As the payer of specific types of trade or business-related miscellaneous income for recipients and provider of other information, use the revised Form 1099-MISC information return. The IRS Form 1099-MISC changes result from the use of a separate IRS Form 1099-NEC to report $600+ of nonemployee compensation (NEC) paid to independent contractors.

Independent contractors receiving Form 1099-NEC instead of Form 1099-MISC are self-employed service providers, including consultants, freelancers, and most real estate agents, but not employees receiving a Form W-2. U.S. payees filing a Form W-9 receive Form 1099-NEC.

Only trade or business payments, not personal payments, are reported on Form 1099-MISC. For many but not all categories, amounts to include in Form 1099-MISC are at least $600.

Recipients use Form 1099-MISC information to file their federal income tax and state income tax returns, if applicable.

This article isn’t intended to give you tax or legal advice. Consult your CPA or attorney and read Form 1099-MISC instructions on the Internal Revenue Service website at www.irs.gov .

IRS Form 1099-MISC for Reporting Prior Calendar Year Miscellaneous Information

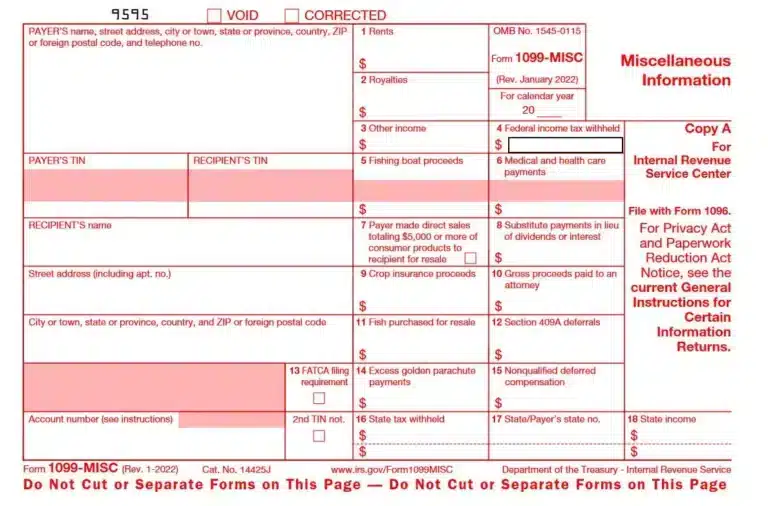

A screenshot of IRS Form 1099-MISC (Copy A for the IRS) – information-only version, is shown below to help you understand the 1099-MISC instructions:

Note that the sample Form 1099-MISC is used to report payments made in the prior calendar year. For example, a 1090-MISC for 2022 payments has a due date in 2023.

In this case, paper filers file Form 1099-MISC with the IRS by February 28, 2023. Electronic filers file Form 1099-MISC with the IRS by March 31, 2023. The due date for furnishing copies of Form 1099-MISC to recipient payees is January 31, 2023, or if amounts are reported in boxes 8 or 10, it is February 15, 2023.

The IRS receives Copy A of Forms 1099-MISC (shown above). The recipients receive Copy B to use in preparing their federal income tax returns for the tax year. Copy 1 is sent to State Tax Departments. Copy 2 is sent to the recipient to file a state income tax return. Not all states collect income taxes. Businesses don’t need to file Form 1099-MISC for those states.

The official printed Form 1099-MISC from the IRS is scannable. Versions downloaded and printed from the IRS website aren’t scannable. Don’t use them for filing Copy A with the IRS to avoid a penalty for using non-scannable information return forms (see part O in the current General Instructions for Certain Information Returns).

Note that the sample Form 1099-MISC has a blank after “For calendar year 20” to insert 22. You will report payments made in calendar year 2022.

Boxes on the new Form 1099-MISC are rearranged and renumbered. Boxes 16 through 18 apply to states. Follow IRS 1099-MISC Instructions to complete the tax form. Some exceptions for 1099-MISC reporting aren’t included in this article.

Is your business properly reporting its global supplier payments?

