The Human Impact of Digital Transformation

Adopting digital transformation initiatives in your finance department should go beyond implementing the very best technology. It’s critical for companies to know exactly how these tools add value to employees.

Companies often underestimate the value of autonomy, with few decisions delegated beyond the leadership team. Even when issues are closest to frontline employees, bureaucratic structures leave these workers questioning whether to seek input from management before arriving at a solution. Given enough time, these practices can have a significant impact on operations—leading to not only inefficiencies and productivity losses but also disengaged teams. In the worst cases, they can even heighten turnover.

Is Lack of Autonomy Worth the Gamble?

With 1 in 4 people quitting their jobs in 2021, this isn’t a gamble worth taking with finance teams. We’re still in the midst of the Great Resignation, making it more important than ever to empower employees. Gains will follow in:

However, employee empowerment requires more than merely delegating responsibilities. Team members require the right tools for making decisions, performing tasks, and supporting growth opportunities. The right tech stack is a critical component—especially as digital transformation continues on its current trajectory.

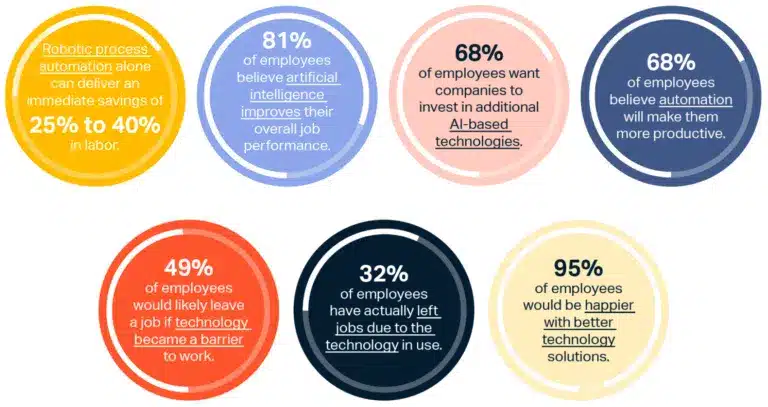

Today, finance teams are taking on additional responsibilities, making burnout a top concern for leadership teams. Outdated operational processes, time-consuming manual tasks, and low visibility hinder teams from reaching their fullest potential. Technology can help by allowing employees to perform their jobs at the highest level. It consolidates and simplifies work and relieves them from more time-consuming tasks. In turn, this saves time, enhances job performance, and improves the bottom line:

With the right technology, finance teams can devote their attention to what truly matters—providing strategic financial understanding and enabling data-driven decisions companywide.

The Human Impact of Digital Transformation

Download our eBook for more expert insights.