With many finance teams still keying in invoices manually, UK small businesses can spend over 120 working hours a year on administrative tasks alone. This lost time is critical, especially as the UK accounting software market is projected to reach over $1.8bn (approx. £1.4 billion by 2035, driving demand for more efficiency. For Xero users, the path to reclaiming this time is through integration. See the best Xero AP automation integrations for UK businesses and their benefits here.

Key Takeaways

- Xero provides a strong accounting core for many UK small to medium-sized businesses (SMEs), effectively handling basic tasks such as billing and VAT forms.

- However, as businesses grow, Xero’s native capabilities can become overwhelmed, and it lacks the comprehensive solutions required for large volumes of invoices, approval queues, or international payments.

- Integrating a specialised external AP solution enables Xero to use its full capabilities, eliminating the need for manual data entry, improving cash management, and providing a foundation for growth.

- For UK firms, it’s important to choose a solution that supports local requirements such as Making Tax Digital compliance and BACS payments, as well as global capabilities.

A Quick Overview of Xero

Xero, a Tipalti partner, provides cloud-based accounting software (rather than an Xero ERP). Like its competitor QuickBooks, Xero is used primarily by startups, small businesses, and mid-sized companies (SMBs). According to Enlyft:

Of all the customers that are using Xero, a majority, at 59% are small (<50 employees), 8% are large ( >1000 employees), and 33% are medium-sized. 34% of Xero customers are in the United Kingdom, 21% are in the United States, and 21% are in Australia.

Xero accounting software is easy to use for online accounting in many different industries. Xero functionality, depending on your company’s SaaS plan choice, can include:

- Sending invoices and quotes

- Entering and capturing bills, often through its Hubdoc integration

- Submitting VAT returns directly to HMRC

- Generating automatic CIS (Construction Industry Scheme) calculations and reports

- Reconciling bank transactions via a direct bank feed

- Managing multiple currencies (on premium plans)

- Tracking projects and claiming expenses

Accountants and bookkeepers use Xero accounting software for client accounting access and their own practice management.

To maximise your investment in Xero accounting software, you’ll need to add on AP automation software.

Does Xero Have AP Automation?

Although Xero has AI extraction features built into its software, it doesn’t have its own fully-featured AP automation software.

Its core focus is on accounting, and for advanced features, Xero works with approved partners that are software vendor, adding third-party Xero accounts payable automation integration to its accounting software. The add-on third-party AP automation software then seamlessly integrates with Xero’s cloud-based accounting software.

Why Businesses Look for Xero AP Automation Alternatives

Xero is a strong accounting and bookkeeping tool for many small and mid-sized firms in the UK. It offers features for accounting, bank account reconciliation, and filing VAT forms directly with HMRC. However, as a company grows, it often finds some limitations with Xero’s basic AP features. Teams then begin looking for special AP automation tools to solve additional workloads, like an increased number of supplier invoices, automatically.

Top AP Automation Integrations for Xero

The best accounts payable automation software provides seamless, two-way integration with Xero to eliminate manual work and strengthen financial controls. Top solutions available in the UK include:

AP Automation for Xero Comparison Table

| Feature | Tipalti | Precoro | Lightyear | Quadient AP | Modulr (fka Nook) |

|---|---|---|---|---|---|

| Global Payments | Yes (200+ countries, 120+ currencies) | Not a core feature | Via third-party integrations | Via third-parties | Yes (35+ currencies) |

| UK Tax Support Features | Automated UK VAT number collection & validation | Captures VAT at invoice/line-item level | VAT capture and data extraction | Captures VAT from invoice data | VAT data sync to Xero |

| Multi-Entity Support | Yes | Yes | Yes | Yes | Yes |

| Xero Integration | Yes, deep integration | Yes | Yes | Yes | Yes |

| Best For | Global AP automation for growing businesses. | Streamlining procurement and purchasing workflows. | Real-time invoice capture and PO matching. | Automate invoices or expense modules. | Embedded payments via Modulr infrastructure. |