Download our “Executive Summary: KPMG on AP Tax Compliance” to understand global supplier tax compliance.

Use AP automation software for self-service onboarding of global suppliers, including W-9s and W-8s before first payment, supplier and TIN verification, and payments tracking for efficiently preparing form 1099s.

Form 1099-MISC Information Not Included in Numbered Boxes

Form 1099-MISC requires the payer’s and recipient’s name, contact information, and taxpayer identification number (TIN), and also an account number. The payer assigns an account number to identify the recipient in their system uniquely.

The IRS issues some TINs like an employer identification number (EIN) and individual taxpayer identification number (ITIN) for resident aliens receiving Form 1099-MISC (and non-resident aliens) after they submit Form W-7. The Social Security Administration issues the social security number used as a TIN by an individual U.S. citizen.

For security purposes, the 1099-MISC filer may present only the last digit of the TIN except on the IRS copy, which includes all TIN digits.

Form 1099-MISC includes four checkboxes. If a Form 1099-MISC is Void or Corrected, check the box at the top of the form. Check the appropriate box if the FATCA filing requirement or 2nd TIN Notice applies. FATCA is Foreign Account Tax Compliance Act.

FATCA “generally requires that foreign financial Institutions and certain other non-financial foreign entities report on the foreign assets held by their U.S. account holders or be subject to withholding on withholdable payments,” according to the IRS.

The payer/filer meets the FATCA filing requirements under Chapter 4 of the Internal Revenue Code by using the 1099-MISC tax form and checking the “FATCA filing requirement” box. The recipient may also have a filing requirement, per the Instructions for Form 8938.

The “2nd TIN not.” box may be checked when the IRS sent the filer notice twice in the last three calendar years that the payee used an incorrect TIN.

But don’t check the 2nd TIN Notice box if you received the two notices from the IRS in the same year or if you received notices in different years for information tax returns for the same year. When you check the box, the IRS will stop sending you notices about the payee’s account.

Filers are assessed per-form penalties by the IRS for a missing or incorrect TIN (or missing name). But they may be able to reverse the penalties by promptly notifying the IRS of a good reason that’s not willful neglect and correcting the form(s).

Form 1099-MISC Information in Numbered Boxes

The numbered Form 1099-MISC boxes are:

- Rents

- Royalties

- Other income

- Federal income tax withheld

- Fishing boat proceeds

- Medical and health care payments

- Payer made direct sales totaling $5,000 or more of consumer products to recipient for resale

- Substitute payments in lieu of dividends or interest

- Crop insurance proceeds

- Gross proceeds paid to an attorney

- Fish purchased for resale

- Section 409A deferrals

- FATCA filing requirement

- Excess golden parachute payments

- Nonqualified deferred compensation

- State tax withheld

- State/Payer’s state no.

- State income

Form 1099-MISC Box 1 – Rents

Report all types of rents of $600 or more in Box 1 of Form 1099-MISC except rents paid to a real estate agent or property manager. The real estate agent or property manager will complete Form 1099-MISC for rents paid to the property owner.

Form 1099-MISC Box 2 – Royalties

Include gross royalties of $10 or more in Box 2. Royalties include certain gross royalties from oil, gas, and mineral properties and intangible property. Intangible property includes patents, copyrights, trade names, and trademarks.

Form 1099-MISC Box 3 – Other income

Box 3 is for other income is applicable income of at least $600 not reported elsewhere on Form 1099-MISC. Box 3 is also for reporting prizes and awards not requiring services performed, the fair market value of prizes from game shows, and sweepstakes not requiring a wager. Box 3 doesn’t include prizes and awards to employees, which are reported on Form W-2.

The 1099-MISC instructions list and describe more specific categories with amounts over $600 to include in Box 3.

Form 1099-MISC Box 4 – Federal income tax withheld

In Box 4 of Form 1099-MISC, report any amount of federal income tax withheld under the backup withholding rules for any payment amount.

