Your business may decide to accept certified checks for payments from consumers. As a buyer, the seller may request that you use a certified check, cashier’s check, or money order to guarantee funds availability for the transaction. When and how do you get and use a certified check and what’s the cost? Are they different from cashier’s checks? As a payee, how do you ensure that the certified check is real?

This guide defines certified check and explains what you need to know about accepting and getting certified checks from a financial institution.

What is a Certified Check?

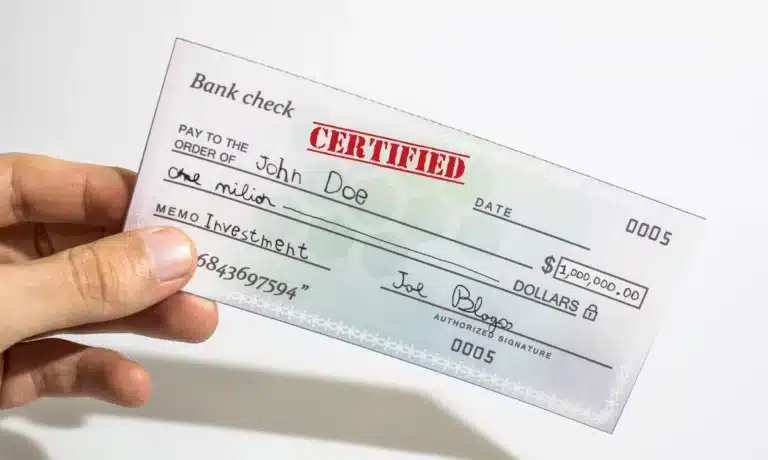

A certified check is a personal check of a bank or credit union account holder, with bank marks (stamp or signature) indicating the check is legitimate, the customer’s check signature is authentic, and enough guaranteed funds from the payer’s bank account are set aside to cover the amount of the check transaction. But fraudsters may forge check certification marks, so be wary.

Where & How to Get a Certified Check

Get a certified check from any bank branch that offers certified checks through a teller or other designated bank employee. It’s preferable to get a certified check from your own bank if they offer certified checks, although some other banks with a physical presence may provide check certification.

Call first to verify that the bank or credit union provides certified checks and inquire about the cost. Ask whether you can make an appointment to get a certified check through a bank employee other than a regular teller. Perhaps you can order a certified check online before you show up at the bank branch. Plan to spend enough time at the bank to wait for the check to be certified, which could take some time if you wait in the bank line for a teller and go through the verification procedure.

Ensure that you have enough funds available in your checking account before writing the personal check that will become a certified check after the verification process. You can’t create an account overdraft to write a certified check.

How Much Do Certified Checks Cost?

Certified checks may be free at your bank or a bank charges between $5 and $15 for a certified check.

Consider the possibly higher cost of a certified check vs. using ACH as an electronic funds transfer to make payments. In our guide, we explain ACH payments, which are next-business-day or same-day electronic transfers, including direct deposits, made in the U.S. through the Automated Clearing House.

Who Uses Certified Checks?

Individual consumers use certified checks drawn on their personal bank accounts from a bank or credit union as a payment option. The bank account used by these check writers may be a joint account for a married couple. If an individual doesn’t have a bank account, alternatives to certified checks are money orders or cashier’s checks that are funded by using cash, or credit cards.

As a buyer, when you use a certified check that’s being mailed, consider using certified mail at the Post Office as proof that you sent the check to the seller. Many businesses accept certified checks.

Should You Accept Certified Checks?

Your business should accept certified checks if adequate safeguards are in place to ensure the genuineness of the certified check. Some scammers committing check fraud place fake bank markings like signatures or stamps on a personal check that doesn’t come from a real person or bank account or have adequate funds to cover the purchase transaction amount.

Although it appears to offer guaranteed funds, a bad check that isn’t truly certified by a bank doesn’t deliver on that implied promise.

As an individual, consider whether to accept certified checks. Do you know enough about the payer to know you’re not being scammed?

