Accounts Payable Tax Compliance Support for Argentina and Brazil Suppliers

Businesses Can Automatically Validate Supplier Tax IDs with Argentine and Brazilian Tax Authorities

Palo Alto, CA, September 6, 2016 – Tipalti, the leader in global supplier payments automation, announced it has extended its accounts payable tax compliance capabilities to help companies collect and validate tax IDs from their suppliers in Argentina and Brazil. This enables all businesses engaging with suppliers and partners in those countries to ensure tax compliance by recording tax information for those payees. In addition, by validating a supplier’s tax information, it can reduce the risk of fraudulent payments to those countries.

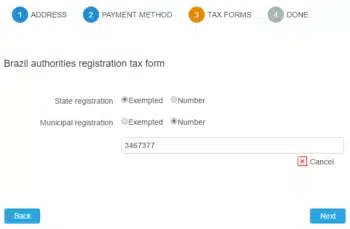

Through Tipalti’s secure self-service portal, suppliers provide their contact and banking information. Supplier data is validated using over 26,000 global remittance rules to eliminate payment issues and suppliers then also provide their tax identification in order to be payable. That data is validated and stored for the payer and accessible at anytime, from anywhere through Tipalti’s cloud platform.

Accounts payable tax compliance capability is seamlessly integrated within Tipalti’s end-to-end supplier payments platform, allowing finance departments to automate their entire accounts payable workflow, from supplier onboarding to tax and regulatory compliance, invoice processing, global supplier remittance, proactive payment status communications, and payment reconciliation and AP financial reporting.

For Brazilian suppliers, Tipalti verifies state and municipal codes for an individual (CPF) or corporation (CNPJ) matches the payee’s name. For Argentine suppliers, Tipalti verifies state and municipal code for an individual (CUIL) or corporation (CUIT) matches the payee’s name.

To support the US Foreign Accounts Tax Compliance Act (FATCA), Tipalti released a software update last year for US-based companies that walks international suppliers through the challenging process of choosing the correct Internal Revenue Service tax form and then collects and validates form data through a digitized form experience including electronic signature. This capability was reviewed and approved by KPMG to meet IRS requirements, enabling companies to efficiently collect tax ID information with digitally signed W-9 and W-8 series forms and automatically perform any required withholding.

“Tax compliance, as we’ve seen with FATCA in the US, is falling more to the accounts payable disciplines due to its close association with paying suppliers,” says Roby Baruch, Vice President of Products at Tipalti. “Tipalti’s new functionality simplifies the compliance effort for companies in Argentina and Brazil as well as for those businesses that rely on suppliers in those countries.”