See how forward-thinking finance teams are future-proofing their organisations through AP automation.

Fill out the form to get your free eBook.

Today, the finance function has more responsibilities than ever. In high-growth businesses, every operation—both front and back-office—is inexplicably tied to investment versus reward. To survive the uncharted road ahead, the modern, forward-thinking finance team has to future-proof their organisation for success. Download the guide to discover: – The untamed wilderness of finance – How to forge an accounts payable path – How to strategise your next move – The ultimate accounts payable survival tool – How real-life survivalists scaled their businesses

Manual data entry can drain hours from your accounts payable (AP) team every week.

OCR invoice processing automates essential tasks by extracting key details so your AP system can validate invoices faster, reduce errors, and improve accuracy.

This guide will explain how OCR invoice processing works and its benefits for your UK-based business. We’ll also share best practices for implementing OCR software in your AP workflows.

Key Takeaways

- OCR (optical character recognition) converts text from scanned documents and digital invoices into machine-readable, searchable, and editable data.

- OCR invoice processing software reduces manual work and errors, speeding up payment cycles and freeing staff for more strategic tasks.

- Integrating OCR invoice processing with your ERP or accounting system improves compliance with HMRC’s Making Tax Digital, VAT, and tax requirements.

What Is OCR Invoice Processing?

Optical character recognition (OCR) invoice processing converts data from scanned or digital documents into editable and searchable text for more efficient data processing—and faster invoice handling.

While OCR itself focuses on text extraction, most finance teams use the technology as a feature of their broader AP automation system. This enables businesses to increase invoice volume and speed up the accounts payable process without extra headcount.

OCR software extracts key information from paper, PDF, spreadsheet, or photographed invoices, such as:

- Company names and addresses

- Company registration numbers

- Invoice numbers

- Purchase order (PO) numbers

- Issue and supply dates

- Quantities and units

- VAT registration numbers

- VAT rates

- Net and total amounts

By making data machine-readable, OCR cuts down on manual data entry and streamlines AP workflows.

How Is OCR Invoice Processing Used in Accounts Payable?

OCR simplifies invoice management for AP teams by “reading” and converting data into searchable data in your accounting system.

All while ensuring accuracy and compliance—critical for UK companies managing VAT and Making Tax Digital (MTD) obligations.

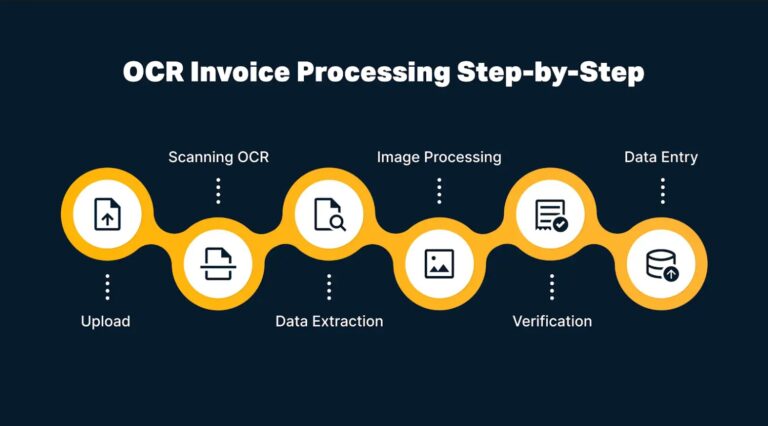

Here’s how OCR fits into an accounts payable workflow.

1) Invoice Digitisation

An accounts payable clerk or administrator scans or uploads invoices into the OCR software, creating a digital invoice record.

2) Image Preprocessing

Before extracting text from a scanned invoice, the OCR attempts to clean the image to improve its quality through digital invoice enhancement, cropping, noise removal, and rotation correction. The process helps the software improve recognition accuracy.

