As UK businesses expand into international markets, QuickBooks Online remains a popular accounting choice for small businesses and mid-sized organisations. However, when your operations involve paying overseas suppliers and contractors in a different currency, you may find its native multi-currency features useful; however, you should also be aware of some limitations.

We’ll walk you through the key points in this tutorial on how to enable and use QuickBooks multi-currency feature as a UK user, and we’ll highlight some day-to-day limitations you may encounter and how integrating a payables automation add-on like Tipalti can overcome these challenges to streamline your company’s global payments.

Key Takeaways

- QuickBooks Online’s built-in multi-currency tool is there for UK firms on the Essentials, Plus, and Advanced plans to handle basic foreign currency invoices and reports.

- The built-in tool’s main challenges include the inability to turn the feature off, the need for different supplier profiles for each currency, and some manual workarounds needed to pay foreign currency invoices from a GBP bank account.

- Adding a payables automation add-on like Tipalti extends QuickBooks’ core functionality by automating supplier sign-up, global payments, and instant reconciliation.

- For UK businesses, the Tipalti-QuickBooks integration offers distinct advantages, including tools to help with Making Tax Digital (MTD) for VAT and the possibility to smoothly enact domestic payments through BACS and Faster Payments.

What is the QuickBooks Multi-Currency Feature?

QuickBooks, a product by Intuit, features a multi-currency tool that enables your firm to create, send, and pay invoices in currencies other than your home currency (such as the British Pound, GBP). Once turned on, you can assign a certain foreign currency to buyers, sellers, and some bank accounts

QuickBooks then logs the value of these transactions in your home currency, using daily FX rates for reporting purposes. It automatically calculates the home currency value and tracks any gains or losses for your bookkeeping within the time window between when an invoice is raised and when it’s paid.

Who can use Multi-Currency in QuickBooks Online UK?

Before proceeding, it’s essential to determine which types of QuickBooks Online include this tool. The pricing and features vary by plan. In the UK, multi-currency is only present in the QuickBooks Online Essentials, QuickBooks Online Plus, and QuickBooks Online Advanced plans. It’s not part of the QuickBooks Online Simple Start plan. If your business is on QuickBooks Online Simple Start and needs to handle foreign transactions, you will need to upgrade your subscription, which can affect your QuickBooks fees.

How to Set Up Multi-Currency in QuickBooks Online

Setting up multi-currency in QBO is a straightforward process, but it comes with a serious consideration you must be aware of before you begin.

A critical warning before you start — how to turn off multi-currency in QuickBooks Online:

Once you enable multi-currency in QuickBooks, you cannot turn it off, according to QuickBooks Online Help. This action is permanent because the system fundamentally changes how it records transactions to account for currency conversions moving forward. A QuickBooks Online Accountant might be able to help you navigate this, but the decision is final. Enabling this feature may also disable other features, such as the Cash Flow Planner tool and certain automated transaction rules.

Hence, before proceeding, ensure you have a complete backup of your company file.

If you are ready to go ahead, here is how to turn on the feature:

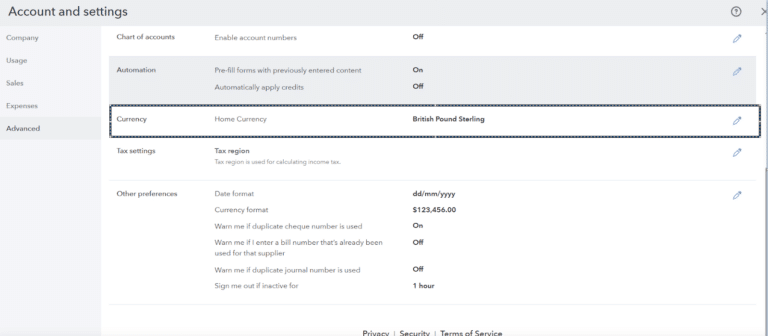

- Navigate to Settings ⚙ and select Account and settings.

- Choose the Advanced tab.

- In the Currency section, select Edit ✎.

- If your Home Currency is not already set to GBP, select it from the dropdown menu.

- Select the Multi-currency checkbox and check the box to confirm you understand this action cannot be undone.

- Select Save, then Done.

How to set multi-currency in QBO (UK version)

Adding and Managing Currencies

Once the feature is enabled, you can add the specific currencies you transact with:

- Go to Settings ⚙ and select Currencies.

- Select Add currency.

- Choose the new currency you need (e.g., US Dollar, Euro) from the dropdown menu.

- Select Add.

How QuickBooks Multi-Currency Works in Practice: Common Tasks and Limitations

Once activated, you can begin managing foreign currency transactions. However, this is where small businesses often encounter practical challenges and need manual workarounds in their bookkeeping.

Assigning a foreign currency to a supplier:

You must assign a currency to each international supplier. When you create a new supplier profile under Expenses > Suppliers, a dropdown menu will appear to select the currency in which the supplier is paid (e.g., USD).

Key Limitation: A supplier profile can only be assigned one currency. If a supplier invoices you in both EUR and USD, you must create two separate supplier profiles for them (e.g., “Supplier A—EUR” and “Supplier A—USD”). This complicates supplier management and reporting.

Paying a Foreign Currency Invoice

When you receive an invoice in a foreign currency from an assigned supplier, QuickBooks records it in that currency. When it comes time to pay, how you do so matters.

- Paying from a matching foreign currency bank account: This is the most straightforward method. If you, for example, have a USD-denominated bank account linked to QuickBooks, you can pay a USD bill directly from it.