1. Tipalti

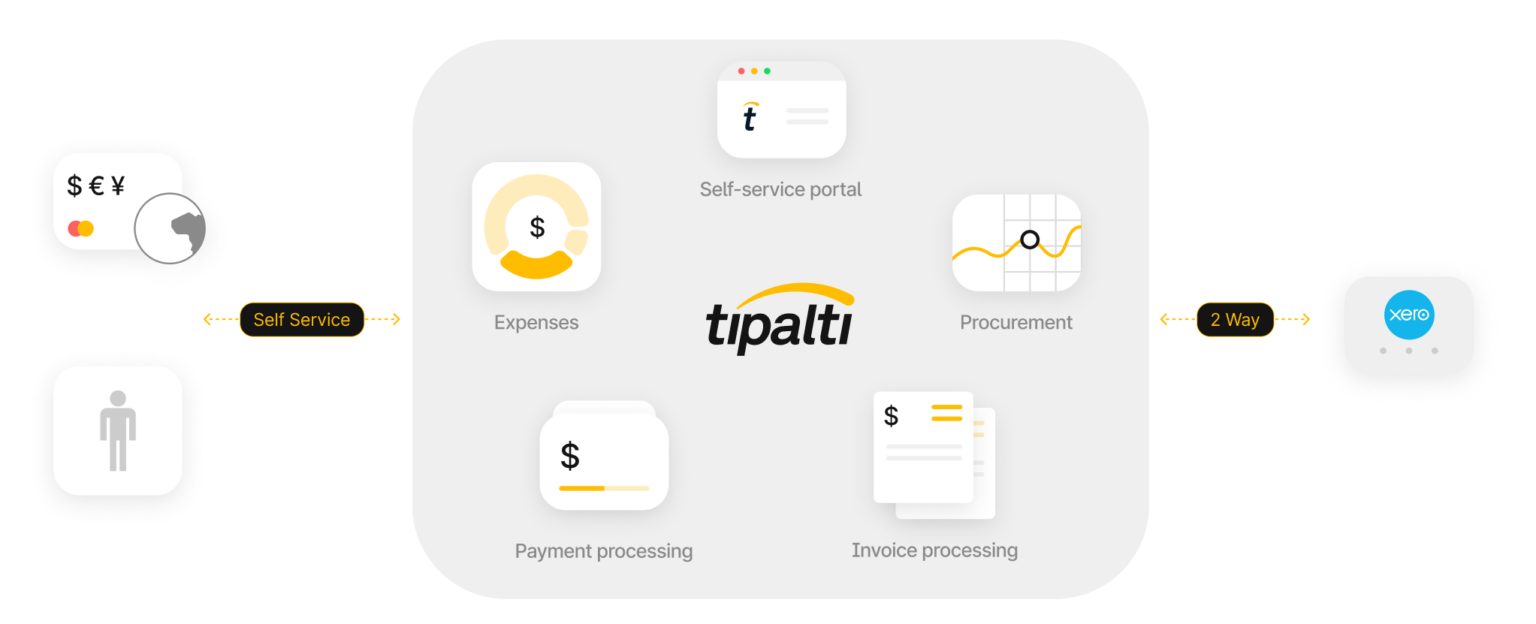

Tipalti and Xero are partners, whereby Tipalti has a dedicated integration available on Xero’s app marketplace.

The integrated solution automates the entire AP process. It starts with a self-service supplier portal that simplifies onboarding and validates banking details, thereby reducing payment errors. The portal also automates the collection and validation of UK VAT numbers. This ensures accurate data is captured, which is a critical step for preparing submissions under HMRC’s Making Tax Digital (MTD) rules. Before processing any payment, the system checks against sanction lists to mitigate the risk of fraud.

Tipalti uses AI-powered optical character recognition (OCR) for invoice management, capturing details at both the header and line level and removing the need for manual data entry. This is combined with automated purchase order (PO) matching and multi-level approval workflows that can be initiated via email, accelerating invoice processing times.

The software also supports global transactions in over 200 countries and territories and more than 120 currencies for payment execution, using UK-friendly methods such as BACS, SEPA, Global ACH and wire transfers.

Best for:

Mid-market and growing businesses needing a comprehensive, global AP automation solution that scales.

Pricing:

Starter plans for AP automation begin at around £99 per month, with quote-based pricing for more complex, global needs.

How Tipalti Solves Scaling Challenges — Plentific’s Story

To understand the real-world impact of end-to-end automation, consider the story of Plentific, a pioneering UK-based property technology company. As Plentific grew, its finance team found itself overwhelmed by manual work. They were processing hundreds of invoices across 21 countries, with bi-weekly payment runs taking two to three days to complete. Managing POs via email across four global entities was no longer sustainable.

Faced with these scaling challenges, Finance Director Alun Davies turned to Tipalti to automate the entire procure-to-pay process.

Getting Tipalti in was one of the first things I did because invoices and payments were really time-consuming. I wanted all accounting in one system… I needed something that could work in every one of those jurisdictions—Tipalti handles that.

Alun Davies, Finance Director, Plentific

The results were transformative. By implementing Tipalti with their ERP, Plentific reduced its manual payables workload significantly and accelerated the monthly financial close. The finance team can now close the books on the first working day of the month, allowing them to focus on strategic initiatives that add value to the business.

