Table of Contents

If you’re doing business with international suppliers, it’s important you understand exactly how to pay them. Some countries require the use of an IBAN number.

What is an International Bank Account Number (IBAN)?

IBAN, or International Bank Account Number, is a code you can use to make or receive international payments. Your IBAN code is different from your account and sort number–it’s solely used to help overseas banks identify your bank account so you can receive or send international payments.

Your IBAN code includes different numeric identifiers, such as a bank account number and country code, that serve to convey your correct bank and bank account to international banks.

An IBAN number is a type of bank code. Click here for more on bank codes, including the major types you need to know.

Main Points

- IBAN is short for International Bank Account Number and is used to identify an individual bank account in cross-border payments.

- IBAN codes facilitate international money transfers.

- SEPA is a separate and smaller network than IBAN, each serving different countries

- An IBAN can be located on your bank statement, through online banking, an IBAN calculator, or the IBAN Registry

- The SWIFT network standardized the formats for the IBAN system and owns the BIC system.

What Does an IBAN Look Like?

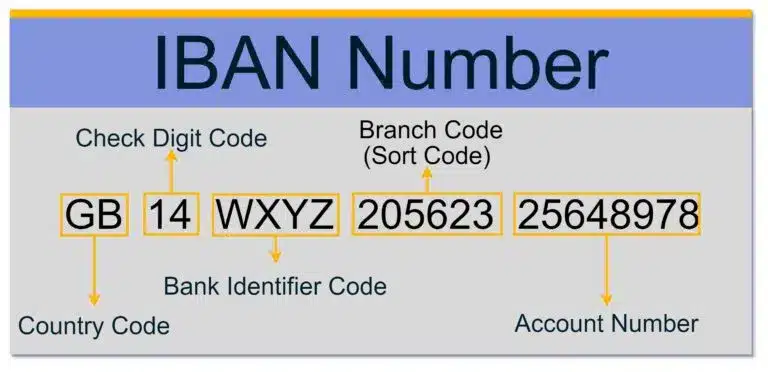

In general, an IBAN number is divided into a numbering system comprised of codes (sometimes in the order presented, although it does vary by country):

- Country code (sometimes called location code)

- Check digit code

- Bank identifier code

- Branch code

- Account number

The last three (bank, branch, and account numbers) collectively make up the Basic Bank Account Number (BBAN) and are used to locate a specific bank.

The IBAN format is always the same for every country, although the number of digits may vary. For example, Norway uses 15 characters, while Liechtenstein uses 21. The maximum number that any country can use is 34.

Please note, the IBAN method is mostly used within the majority of European Union countries and other European countries. Always check with your bank if you’re unsure about an international transfer.

IBAN vs BIC

A Bank Identifier Code (BIC) is just a general term for a SWIFT code. That’s why you sometimes see the terms paired together as SWIFT/BIC. Technically, the network through which international transfers are sent is the SWIFT network, and the codes are BIC codes.

Whereas an IBAN identifies a bank’s country of business and one’s precise account number within that institution, a BIC (Bank Identifier Code) breaks down into 3 more specific elements to aid a transaction. It’s composed of alphanumeric characters, namely, a 4-letter bank code, a 2-letter country code, and a branch identifier composed of one letter and one number.

A BIC is also important to avoid post-transaction costs that can incur from fixing a misdirected wire transfer.

IBAN vs SWIFT Code

IBAN vs. SWIFT codes are both internationally recognized for identifying bank accounts when a transfer is being made. The unique identifier required depends on the country involved and the recipient’s bank.

SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication. A SWIFT code refers to a specific financial institution in an international transaction, whereas an IBAN number identifies an individual account and the country of business. It’s the global equivalent to a bank account and an ABA routing number in the United States.

The primary difference between the two codes lies in the information inside.

Learn more about IBAN vs SWIFT codes, including costs, use cases, and examples.

Examples of an IBAN Number

In the register of countries that currently use an IBAN code, here are a few examples:

- Albania: AL47 2121 1009 0000 0002 3569 87411

- Luxembourg: LU 28 001 94006447500003

- Cyprus: CY 17 002 00128 00000012005276002

- Norway: NO 93 8601 1117947

- Kuwait: KW81CBKU0000000000001234560101

Are you struggling to find ways to pay international suppliers?

There are tons of ways to pay, from wire transfers to domestic ACH, prepaid debit cards, and more!

How to Find Your IBAN Number

The IBAN is located on every paper bank statement an institution prints. It may also appear inside your web-based account if you use online banking. If you can’t find it in either of those locations, contact the bank, use the IBAN Registry, or an IBAN calculator tool.

Does it Cost Money to Use an IBAN?

