The UK is an international economy — in the 12 months to the end of May 2025, the total value of UK trade (imports plus exports) was £1.8 trillion, representing a 3.0% increase from the previous year. As your UK business expands to Europe and globally, a variety of complexities related to dealing with multiple currencies and fluctuating exchange rates can occur.

Using the NetSuite Enterprise Resource Planning (ERP) platform simplifies multi-currency dealings. See how NetSuite multi-currency handling works, how to configure it within NetSuite, and how to enhance its power with a dedicated accounts payable automation from Tipalti.

Key Takeaways

- NetSuite OneWorld’s native multi-currency feature is available to UK businesses, enabling them to manage global transactions, consolidate reporting across different currencies, and handle basic foreign exchange (FX) management.

- While foundational, NetSuite’s native tools require manual setup for various use cases to automate the complete global payables lifecycle.

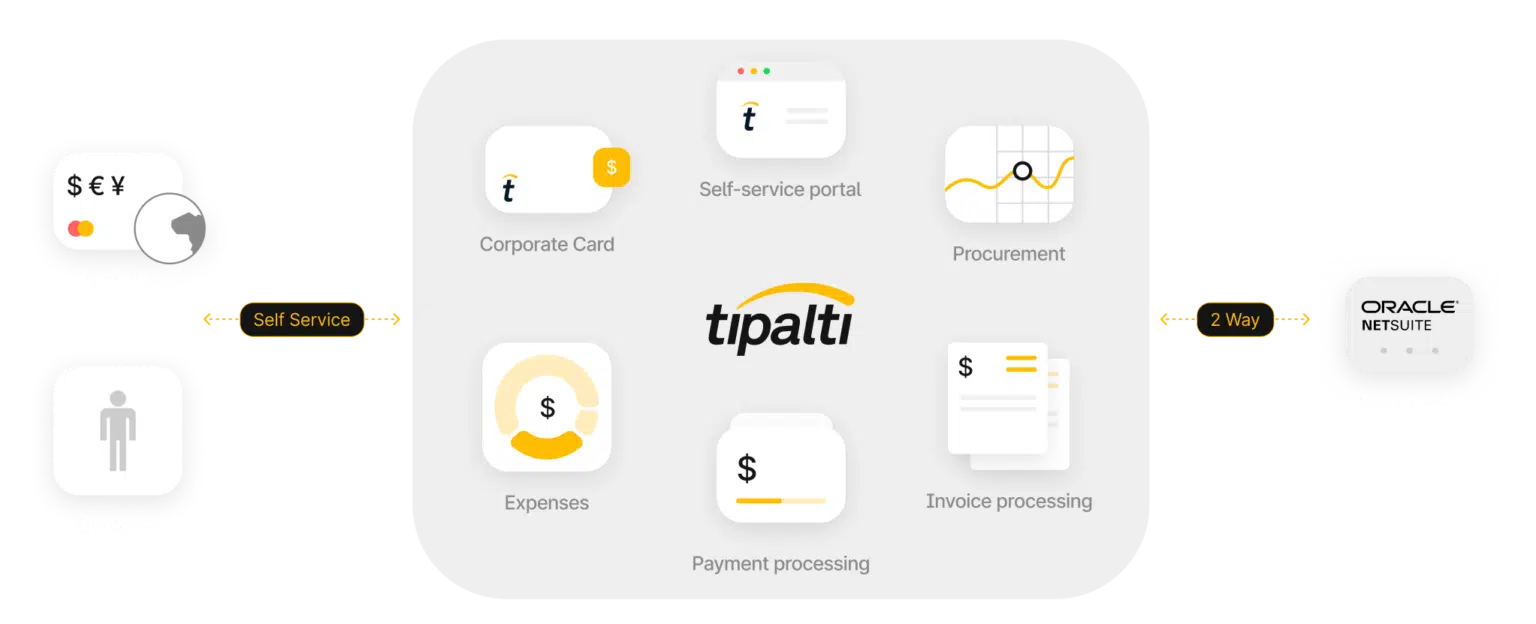

- Integrating an AP automation platform like Tipalti extends NetSuite’s capabilities, creating a complete end-to-end solution that automates supplier onboarding, invoice processing, global payment execution, and multi-entity reconciliation.

- For UK businesses, the Tipalti-NetSuite integration offers specific advantages, including features to support Making Tax Digital (MTD) for VAT compliance and the ability to execute domestic payments seamlessly via BACS and Faster Payments.

What is Multi-Currency Accounting?

In brief, multi-currency accounting entails tracking and managing financial transactions in multiple global currencies. For UK firms that transact with foreign vendors, sell to buyers globally, or run branches overseas, handling multiple currencies in their bookkeeping systems and financial statements is hence a necessity.