Form 1099-MISC Box 5 – Fishing boat proceeds

According to IRS Form 1099-MISC Instructions, any fishing boat proceeds should be reported on Form 1099-MISC Box 5 for fishing boats normally having fewer than 10 crew members. The individual’s share of proceeds from the catch sale or fair market value of goods distributed to crew members should be reported in Box 5. Also, report in Box 5 up to $100 in minimum catch contingent cash payments that may relate to additional duties but aren’t wages to be included in Form W-2.

Form 1099-MISC Box 6 – Medical and health care payments

If performed for the trade or business, Box 6 of Form 1099-MISC is for reporting payments of $600 or more for physicians or suppliers or providers of other medical or health care services, excluding prescriptions. Report amounts charged for items like injections, drugs, and dentures if they’re included in the payments for health care services.

Form 1099-MISC Box 7 – Payer made direct sales totaling $5,000 or more of consumer products to recipient for resale

According to IRS 1099-MISC Instructions, Box 7 applies to “resale anywhere other than a permanent retail establishment.”

Form 1099-MISC Box 8 – Substitute payments in lieu of dividends or interest

Reportable 1099-MISC amounts are $10 or more paid in broker payments in lieu of dividends or tax-exempt interest (and royalties reported in Box 2).

Form 1099-MISC Box 9 – Crop insurance proceeds

In Box 9 of Form 1099-MISC, report crop insurance proceeds of at least $600 that insurance companies paid to farmers. (An exception is if the farmer has informed the insurance company that expenses are capitalized under section 278, 263A, or 447.)

Form 1099-MISC Box 10 – Gross proceeds paid to an attorney

Gross proceeds of $600 or more paid to an attorney include the entire amount paid for a claim or settlement agreement. Attorney fees deducted from the gross proceeds by the attorney are still included in the gross amount instead of being reported on Form 1099-NEC. Generally, filers don’t have to include the claimant’s attorney fees in Form 1099-MISC.

Form 1099-NEC can be used to report attorney services paid if no claim is involved.

The attorney must furnish their TIN, even if a firm operates as a corporation or other entity.

The IRS considers an attorney to be a law firm or provider of legal services.

Form 1099-MISC Box 11 – Fish purchased for resale

The amount of cash payments for fish (fish or other forms of aquatic life) purchased from a trade or business for resale in your trade or business for at least $600 belongs in box 11.

According to IRS Form 1099-MISC Instructions, “ ‘Cash’ means U.S. and foreign coin and currency and a cashier’s check, bank draft, traveler’s check, or money order. Cash does not include a check drawn on your personal or business account.”

Form 1099-MISC Box 12 – Section 409A deferrals

Box 12 of Form 1099-MISC is optional.

According to the IRS 1099-MISC instructions:

“If you complete this box, enter the total amount deferred during the year of at least $600 for the nonemployee under all nonqualified plans. The deferrals during the year include earnings on the current year and prior year deferrals…”

Form 1099-MISC Box 13 – FATCA filing requirement

Check the FATCA box if applicable.

Form 1099-MISC Box 14 – Excess golden parachute payments

Report excess golden parachute payments in Box 14 of Form 1099-MISC.

According to the IRS 1099-MISC instructions:

“An excess parachute payment is the amount over the base amount (the average annual compensation for services includible in the individual’s gross income over the most recent 5 tax years).”

Form 1099-MISC Box 15 – Nonqualified deferred compensation

According to the IRS 1099-MISC instructions:

“Enter all amounts deferred (including earnings on amounts deferred) that are includible in income under section 409A because the nonqualified deferred compensation (NQDC) plan fails to satisfy the requirements of section 409A. Do not include amounts properly reported on a Form 1099-MISC, corrected Form 1099-MISC, Form W-2, or Form W-2c for a prior year. Also, do not include amounts that are considered to be subject to a substantial risk of forfeiture for purposes of section 409A.”

Form 1099-MISC Boxes 16 – 18

Boxes 16 through 18 relate to state taxes. According to the IRS 1099-MISC instructions:

“They are provided for your convenience only and need not be completed for the IRS. Use the state information boxes to report payments for up to two states. Keep the information for each state separated by the dash line…If a state tax department requires that you send them a paper copy of this form, use Copy 1 to provide information to the state tax department. Give Copy 2 to the recipient for use in filing the recipient’s state income tax return.”