3) Text Recognition

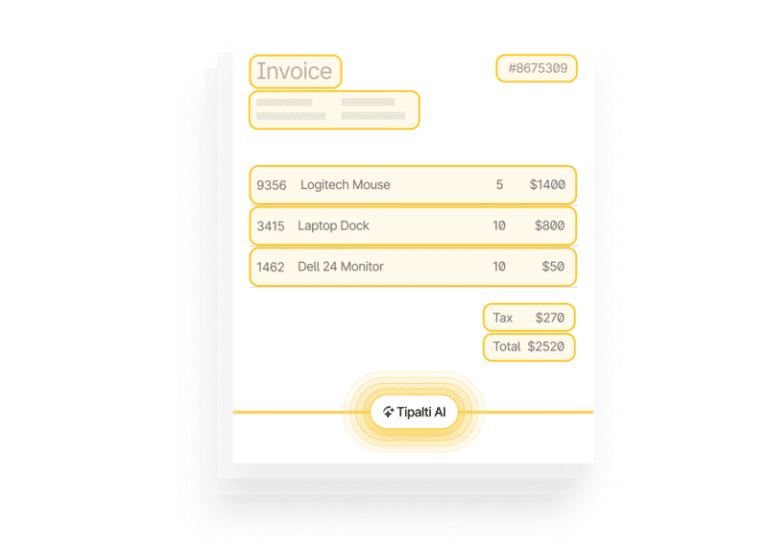

Next, the system uses automated optical character recognition to read text and pull key information from the processed invoice. It converts details into machine-readable text for easy retrieval and processing.

In addition to dates, items, and totals, OCR technology often uses machine learning (ML) algorithms to handle different invoice formats. This allows it to identify and extract extra data points such as payment terms or discounts. We’ll talk more about machine learning soon.

4) Validation and Verification

Paired with AP automation, OCR software can validate and verify the extracted data to ensure accuracy and consistency. It does this in two ways.

- Rule-based validations: The system checks data against pre-defined rules or templates covering dates, formats, totals, and vendors. For example, OCR might ensure that the due date is equal to or later than the invoice date.

- Cross-reference verifications: OCR verifies correctness by automatically checking against existing records, such as purchase orders, totals, contracts, or vendor details.

Automating the validation process saves AP admins precious time. That said, human verification is essential to ensure no discrepancies in results. Having a team member run final checks is always a good idea.

5) Data Export and Archiving

Once data is verified, the system syncs it with your enterprise resource planning (ERP) or accounting system, updating your records with accurate information for faster processing and payment.

Original invoices are archived, giving you a compliant audit trail and a searchable database for easy referencing—a crucial requirement for UK VAT audits and financial transparency.

Note: OCR solutions can be cloud-based for remote access or on-premise for operating in strict regulatory environments that require complete data control (e.g., financial, legal, or healthcare). In both instances, the technology works the same.

The Advantages of OCR Invoice Processing for UK Businesses

OCR software analyses and processes data much faster than humans, so AP can increase productivity, reduce costs, and speed up payments. It helps teams work smarter, not harder.

Here’s how OCR invoice processing can benefit your business.

Save Time and Money by Automating Data Entry Tasks

OCR invoice processing reduces hours of manual data entry into a task completed in minutes.

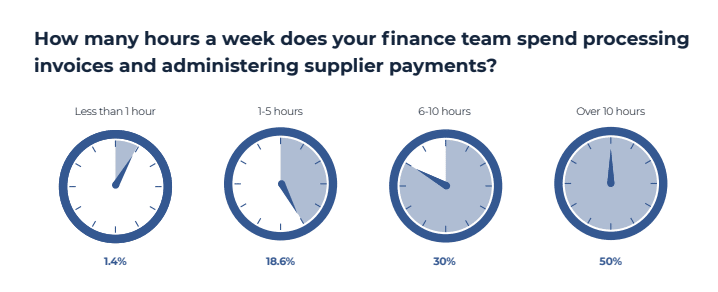

Fifty per cent of AP professionals spend over 10 hours a week processing invoices, research by the Institute of Financial Operations & Leadership (IFOL) shows.

