Table of Contents

Finding ways to more efficiently manage your business through different economic cycles and identify cost-saving opportunities is essential.

Adding advanced technology automation to your payables workflow saves significant time and money and improves your company’s cost structure. It lets your team focus on strategic business improvements and growth opportunities. When business transaction levels increase and new complexities are introduced, the software is built to support that business growth.

This article compares Tipalti vs. Coupa, including rating screenshots for each company. When considering Coupa alternatives in purchase order management, accounts payable automation, and global payment remittance, Tipalti provides a best-in-class solution.

What Does Tipalti Do?

Tipalti is a provider of robust cloud-based AP automation and purchase order (PO) management software. Tipalti software is mostly used by midmarket companies to improve efficiency, save costs, and strengthen financial controls and global compliance. The software scales with you as your company grows.

TrustRadius Top Rated 2022

G2 High Performer Mid-Market FALL 2022

G2 Tipalti 4.4 / 5 stars

Tipalti Product Capabilities Overview

Tipalti’s AP automation, PO management, and global payments software provides:

- Self-service supplier onboarding with automated real-time supplier data validation using thousands of rules

- Invoice management with machine learning empowered OCR, advanced 2- & 3-way PO matching with tolerance thresholds, smart approvals routing, and more

- Tax and global regulatory compliance

- Multi-entity cloud architecture

- Enterprise-grade financial controls

- for fraud risk detection and strengthening internal controls

Tipalti software significantly improves business process efficiency, saving your company substantial time and money. Tipalti also offers a virtual card for managing all spend in one platform while earning cash-back rebates on every transaction.

Tipalti offers scalability to:

- Expand through internal growth and acquisitions

- Minimize headcount additions

- Avoid the need to implement another system to perform the same functions when your company grows

With multi-entity cloud architecture, Tipalti:

- Supports payables across your enterprise globally

- including independent branding, payment methods, tax onboarding flows, supplier communications, reconciliation, reporting, and modules per business unit / subsidiary / division

- gives you a consolidated view of payables at the HQ level

Tipalti’s global payments software:

- Supports multiple payment methods in 196 countries and 120 currencies

- Uses Tipalti’s superior advantages from its Money Transmitter Licenses (MTL), operating as a money services business (MSB)

- Provides proactive supplier payment status communications

- Real-time payment reconciliation, and reporting

- Lets you decide whether to split or shift payment processing fees to payees, reducing your business costs

Tipalti integrates with all ERPs and accounting systems, including:

- Oracle NetSuite

- Sage Intacct and Sage ERPs

- Microsoft Dynamics ERPs

- QuickBooks

- Xero

- SAP ERPs

- Oracle ERP

- Acumatica

With dedicated implementation experts, Tipalti has a proven track record of getting customer live in just weeks.

Tipalti Pricing

Tipalti uses a SaaS subscription pricing model starting at $149 per month for the platform fee. To upgrade from the basic platform, you can add advanced functionality and users as needed and when your business grows.

How can your business best automate payables?

Download “The Holy Grail of Accounts Payable” white paper to learn how your growing business can optimize and scale its accounts payable automation.

Use AP automation software for end-to-end payables with all-in-one self-service supplier onboarding and management, payments tracking for tax compliance, and automated verification processes for supplier legitimacy, global regulations compliance, and reducing fraud risks.

What Does Coupa Do?

Coupa provides an integrated platform consisting of various modules with a focus on optimizing supply chain, procurement and finance. Its value proposition is to manage all your transactions across procurement, payments, and supply chain in one single cloud platform. Coupa services mostly large enterprise customers who are looking to solve a procurement problem.

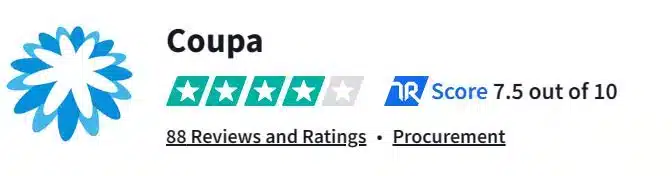

TrustRadius

G2 Coupa Invoice 4.2 / 5 (33 reviews)

G2 Coupa AP Automation 4.0 / 5 (6 reviews)

G2 Coupa overall 4.0 / 5

Coupa Product Capabilities Overview

Coupa’s Business Spend Management (BSM) software platform integrates with ERP systems and also add-on third-party software apps. Its cloud software handles the supply chain planning, sourcing, and procure-to-pay cycle.