2. Precoro

Precoro is primarily a cloud-based procurement and spend management software that integrates with Xero. Its core strength lies in automating the purchasing process, from creating purchase requests and orders to managing supplier relationships and tracking budgets in real-time. While it handles invoice management and offers customisable approval workflows, its focus is less on the payment execution side and more on controlling spend before it happens. Its invoice management module captures essential data, including VAT information at the line-item level, which can then be synced to Xero for accounting.

Best for:

Businesses whose main priority is to streamline procurement and gain control over purchasing workflows.

Pricing:

Precoro offers tiered pricing, with a “Core” plan starting from $499 USD per month and an “Automation” plan from $999 USD per month.

3. Lightyear

Lightyear is an accounts payable automation platform that focuses on fast and accurate invoice data extraction and purchase order matching. It offers line-item data capture, extracting key details like VAT amounts and automated approvals to help reduce manual data entry. Lightyear integrates with Xero to sync purchasing and AP data. However, the platform does not execute payments itself; this must be handled separately through a bank or another payment provider.

Best for:

Finance teams in small—to medium-sized businesses that want to automate invoice capture and approvals in real time.

Pricing:

Lightyear’s pricing is based on document volume, with a “Starter” plan from £125 per month for up to 100 credits (e.g. 1 exported invoice = 1 credit) and a “Business” plan from £279 per month for up to 500 credits.

4. Quadient AP (formerly Beanworks)

Quadient AP by Beanworks is a modular solution that allows businesses to automate different parts of their payables process, including invoices, payments, expenses, and purchase orders. This allows companies to choose the specific functionality they need. It offers automated invoice-to-PO matching and custom approval channels. As part of its workflow, it captures and digitises invoice data, including VAT details, which syncs back to Xero for financial record-keeping. The platform supports multi-entity management and syncs with Xero. Global payments are available through third-party integrations.

Best for:

Companies that want to automate specific parts of their AP workflow with a modular approach.

Pricing:

Quadient AP provides custom quotes based on the specific modules and workflows a business requires.

5. Modulr (fka Nook)

Following its acquisition by embedded payments platform Modulr, Nook is now part of a bigger software suite. The platform leverages Modulr’s technology to combine AP automation with direct payment execution, offering a unified workflow for invoice processing, approvals, and bulk payments. Designed primarily for accounting firms and SMEs, it ensures accurate invoice data, including correct VAT amounts, is captured and seamlessly synced back to Xero. It enables payment runs in GBP and other currencies directly from the platform, powered by Modulr’s robust and regulated payment engine, while syncing all transaction data back to Xero.

Best for:

Accountants and UK SMEs who need a straightforward platform to manage and execute payment runs securely.

Pricing:

Modulr’s accounts payable plan starts at £20 per month per company for a Bronze plan and goes up to £320 per month for a Platinum plan.

Get More from Your Xero Investment

Ready to maximise your company’s investment in Xero? See how end-to-end AP automation eliminates tedious, manual AP tasks so you can focus on strategic initiatives.

Choosing the Right AP Automation Platform

When evaluating solutions, it’s important to look beyond basic features and consider your long-term needs. Assess each platform based on:

- Global and Multi-Entity Needs: Can the solution handle payments to different countries and manage payables across multiple business entities from a single dashboard?

- Compliance Complexity: Does the platform offer built-in support for UK tax regulations, such as MTD for VAT, and robust financial controls?

- Integration Depth: How seamlessly does the software sync with Xero? Does it offer real-time, two-way synchronisation to avoid manual reconciliation?

- Scalability: Will the platform grow with your business as transaction volume, geographic reach, and compliance requirements increase?

Take Control of Your AP Process with Tipalti

Once your firm has outgrown Xero’s basic features, implementing an AP automation solution is useful: By automating the accounts payable process, from invoice receipt to payment and reconciliation, you can free up your finance team from tedious manual tasks. Tipalti grows with your business while seamlessly integrating with Xero.

Ready to see how Tipalti can transform your Xero AP workflow? Book a demo today.

Frequently Asked Questions (FAQs)

What is the best AP automation for Xero in the UK?

It depends. If you want full automation with global payment capabilities and robust rule-keeping features, Tipalti is a top choice. Also, Precoro is ideal for basic purchasing tasks, while Modulr (fka Nook) is great for UK payment batches.

Why integrate AP automation with Xero?

If you grow, your financial team will have additional overhead and manual tasks. Using a dedicated AP automation tool that neatly integrates with Xero eliminates the need for manual invoice processing, improves financial control processes, and helps automate complex approval queues. It also supports payment processes by facilitating domestic and international payments.

Can I make international payments with Xero?

Xero’s premium plans offer multi-currency features, but they typically don’t support overseas payments directly. An AP automation solution, Tipalti is helpful as an addition if you natively want to process large cross-border payments, manage currency conversions and ensure compliance with regulations in over 200 countries and regions.