As a business or consumer, you can examine the check or request details in advance, then contact the bank shown on the personal check to verify that a certified check was issued by the bank on that bank account for the right person and amount of money to cover it. Look up the bank’s phone number on the Internet. Don’t accept a phone number supplied by the buyer which might not be real.

A certified check may look like a fake to tip you off. Verify the ABA number with the bank’s routing number, bank account number, and check number to see if they agree with the bank name and details on the certified check you’ve received.

The State of Connecticut Department of Banking alerts sellers accepting a cashier’s check for a transaction about a popular scam. The same scam applies to a fake certified check. A buyer may ask to pay the seller more for a transaction with a (fake) cashier’s check or certified check and ask the seller to refund the difference from their bank account to the buyer’s account. It takes time for these types of checks received to clear.

In this scam, after accepting a larger amount for the purchase from the buyer, you deposit their phony certified check or cashier’s check in your bank account. It takes time for these types of checks to clear to receive the funds in your bank account. If the check received from the buyer isn’t good, then you’ll get a chargeback from your bank reversing the entire amount from depositing the fraudulent check. And you’ll be losing money from both the goods sent to the buyer and your payment for the difference between the larger check amount and the actual purchase price.

It’s not just wire transfer fraud that you should be concerned about.

Certified Check FAQs

Frequently asked questions about certified checks with answers follow.

What’s the difference between a cashier’s check and a certified check?

A certified check vs. cashier’s check are different.

A cashier’s check is an official bank check. The issuing bank pulls the funds from your account to an escrow account to cover the transaction amount, then the bank writes a cashier’s check on its own account and signs the check upon approval.

A certified check is a personal check from your own bank account that you sign and the bank certifies the guaranteed funds for the transaction and authenticity of the check with bank marks on the check like a stamp or signature.

Can I get a certified check from any bank?

You may be able to get a certified check from a bank or credit union offering the service, but not all banks offer certified checks to non-account holders. It’s best to get the certified check from your own bank where you hold the checking account.

It may be possible to get a certified check from a financial institution holding your savings account or investment account. Or you may need a certified check when you’re traveling and use a smaller bank for your checking account without branches in that area.

Can I get certified checks online?

No. Banks require a physical bank branch visit to get certified checks. Getting a certified check isn’t an automated procedure that you can perform online. The teller or other bank employee needs to view and stamp or sign your personal check to evidence certification and look at your photo ID besides verifying that your checking account balance has sufficient funds. Online-only banks like Marcus, Ally, or Chime offer bank-issued cashier’s checks.

Banks and credit unions may offer typical money orders with up to a $1,000 limit to use instead of certified checks. You can see where to buy money orders. Places to buy money orders include the Post Office, retailers like Walmart, Kroger, and CVS, check cashing services, and money transfer services like Western Union and MoneyGram.

Is cash or certified check better for payment?

Although either cash or certified checks can be used for payment, it’s safer to use a certified check for large transactions or down payments instead of carrying or mailing that much cash that can be lost or stolen. When you don’t know the seller’s trustworthiness for a purchase, you can stop payment on a regular check but it’s harder to stop payment on a certified check. Cash paid is often impossible to recover.

Losing a certified check does present issues though because the bank account funds were designated for funding only once. To replace a certified check, an indemnity bond for the bank may be required and the bank may set a time delay for replacement.

Consider whether a credit card payment would be accepted for the payment if you’re a buyer. Credit cards provide buyers with some fraud protection for their purchases that could allow them to reverse a transaction payment.

Conclusion

A certified check is drawn on a personal bank account and signed by the payer. It’s a form of payment verified by a bank as genuine, with adequate funds from the bank account set aside to guarantee the transaction. But beware that it may be a fake check with not enough money to back it up.

Accepting certified checks as a business or individual may be a strategy for receiving guaranteed funds. But you must verify with the financial institution holding the account on which the check is drawn that the certified check is authentic before shipping the goods in a sales transaction. To further avoid scams, don’t accept an overpayment for goods with a certified check or cashier’s check because it’s probably a scam.

To reduce financial fraud, download our eBook, Avoiding the Risks of Financial Fraud.