Coupa’s main BSM platform modules include:

- Procure

- Invoice

- Expense

- Pay

Other BSM platform functionality includes:

- Supply chain design and planning

- Strategic sourcing

- Contract management

- Contingent workforce

- Treasury management

- Supplier management

- Spend analysis

Procure and Invoice modules together make up the core of Coupa’s solution. Typically, suppliers flip a PO into an Invoice within Coupa’s supplier portal or create an invoice from scratch. Coupa also offers InvoiceSmash for emailed invoices and OCR solutions for invoice processing as add-ons. Expense is a separate module offering travel & expense management functionality. Pay is a separate module as well and can include digital payment, virtual cards, early payment and treasury solutions.

Coupa Pricing

Coupa is a premium priced solution provider. Its core solution, which includes Procure and Invoice modules, is priced as a simplified, bundled amount, which is based on the company size and number of users. Customers usually sign a 3-year contract, and fees are paid upfront annually with Coupa billing. Implementation fees can come close to the amount of annual subscription costs of the core solution, which can be expensive. Optional add-on modules like Expenses & Pay are priced separately as well.

End-to-End Automated Accounts Payable: Tipalti vs Coupa

Tipalti offers end-to-end automated accounts payable, starting with self-service supplier onboarding and tax compliance through an online white-labeled supplier portal.

At the end of the AP automation cycle, Tipalti’s global payments software pays your approved invoices with your choice of multiple payment methods to 196 countries, in 120 available currencies. Tipalti excels at making cross-border payments with advanced foreign exchange (FX) capabilities like hedging and offers AI-based fraud detection with Tipalti Detect to help you avoid paying bad actors. All payables data syncs with your ERP or accounting software, making reconciliation and reporting a breeze.

Because Tipalti is an all-in-one provider and a regulated licensed money transmitter, its software users don’t need to implement other partnerships beyond Tipalti to facilitate payments, as they would with Coupa. That’s a big Tipalti advantage.

Tax & Regulatory Compliance: Tipalti vs Coupa

Suppliers provide their W-9 or W-8 information via guided digital tax forms when onboarding on your white-labeled portal. Tipalti also validates supplier data, including TINs (IRS and VAT tax identification numbers), making your annual 1099 tax preparation simple.

As a Tipalti customer, you can easily prepare and automatically file your 1099s online using the Zenwork integration. Coupa’s solutions do not have native tax compliance capabilities.

Tipalti also performs automated supplier payment data vetting and OFAC screening, features that are unavailable with Coupa.

Invoice Management: Tipalti vs Coupa

Tipalti enables a automated invoice processing workflow with machine learning (ML) powered OCR technology that captures the header and line-level details. 2-way and 3-way PO matching allows automated syncing of POs and GRNs from your ERP (or from Tipalti’s PO management solution) to Tipalti in order to complete the PO match flow, helping eliminate overspending and strengthen financial controls. Tipalti’s purchase order management functionality helps your business achieve higher spend under compliance for a significantly lower cost than Coupa.

The focus of Coupa’s software is procurement and e-invoicing via XML, PO flip or manual entry by suppliers in its portal. Coupa also provides 2-way or 3-way invoice matching. Coupa does not have a strong solution for emailed invoices – its Invoice Smash OCR solution costs extra money, and is limited in what it can read and it takes a long time to learn & correct itself (machine learning).

Tipalti does not require suppliers to change their behaviors by having them submit their invoices via a portal, although invoice submission via the portal is an option. Suppliers can continue to send in invoices via email. The success of Coupa depends on e-invoicing adoption and adoption rates vary based on the bargaining power of the payer. For example, Walmart can enforce manual invoice entry, whereas smaller companies will receive more emailed PDF invoices.

Supplier Onboarding & Management: Tipalti vs Coupa

Tipalti AP automation provides all-in-one supplier onboarding and management. Tipalti has a payer-branded portal for self-service supplier onboarding that includes guided digital tax forms and collection of preferred payment method information. Tipalti automatically validates supplier payment data using 26 thousand global banking rules.

Coupa’s supplier onboarding solution is also self-service, but it doesn’t offer a payer-branded supplier portal. Coupa does not automatically validate supplier data like Tipalti.

Coupa focuses on spend management functionality that includes purchase order management and a supplier network that provides supplier matches for purchasing. Coupa also offers spend analytics using AI called Coupa Community Insight.