IBANs are needed for international bank transfers, so expect to pay bank transfer fees. The cost will vary by country and exchange rate, but there is usually a processing fee and commission charged.

Main Functions of an IBAN Number

When it comes to international banking, IBANs are a critical piece of information. It serves three main functions for sending and receiving cross-border payments, which are:

- Allows banks and other financial institutions to quickly note the country of origin for the bank.

- IBAN pinpoints the exact account number to which the money will be sent.

- It’s an easy way to double-check the accuracy of a bank’s details and ensure a transfer will be successful.

Which Banks Use IBAN Numbers?

This all depends on where you live. Banks in the United States, Canada, Australia, New Zealand, and China do not use IBAN codes. They use SWIFT codes and routing numbers. IBANs are mostly reserved for European countries.

According to the ECBS (European Commerce Banking Services) “generation of the IBAN shall be the exclusive responsibility of the bank/branch servicing the account”.

The Basic Bank Account Number (BBAN) format is decided by designated payment authority, or central bank of each country, and there is no consistency between which formats are adopted. They may register the BBAN format with SWIFT, but countries are not obliged to do so. The same goes for IBAN numbers. A major difference between the two, is that under SWIFT there is no requirement that BBANs are a certain length.

What is the IBAN Registry?

The IBAN registry is a catalog of those countries that are compliant with the most recent IBAN standards (ISO 13616). The registry is published by SWIFT and contains the details of each country’s IBAN format.

The registry also shows the document’s update history and gives a brief description of important terms used in IBAN transactions.

Is IBAN Number Used in the USA?

IBAN numbers are only used in the USA for sending money to a foreign bank account that also participates in the International Bank Account Number System. Currently, US banks do not use the IBAN number domestically. Instead, US banks use ABA routing numbers (for domestic transfers) and SWIFT codes (for international transfers).

What Is the Difference Between IBAN and SEPA?

The Single Euro Payment Area (SEPA), as the name suggests, is a payment network in Europe that provides digital transfers within the European Union. This includes places like Spain, Ireland, Hungary, the United Kingdom, and more. It also covers a few countries outside of the union, including Norway, Iceland, Switzerland, and Liechtenstein.

It’s overseen by the European Committee for Banking Standards (ECBS) who help set forth the national standards for business identifier codes.

In total, the SEPA network works across 28 countries. By comparison, over 60 countries currently use the IBAN system. Multiple currencies can also be sent using IBAN, whereas only Euros can be used on the SEPA network.

Since its adoption throughout Europe in the late 1990s, some countries in the Middle East and the Caribbean have also begun using the IBAN system for digital money transfers.

Find out more about SEPA payments, including setup, benefits, and requirements.

What is the Purpose of IBAN?

Before International Bank Account Numbers were adopted, different European countries had different bank account number formats, and this discrepancy led to errors in cross-border transactions. International payments would end up in the wrong location, requiring extra fees and time to resolve the issue.

Then in 1997, the International Organization for Standardization (ISO) proposed a new system of global money movement. Today, this international standard is known as ISO 13616-2:2007.

The result of the IBAN program has been fewer errors in international wire transfers and other financial transactions. Because multiple countries now operate within the same system, it’s also easier for people to send money from one jurisdiction to another.

Despite these advantages, there are issues IBAN cannot address, such as foreign exchange rates.

FAQ

Is it safe to give out an IBAN number?

It is absolutely safe to give anyone your IBAN number. That’s because it only exposes data that allows someone to send money to you, and not personal account details.

Is it safe to give out an IBAN number?

It is absolutely safe to give anyone your IBAN number. That’s because it only exposes data that allows someone to send money to you, and not personal account details.

Is a SWIFT code the same as a routing number?

The SWIFT system is used by international organizations, whereas routing numbers are in the US only.

Who uses IBAN codes?

As of May 2020, 77 countries are using the IBAN system.

Should I use BIC or IBAN?

If you’re using the IBAN system, you’ll need both. While an IBAN provides data about your individual account, the BIC code is the bank your account is held at.

Power your entire partner payouts operations

98%

Customer Satisfaction

$60B+

Annual Transactions

4M+

Partners

5,000+

Customers

99%

Customer Retention

One Option Among Many

Using an IBAN to send money to a bank that participates in such transfers is a convenient way to perform a funds transfer. But remember that not all banks have an IBAN, so in some cases, you’ll need to use a different method.

IBAN, SWIFT, and BIC

The overseas transfer of wealth (and therefore the wellbeing of international markets and trade) is inextricably tied to the numbers and international standards we’ve covered in this article.

An IBAN, a SWIFT code, and a BIC are each a vital component in making, receiving, and processing international payments of all kinds.