NetSuite is used by many finance and operations teams across the UK as their core ERP. Yet, executing a comprehensive accounts payable AP workflow on the platform still comes with many manual steps and approvals.

It is not unusual; a recent study by the Institute of Financial Operations & Leadership (IFOL) found that while 74% of UK AP teams are partially automated, only 5% have achieved full automation.

All of this makes managing supplier invoices, approvals, and payments time-consuming. We walk you through setting up a NetSuite invoice approval workflow based on their documentation and explain how a fully automated solution like Tipalti can speed up this process even further.

Key Takeaways

- NetSuite has a plethora of native tools for invoice approvals across its SuiteApp and customisable SuiteFlow platform.

- Native tools have limits. They are effective for basic approvals but cannot automate the entire payables lifecycle.

- NetSuite integrations like Tipalti unlock the full ability to completely automate the AP process from start to finish, including invoice intake, approvals, and global payments.

- UK-specific features of NetSuite integrations also enhance compliance with regulations such as Making Tax Digital (MTD) and help execute domestic payments via BACS and Faster Payments.

What is Invoice Processing?

Invoice processing involves receiving, validating, and verifying supplier invoices for accuracy, ensuring they comply with company policies and UK regulations like Making Tax Digital (MTD) for VAT. The process includes matching invoices to purchase orders, routing them for approval, and processing the final payment. Efficient invoice processing is essential for managing cash flow, maintaining strong supplier relationships, and ensuring financial control.

How to Set Up a Native NetSuite Invoice Approval Workflow

NetSuite offers two main paths for managing invoice approvals: using its dedicated SuiteApp for a ready-to-go solution or building a custom workflow from the ground up using SuiteFlow.

(information taken and distilled from NetSuite Online Help on Oracle’s website in August 2025).

Method 1: Using the NetSuite Approvals Workflow SuiteApp (Recommended)

For most businesses, the fastest and most reliable way to start is by using NetSuite’s own purpose-built application.

1. Enable Prerequisites: An Administrator must go to Setup > Company > Setup Tasks > Enable Features and ensure Approval Routing (on the Employees tab) and SuiteFlow (on the SuiteCloud tab) are enabled.

2. Install the SuiteApp: Search for and install the “NetSuite Approvals Workflow” (Bundle ID: 240841) from the “Search & Install Bundles” page. To find the Search & Install Bundles page, go to Customisation > SuiteBundler > Search & Install Bundles. This is a managed SuiteApp that NetSuite automatically updates.

3. Set Roles and Permissions: Assign supervisors as the approvers to employees who create invoices. The SuiteApp automatically grants permissions to standard roles like Accountant and CFO.

4. Run the Workflow: Go to Customisation > Scripting > Workflows, find the “Invoice Approval Workflow,” for the default workflow, click “Change Status”, and click “Save”.

This pre-built workflow already includes standard states (Pending Approval, Approved, Rejected) and exception criteria.

Method 2: Building or Customising a Workflow with SuiteFlow

If the standard SuiteApp doesn’t meet your specific business needs, you can build a custom workflow from scratch or make a copy of the standard one and modify it. The steps below outline this custom process.

When you are running a custom workflow rather than the default workflow, in the “Run the Workflow step detailed above, instead of “Change Status,” set its Release Status to “Released,” and click “Save”.

Step 1: Develop the Basic Workflow

A simple SuiteFlow workflow should have four states:

- Initiation: The starting point where a purchase order (PO) is created and submitted for approval.

- Purchasing Approval: A central purchasing role can approve or reject the request.

- Rejected: The state is triggered if the request is denied.

- Approved: The final state once the transaction is accepted.

This workflow is simple to configure and helps automate the basic approval process within NetSuite.

Step 2: The Initiation Stage

During this stage, you will set initial field values and add a “Submit for Approval” button. This ensures that the person who requested the PO is the only one who can submit it. Key actions include:

- Set Field Values: Default the ‘Next Approver Role’ to “Central Purchasing” and the ‘Approval Status’ to “Pending Approval”.

- Disable Fields: Prevent users from manually overriding the approval status or next approver.

- Add Button: Create a “Submit for Approval” button visible only to the user who created the record.

When the button is clicked, the record moves to the Central Purchasing Approval state.

