Payments That Don’t Get Lost in Translation

Approve invoices fast and make easy payments using multiple currencies. With our seamlessly automated workflows, you can take control of cash flow and stay on top of compliance.

Translation Features

How to Be Fluent in Smooth Translator Payments

Our quick global payment capabilities and built-in fraud protection will make your company a preferred choice for translators. And our self-service onboarding and automated compliance will simplify your processes and help you build a reliable, efficient network of translators.

Pay Anyone, Anywhere

Scale anywhere with cross-border payments to 200+ countries and territories and territories in 120 currencies via 50+ payment methods and built-in multi-entity and multi-language capabilities.

Protect Against Fraud

Built-in OFAC screening, enterprise-grade platform security, up-to-date regulatory compliance, and advanced fraud controls ensure every payment is checked for legitimacy and legality.

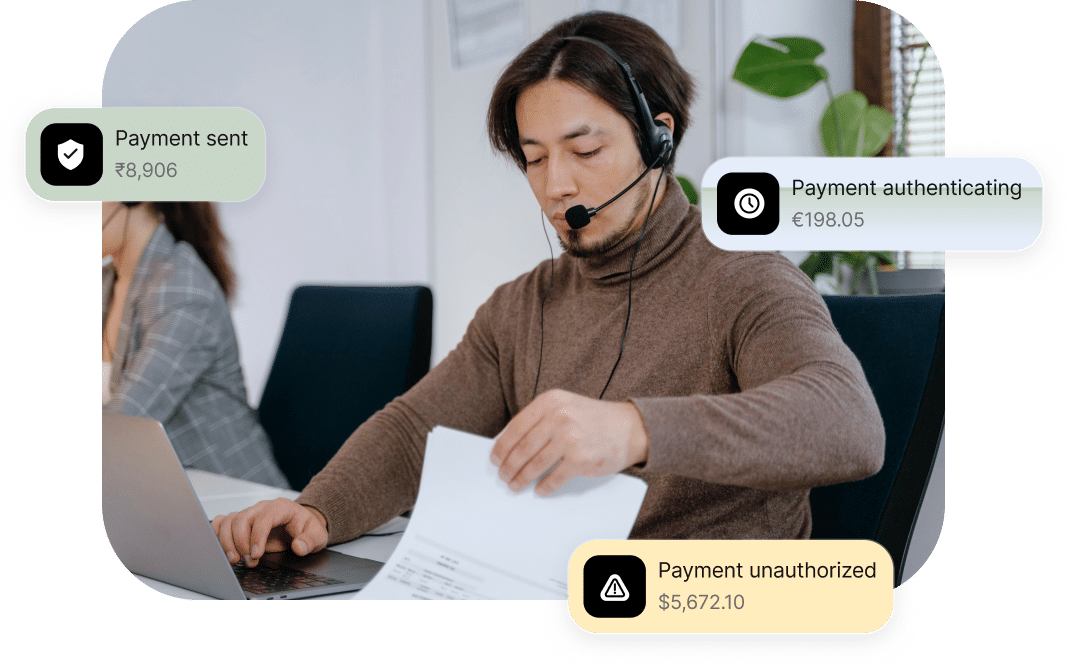

Self-Service Onboarding

Our fully customisable onboarding system is designed to take the work out of your hands and provide a user-friendly experience for your suppliers.

Automated Tax Compliance

Digitally collect and validate W-9 and W-8 series tax forms, or VAT and local tax IDs during onboarding, and have submission-ready 1099, 1042-S, and DAC7 reports to eFile during tax season.

Integrate with Critical Systems

Connect your workflows and tracking platforms like Phrase to boost visibility into your payment process. Synchronise detailed transaction reports with your ERP system to increase visibility.

Customer Stories

Don’t just take our word for it,

see what our customers are saying

How It Works

Up and Running in Weeks, Not Months

Collaborative customer support with personalised assistance to get you operational quickly.

Step 1

Plan

Kickstart your success with a comprehensive setup call that reviews your manual AP workflow, outlines the onboarding plan, validates technical configurations, and prepares for training.

Step 2

Configure

Customer onboarding experts configure Tipalti sandbox and production environments, test the hosted payee portal or embedded iFrame, execute sample payment runs, and establish integrations.

