Table of Contents

When a business wants to pay all of its vendors at the same time, it must be done in batches. If you’ve ever had to deal with payment files, they can be a huge headache. These text files (NACHA files) vary between long lengths of code and specific formatting. The variance largely depends on if a business is using an ACH API, mass payments platform, bank portal, or digital payment solution like PayPal Mass Pay.

Here we look at the file format for the National Automated Clearing House Association (NACHA) and how they are used to execute domestic ACH payments.

What is the NACHA File Format?

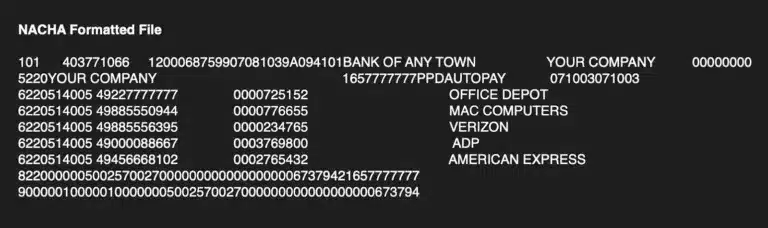

A NACHA file is an electronic set of instructions that triggers a batch of ACH payments when uploaded into a bank portal. The file must be formatted in such a way that the scanner reads it properly and initiates payment.

A NACHA file is one of the most common types of payment files and is used to execute domestic ACH payments through the National Automated Clearing House Association. It’s a fast way for a business to pay vendors without having to use checks or a credit card.

Each line is 94 characters long and is structured in the form of alphanumeric ASCII text. The file is formatted in a digital envelope and contains important payment instructions like:

File Header Record

This record will indicate company discretionary data like your company name and reference code. It also designates the immediate destination of the entries contained in the file. For example, LaSalle Bank N.A. or Bank of America.

The file header record contains important field names like:

- Destination Name (name of bank)

- File Creation Date and File Creation Time (HHMM – uppercase)

- File ID Modifier (code to distinguish among multiple input files)

- Record size and type (number of bytes per record)

- Priority Code (the lower the number the higher the processing priority)

- Blocking Factor (block at 10)

The File Header Record contains all related information for the ACH transaction to go through.

Batch Header Record

This code indicates the effective entry date and includes a service class code. That’s the date you request total credits/total debits to be settled. It also identifies your business and provides a description of the credit and debit entries. Descriptive fields include:

- Company Name

- Company Entry Description

- Company Descriptive Date (YYMMDD)

- Individual Identification

- Settlement Date

- Batch Number

The batch header record is where your company identification, batch number, and other identification numbers are located that are required for the NACHA file.

Entry Detail Record

This part of the record contains important information needed to deposit to or withdraw from an account. Data will include the recipient’s name, account number (savings account or checking account), and the dollar amount of the payment.

There might also be an Entry Detail Addenda Record which is optional. This addenda count contains additional data relating to the prior entry detail record. It is primarily used for CCD+ and CTX, which are corporate transactions.

The Entry Detail Record will contain filed names like:

- Trace Number (the bank assigns this)

- Addenda Record Indicator

- Individual Name

- Record Type Code

- Check Digit

- DFI Account Number

Batch Control Total

The batch control record appears at the end of each batch and indicates the totals for the batch. This includes:

- Total Debit Entry Dollar Amount

- Total Credit Entry Dollar Amount

- Company Identification

- Originating and Receiving DFI (routing number)

- Message Authentication Code

File Control Record

This is a final check on the data submitted. It contains block counts and batch counts, as well as totals for each type of entry.

While the details of a payment file can vary slightly between different banks and financial institutions, there are a number of Standard Entry Class Codes (SEC codes) that are required when sending ACH payment files.

Biggest Takeaways on Nacha File Format for AP Teams

When handling NACHA files, AP teams need only be concerned about what NACHA is and how it is part of the ACH process. AP teams should understand that NACHA files are the key to batch ACH payments and the NACHA file format is the protocol for setting that up.

Due to modern automation and payments software, most AP departments need not worry about creating a NACHA file from scratch. However, the information is still here in case the need arises.

It’s also important you know how to identify a NACHA file, as well as the best tools for batch payments and the benefits of using this type of payment structure.

NACHA Format Codes

File Header

This provides basic information about the NACHA file including:

- Who the payer is

- Which bank is handling the transaction

Batch Header

This includes specific information about the payment run including:

- Standard entry class

- Description of payments

- Effective date

- Any other prenotes

Detailed Transaction Record

This contains:

- Payment details

- Information about the payee (banking information)

- Amount of payment

Batch Control Total

The total included in each batch.