Future Strategic Direction & Roadmap: Tipalti vs Coupa

Tipalti has a Finance Operations vision and the ability to execute on its roadmap. The company has over 300 product experts working across different areas of its solutions. Tipalti releases over 170 product features and improvements every year. Tipalti also has a world-class global operations team with over 200+ members who will get you up and running quickly, train, advise, respond to and support your organization.

From our experience serving thousands of happy customers, we have a tried and tested methodology to ensure fast speed to market with minimal disruption so you realize the value of our platform sooner. Our customers are central to our success, and this is evidenced by our industry-leading 98% Customer Satisfaction score and 99% retention ratings.

Private equity firm Thoma Bravo is buying Coupa and taking the company private. As described in this Forbes article, the question is whether the acquisition of Coupa will lead to cost-cutting resulting in a diminished user experience and customer value, and / or a departure of thought leaders & executives impacting the company’s future strategic direction.

Features of Tipalti vs. Coupa

Coupa built its business spend management platform with an initial procurement focus, later adding invoicing and payments. Tipalti started with AP automation and payments, later adding procurement with the acquisition of Approve.

Although Coupa and Tipalti both help companies automate AP processes, each platform incorporates different features and solutions for finance teams. Here’s a look at some of the differences between Tipalti and Coupa.

| Functionality |  |  |

|---|---|---|

| *Limited functionality | ||

| Global Payments | Paying to 196 countries in 120 currencies with 50 different payment methods. Money Transmitter License (MTL)

| Coupa Pay with comparable payment capability but no MTL

|

| PO Management | Integrated PO and payables solution, helping streamline company purchases, improve spend controls, and reduce AP processing time. Integrated with Slack to accelerate approvals

| PO creation, no Slack integration to accelerate approvals |

| Automated Invoice Processing & PO-Matching | OCR (Header and line level scan and capture), Machine Learning, Managed services; 2&3-way PO-Matching

| Comparable capability but emphasis is on invoicing via PO flip |

| Supplier Onboarding and Vetting |

Effortlessly onboard vendors with a client-branded portal, preferred payment method, currency, and payment thresholds. 26K+ rules validate payments, screen against OFAC/SDN lists

|

Onboarding through Coupa network but no 26k payment validation rules. No OFAC screening |

| Multi-Entity Payable Reconciliation | Manage multiple entities in a single instance with a consolidated view; instant reconciliation across entities and payables workflows

| Can have multiple entities but cannot configure entity-level branding and tax workflow.

|

| Tax Compliance |

KPMG approved tax engine; collect W8 & W9 tax forms, collect and validate IRS and VAT tax ID, 1099 & 1042 prep reports and withholding. Validates against 3,000+ rules

| Collect tax forms but no tax validation rules |

| FX Solutions |

Currency conversions without the complications – save time and money on currency conversions. Also, advanced FX solutions – intercompany bank transfers, FX hedging, payee FX | No FX solutions |

| Early Payments / Rebates | Payees can get paid earlier than their due date without any change to the AP process | Supply chain finance & Accelerate product |

| ERP Integrations | Native API integrations with major ERPs (NetSuite, Intacct, and QuickBooks Online & Xero). Integration with all other ERPs via pre-built connectors using no-code, drag-and-drop interface | Comparable |

Which Solution Works Best for Your Business (and Why)

Selecting an AP Automation solution that fits your business’ needs is an important choice, especially for growing teams needing a solution that can scale with their business. Consider these scenarios to help you decide when to choose Tipalti or Coupa as an AP automation partner:

When to Choose Tipalti

You run a hyper-growth business that is rapidly scaling

Whether growing domestically, internationally, or both, you need software with scalability to future-proof your payables operations. As your company grows, your AP workflow complexities increase, including paying global suppliers, handling multi-subsidiary business payables, and processing a growing amount of payments. You also need to offer a wide range of localized payment methods to pay your domestic and global suppliers in their preferred payment methods and local currencies.

Tipalti’s end-to-end accounts payable platform future-proofs your payables operations, so you don’t need to keep investing more resources as you grow. With Tipalti Multi-Entity, you can manage several business entities with different AP processes & workflows within a single instance of the platform. Tipalti’s multi-entity capabilities will help your business to centralize financial controls & reporting while providing visibility into operations at both the entity and consolidated business levels. Coupa offers multi-entity capabilities but it cannot offer features like customer branding and tax workflows per entity.

