training.

Step 2

Configure

Tipalti’s implementation experts set up your hosted portal, create sample payment files, configure payment options and email integrations, and establish ERP integrations using our pre-built solutions.

Step 3

Deploy

In-depth training for AP staff on the Tipalti Hub and the end-to-end AP automation functionalities, ensuring thorough knowledge transfer to turbocharge your successful launch.

Step 4

Adopt

Support user adoption and change management during launch while guiding suppliers through onboarding. Once set, you’ll be ready to execute your first payment run and officially launch Tipalti.

Step 5

Optimize

Continued technical support by phone and email. Tipalti customer success team learns your goals and offers solutions to reach them.

Compare

See how we stack up

| Features | Tipalti | BILL | Stampli | Concur |

|---|---|---|---|---|

|

Supplier Management |

|

Limited functionality | Limited functionality |

|

|

Payments Network |

|

Limited functionality | Limited functionality | Limited functionality |

|

Cards |

|

|

|

Limited functionality |

|

Invoice Management |

|

Limited functionality |

|

Limited functionality |

|

Tax and Regulatory Compliance |

|

Limited functionality |

|

|

|

Global Multi-Entity |

|

|

Limited functionality | Limited functionality |

|

Reconciliation and Reporting |

|

Limited functionality | Limited functionality | Limited functionality |

|

Procurement |

|

|

|

Limited functionality |

|

Expense Management |

|

|

Limited functionality |

|

|

FX Solution |

|

|

Limited functionality |

|

Awards

#1 award-winning finance automation solution

2024 Inc. 5000 List of America’s Fastest-Growing Companies

Awarded to Tipalti for the 7th consecutive year

2023 Deloitte Technology Fast 500

Awarded to Tipalti for the sixth consecutive year

2024 CNBC World’s Top Fintech Company

Digital Business Solutions Category

2023 Merit Awards for Technology

Gold Winner

Ready to save time and money?

Book a demo to get started today and take control of your finance operations with Tipalti.

Recommendations

Access All Insights on AP Automation

AP Automation FAQs

What is AP automation?

Accounts payable automation (AP automation) involves using software to automate common vendor invoice tasks. It facilitates manual tasks for the payable department and allows for paperless document management, invoice processing, PO matching, and payment reconciliation.

Traditional accounts payable teams are burdened by overhead, manual data entry, and inefficiencies. An AP system allows teams to scale without adding more staff, gain better visibility into financial data, and achieve financial close-up to 25% faster.

Accounts payable software is a more affordable, flexible, and easier solution than accounts payable outsourcing.

How does AP software work?

AP software optimizes the accounts payable process in key areas where manual labor is causing inefficiencies, such as invoice processing, mass payments, data entry, price matching, and more.

The first step in invoice automation is data capture. An AP automation solution extracts all invoice data and automatically compares the line items with the purchase order information that is synced in your system, which is called PO matching. This can also be done with other documents like inspection reports and shipping receipts.

It then routes the invoice to the correct approvers. Once approved, the software sends invoice data to an integrated ERP system while archiving data from digital documents, paper invoices, and audit trails.

AP automation has many benefits. When automation software is used, accounts payable teams can reduce costs, eliminate routine tasks, and provide better visibility and control over financial data. It also facilitates cash flow and leads to early payment discounts.

How does automation software help AP teams scale?

If you seek to scale your AP team, automation is the next step. It’s an efficient tool for any modern CFO. AP software helps teams grow through automated invoice processing, cost savings, streamlined approval routing, stronger vendor relationships, reduced risk, and complete integration.

Automation means you always pay on time, at the right time, every time. It solidifies supplier relationships, streamlines transactions, and keeps partnerships intact. This type of system will also help avoid late payment fees.

How much does AP software typically cost?

The cost of AP automation software depends on the tasks your business needs to perform and how you plan to automate accounts. The best AP automation software offers the following modules:

- Scan and Archive: A document management system with invoice capture.