File Control Record

This is a final check on the payment batch. It includes counts for each type of entry.

Addendum

An optional record that sometimes accompanies NACHA files, primarily for corporate-to-corporate transactions.

ACH and NACHA File Terms

The following terms are not necessarily part of the format in a NACHA file but are terms and acronyms associated with the ACH network.

Originator — This is the entity that is making the payment or the payer.

ODFI — The Originating Depository Financial Institution is the bank or institution where the funds are coming from. It’s the immediate origin of funds.

ACH Operator — This is a clearing facility that receives and clears batch payments from the ODFI.

RDFI — The Receiving Depository Financial Institution (DFI) is the bank of the payee and receives funds once they are made available by the ACH Operator. This is the immediate destination of funds.

NACHA Standard Entry Class Codes

There are a variety of codes that accompany a NACHA payment file. They are included in the batch header to describe the type of payments that are in the file. These ACH payment files can take on many different formats to fit the types of transfer it facilitates.

Some of the formats include:

ARC – Accounts Receivable Conversion

When a check is received in the mail and then undergoes an ACH transfer, it’s known as an Accounts Receivable Entry (ARC). It’s a single-entry ACH debit where a check is processed electronically and appears on the customer’s statement as an ACH transaction.

BOC – Back Office Conversion

This transaction code allows originators to convert paper checks to single-entry ACH debits during back-office processing.

CCD – Cash Concentration or Disbursement

A Cash Concentration or Disbursement applies to corporate debits and credits. It provides secure and fast transactions where funds appear overnight.

CIE – Customer Initiated Entry

A Customer Initiated Entry allows a consumer to initiate an ACH credit to transfer funds to a business for payment owed.

CTX – Corporate Trade Exchange

Corporate Trade Exchange transfers in the ACH network are used by government agencies and corporations to pay trading partners.

IAT – International

An International ACH Transaction is an ACH entry that is part of a transaction involving a bank that is not located in the United States.

POP – Point of Purchase Entry

The Point of Purchase (POP)ACH format integrates a point of purchase or swipe terminal, which triggers a single entry ACH debit transaction for in-person purchases made.

PPD – Prearranged Payment and Deposit Entry

Prearranged Payment and Deposit is used for personal (consumer) accounts. This includes things like direct deposit of payroll to employees, payments to individuals, and collections of consumer funds.

RCK – Re-Presented Check Entry

The Re-Presentation Check Entry format is used for a returned check. It enables an ACH debit transaction to represent a paper check after it has been returned for insufficient or uncollected funds.

TEL – Telephone-Initiated Entry

The Telephone-Initiated Entry format is for an oral authorization that is recorded as an ACH debit.

WEB – Internet Initiated Entry

An Internet Initiated Entry is for the origination of debit entries (one-time or recurring) to a consumer’s account based on an authorization obtained online.

What are NACHA Rules?

Just like the American National Standards Institute (ANSI), NACHA has its own operating rules which form the foundation of every ACH payment. By establishing clear guidelines for each network participant, the NACHA rules help define the roles and responsibilities of financial institutions. The NACHA rules help to ensure millions of payments occur easily and smoothly every single day.

Why Use NACHA Files?

There are many reasons why a business might need to use a NACHA file. ACH is a popular payment method for B2B transactions. It leverages the ACH network to clear the transfer of funds from one bank account to another. The ACH network moves over 25 billion transactions each year.

ACH is the prime vehicle for B2B and mass payments because of the quick delivery, low fees, and overall reliability.

Problems with Payment Files

Another reason why the NACHA file format is so popular is that it’s standardized. A batch payment file is a document typically produced by accounts payable or payment processing software. It specifies the details of each individual payment in a batch and contains sensitive information that must be kept secure.

The problem is that payment files must be secure enough, that information cannot be easily accessed or changed, but accessible enough, that people can view, upload, and approve them. While some consistency lies around requirements to send a batch of ACH payments, there is a general lack of standardization.

Different accounting systems will create different types of payment files. In many cases, each payment method will require it’s own type of file. A large corporation or multi-entity business may use multiple accounting or ERP platforms. Multiple systems, along with the need for multiple payment methods, results in dozens of payment file types and formats.

It can be a huge mess!

Another issue with payment files is that workflows are easily broken or flawed, which causes a rejection. Leveraging different methods, setting up new users, and integrating a bank portal are all human processes that can result in errors and rejections. When this happens, it requires extra time and labor. This will frustrate your vendors and can result in additional bank fees.