This delays AP processes—leading to more stress on teams and impacting performance.

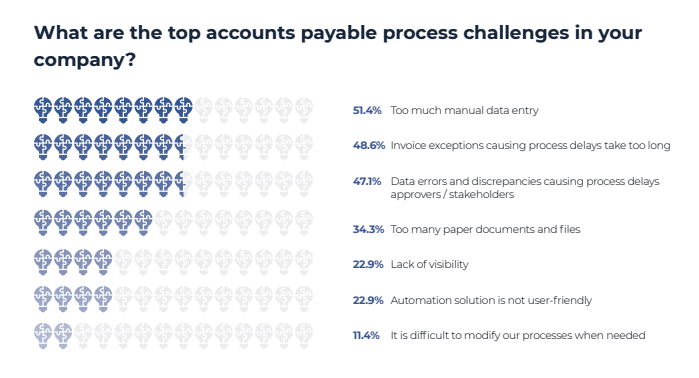

By speeding up the payable workflow, OCR invoice processing helps AP teams overcome challenges such as too much manual input and data errors.

Reducing workload frees staff to focus on strategic tasks like supplier relationship management or supporting expansion plans.

For example, property management software Plentific used Tipalti’s AP automation to cut 108 days previously spent processing invoices and speed up financial close by 23 days.

Getting Tipalti in was one of the first things I did because invoices and payments were really time-consuming. I wanted all accounting in one system. I didn’t want to have a German accounts payable software and a US accounts payable software, so I needed something that could work in every one of those jurisdictions—Tipalti handles that.

—Alun Davies, Finance Director, Plentific

Improving invoice processing can also result in direct cost savings. AP automation can help your business take advantage of early payment discounts (e.g., 2% off for payment within 10 days) while avoiding late payment penalties.

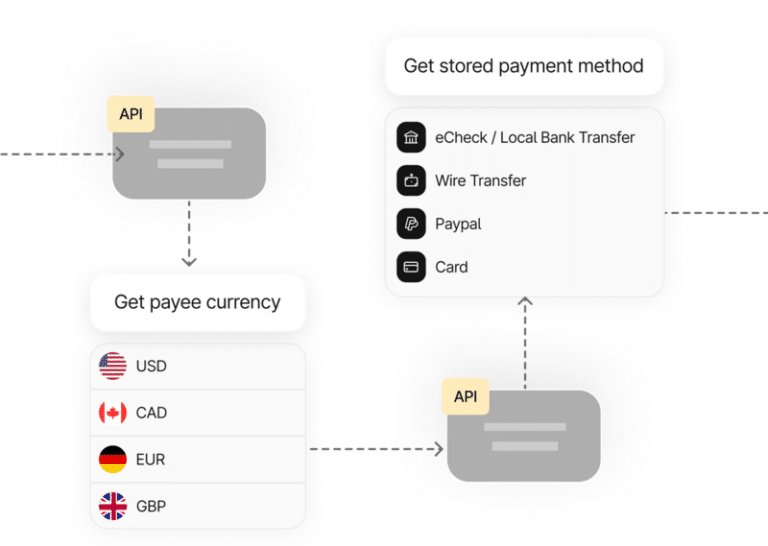

Here’s how automated payments work:

Reduce Errors to Avoid Costly Mistakes

Where humans can become more distracted and error-prone during repetitive tasks, OCR invoice processing maintains high accuracy—catching potentially costly mistakes before they impact your business.

OCR technology can automatically:

- Detect typos and transpositions.

- Identify incorrect date formats and currency symbols.

- Flag mismatches in subtotals, VAT, shipping, and totals.

- Alert you to misaligned rows and columns.

- Spot duplicates in your ERP or accounting system.

- Read QR codes that contain invoice metadata (e.g., payment links and pre-filled details).