Invoice Approval Workflow Exception Criteria

As a request enters the workflow, NetSuite can validate it against exception criteria to determine if it requires approval. Common exceptions include:

- Tax Amount Exception: The VAT amount is verified. If it’s missing or incorrect, the invoice is routed for approval.

- Terms Validation: Payment terms on the invoice are compared to the supplier record. A mismatch triggers an approval route.

- Credit Hold: The workflow validates that the supplier account is not on a credit hold.

- Flagged Suppliers: Invoices for new or flagged suppliers are automatically routed for approval.

Step 3: The Central Purchasing Approval Stage

In this stage, the purchasing team reviews the request. Key actions include:

- Lock Record: The record is locked to all users except those in the designated purchasing role.

- Add Buttons: An “Approve” and a “Reject” button are added.

Clicking either button moves the record to the corresponding “Approved” or “Rejected” stage.

Step 4: The Rejected Stage

If the approver rejects the invoice, the approval status changes to “Rejected,” and an email alert is sent to the requester. A “Resubmit for Approval” button is created, allowing the requester to make necessary changes and send the transaction back for review. The “Notes” field is often made mandatory here to ensure the reason for resubmission is documented.

Once resubmitted, the invoice returns to the Central Purchasing Approval stage.

Step 5: The Approved Stage

Once approved, the ‘Approval Status’ is changed to “Approved.” An email is sent to the requester notifying them of the approval, and the record is locked to prevent further edits, except by an Administrator.

Optimising Your NetSuite Workflow: Key Considerations

Setting up the workflow is the first step. To truly optimise your AP process within NetSuite, consider these additional points:

- Use Your Dashboard: The NetSuite dashboard should be your central point of management. Use its alerts to notify the AP team of supplier bills that need approval and payment.

- Configure Suppliers Correctly: Before processing any transactions, search for existing supplier records to avoid duplicates. Store as much data as possible in the record, including payment terms and VAT registration numbers.

- Manage Vendor Returns and Credits: Use NetSuite’s vendor credit transaction functions to record returns or negotiated discounts. This ensures your payables reports are always accurate.

- Leverage Reporting: Use NetSuite’s standard reports, like AP Ageing (Summary or Detail) and Open Bills, to monitor the effectiveness of your workflow and maintain a comprehensive audit trail for HMRC compliance.

- Automate Tax Calculations: Set up each tax authority (like HMRC) as a vendor and designate it as a “Tax Agency” in the Category field. NetSuite can automatically calculate VAT for taxable items, ensuring accuracy and simplifying remittances.

Tipalti’s NetSuite Integration: Full AP Automation for UK Businesses

While NetSuite’s native workflows provide a solid foundation, a dedicated AP automation solution is essential for UK businesses looking to truly scale, improve financial controls, and manage global payments efficiently.

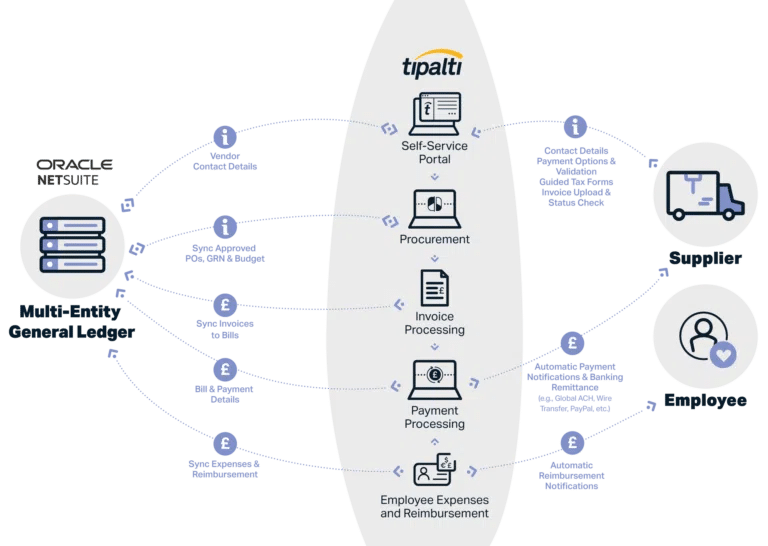

Tipalti offers a “Built for NetSuite” integration that automates your entire accounts payable process, from invoice intake to payment and reconciliation. The platform is designed to handle the complexities of UK and global financial operations, eliminating up to 80% of your manual AP workload.