- Paying from your home currency (GBP) bank account: This is where things get complicated. QuickBooks cannot directly match a GBP payment from your main bank account to a USD bill, for example. This requires a manual workaround, which often involves creating a temporary “dummy” bank account to act as an intermediary, recording the payment there, and then creating a transfer to reconcile the amounts. This multi-step process is time-consuming and increases the risk of errors.

Understanding Exchange Rate Gains and Losses

QuickBooks automatically creates an Exchange Gain or Loss account in your Chart of Accounts. It records the difference in value that occurs if the exchange rate changes between the date an invoice is entered and the date it is paid. While this is an essential accounting function, reconciling these differences across many transactions can be tedious.

Ready to Simplify Multi-Currency Payables in QuickBooks?

Manual supplier setup, duplicate vendor profiles, and currency mismatches don’t have to slow your team down. Learn how automation helps QuickBooks users eliminate common payables roadblocks and streamline global payments.

Get More from QuickBooks with a Tipalti Add-On

The native limitations of QuickBooks multi-currency—from the irreversible setup to manual payment workarounds—create significant operational burdens for growing UK businesses. An accounts payable (AP) automation add-on like Tipalti is designed to eliminate these challenges entirely. The Tipalti app is directly available online from the QuickBooks App Store.

Tipalti is an end-to-end finance automation platform that integrates directly with QuickBooks Online. Authorised as an Electronic Money Institution (EMI) by the FCA, it extends QuickBooks’ core functionality to deliver a seamless and scalable global payables workflow.

Here is how Tipalti solves the key multi-currency problems:

- Self-service supplier hub: Instead of creating duplicate supplier profiles, you invite suppliers to a branded online portal. They securely input and manage their own bank details and tax forms, and can select from a wide range of payment methods and currencies. This places the onus of data accuracy on the supplier, significantly reducing errors.

- Scalable global payments: Tipalti lets you pay suppliers in 200+ countries and 120+ currencies from a single dashboard—no need for multiple bank accounts or manual workarounds. Supports key UK and international methods like BACS, SEPA, Faster Payments, and wire transfers.

- Advanced FX and Multi-FX: Tipalti’s optional Multi-FX features provide your business with access to live foreign exchange rates, enabling you to execute currency conversions with self-service. This helps manage currency volatility and secure competitive rates.

- Deep QuickBooks integration: Tipalti syncs invoices and payments with QuickBooks in real time, including across multiple entities. This keeps your general ledger accurate, simplifies reconciliation, and accelerates financial close—even for complex organisations with multi-subsidiary operations.

- Built-in tax and regulatory compliance: The platform helps streamline tax compliance, featuring a global tax engine that includes UK VAT number validation. It supports digital record-keeping to aid compliance with Making Tax Digital (MTD) for VAT and other global frameworks, such as DAC7.

- Stronger financial controls: Tipalti reinforces security with multi-level approval workflows to ensure proper payment oversight and proactively identifies fraud by screening payees against ‘Do Not Pay’ blocklists.

How a Tipalti Add-On Enhances QBO Functionalities in Comparison

| Feature | QuickBooks Online (Native) | QBO With a Tipalti Add-On |

|---|---|---|

| Supplier Management | Manual setup; requires separate supplier profiles for each different currency. | Automated self-service portal where suppliers manage their own details for all currencies. |

| Global Payments | Requires manual workarounds and “dummy” accounts to pay foreign invoices from a GBP account. | Direct payments to 200+ countries in 120+ currencies from a single dashboard. |

| Payment Methods | Limited to methods supported by your bank; manual reconciliation is often needed. | Supports a wide range of methods like BACS, SEPA, Faster Payments, and wire transfers. |

| Tax Compliance | Basic VAT tracking. | Built-in validation for UK VAT and support for global rules like DAC7 to aid compliance. |

| FX Rate Management | Uses automated daily rates; provides a basic gain/loss account. | Offers optional advanced Multi-FX features for live rates and self-service currency conversion. |

The Benefits of Streamlining Global Payables

By integrating AP automation with QuickBooks, your finance team can move beyond the limitations of native multi-currency tools and achieve greater efficiency. The benefits include:

- Eliminating the bulk of your end-to-end payables workload frees up your team for more strategic work.

- Reducing the need for new finance hires as your business scales and payment volume grows.

- Minimising fraud risk and payment errors with automated financial controls and supplier validation rules.

- Accelerating your monthly close with automated, real-time reconciliation across all payment methods and currencies.

While QuickBooks is a powerful tool for many UK businesses, its native multi-currency functionality creates manual work and complexity for organisations with global ambitions. Understanding these limitations can help you better know when to extend its capabilities with an automation platform.

To learn more about transforming your payables process, see how the Tipalti and QuickBooks integration can automate your entire workflow from invoice to pay.

QuickBooks Multi-Currency FAQs

What are the main benefits of using the multi-currency feature in QuickBooks Online?

The key functionalities of the QBO multi-currency feature are the ability to create and pay invoices in foreign currencies, add a specific currency to international customers’ accounts and suppliers, and track FX gains and losses for more accurate financial reporting.

How does Tipalti enhance QuickBooks’ multi-currency capabilities?

Tipalti and QuickBooks work together by automating the entire accounts payable workflow. The Tipalti integration eliminates the need for manual payment workarounds, enabling direct global payments from a single dashboard. Additionally, it provides supplier management through a self-service portal and real-time reconciliation for all payment methods and currencies, which then syncs directly with QuickBooks.

Can I turn off the multi-currency feature in QuickBooks Online once it is enabled?

No. Once the multi-currency tool is switched on in QuickBooks Online, it’s locked and can’t be undone. This is because turning on the tool fundamentally changes how the system’s database logs all transactions to account for different currencies moving forward.