With many finance teams keying invoices and other documents manually into cloud-based ERP software, it’s evident that your staff is losing valuable time that could be spent on strategic business tasks.

This, together with the ERP market expected to reach over $140bn (approx. £100 billion) by 2030, will only increase the demand for powerful NetSuite integration solutions. Our guide explores the best NetSuite integrations for UK businesses, their benefits, and how to choose the right one for your business — to save time and get things done efficiently.

Key Takeaways

- NetSuite gives UK firms a strong, central ERP hub to handle core financials and operations, acting as a single source of truth for business and NetSuite data.

- However, leaning only on NetSuite’s built-in features requires significant manual work, and building custom integrations requires additional technical expertise for complex integration projects.

- Integrations help NetSuite achieve its full potential by connecting key business apps with the ERP, automating workflows, and eliminating the need for manual data entry within your technology ecosystem.

- Often, it is easier to rely on a certified SuiteApp that supports the essentials of your use case with added security assurance.

Top 5 NetSuite AP Integrations for UK Businesses

For most UK finance teams, selecting a NetSuite integration isn’t just about features; it’s about compliance and local functionality. The right partner must understand UK-specific challenges like Making Tax Digital (MTD) for VAT, HMRC reporting standards, and popular payment schemes like BACS and Faster Payments. Below are some of the top accounts payable (AP) automation solutions that integrate with NetSuite, tailored for the UK market.

AP Automation for NetSuite — UK Solution Comparison

| Feature | Tipalti | Medius | Payhawk | Spendesk | Yooz |

|---|---|---|---|---|---|

| Global Payments | Yes (200+ countries, 120+ currencies) | Yes | Yes | Yes (100+ countries) | Yes |

| UK Tax/Compliance | Yes (MTD support, VAT validation) | Yes | Yes | Yes | Yes |

| Invoice Automation | AI-powered OCR, PO Matching | Advanced OCR & Matching | Invoice management & OCR | AI data extraction, approvals | AI-based data extraction |

| Multi-Entity Support | Yes | Yes | Yes | Yes | Yes |

| Best For | Scaling global and multi-entity finance operations. | Achieving high-level, touchless invoice processing. | All-in-one spend management (cards and expenses). | Strong budget control, streamlined invoice approvals. | Reducing manual data entry with powerful AI. |

1) Tipalti

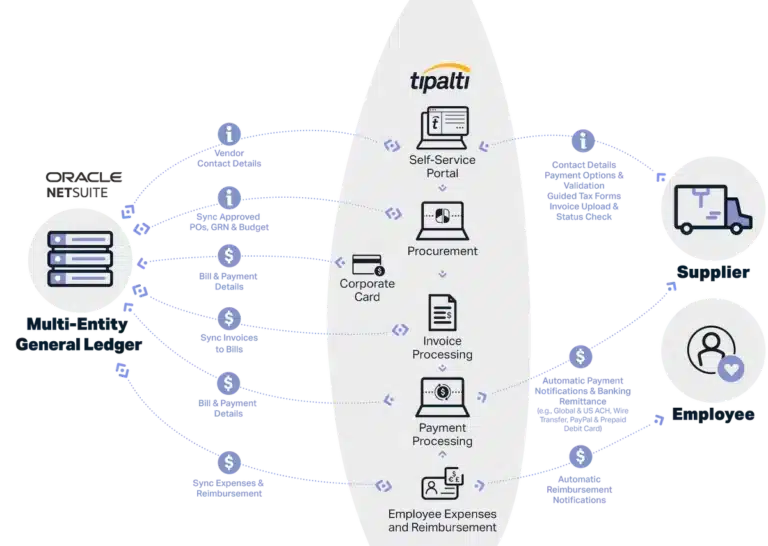

Tipalti, a ‘Built for NetSuite’ partner and NetSuite’s Growth Partner of the Year in 2024, offers a comprehensive and pre-built NetSuite connector. The platform is designed to streamline Purchase Order (PO) management, invoice processing, and multi-currency global payments to suppliers. It allows finance teams to reconcile transactions in real time, with automatic, bidirectional synchronisation of all financial data to entity-specific sub-ledgers.

Tipalti and NetSuite can also automate payments to 200+ countries and territories in 120+ currencies using more than 50 different payment methods, and provides suppliers with 24/7 payment status visibility.

For bringing suppliers aboard, Tipalti automates digital tax form collection, including features such as UK VAT number validation, helping with making-tax-digital (MTD) compliance. Overall, it is a comprehensive solution that covers a broad range of automation aspects, helping you streamline business purchasing, improve spend controls, and reduce AP processing time within a single, unified integration.

How Tipalti and NetSuite Complement Each Other in Real Life

Vivino is the world’s largest online wine marketplace. With over 13 global subsidiaries managed from its EMEA headquarters, using NetSuite as their ERP, which helps them manage their entire supply chain.

By integrating Tipalti with their NetSuite ERP, Vivino created a single, automated platform for their entire accounts payable lifecycle. This eliminated manual work by streamlining invoice processing and global payments, with all data syncing seamlessly back to NetSuite.

