Table of Contents

Key Takeaways

- The accounting equation is a mathematical formula in financial accounting. It proves that Total Assets equals Total Liabilities plus Total Equity from a company’s balance sheet.

- The exact name for Total Equity varies based on a company’s legal entity.

- Accounting equation is also called balance sheet equation and fundamental accounting equation.

- The accounting equation formula is based on the double-entry bookkeeping and accounting system. Debits and credits are equal when recording business transactions and preparing financial statements.

- The basic accounting equation is less detailed than the expanded accounting equation. The expanded accounting equation shows more shareholders’ equity components in the calculation. Results are equivalent.

- Cash flow isn’t considered in the accounting equation. You don’t need to use the company’s Cash Flow Statement to compute the accounting equation.

Companies compute the accounting equation from their balance sheet. They prove that the financial statements balance and the double-entry accounting system works. The company’s assets are equal to the sum of its liabilities and equity.

This article gives a definition of accounting equation and explains double-entry bookkeeping. We show formulas for how to calculate it as a basic accounting equation and an expanded accounting equation.

What is the Accounting Equation?

The accounting equation is a formula that shows the sum of a company’s liabilities and shareholders’ equity are equal to its total assets (Assets = Liabilities + Equity). The clear-cut relationship between a company’s liabilities, assets and equity are the backbone to double-entry bookkeeping. The source of a company’s accounting equation numbers is its balance sheet. Equity can be Shareholders’ Equity, Stockholders’ Equity, or Owner’s Equity.

Like other equations, if two terms of the basic accounting equation are known, you can solve for the third term. For example, Total Assets – Total Liabilities = Total Equity, or Total Assets – Total Equity = Total Liabilities. You move a term from the right side to the left side of the accounting equation by using a minus sign.

Names meaning the same as Balance Sheet are Statement of Financial Position or Statement of Financial Condition.

What are Specific Names for Equity on the Balance Sheet?

Equity is named Owner’s Equity, Shareholders’ Equity, or Stockholders’ Equity on the balance sheet. Business owners with a sole proprietorship and small businesses that aren’t corporations use Owner’s Equity. Corporations with shareholders may call Equity either Shareholders’ Equity or Stockholders’ Equity.

What is Double-Entry Accounting (Bookkeeping)?

In double-entry accounting or bookkeeping, total debits on the left side must equal total credits on the right side. That’s the case for each business transaction and journal entry. As a result, the financial statements are in balance.

The monthly trial balance is a listing of account names from the chart of accounts with total account balances or amounts. Total debits and credits must be equal before posting transactions to the general ledger for the accounting cycle.

Double-entry bookkeeping started being used by merchants in Italy as a manual system during the 14th century.

Accounting software is a double-entry accounting system automatically generating the trial balance. The trial balance includes columns with total debit and total credit transactions at the bottom of the report.

Basic Accounting Equation Example – How to Calculate

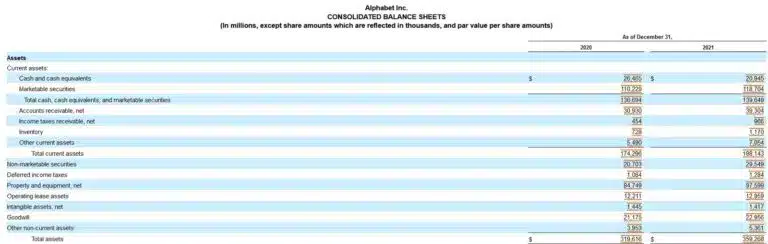

A screenshot of Alphabet Inc Consolidated Balance Sheets from its 10-K annual report filing with the SEC for the year ended December 31, 2021, follows. Alphabet Inc is the parent company of Google. As our example, we compute the accounting equation from the company’s balance sheet as of December 31, 2021. Note that amounts are in millions of dollars.

The solution to Alphabet Inc.’s basic Accounting Equation formula is:

Total Assets = Total Liabilities + Total Stockholders’ Equity

$359,268 = $107,633 + $251,635

$359, 268 = $359,268

Because the Alphabet, Inc. calculation shows that the basic accounting equation is in balance, it’s correct. And the double-entry accounting system is working.

What is the Expanded Accounting Equation?

The expanded accounting equation lengthens the basic accounting equation (Assets = Liabilities + Shareholders’ Equity). It shows items within the shareholders’ equity section of the balance sheet in the formula.

The expanded accounting equation is:

Total Assets = Total Liabilities + CC +/- AOCIL + BRE + R – E – D – SR

Where terms from the Shareholder’s Equity section of the balance sheet include:

CC is Contributed Capital

AOCIL is Accumulated Other Comprehensive Income (Loss)

BRE is Beginning Retained Earnings

R is Revenue

E is Expenses

D is Dividends (paid)

SR is Stock Repurchases

In this expanded accounting equation, CC, the Contributed Capital or paid-in capital, represents Share Capital. AOCIL is added for income or subtracted for loss. Retained Earnings is Beginning Retained Earnings + Revenue – Expenses – Dividends – Stock Repurchases.