The main challenges with multi-currency bookkeeping are:

- Currency rate (FX) fluctuations: Currency values change daily, affecting your company’s assets, liabilities, earnings, and spending. These rate fluctuations impact the general ledger and require careful management.

- Consolidated reporting: If you run several subsidiaries or entities using different currencies, you need a solid method to combine their financial data into one clear picture for your parent firm’s financial reporting.

- Regulatory compliance: Every country has its own unique financial laws and reporting requirements. For example, in the UK, the VAT reporting process under Making Tax Digital (MTD) rules is entirely digital.

Well-organised multi-currency accounting provides a clear and precise view of your firm’s financial well-being, helps reduce risks, and enhances the decision-making process of management and finance departments.

What is the NetSuite Multi-Currency Feature?

Oracle NetSuite’s multi-currency handling tool is a key function within the NetSuite ERP environment, enabling businesses to manage transactions, create reports, and track finances across multiple local and foreign currencies.

The feature is especially helpful for companies operating in global markets that deal with partners, suppliers, or buyers in other countries and need to manage foreign currency transactions smoothly and efficiently.

Key Capabilities of NetSuite Multi-Currency

The NetSuite multi-currency feature helps to ease doing business and accounting globally. Here are a few of the top functionalities that NetSuite or NetSuite OneWorld customers enjoy:

- Consolidated exchange rates: The tool ensures that currency amounts are accurately translated from subsidiaries to parents or holdings, facilitating consolidated reporting. When using Multi-currency suppliers and customers: NetSuite firms to link multiple currencies of each subsidiary and its parent.

- currencies to a single customer or vendor. This means you can trade in different currencies with the same partner and take payments from clients in various currencies.

- Base currency revaluation: Fluctuations in exchange rates between your home currency and foreign currency used in transactions can affect your base (home) currency valuation. NetSuite can assist with automatically revaluing open foreign-currency positions during each accounting period, adding the difference to a realised or unrealised gain/loss account.

- Currency exchange rate integration: NetSuite’s currency exchange integration feature refreshes exchange rates each day using your chosen provider. This daily update brings more accurate reporting and conversion of local currency in your systems.

- Global compliance: The software helps your firm adhere to local laws and compliance regulations in various countries, ensuring your business remains aligned with local financial reporting standards and regulations.

- Efficient currency conversion: Effectively handles currency changes for transactions like sales, purchase orders, invoices, and expenses using current exchange rates, enabling accurate reporting.

- Seamless integrations: The multi-currency tool seamlessly integrates with other NetSuite modules, covering financials, procurement, sales, and inventory management, thereby streamlining global business processes.

How to Set Up Multi-Currency in NetSuite (Tutorial)

According to the official NetSuite documentation, setting up multi-currency features involves several steps to enable and configure how your business handles global finances.

It begins with activating the core feature and then requires further configuration depending on whether you are managing global e-commerce or processing multi-currency payments.

First, an administrator must perform the foundational setup to enable the functionality across the business, which works as follows:

Step 1 – Enabling the Multi-Currency Feature

- In NetSuite, navigate to Setup > Company > Enable Features.

- On the Company subtab, check the Multiple Currencies box and click Save.

Step 2 – Creating Currency Records

- NetSuite includes default records for major currencies like GBP, EUR, and USD.

- To add others, go to Lists > Accounting > Currencies > New and enter the unique details for each new currency, such as its name and ISO code.

Step 3 – Defining Exchange Rates

- Manually set exchange rates by going to Lists > Accounting > Currency Exchange Rates.

- Here, you can define the rate between your base or primary currency and each foreign currency.

Step 4 – Assigning Currencies to Multiple Subsidiaries

- In a NetSuite OneWorld account, each subsidiary must have a base currency assigned to it.

- This is managed under Setup > Company > Subsidiaries.

Step 5 – Configuring Currency Revaluation (Optional)

- Set up rules for how NetSuite adjusts the value of foreign-currency-denominated accounts to ensure your financial statements remain accurate, especially for month-end closing.

Step 6 – Setting up Foreign Currency Bank Accounts (Optional)

- To transact in foreign currencies, set up corresponding bank accounts under Lists > Accounting > Bank Accounts.

Once this foundation is in place, you can configure it for specific business needs. The official NetSuite documentation outlines that multi-currency payment processing typically involves using the Electronic Bank Payments SuiteApp to process payment files for suppliers and employees. For a SuiteCommerce web store, additional steps are required to assign the currencies that are displayed to shoppers.