While Coupa only collects tax forms, Tipalti has advanced, global tax compliance capabilities that include collecting, validating, and maintaining IRS, W-9, and W-8 series forms and VAT details, generating 1099/1042-S preparation reports, and calculating any necessary withholdings. With an optional partner’s 1099 tax software integrated with Tipalti, you can automatically prepare 1099-MISC and 1099-NEC forms using Tipalti payment data. Our tax capability meets IRS requirements, as prescribed by KPMG.

Tipalti can also execute fast global payments to 196 countries in 120 currencies, supporting multiple international payment methods—global ACH, wire transfer, PayPal, and prepaid debit card. You can also streamline your FX conversion workflow with advanced FX capabilities such as Multi-FX, FX hedging, and Payee FX optimization. Coupa has limited international payout capabilities.

You want to automate the entire accounts payable process, end-to-end

Tipalti and Coupa both automate AP processes and reduce manual workloads. However, only Tipalti offers end-to-end AP automation from supplier onboarding through to global remittance and payment reconciliation in a single purpose-built solution. Coupa requires you to add-on modules such as InvoiceSmash or Coupa Pay to achieve end-to-end functionality.

Tipalti makes AP processes invisible. By cutting out 80% of manual payables workload, you can align your resources to focus on mission-critical activities instead of back-office financial operations. Tipalti enables a complete touchless invoice processing workflow with machine learning (ML) powered OCR technology that captures the header and line-level details. 2-way and 3-way PO matching allow automated syncing of POs and GRNs from your ERP to Tipalti in order to complete the PO match flow, helping to eliminate overspend and strengthen financial controls.

Tipalti also helps streamline the supplier onboarding process with a self-service, white-labeled portal, enabling faster, more accurate payee data collection and verification. Tipalti automatically validates supplier payment data in real-time using 26,000 global banking rules to proactively reduce payment errors by 66%. Tipalti’s supplier portal is accessible 24/7 and available in multiple languages. Suppliers can access the portal to check on invoice & payment statuses and the portal also sends proactive automatic payment status emails to reduce supplier inquiries. With Coupa, all supplier management is via the Coupa network with no white-label capabilities that let your brand take center stage. Coupa also does not do any payment validation to reduce payment errors.

With Tipalti, you can accelerate financial close by more than 25% as payment methods, currencies, subsidiaries, and geographies are combined and reconciled in real-time for instant visibility. Detailed transaction and reconciliation reports are integrated with your ERP system, providing a consolidated view of all payable accounts.

You want to implement AP automation quickly & need fast time-to-value

Both Tipalti and Coupa have experienced customer support teams and provide implementation services. Tipalti’s implementations are collaborative engagements where our team works closely with you to guide you through the process. Average time to go-live is four weeks, but the timeline can easily be accelerated with fast turnaround from your team.

In a mid-2022 presentation, Coupa sets the average timeline for go-live implementation at four months for mid-market companies and eight months for enterprise customers. It can often take 8-12 months before you are up and running with Coupa as its implementations are very time & resource intensive, involving project managers, IT, procurement and finance. Onboarding with Coupa is also a significant change management initiative that requires company-wide training with many end users in procurement, sourcing, inventory, and more.

With Tipalti, you will experience a much faster time-to-value. With Coupa you will need to navigate the change management burden, longer implementation timelines, intense resource commitments on multiple functional areas & large implementation fees.

When to Choose Coupa

You are a large enterprise with a big budget

Coupa is a solution primarily for large enterprises looking to solve a procurement problem. Its customers often have sizable technology budgets. If you are a midmarket company, Coupa can be cost-prohibitive as the pricing model is designed for larger enterprises with a dedicated procurement team.

Coupa’s core solution, which includes Procure and Invoice modules, is priced as a simplified, bundled amount, which is based on the company size and number of users. Customers usually sign a 3-year contract, and fees are paid upfront annually. Implementation fees can come close to the amount of annual subscription costs of the core solution, which can be expensive. Optional add-on modules like Expenses & Pay and optional add-on features like InvoiceSmash or OCR are priced separately as well.

In contrast, Tipalti’s pricing model is much simpler and ideal for midmarket companies. Pricing starts at $149 per month for the platform fee. As your business gets more complex, you can upgrade to Tipalti’s more advanced capabilities, such as W-8 tax forms, international tax IDs, or multi-entity capabilities. As companies add more invoices, payments, global suppliers, subsidiaries, costs, and audit controls, Tipalti is built to easily and rapidly handle changing needs without requiring more resources or substantial financial commitments.