Accumulated Other Comprehensive Income (Loss), AOCIL, is a component of shareholders’ equity besides contributed capital and retained earnings. AOCIL includes unrealized gains or losses on available for sale securities, foreign currency translation gains or losses, and pension plan-related items, including gains or losses, prior pension service costs, and credits.

Share repurchases are called treasury stock if the shares are not retired. Treasury stock transactions and cancellations are recorded in retained earnings and paid-in-capital. The journal entry depends on transaction specifics.

Share capital consists of preferred stock, if any, and common stock. Retained Earnings is computed as Beginning Retained Earnings plus year-to-date additions to Retained Earnings (from Revenue minus Expenses = Net Income) minus Dividends paid minus Share Repurchases.

For EAE, you’ll still need the Balance Sheet. Note that you’ll also need the Income Statement and possibly the detailed Statement of Stockholders’ Equity.

Not all companies will pay dividends, repurchase shares, or have accumulated other comprehensive income or loss.

The future of finance is here. Is your business prepared?

Consider an end-to-end payables solution that automates the easy stuff, so you can focus on growth.

Expanded Accounting Equation Example – How to Calculate

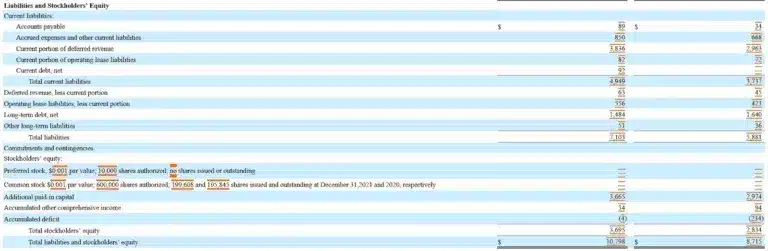

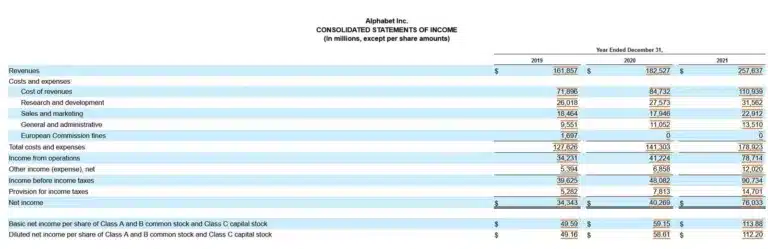

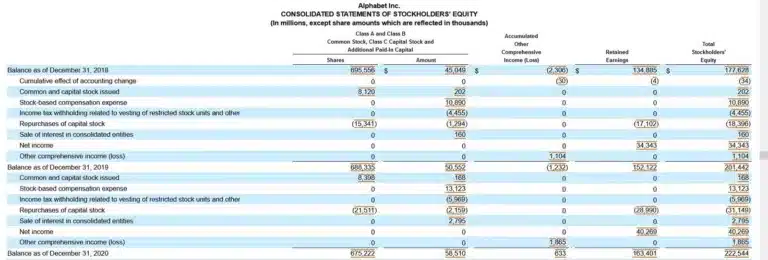

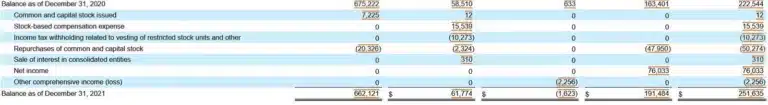

We calculate the expanded accounting equation using 2021 financial statements for this example. To trace back the numbers, refer to the same Alphabet Inc. Balance Sheets shown above and the Income Statement and detailed Statement of Stockholder’s Equity in this section.

Alphabet is a tech company that doesn’t pay dividends. From the Statement of Stockholders’ Equity, Alphabet’s share repurchases can be seen. Their share repurchases impact both the capital and retained earnings balances.

Total Assets = Total Liabilities + CC +/- AOCIL + BRE + R – E – D – SR

$359,268 = $107,633 +((0 + $61,774) – $1,623 + $163,401 + $257,637 – ($178,923 – $12,020 + $14,701) – $0 – $47,950)

$359,268 = $107,633 + ($61,774 – $1,623 + $163,401 + $257,637 – $181,604 – $0 – 47,950)

$359,268 = $107,633 + $251,635

$359,268 = $359,268

How Does the Accounting Equation Differ from the Working Capital Formula?

The accounting equation uses total assets, total liabilities, and total equity in the calculation. This formula differs from working capital, based on current assets and current liabilities.

Working capital measures liquidity. The working capital formula is Current Assets – Current Liabilities.

Current assets include cash and cash equivalents, accounts receivable, inventory, and prepaid assets. Current liabilities are short-term financial obligations payable in cash within a year. Current liabilities include accounts payable, accrued expenses, and the short-term portion of debt.

Working capital indicates whether a company will have the amount of money needed to pay its bills and other obligations when due.

Summing It Up

As the fintech industry continues to expand, memorizing accounting equations will become obsolete. The bread and butter lies in freeing up your human labor to work on value-based tasks, while automating manual processes.

There is so much of accounting that can be relegated to a computer, so you can use your resources more wisely. To get a few ideas, check out our eBook: Future Office of Finance.