OCR eliminates human error from invoice processing, avoiding costly mistakes like incorrect or duplicate payments. It also keeps financial records accurate, providing consistent information for HM Revenue & Customs (HMRC) tax and VAT returns.

Maintain Strong Supplier Relationships

OCR invoice processing routes invoices for faster approval and prompt payments, keeping vendors happy and cash flow health reports accurate.

IFOL’s research also shows that delayed accounts payable processes cause teams major problems, such as damaged relationships, late deliveries, and cancelled contracts.

Using OCR to pay suppliers on time ensures you comply with HMRC’s statutory 30-day payment terms (unless you’ve agreed a payment date).

You also avoid late payment charges—an issue that costs the UK economy almost £11 billion per year, according to research commissioned by the Department for Business and Trade and the Office of the Small Business Commissioner.

Here are some other key findings:

- Late payments impact 28% (1.5+ million) businesses annually, resulting in 14,000 firms closing yearly (or 38 per day).

- Around £26 billion is owed in late payments, averaging £17,000 per UK business affected.

- 15% avoid offering repeat business to customers with unreliable payment behaviour.

By reducing this friction, you’ll increase trust and earn a reputation for being fast, predictable, and easy to work with—the kind of company suppliers want to work with.

Improve Compliance with HMRC Requirements

Automating invoice processing with OCR ensures vital information is systematically recorded for accurate record-keeping.

As part of its MTD Initiative, HMRC requires all VAT-registered businesses to keep electronic financial records by law. The scheme will become mandatory for all companies in phases, starting from 2026.

Under MTD, businesses must use ERP or accounting software to keep tax records, submit tax returns, and make payments. For VAT purposes, keep these documents for at least six years—and you may need to store some other tax records longer.

While there are no rules on what your VAT account should look like, it must include specific information on total VAT sales and purchases, and the VAT you owe and can reclaim from HMRC.

For invoices, HMRC requires you to keep accurate information on the:

- Supplier’s name, address, and VAT registration number.

- Name and address of the person receiving the goods.

- Unique identification numbers.

- Date of issue and time of supply.

- Description of the goods or services supplied, including the quantity of each type of item.

- Total amount, excluding VAT.

- Total amount of VAT.

- Price per item, excluding VAT.

- Rate of VAT charged per item (if an item is exempt from VAT or is zero-rated, this should be clearly stated).

- Rate of any discount per item.

Pro Tip: If you sell or rent goods or services to EU-based customers online, you’ll need to collect and report similar data to comply with DAC7 guidance. Learn more in our DAC7 EU compliance guide.

OCR software like Tipalti enables you to collect and securely store VAT data and sync it with your ERP or accounting system, regardless of how you receive invoices.

Keeping accurate invoice records reduces the risk of inaccurate payments or penalties on VAT returns. It also makes it easier to claim the correct VAT amount for purchases, helping you better manage cash flow.

Scale Without Extra Resources

OCR invoice processing helps you meet demand as your business grows without adding extra headcount or burdening your AP team.

Automation allows you to manage large volumes of invoices while keeping payment cycles short.

With OCR software processing invoices in various formats, layouts, and languages, AP can quickly adapt to diverse suppliers, reducing bottlenecks and improving efficiency.

Take Spitfire Audio, a leading UK music technology company.

As the business expanded globally, its stretched finance team faced growing complexity in managing royalty and supplier payments.

By implementing Tipalti AP automation with OCR, Spitfire eliminated manual, spreadsheet-based processes and streamlined 1500+ global payouts without additional staff.

It took us four to six weeks of solid work to do all the statements and payments, whereas now, it’s 30 minutes of solid work. We were spending a long time trying to get royalty payments done, and now we’re ahead.

—Shahid Khalid, Head of Finance, Spitfire Audio

OCR invoice processing isn’t designed to replace humans. Instead, it’s a tool to increase productivity and share resources where you need them most.