Form 1099-MISC Box 16 – State tax withheld

Enter state income tax withheld in Box 16.

Form 1099-MISC Box 17 – State /Payer’s State No.

“In box 17, enter the abbreviated name of the state and the payer’s state identification number. The state number is the payer’s identification number assigned by the individual state.”

Form 1099-MISC Box 18 – State income

Enter the amount of the state payment.

What is Considered a Trade or Business for Form 1099-MISC Reporting?

According to IRS Form 1099-MISC instructions:

“Operating for a gain or profit” is characteristic of a trade or business.”

Entities other than businesses that are required to use Form 1099-MISC are:

- “Nonprofit organizations

- Trusts of qualified pension or profit-sharing plans of employers

- Certain organizations exempt from tax under section 501(c) or (d)

- Farmers’ cooperatives that are exempt from tax under section 521

- Widely held fixed investment trusts.”

“Payments by federal, state, or local government agencies are also reportable” on Form 1099-MISC.

IRS Exceptions for Reporting Payments on Form 1099-MISC

The IRS lets 1099-MISC filers exclude the following payment items from the Form 1099-MISC information return. Some of these items may be taxable to the recipient:

- “Generally, payments to a corporation (including a limited liability company (LLC) that is treated as a C or S corporation). However, see Reportable payments to corporations, later.

- Payments for merchandise, telegrams, telephone, freight, storage, and similar items.

- Payments of rent to real estate agents or property managers. However, the real estate agent or property manager must use Form 1099-MISC to report the rent paid over to the property owner. See Regulations sections 1.6041-3(d), 1.6041-1(e)(5), Example 5, and the instructions for box 1.

- Wages paid to employees (report on Form W-2, Wage and Tax Statement).

- Military differential wage payments made to employees while they are on active duty in the Armed Forces or other uniformed services (report on Form W-2).

- Business travel allowances paid to employees (may be reportable on Form W-2).

- Cost of current life insurance protection (report on Form W-2 or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.).

- Payments to a tax-exempt organization including tax-exempt trusts (IRAs, HSAs, Archer MSAs, Coverdell ESAs, and ABLE (529A) accounts), the United States, a state, the District of Columbia, a U.S. possession, or a foreign government.

- Payments made to or for homeowners from the HFA Hardest Hit Fund or similar state program (report on Form 1098-MA).

- Compensation for injuries or sickness by the Department of Justice as a public safety officer disability or survivor’s benefit, or under a state program that provides benefits for surviving dependents of a public safety officer who has died as the direct and proximate result of a personal injury sustained in the line of duty.

- Compensation for wrongful incarceration for any criminal offense for which there was a conviction under federal or state law. See section 139F, Certain amounts received by wrongfully incarcerated individuals.”

Regarding Form 1099-K, according to IRS 1099-MISC instructions:

“Payments made with a credit card or payment card and certain other types of payments, including third-party network transactions, must be reported on Form 1099-K by the payment settlement entity under section 6050W and are not subject to reporting on Form 1099-MISC. See the separate Instructions for Form 1099-K.”

Some exceptions for 1099-MISC reporting aren’t included in this article, so read the 1099-MISC instructions before preparing your information returns to be sure they’re correct.

What Should a Recipient Do if the Information on Form 1099-MISC is Incorrect?

The recipient should request a corrected Form 1099-MISC from the payer. If the payer doesn’t issue a corrected form, the recipient should use the correct information and attach a note of explanation when submitting the tax return(s).

Conclusion

Filling out Form 1099-MISC requires understanding the IRS rules that apply to domestic and international supplier payments and reading IRS Instructions for Form 1099-MISC.

It also requires software like AP automation to collect W-9 and W-8 forms, verify TIN numbers and suppliers to avoid IRS penalties, and track their calendar year payments. To learn more from a tax expert, get Executive Summary: KPMG on AP Tax Compliance.”