What’s the Difference Between ACH and NACHA?

These two terms mean virtually the same thing. NACHA oversees the ACH network, which is an electronic system that moves payments from one bank account to another. NACHA sets forth and enforces the rules that the ACH network must abide by. It manages the administration, governance, and development of the entire ACH network.

How to Create a NACHA File

Creating a NACHA file is not an easy task. Due to the sensitive nature of these files, it’s best to consult with your financial institution or payment processor before attempting to make one. Unless you have coding experience, leave it up to the professionals. That being said, you have a multitude of options for creating a NACHA file at your disposal.

Thankfully, some bank portals have automated components of the NACHA file process that simplify the formatting and make your life a little easier. Bank of America, Chase, and Wells Fargo each have unique systems for the execution of batch payments.

In many cases, accounting software will generate the NACHA file for you, removing the complications of manual entry and human error.

Create a NACHA File Using Excel

Premier ACH is a product that many banks use to convert a NACHA file from an Excel file. It enables a business to enter all the data required for an ACH transaction (think direct deposit, etc.) and creates a properly formatted NACHA file.

It’s a two-step process to accomplish this manually. First, you need to create a wrk file, which is an XML file. Then, it needs to be converted into the NACHA format for payment.

It all starts with an Excel file. This is something that can be exported from common accounting programs like QuickBooks or Sage. Once you have the Excel file, it’s best to hand the programming over to a professional developer.

The steps to format an Excel file into a NACHA file include:

- Identify objects and relationships

- Create class modules

- Write code to fill classes

- Write code to create an XML file

- Augment class modules until it compiles

The original Excel file should look like this:

A sample of an XML (wrk file) looks like this:

You can also create a payroll review sheet to check work. To further understand coding custom NACHA files from Excel, check out this in-depth tutorial. The goal is to turn Excel data into a properly formatted work file that can then be used to create a NACHA file.

Create a NACHA File Using QuickBooks

QuickBooks is one of the most popular AP platforms on the planet. It allows the use of ACH direct deposits through a payroll subscription service.

To use QuickBooks for ACH debits from your bank to a vendor’s bank, it’s necessary to integrate a third-party file conversion tool. This creates a NACHA file that enables a business to pay people without having to write a check or use debit cards.

Install QuickBooks and follow the automated prompts to create your company file. Make sure to include all bank account information for the account you wish to transfer funds to and from. The payroll subscription enables a business to pay direct deposit straight through the platform.

InLattice is a system that connects with QuickBooks and allows you to upload invoices to be sent via email. It processes payments from a variety of gateways and creates a NACHA file that’s automatically transmitted to banks.

Simply open an account and enter the same data as you would into QuickBooks. Open your QuickBooks file in another window and you’re ready to start importing and exporting between programs. Bills and invoices can easily be dragged and dropped from QuickBooks into InLattice, where they will be processed for payment and a NACHA file created.

Create a NACHA File Using Netsuite

Netsuite was built to process large batches of ACH payments. One way to reduce manual efforts is to use the standard Electronic Bank Payments function in Netsuite.

Rather than manually entering ACH payments into your bank’s interface, Netsuite will generate a NACHA file that can be automatically uploaded to your bank’s system. It cuts out an entire step in the process of remitting large payment batches. This installation is free and easy to set up.

To get started, follow these simple steps:

- Install the Electronic Bank Payments tool (Bundle ID 308852)

- Set up bank details

- Set up an approval workflow

- Set up your vendor records for electronic payment

- Set up default AP account on the vendor record

- go to Employee-> Financial-> Account Information-> Default payables account

- Use a CSV Import to create new bank detail records

- Generate NACHA file for vendor payments

- Bills are marked paid once electronic payments are approved and processed

- For the “Date to be Processed” choose the next day if you are loading the file today

- Make sure the vendor’s default payables account is the same as the EFT bank details set up

- Make sure the bill is approved if you do not see it on the list

- Uncheck the “Aggregate by Payee” box to create separate payment transactions

- Start the approval workflow

- The approver will be emailed notification that approval is needed OR

- The approver is notified of where to check for approvals

- This can be found in Payments-> Payment Processing-> Bill Payment Batches

- Retrieve the file for upload to the bank

- Here is where to check for a processed file: Payments-> Payment Processing-> Payment File Administration

- Upload file to your bank

Create NACHA using Third-Party Tools

The best third-party tools enable a business to create NACHA formatted ACH files using data you enter, or from an Excel, or comma-separated values (CSV) file. It should support multiple common Standard Entry Class Codes (SECs) and work independently without the need for extra software.