Your primary focus is a procurement solution, and you are ok with managing some AP workflows manually

Coupa is primarily a procurement solution and has some AP automation gaps that may require manual efforts to manage.

For the supplier payment workflow, Coupa launched “Coupa Pay” in 2018, but it still has a relatively low adoption rate within its customer base. Also, Coupa does not have its own payment rails, relying on integrations with PayPal, Transfermates, and banks for card payments, creating complexity and unpredictability.

Coupa Pay offers limited cross-border payments capabilities and has no advanced FX solutions such as intercompany transfers and FX hedging.

Lastly, Coupa has limited tax compliance capabilities. They collect tax forms but do not offer tax rules validation to help ensure IRS compliance. You need to manage the vendor tax compliance process outside of Coupa.

You need spend analysis that includes insights beyond your internal data

Coupa Spend Analysis helps companies to understand their business spend and to create new dashboards and reports that track progress against KPIs. Coupa also helps you to classify spend data for better analytics. Coupa also offers Community Insights that leverage AI and analytics on spend data from its network to prescribe insights that help companies reduce risk, and improve efficiency. Lastly, Coupa also offers Spend Guard to help you identify fraudulent spend using AI.

Tipalti does not offer anything comparable to Coupa Community Insights. However, Tipalti does offer robust reporting and analysis that includes over 20 pre-built reports related to payments, payees, bills, tax forms and more. Tipalti also has integrations with Datarails, PowerBI, and Tableau that enable finance users to view all finance data in one place using predefined dashboards or by building their own dashboards, empowering users to leverage KPIs and trends. Coupa does not offer tax reports, payment reconciliation, or detailed payee reports.

Lastly, Tipalti also offers AI-based fraud detection called Tipalti Detect. Since Tipalti manages the end-to-end supplier payments operation, it is able to track a wide variety of relevant datapoints – contact details, account numbers, emails, and payments – to proactively uncover patterns that help identify potential fraudsters in your network. With more than 7,400 payees blocked and $4 million in potential savings, Detect cuts the risk without any additional work required from you.

What Our Customers Say

Tipalti streamlined international payments and compliance. As we continue to acquire companies, we can maximize these investments without compromising scalability or needing new approaches or technology.

Phill Newell | Director of Finance IT, GoDaddy

Tipalti has allowed us to make quick and significant process improvements and has enabled us to improve our payment timing. Tipalti also elevated our financial reporting process, and we’ve shaved two days off our month-end close process.

Andrew Cole | Senior Accounting Manager, Uptake

Vendors can easily set up their preferred payment method and have all their documents in one place. Tipalti documents the approvals through an easy workflow and completely consolidates reconciliations.

Nancy Spencer | VP of Finance, Aceable

Save Time and Money with Accounts Payable Automation

In our recent global accounts payable teams survey based on IFOL research, we discovered that nearly half of the survey participants spend over five days each month manually processing invoices. 41% of all respondents plan to automate their AP processes within a year. By using accounts payable automation technology, you’ll shift a significant amount of time from data entry to strategic finance, meaningfully contributing to business growth and cost reduction.

Although both Tipalti and Coupa offer user-friendly AP automation and global payment solutions that increase efficiency and handle global regulatory compliance, these capabilities are Tipalti’s core competency.

Consider an overall comparison of Tipalti vs.Coupa to decide which AP automation solution is the better fit for your business needs and budget.

If you’re seeking an AP automation system for your startup on the cusp of hypergrowth, begin your software evaluation to make a decision. Tipalti can handle the requirements of any sized company and will scale with you as you grow. Coupa may be an inappropriate solution for small businesses.

Conclusion

Tipalti’s expertise is AP automation and global supplier payments whereas Coupa’s focus is on procurement, not payables. With Tipalti PO management, the company also provides a low-cost modern procurement solution covering the purchase-to-pay cycle that’s ideal for mid-market companies.

Tipalti’s PO management, AP automation, and global payment solutions are much lower cost than Coupa, with a much faster time-to-value. Tipalti implementations are also quick and affordable compared to Coupa, who’s costly implementations can take several months.

Tipalti’s scalable automation software handles your purchase order, accounts payable, and global payments needs and provides you with the spend control your business needs at the right price.

Get started with a free demo of Tipalti today.