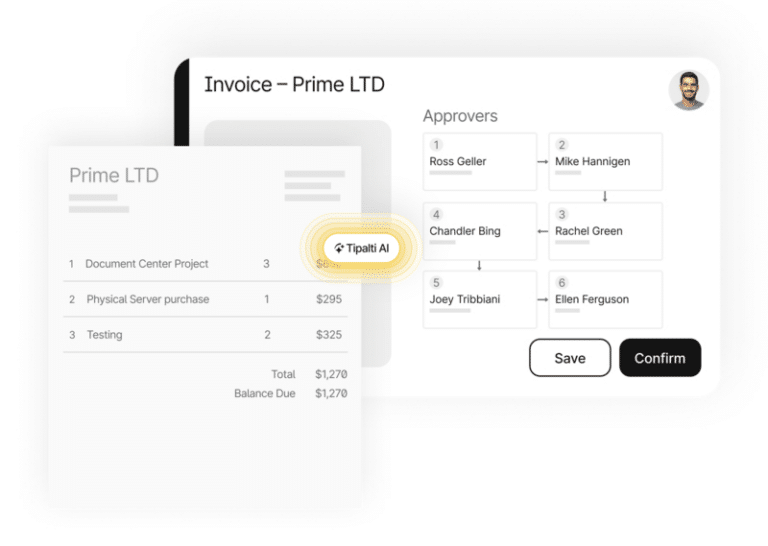

AI-powered, automated invoice approval cannot get any easier:

As Shayon notes:

Our staff doesn’t have to spend all day living in Tipalti. We can better allocate our time supporting the business as opposed to entering and coding invoices.

How Accurate Is OCR Invoice Processing?

OCR invoice processing speeds up AP workflows, and modern automation software achieves high levels of accuracy. But like any technology, it has limitations.

As a standalone tool, OCR is estimated to be accurate 85–90% of the time. That’s not outstanding, considering human accuracy typically ranges between 96% and 99% (not accounting for fatigue and distractions).

The legacy technology behind OCR isn’t specifically trained for invoices. Standalone software often struggles to read data from low-quality invoices, like blurry scans or messy handwriting.

Additionally, OCR alone doesn’t intuitively understand invoices—hence the need for human input 10–15% of the time.

However, in OCR invoice processing, OCR doesn’t work alone. It’s typically a feature of a complete invoice management solution that analyses, discerns, and processes data.

This pushes accuracy to around 98–99%—equal to humans, without manual processing.

So what makes the difference in accuracy? Using artificial intelligence (AI)—here’s how.

Combining OCR with AI for Complete Invoice Processing

Combined with AI, OCR invoice processing software solves ongoing problems and gets smarter over time.

OCR extracts data while machine learning algorithms (a subset of AI) analyse invoice structure for patterns and place them in specific fields for processing. Over time, the system improves by learning from recurring formats and recognising trends.

For example, Tipalti’s AI-Driven Smart Scan uses intelligent data capture to extract information from contact details, line items, and table data and categorise it correctly based on previous invoices.

As well as quickly validating, matching, and detecting anomalies in data, AI uses patterns to automate repetitive tasks, including:

- Sending specific supplier invoices to the correct approver.

- Assigning invoices to the right category or General Ledger (GL) code in your ERP.

- Handle exceptions (e.g., invalid VAT or wrong PO numbers) by comparing invoices to previous records.

- Triggering manual reviews for alerts (e.g., a missing name or unique ID number).

The more ML models learn about workflow logic, the more efficient and accurate they become, turning standard OCR functionality into a complete AP productivity tool.

Beyond OCR: Smarter AP for UK Businesses

Automating data capture is only part of the solution. Learn how AP automation helps UK finance teams reduce errors, stay compliant with HMRC requirements, and scale efficiently.

How to Implement OCR Invoice Processing in Your Business

Choosing the right OCR invoice processing software is crucial. Getting it wrong can disrupt AP workflows, affect compatibility, and waste more money than it saves.

Here’s how to ensure your new automation technology delivers value from the start.