Streamline NetSuite AP in the UK: From Invoice to Payment

Speed up approvals, ensure MTD compliance, and pay suppliers via BACS and Faster Payments — all within one seamless platform.

Key benefits of integrating Tipalti with NetSuite include:

- Robust UK and Global AP Capabilities: Pay suppliers in over 200 countries and territories and 120+ currencies. In the UK, Tipalti processes payments directly via BACS, Faster Payments, and CHAPS, giving your suppliers more choice and improving efficiency.

- End-to-End Automation: From supplier onboarding and global tax form collection to AI-driven invoice capture, 2- and 3-way PO matching, and automated approval workflows, Tipalti handles the entire AP lifecycle.

- Built-In Tax and Regulatory Controls: Tipalti helps ensure compliance with Making Tax Digital (MTD) for VAT by validating UK VAT numbers against over 3,000 rules. As an Electronic Money Institution (EMI) authorised by the FCA, Tipalti provides enhanced data security and complete audit trails.

- Multi-Entity Management: For businesses running NetSuite OneWorld, Tipalti allows you to manage AP across all subsidiaries from a single, consolidated view while keeping workflows, controls, and branding specific to each entity.

- Real-Time Reconciliation: All payment data syncs instantly back to your NetSuite general ledger, accelerating the financial close by 25% or more.

How Plentific Cut AP Workload with Tipalti and NetSuite

Plentific, a UK property work platform, grew worldwide and was stuck with manual AP and procurement processes. The finance team spent days on payment runs for over 200 monthly invoices across 21 countries, preventing them from focusing on strategic work.

By putting Tipalti to work, the firm automated its whole procure-to-pay process, all smoothly linked with its NetSuite ERP. They gained full control over its financial operations, and the gains were game-changing:

- Manual AP work was cut by 90%.

- 108 days a year that were once spent on bill processing and payments were eliminated.

- Sped up the monthly close by 23 days.

Getting Tipalti in was one of the first things I did because invoices and payments were really time-consuming. I needed something that could work in every one of those jurisdictions—Tipalti handles that.

Alun Davies, Finance Director of Plentific

Future-Proof Your AP Process

NetSuite is a powerful platform designed to make your life easier. Setting up a native invoice approval workflow is a great first step toward reducing manual, labour-intensive tasks.

However, for UK businesses ready to scale, automating the entire payables process with an integrated solution like Tipalti is key. By enhancing NetSuite with robust financial controls, global payment capabilities, and deep automation, you free up your finance team to focus on strategic growth.

Ready to transform how your finance team works? Request a demo to see how Tipalti can bring scale and efficiency to your NetSuite environment.

Frequently Asked Questions (FAQs)

Why use an integrated solution if NetSuite has its own approval workflow?

NetSuite’s built-in workflow handles simple invoice approvals, but growing UK companies still struggle with hands-on work like typing invoice details, adding new vendors, international payments, and matching transactions. A connected tool such as Tipalti automates everything in accounts payable — capturing invoices, making payments, and instantly updating NetSuite’s books.

What does a “Built for NetSuite” integration actually mean?

Built for NetSuite (BFN) is NetSuite’s stamp of approval for integration partners like Tipalti. It confirms that they meet stringent requirements for quality, safety, and technical structure, guaranteeing smooth, dependable data exchange between both systems.

Can this type of automation handle multi-entity businesses using NetSuite OneWorld?

Yes. Tipalti links perfectly with NetSuite OneWorld, which is crucial for handling bills across various global subsidiaries. The platform aligns with your company hierarchy, giving central oversight of all payables while preserving unique approval and payment procedures for each entity.

How does automation help with paying UK-based suppliers?

NetSuite tracks bills, but paying them remains a detached, hands-on chore. AP automation tools connect straight to UK payment networks. Tipalti handles local transfers through BACS, Faster Payments, and CHAPS, enabling swift vendor payments using their preferred option. This bolsters supplier ties and cuts paperwork.

Disclaimer: The information provided in this blog post is for general informational and educational purposes only and does not constitute financial or accounting advice. Tipalti makes no representations or warranties about the accuracy, reliability, or completeness of the information provided. You should consult with a qualified professional for advice tailored to your individual circumstances before taking any action related to the content of this article.