Step 3

Deploy

In-depth training for AP staff on the Tipalti Hub and the end-to-end AP automation functionalities, ensuring thorough knowledge transfer to turbocharge your successful launch.

Step 4

Adopt

Tipalti supports user adoption and change management during launch with the option to guide payees through onboarding. Once set, you’ll be ready to fund your Tipalti Virtual Account, execute your first batch of payments, and officially launch Tipalti.

Step 5

Optimise

Following your setup, technical support teams are always available by phone and email, and the Tipalti customer success team will continuously advise you on achieving your goals.

Integrations

Pre-Built ERP Connections to Extend Automated Workflows

Easily extend and simplify your workflows with pre-built integrations and powerful APIs for your ERPs, accounting systems, performance marketing platforms, HRIS, SSO, Slack, credit cards, and more.

Products

Everything you need to control spend

Tipalti’s connected finance automation suite ensures you get the visibility and control you need across accounts payable, global payments, procurement, and employee expenses to run your business more efficiently and drive growth.

Get Up and Running in Weeks, Not Months

Book a demo to get started today and take control of your finance operations with Tipalti.

Translation Industry Solutions FAQs

What is a Language Service Provider (LSP)?

A Language Service Provider (LSP) is a company, translation agency, or entity that offers a wide range of language-related services to businesses, government agencies, and individuals.

LSP services primarily include translation, interpretation, localisation, and sometimes side tasks like content creation, language training, and linguistic consultancy.

The job title of language service provider may cover the following:

Translation

Converting written text from one language to another while maintaining the meaning, tone, and context.

Interpretation

In this translator job, LSPs facilitate spoken or signed communication, in real-time, between speakers of different languages.

Localisation

In this task, professional translators adapt content to fit the cultural and linguistic nuances of a specific target market. This can go beyond mere translation, where translators make adjustments for local customs, idioms, currency formats, and even visual elements like images and colors.

Transcreation

Freelance translators refurbish content to resonate with a specific target audience, while being careful to convey the original intent, tone, and style.

Multilingual Content Creation

Creating content directly in the target language (rather than translating it) ensures it is culturally appropriate and effective. This can be any language, from Spanish to German, Japanese, Chinese, French, Arabic, and more.

Language Training

Translators can also take the career path as trainers, offering courses or programs in specific languages. These programs are often tailored to the needs of businesses or professionals.

Linguistic Consultancy

The majority of translators will also provide expert advice on language use, cultural considerations, and communication strategies in different languages.

What payment challenges do LSP companies face when paying their global translators?

Language Service Providers (LSPs) face a multitude of payment challenges when trying to compensate a global network of translators. These issues arise due to the complexity of managing global payments across different countries, currencies, and banking systems.

Some of the key payment challenges LSPs encounter, include:

High Transaction Fees

Global bank transfers often come with high fees, especially for small payments. These fees can significantly affect the amount actually received by the translators. LSPs may have to increase the hourly rate just to compensate for high bank fees.

Currency Exchange and Fluctuations

Language Service Providers often work with translators in different countries that expect payment in their local currency. This requires conversion, which can be complex and costly.

LSPs may also be dealing with fluctuations between the time an invoice is issued and when payment is made. This can also affect the amount the translator receives, which creates uncertainty for both parties.

Global Regulations and Compliance

LSPs must navigate the financial regulations and tax laws of multiple countries. This includes understanding withholding taxes, VAT/GST, and other local tax obligations. Even with years of experience, navigating global compliance can get tough since these laws vary significantly from country to country.

To prevent fraud and money laundering, many countries impose strict regulations on global payments. LSPs must ensure compliance with these laws, which can involve complex verification processes.

Additional Payment Challenges

- International transfers can take several days, especially with multiple banks

- Different payment options that translators require (depending on location)

- Lack of transparency on fees can lead to translator dissatisfaction

- Handling sensitive payment information leads to significant data security risks

- Balancing the need to minimise costs while ensuring timely payments

What factors influence the rate of pay for translation services?

There are a variety of factors that can influence the rate of pay for translation services. Understanding these factors helps both translators and clients set fair rates and better manage expectations.