ACH File Creator is a standalone program that allows a business to create a NACHA file format using data from any accounting package that can produce an Excel or CSV file.

A business can pay anyone with the following steps:

- Enter the corresponding data or import it from an Excel or CSV file.

- The software uses the data to create a NACHA file.

- The file is sent to your financial institution.

- Your financial institution re-transmits the file data to your customer or employee accounts.

- Your customer or employee gets paid.

NACHA Preferred Partner

In 2016, NACHA announced its preferred partner program for creating ACH files. It identifies leading innovators and providers that advocate for the industry and best practices in support of the ACH network. Specifically, NACHA announced the company Treasury Software as the best tool for converting files into the NACHA format.

NACHA’s strategic initiative is that companies and organizations of all sizes can easily use the ACH network and increase the adoption of electronic payments. They chose Treasury Software because it offers a variety of tools and resources that support the enablement of ACH payments, such as Direct Deposit and Same Day ACH. It also provides tools that assist with the ACH integration of QuickBooks.

The Best Way to Facilitate Payments Using the NACHA File Format

As you can see, NACHA files are quite burdensome for AP departments. They have to manually assemble, calculate, and format each payment. Additionally, these processes can be steeped in human error.

Many banks and financial institutions will provide software that automatically formats a NACHA file. This means a business doesn’t have to think about setting up payment batches.

Popular ERPs also offer features that will generate a NACHA file. These are worth utilizing because B2B payments can be complex. If your bank or platform doesn’t automatically provide you with a service for NACHA file creation, you have a few other options.

Accounts Payable Automation Software

AP automation software is disrupting the financial industry and providing convenient ways to process and pay invoices via ACH transactions. Rather than adding a payment solution on top of your current AP process, this type of software will streamline the entire workflow. This is done by eliminating all the time-consuming pain points of manual intervention. In fact, studies have shown that AP teams who implement some form of automation software can increase efficiency by up to 60%.

These types of tools work by converting files during the payment step of the process. The software sends NACHA files directly to your bank while simultaneously recording the transaction in the system. This is done through a bi-directional data sync to ensure record-keeping is succinct and accurate in real-time. This also includes remittance details.

Payment Automation Software

Although it sounds the same, payment automation software is slightly different than AP automation platforms. It is a good method for following the NACHA file format guidelines and ACH batch payments, but it’s not the best tool for optimizing the entire end-to-end AP process.

This type of platform can be thought of as a “point solution” that is meant to automate one step in the workflow. Most payment automation platforms work similarly to the payment portion of AP automation software. It consolidates all of your payment methods into a single electronic file, including:

- Check

- ACH

- Wire transfer

- Credit card

This type of aggregation saves a business time and ensures you are paying each vendor with the most advantageous method.

What are the Benefits of ACH for B2B Payments?

There are many reasons why a business needs an easy way to facilitate ACH payments. Using ACH for debits and credits has a multitude of benefits not only for consumers but business-to-business ventures.

Here is a quick explanation for why ACH payments are at the forefront of business transactions:

- The ACH network is cheaper than other methods because payments are processed in batches, rather than on an individual basis.

- Automation means a business doesn’t have to worry about making or receiving a payment on-time each month. Money can be instantly pulled or sent with the appropriate permissions in place.

- ACH means a business doesn’t need to process paper checks. This saves time and reduces human error.

- Paying with ACH is a much faster method than mailing a payment. Everything is processed electronically, so funds move faster.

- ACH automation means a business can take better advantage of early payment discounts and reduced rates.

The Future of NACHA Files

“2021 is going to be a year full of some great Rules changes, things that help drive our ACH Network forward, increase our volume, and keep it the safe, reliable ACH Network that we all know and love.”

~Debbie Barr, Nacha Senior Director, ACH Network Rules Process

In 2019, the ACH network moved 55.8 trillion dollars and has risen 8.9% in the last quarter.

In this coming year, NACHA plans on implementing new rules that will affect how organizations do business.

Rule Change

The Same Day ACH window of hours will be extended. Two additional hours will be added to the banking day. There is a new third window of 4:45 p.m. ET deadline that is especially useful for the west coast financial institutions. It will help all banks with returns as the current 4 p.m. window is rolled into the later same-day ACH window.

New Rule

There is also a new rule coming March 19, 2021. It makes explicit that account validation is part of a “commercially reasonable fraudulent transaction detection system” for screening WEB debits. It applies when using an account number for the first time or making any changes to current ones. However, the rule remains neutral for any specific method or tools required.