1) Evaluate Your Current Workflows

Start by determining the invoicing tasks you want OCR software to handle. While all OCR invoice processing software automates invoice data extraction, you should assess your entire invoicing process to identify all your workflow needs.

Here are some questions to ask:

- Are your invoice intake methods efficient?

- Do you struggle to manage manual data entry?

- Are there delays in invoice validation?

- Are bottlenecks delaying invoice approvals?

Pinpointing areas where accounts payable automation can save processing time and resources will give your search direction.

2) Choose the Right OCR Solution

Look for an OCR invoice processing solution that fits your needs. For example, if approval bottlenecks delay payments, shortlist software that streamlines stakeholder collaboration.

Here are features to evaluate when weighing up potential solutions:

| Feature | Key Purpose |

|---|---|

| AI-powered OCR | Reduce manual data entry and improve data accuracy across various invoice formats. |

| Third-party integrations | Increase AP workflow automation by integrating OCR software with your existing ERP and collaboration tools. |

| Security controls | Ensure the software stores invoices and payment data in a secure portal, with safeguards such as role-based access, fraud protection, and GDPR compliance. |

| Compliance | Adhere to UK tax and privacy regulations with a solution that handles VAT and is compatible with MTD-approved systems. |

| Payment methods | Facilitate suppliers with local and global payment options, including BACS, SEPA, wire transfers, Global ACH, and PayPal. |

| Reporting and analytics | Monitor spending and expenses to spot invoice trends and improve decision-making. |

| Multi-user support | Allow AP teams to manage the invoicing process using the same tool. |

| User onboarding | Make it easy for AP teams to use features with self-service onboarding and training resources like user guides, blog posts, and webinars. |

| Technical support | Troubleshoot with expert help and fast response times across different channels (e.g., phone, email, and live chat). |

Tap into customer stories and reviews to support your research. Additionally, make the most of product demos—seeing a tool in action is the best way to decide if it’s for you.

3) Integrate OCR Invoice Processing with your Existing Tech Stack

AI-powered solutions get smarter and perform better with high-quality data. So it’s important to integrate OCR software with as many of your existing finance and marketing automation tools as possible.

For a complete invoice management workflow, connect a document processing solution with your:

- ERP or accounting system to sync invoice data with supplier, transaction, and performance data (e.g., Oracle NetSuite, Microsoft Dynamics, Sage, or Xero).

- SSO for secure user logins and authentication (e.g., Microsoft Azure, Google Workspace, or OneLogin).

- Third-party credit cards for fast payment processing (e.g., Mastercard and Visa).

- Human resources information system (HRIS) to enhance AP employee experiences (e.g., BambooHR or HiBob).

- Marketing platforms for efficient communication across teams, affiliates, and external partners (e.g., Slack or HitPath).

Where native integration is available, the setup should allow you to connect tools in a few clicks.

Tipalti, for example, has a wide range of pre-built, seamless integrations and APIs you can access directly without workarounds.

If you want to connect multiple tools fast, reach out to your software provider or an implementation expert for support.

4) Train Your Team for Effective Use

Provide your AP team with training materials to learn and use your software efficiently. While OCR invoice processing does most of the heavy lifting, maximising value requires human input.

Support your staff with:

- Interactive product demos that let users get hands-on with tasks.

- Onboarding guides that guide users on features, workflows, and setting up validation rules.

- Tutorials for high-quality invoice scanning and generating digital images of paper invoices.

- Access to the software’s customer support and help centre for troubleshooting.

Invite key members of your AP team to software demos. First-hand experience will speed up adoption and help them understand how OCR invoice processing fits into their workflows.

5) Track and Optimise OCR Performance

Establish a process to review and validate extracted data to improve OCR performance over time.

Fixing data errors and training models helps OCR stay accurate and efficient, especially early on.

Make it easy for AP clerks, admins, and approvers to collaborate across your workflows. Tools like Slack or in-built communication features work well for this.