Here’s what can influence translation rates:

The Language Pair

Rates can greatly vary depending on the language pair. Common languages (like English-Spanish or Portuguese-Italian) have lower rates due to higher competition and a larger pool of translators. Rare or less common language pairs (like Russian-Mandarin or Icelandic-Korean) command higher rates due to a lower supply and a higher demand.

Content Complexity

Specialised fields (like healthcare or legal) usually require higher rates due to the expert subject matter needed and the limited job market. Translators with specialised knowledge or certifications will charge more. Texts with greater complexity that require a lot of research, or involve highly specialised terminology, will also lead to higher rates.

Turnaround Time

Rush jobs or projects with tight deadlines will incur higher rates due to the need for expedited work. Fast turnaround times require reprioritisation, which can affect the cost.

Volume of Work

Rates are generally quoted by word, page, or hour. Larger projects may come with volume discounts, while smaller, urgent tasks, will have higher rates. Ongoing work and consistency may also influence rates. Whether part-time or full-time, translators may be willing to give discounts for ongoing work.

Translation Method

If the translation method involves machine-translated content, the rates might be lower compared to full human translation. However, this all depends on the quality of the machine translation and the extent of editing required. The method may also change depending on whether the material is being translated or transcreated.

Additional Factors

- Translator’s experience, specialised expertise, memberships, and certifications

- Locations and regions with higher cost of living will charge more

- Payment structure and contractual terms can influence rates

- Nature of the client where corporate entities have a higher budget

- Extra services requested like proofreading, project management, and publishing

How can Tipalti’s AP and mass payments automation software help LSP companies manage payables?

Tipalti’s AP and mass payments automation software can significantly streamline and enhance the management of payables for Language Service Providers (LSPs).

Here’s how Tipalti’s solutions can benefit LSP companies:

Enhanced Global Payments

Tipalti supports multi-currency payments across various countries. This is vital for LSPs that work with a global network of translators who expect payments in their local currencies. The system offers a myriad of payment methods, like wire transfers, global ACH, PayPal, and local payment networks, ensuring that translators receive payments through their preferred method.

Optimised Payment Process

Tiplati was built to automate the end-to-end AP process, from invoice receipt to payment execution. This form of automation reduces manual data entry, minimises errors, and accelerates invoice processing times.

The Tipalti suite of solutions will also help LSPs make batch payments to multiple translators or vendors in one transfer. This is particularly useful when dealing with a high volume of global payments.

Comprehensive Compliance and Risk Management

Tipalti’s global tax compliance features automate the collection, validation, and reporting of tax information, ensuring you meet international regulatory standards while reducing the risk of non-compliance.

The platform supports multi-currency transactions, VAT and GST reporting, and automated withholding tax calculations, all integrated seamlessly with ERP and accounting systems.

Poised For Growth

As LSPs expand their operations and onboard more translators or vendors, Tipalti’s automation scales with their needs. The system will handle increasing volumes of transactions without compromising efficiency.

Tipalti also integrates with various accounting and ERP systems, ensuring seamless data flow. This further supports scalable and efficient financial management.

Additional Benefits

- Improved visibility with real-time reporting and payment tracking

- Reduced administrative burden with fewer human errors

- Self-service supplier portal to track payment status and update details

- Security measures to protect payment data and prevent unauthorised access

- Automated payment scheduling ensures translators are paid on time

Can Tipalti’s payments software integrate with our performance tracking system?

Yes, Tipalti’s payments software will integrate with performance tracking systems and other financial tools.

Tipalti offers several integration options to ensure that the solution works seamlessly with your existing systems. Here’s how:

- API integration: Tipalti provides a robust API that enables custom integrations with your performance tracking system.

- Pre-built connectors: pre-built connectors for popular accounting and ERP systems like QuickBooks, NetSuite, and SAP.

- Data export and import: use CSV or Excel to transfer data between Tipalti and your tracking system. This is often used for periodic data synchronisation or bulk updates.

Using Tipalti, and LSP can directly tie performance analytics and data to partner payments. It enables complete visibility into the publisher’s performance-to-pay lifecycle and quickly syncs onboarding data from affiliates, publishers, influencers, content creators, translators, and other partners.

Recommendations