- Archival and Auto-Matching: This includes internal controls for AP, such as front-end processing and approval workflows. For this type of system, associated spend will include the annual license fee and related support costs, which include:

- Bi-directional integration

- Optical Character Recognition (OCR)

- Business intelligence

- Robotic Process Automation (RPA)

- Cloud-based Automation: In cloud-based AP automation, all infrastructure investments are made in the cloud, and the cost is shared. Usually, providers of this approach charge on a transactional basis instead of the license model.

How much can a business save with Accounts Payable automation?

According to Tipalti’s Invoice Processing & Payment Cost Calculator, automated processing can save a business an average of $14.93 per invoice compared to companies that manually process their invoices.

Additionally, you can try Tipalti’s Payment Error Cost Calculator to help calculate costs due to errors.

How does AP software handle tax compliance?

Accounts Payable (AP) software help companies manage their bills and payments efficiently, especially when it comes to tax compliance. AP software includes features and functionalities that address tax-related requirements in an accurate and timely manner.

Tipalti’s tax solution helps your company comply with IRS tax provisions and simplifies the AP process. Our guided tax form wizard assists suppliers in choosing the correct form based on the country and business structure.

For non-US payers, local and VAT tax ID collection is available. If the foreign entity comes from a country with a U.S. tax treaty, they can fill out and submit a W-8BEN-E form.

Tipalti facilitates IRS AP tax compliance with KPMG-approved tax form data validation and withholding calculations.

How does AP automation software integrate with ERP systems?

ERP system integrations are largely built around identifying back-end processes that can be streamlined with AP automation. Tipalti has pre-built integrations to connect to popular systems like Sage Intacct, NetSuite, QuickBooks Online, Microsoft Dynamics 365, Xero and Acumatica.

The Tipalti platform syncs bill and payment data in real-time, accelerating the reconciliation process. The level of integration is always dependent on your needs and workflow.

How does AP automation help the approval process?

Automation helps to reduce the AP portion of procure-to-pay cycle time. It’s a best practice for improving the AP workflow. It skips the endless approver follow-up that happens with manual invoice processing and eases the labor workload.

The system automatically verifies vendors and validates invoices. It then forwards the approval request to the right person in the organization, completely automating the AP invoice approval process.

The invoice is automatically matched to the electronic purchase order in a two-way approval. Three-way approval requires those documents, plus a receiving report as the third item.

Does AP automation software improve supplier relationships?

AP automation improves global supplier management in a variety of ways. It immediately alerts merchants when invoices have been paid. Real-time status updates can be sent via email when something is not paid.

An automated AP accounting system can also be used for vendor management and compliance, collecting tax data for VAT, W-8, and W-9’s.

AP automation software forges stronger supplier relationships, and when a situation demands increased support or supply, vendors will be willing to go above and beyond to meet your needs.

How can automation improve the structure of an AP department?

Accounts payable automation software improves the structure of an AP department by separating duties both inside and outside of the team.

Proper segregation of AP duties is a requirement for solid internal controls. Other objectives include preventing fraud, matching responsibilities, and redefining roles to accommodate automation.

How does automated payment reconciliation work?

Automatic payment reconciliation enables a business to upload an electronic version of a bank statement and automatically reconcile it. The bank provides the e-version using “matching rules” that are designated in the system.

A business can speed up financial close with features like drill-down filters, transaction level details, ERP synchronization, and real-time integrated reports.

Remittance results across all payment methods, entities, and geographies are instantly normalized and built into deep reporting. This leads to faster and more accurate reconciliation and general ledger reporting.

How does B2B payment processing work with AP automation software?

AP software improves oversight with a full view of B2B payment cycles and the analysis of accounts payable metrics. This is what makes AP software especially critical for operations for a small business.

When it comes to B2B payments, ACH transfers are the leading form of payment. Every year, check remittances steadily decrease while wire transfers are on the rise.

Can AP automation software find duplicate payments?

When selecting the best accounts payable software, look for a system that finds duplicate payments.

Tipalti has built-in financial controls and artificial intelligence to identify duplicate invoices in your accounts payable workflow. Our system checks from when the invoice is uploaded to when it’s approved, even communicating with integrated systems. When a potential duplicate is found, the system will notify the user with an urgent notification.