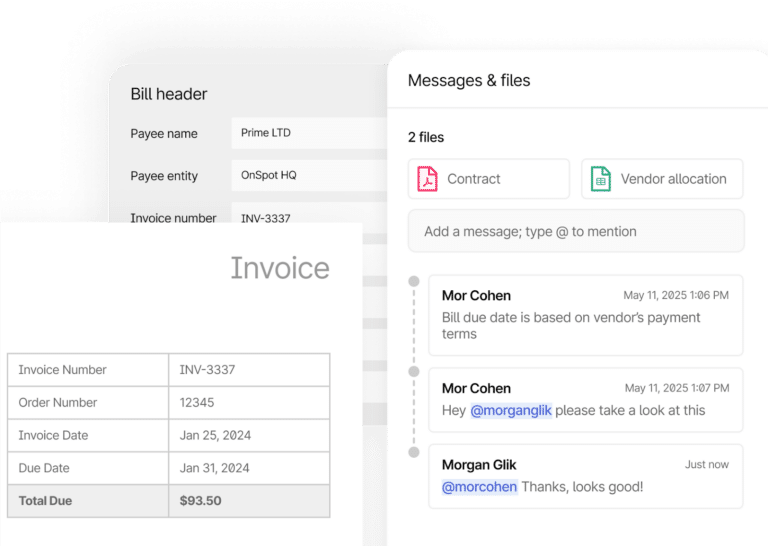

For example, Tipalti’s Comments feature lets users tag colleagues, attach documents, and send messages within the platform.

This real-time collaboration helps teams spot inconsistencies and speed up issue resolutions to increase productivity.

OCR Invoice Processing FAQs

How does OCR invoice processing work?

OCR invoice processing uses optical character recognition to extract key details such as purchase order (PO) numbers, vendor names, dates, VAT, and totals from a scanned or digital invoice.

The technology validates data against pre-defined rules or POs and routes invoices to the right people for approval. The information then syncs with an ERP or accounting system and becomes searchable, editable, and usable data—enabling faster, more accurate payments and reporting.

What are the benefits of OCR invoice scanning?

OCR invoice scanning turns invoices into digital documents with structured data. This reduces the need for physical storage while improving accuracy and payment processing speed.

Reliable data in your ERP or accounting system enhances compliance with HMRC VAT rules, tax regulations, and Making Tax Digital requirements. It also gives your business better visibility into cash flow, helping you manage finances and make informed decisions.

Can OCR invoice processing software handle different invoice formats?

Yes. Accounts payable software extracts data from PDFs, invoice images, and scanned documents. It can also work in multiple languages.

What is intelligent document processing?

Intelligent document processing (IDP) combines OCR with AI and machine learning to extract invoice text and understand context. In invoice management, IDP detects errors, automates approvals, and continuously improves accuracy.

How does OCR improve invoice processing efficiency?

AI-driven OCR software eliminates manual data entry by extracting key details from invoices, coding them, and importing information to your ERP or accounting software.

Automating the invoicing process speeds up payment cycles, minimizes errors, and allows businesses to process more invoices without additional resources.

How accurate is OCR technology in processing invoices?

AI-powered OCR invoice processing software achieves 98–99% character-level accuracy. Actual accuracy is determined by invoice quality and complexity.

Clear scans improve results for paper invoices. Machine learning models help software understand formats and patterns to produce accurate results consistently.

Streamline Your Invoice Processing Workflows

OCR automated invoice processing can be a game-changer for accounts payable teams in the UK. By taking repetitive, error-prone work off their plates, it frees up resources for higher-value tasks.

Choose an AP solution that streamlines time-consuming workflows across your invoice management processes. With the right system in place, you’ll soon notice improvements in accuracy, efficiency, and HMRC compliance.

The result? Smoother financial operations and happier suppliers.

Want to build an efficient AP department to drive your UK business forward? Get started with Tipalti Invoice Management.