Remittance advice sounds like some complex counsel, but it’s really a simple concept that goes hand in hand with an invoice.

A supplier invoices a customer to detail and request payment for services or goods, while remittance advice indicates a payment was processed—it comes from the customer to the supplier.

What is Remittance Advice?

Remittance advice is a proof of payment letter sent by a customer to a supplier that verifies they have paid their invoice–sometimes, the payment is sent with the letter if they pay by check.

Remittance advice adds an extra layer of clarity and security to the invoicing process for both customers and suppliers. To “remit” a payment is to simply send it back. Think of any type of payment or funds transfer between friends and family, for businesses, or even overseas.

Remittance advice is proof that this remittance has happened or is going to happen.

Remittance Advice Basics

Remittance advice is a proof of payment letter sent by a customer to a supplier that verifies they have paid their invoice. Remittance advice may be an electronic notification or a paper-based document.

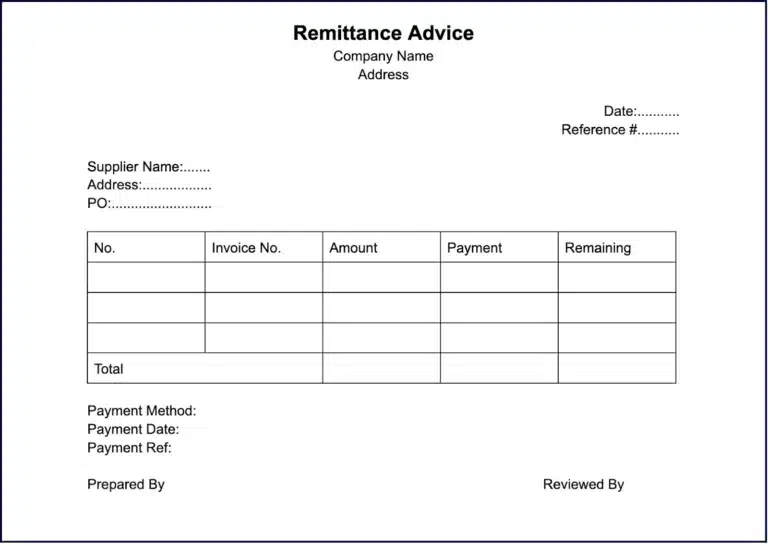

What Does Remittance Advice Look Like?

Remittance advice notifies the recipient of a payment, with the details included. Paper remittances include a detailed check stub, perforated invoice, or billing account statement section that is detached and mailed with the payment indicating the amount paid. If the customer pays by check, for example, the payment may be sent with the remittance letter.

An Example of Remittance Advice

What Details Does a Business Remittance Advice Include?

Remittance advice details the payment amount that was sent toward a particular invoice. The statement will include an invoice number and is generally sent by a purchaser to a vendor or supplier.

Business remittance advice details include:

• Payer/payee name and contact information

• Method of payment, payment date, and payment amount

• Invoice date, invoice number, and amount paid by invoice number (or payroll period)

• Amount of any credit issued with identifying credit number(s) and expected receipt date (if not immediate)

Paystubs are a form of remittance advice. Employers provide details to the employee, including the payment amount, date, payroll period, earnings, hours for hourly workers, overtime, and paycheck deductions, such as taxes and 401(k) or other retirement plan contributions. A payroll payment notification can be either an electronic remittance advice or a paper paycheck stub.

What Types of Remittance Advice Are There?

According to the Institute of Financial Accountants, there are three types of remittance advice. These are:

• Basic remittance advice: This letter includes the basic information needed to follow up on the invoice, like the invoice number and payment amount.

• Removable invoice advice: Some organizations will include the remittance form on their invoice as a payment coupon. In this situation, the receiver would simply fill it out and return it when the payment is made.

• Scannable remittance advice: This is an electronic notification option for bookkeepers. Remittance advice forms are generated automatically and transmitted to the supplier at the time of payment.