It is important to distinguish this initial setup from managing transactional approvals. While the steps above enable the core FX feature, tools like the SuiteApprovals SuiteApp or custom SuiteFlow workflows create rules for approving individual transactions, which can include criteria based on the transaction’s currency.

Optimise NetSuite Multi-Currency for UK Finance Teams

Unlock faster closes, error-free global payments, and VAT-ready compliance. See how Tipalti extends NetSuite’s multi-currency capabilities for UK businesses.

Enhancing NetSuite’s Multi-Currency Handling Capabilities with Tipalti

While NetSuite provides a robust foundation for multi-currency accounting, UK businesses can unlock even greater efficiency and control by integrating a dedicated accounts payable automation solution like Tipalti.

Tipalti was named NetSuite’s SuiteCloud Growth Partner of the Year 2024. Tipalti extends NetSuite’s capabilities to automate the entire AP and payments workflow, from supplier onboarding and invoice processing to global payment execution and reconciliation.

Here is a quick comparison:

| Capability | NetSuite Standalone | NetSuite + Tipalti integration |

|---|---|---|

| Global Payments | Supports 190+ currencies | Pay to 200+ countries in 120+ currencies |

| Payment Methods | File-based bank transfers (e.g., BACS) via SuiteApp. | 50+ methods (BACS, SEPA, etc.) |

| Supplier Onboarding | Manual setup of vendor records | Self-service, branded portal with 26k+ validation rules, helps to reduce errors |

| Tax Compliance | Requires manual configuration for local tax | Automated UK VAT number validation and digital record keeping to support MTD for VAT |

| FX Management | Standard daily exchange rate updates | Advanced FX solutions, including hedging, multi-currency transactions, and payee-level FX options |

| Reconciliation | Standard financial consolidation | Automated, real-time reconciliation for all payment methods and entities, helping to accelerate financial close |

By integrating Tipalti, you are not just adding a feature; you are upgrading your entire financial operations infrastructure to handle global scale with less manual effort and greater accuracy.

Automate Multi-Currency Processing with Tipalti and NetSuite

The importance of streamlined global payables cannot be overstated. An optimised process is vital for maintaining strong supplier relationships, ensuring compliance with bodies like HMRC, and enhancing financial performance. Integrating an automation platform like Tipalti with NetSuite helps fine-tune these international payment systems.

Utilising Tipalti Integrations with NetSuite — a Case Study

As a UK-based property technology company, Plentific faced significant manual work as it scaled across multiple global entities. The finance team was spending days on payment runs to handle hundreds of monthly invoices across dozens of countries, using a manual PO process managed entirely via email.

By implementing Tipalti’s Procurement and AP Automation solutions, Plentific automated its entire procure-to-pay workflow and seamlessly integrated it with NetSuite. This created a single, unified system for all accounting and payments across its international jurisdictions. As a result, the company significantly reduced its manual workload and accelerated the monthly financial close, freeing the finance team to focus on strategic growth.

Getting Tipalti in was one of the first things I did because invoices and payments were really time-consuming. I wanted all accounting in one system. I didn’t want to have a German accounts payable software and a US accounts payable software, so I needed something that could work in every one of those jurisdictions—Tipalti handles that.

Alun Davies, Finance Director, Plentific

By embracing automation, businesses can transform their finance function from a cost centre into a strategic growth driver.

Regardless of your business size, if you operate globally, exploring the capabilities of NetSuite’s multi-currency transactions feature and its integration with a leading automation platform like Tipalti is crucial for unlocking global success while ensuring maximum compliance with local regulations.

Automate NetSuite Multi-Currency and Scale Without Limits

Take the complexity out of managing global payments. Tipalti extends NetSuite’s multi-currency capabilities, automating AP, FX management, and reconciliation, so UK finance teams can close faster and operate globally with confidence.

NetSuite Multi-Currency FAQs

What are the main benefits of NetSuite’s multi-currency feature?

The key benefits include the ability to transact with overseas clients and vendors, automatic foreign exchange conversions, creating consolidated financial summaries across various legal entities and subsidiaries with OneWorld, and managing foreign exchange fluctuations.

How does Tipalti improve NetSuite’s multi-currency handling?

Tipalti improves NetSuite or OneWorld by automating complete accounts payable tasks. It offers self-serve supplier onboarding with embedded checks and streamlines global payments to over 200 countries and regions, utilising local payment methods such as BACS. It also delivers advanced currency management tools and provides instant multi-entity reconciliation to improve the financial closing process.

Can I process UK-specific payments like BACS through the Tipalti and NetSuite integration?

Yes. Tipalti’s integration with NetSuite supports various global and local payment types, including BACS, Faster Payments, and SEPA for UK and European transfers, directly within the system.