How Do Businesses Generate Remittance Advice?

Software programs may automatically generate the remittance advice slip and email it to the payee. Check the features of your accounting software or ERP system for this automation. If the “send remittance” feature isn’t included, third-party software that uses either a flat-file or API connection can usually be integrated.

You can also use templates in Word or Excel, Google Docs, Sheets, or Forms to customize the remittance advice for each payment recipient.

For invoices and online payments, EDI (Electronic Data Interchange) is an older standard for communication between trading partners.

Why Do Businesses Send Remittance Advice?

For businesses paying suppliers, remittance advice simplifies the vendor’s record-keeping process of applying the payment amount to specific invoices included in their customers’ accounts receivable balance. Because a remittance advice also notifies the vendor of the payment amount, status, any account credits, and the invoice numbers being paid, it helps to reduce under or overpayment.

In the case of payroll remittance advice, employees can verify that the amount received is correct and see when the payment is processed.

Financial institutions and money transfer companies make requested payments and send remittances to recipients, such as independent contractors or friends and family members.

Payment methods include:

• Electronic bank account transfers using U.S. ACH (Automated Clearing House)

• Global ACH for international payments

• Wire transfers

• Member-to-member account transfers

Payment remittance gives the recipient a written record of the amount of the transaction, the date to expect the funds, and a transaction number. The recipient can use the payment remittance advice to plan and follow up on any electronic fund transfers (EFTs) not received.

Electronic remittance advice (ERA) is used by claims processors, including Medicare, Medicaid, and insurance companies, to pay healthcare providers. ERA gives required details, claim payment amounts, and when they’re paid. It also lets providers manage cash flow and patient accounts, allowing them to change incorrect billing codes or bill patients or supplemental policy insurers for allowable charges.

Power your entire partner payouts operations

98%

Customer Satisfaction

$60B+

Annual Transactions

4M+

Partners

5,000+

Customers

99%

Customer Retention

How a Seller Handles a Customer Remittance Advice

When a seller gets remittance advice from their customer, they run through a detailed process to make sure the payment was received properly. The seller:

- Receives a detailed bank account deposit

- Enters or reviews an automatic software transaction to record the customer’s payment

- Debits (increases) cash account

- Credits (reduces) accounts receivable in the customer’s account

- Researches and follows up on any payment discrepancies

- Runs and reviews accounts receivable aging report by customer

Other Common Remittance Advice Questions

These are other questions accounting professionals have about remittance advice.

Is Sending Remittance Advice Required?

Customers are not required to send remittance advice to suppliers, but it is best practice. For the senders, they are doing their due diligence by notifying the supplier that an invoice has been paid. For the seller, it eliminates confusion over bill payments.

If there are issues with the account or transaction, the remittance also reveals the step in the payment process where something went wrong. If a customer has paid an invoice and sent remittance advice, but the seller has not received the funds, the sender can contact the payment issuer to see if there has been a delay or if the payment was processed incorrectly.

Is a Remittance Advice Proof of Payment?

No, remittance advice is a notification to the payee that a payment was sent. The payment may not reach the intended receiver, which is the very reason remittance advice is important.

For example, wire transfer funds don’t always reach the recipient because of information errors or problems completing a global transaction. Auditors don’t rely on payment remittance advice to confirm the existence of a cash receipt—for that, they go by the transactions in the ledger and the bank statement.

Send Remittance Advice to Keep Transactions Transparent

Remittance advice can add an extra layer of clarity to complex transactions and keep accountants better organized. A statement of payments remitted is helpful in the short term to make sure invoices are paid month to month, as well as in the long run when it comes to reviewing the books for quarterly and year-end reporting.

With Tipalti, payment remittance is simple and efficient. Our platform brings outdated, manual accounts payable processes into the future with end-to-end automation. If you’re interested in learning more, reach out for a demo here.