The integration delivered crucial visibility and automation as an addition to their core ERP system offerings. As Global Corporate Controller, Rebecca Simmons highlights:

I wanted to have as few integrations into our ERP as possible. So that meant finding a platform that could handle not just invoice approval, but also the payments. We always struggled with the local banks, too. [With Tipalti], to be able to control everything in the bank and have a different payment solution gave us more flexibility.

Tipalti NetSuite Integration

Learn more about how the Tipalti NetSuite integration can rapidly scale payables and future-proof your business for healthy growth.

2) Medius

Medius provides an accounts payable automation solution focused on maximising touchless invoice processing. Its platform uses AI and intelligent data capture to streamline workflows from invoice reception to payment. As a ‘Built for NetSuite’ partner, Medius offers a deep integration that provides end-to-end visibility into procure-to-pay processes. The SuiteApp ensures that approved purchase orders and supplier data are automatically reflected in NetSuite, which helps improve financial planning and reporting. It is designed for businesses looking to gain significant time savings and achieve high automation rates in their AP department.

3) Payhawk

Payhawk is a complete spend management solution, combining corporate cards, expense management, and accounts payable in one platform. For NetSuite users, Payhawk offers a direct API link that ensures real-time data flow between the two systems. This is ideal for UK businesses that want a unified view of all company spending, from card transactions to supplier invoices, with tools to manage budgets and control costs proactively.

4) Spendesk

Spendesk is an all-in-one spend management platform that offers AP automation with a strong focus on controlling expenditure. Spendesk brings a native link that instantly syncs spending data, creating vendor bills, expense reports, and bill payments inside the NetSuite ERP.

This makes it easy to connect NetSuite to your spend management tool. The setup centralises supplier invoices, automates data entry with AI, and routes them through clear approval workflows that provide real-time budget visibility. It supports payments to over 100 countries, making it a solid pick for UK firms with some foreign suppliers who need to keep strict reins over spending.

5) Yooz

Yooz is an AP automation tool recognised for its powerful AI and machine-learning technologies that automate data extraction from invoices, aiming to drastically reduce or eliminate manual entry. As a ‘Built for NetSuite’ certified solution, Yooz enables real-time, two-way data sync. It provides an end-to-end procure-to-pay solution, automating everything from purchase orders to payments, giving businesses better control over their supply chain.

For UK businesses with a high volume of invoices, Yooz aims to cut processing times from weeks to days and reduce the risk of human error and payment fraud.

Fill the AP and Payment Gaps in Your NetSuite Workflow

NetSuite streamlines much of your finance operation, but gaps still remain in global payments, tax compliance, and supplier onboarding. Learn how to extend NetSuite with full AP automation and eliminate up to 80% of manual workload.

A Quick Overview of NetSuite

Owned by database giant Oracle, NetSuite is a leading integrated cloud software suite for enterprise resource planning (ERP). It consolidates enterprise resource planning (ERP), financials, customer relationship management (CRM), e-commerce, and more, providing a single source of truth for an entire organisation.

At its heart, NetSuite brings a full set of parts made to handle key business tasks. For firms working globally, NetSuite OneWorld extends these capabilities, allowing them to manage multiple subsidiaries, currencies, and tax compliance regulations from a single NetSuite account. This is essential for UK businesses with global operations, enabling streamlined financial consolidation and reporting across different entities.

Beyond its built-in features, NetSuite offers the SuiteApp marketplace. SuiteApps are certified, third-party applications, for example for accounts payable workflows, that are built on NetSuite’s platform base to add special features. This web of apps lets companies to tailor the platform precisely to their needs, integrating best-in-class solutions directly into their main ERP setup.

How Do NetSuite Integrations Work?

A NetSuite integration or SuiteApp works by joining a NetSuite setup with other files, systems, and apps. This tie lets data stream continuously between the NetSuite platform and other software in your tech stack. It can happen in one direction or both ways.

For example, when a fresh supplier invoice gets approved in a platform like Tipalti, the details are pushed instantly to the subsidiary ledger within your NetSuite OneWorld environment, without anyone needing to transfer the data manually. This is how smooth the integration process can be.

NetSuite integrations and the accompanying automated workflow allow a company to choose best-in-class solutions for every function, often through certified SuiteApps found on NetSuite’s official marketplace.

So, instead of sacrificing efficiency, NetSuite allows you to bring your best tools with you. Integrations are useful for organisations that want to streamline the customer experience, organise backend processes, and improve data accuracy across teams.

Different Options for NetSuite Integration

There are a few different ways to approach NetSuite integration:

- Native integration: NetSuite has pre-built integrations that connect with popular applications like Salesforce and Google, suitable for basic data syncing.

- Certified SuiteApps (pre-built connectors): Perhaps the most popular method is to use a certified SuiteApp from NetSuite’s official marketplace. These configurable, third-party platforms like Tipalti are “Built for NetSuite” verified, meaning they meet NetSuite’s standards for security and quality. They are the key to maximising the system’s value without requiring deep technical resources.

- Custom-coded integration: Using NetSuite’s own tools like SuiteTalk (a web services tool) or SuiteScript, developers can build completely custom, hand-coded integrations. This approach offers maximum flexibility but requires significant in-house technical expertise and ongoing maintenance.

For most businesses, a certified SuiteApp offers the best balance of power, speed, and cost-effectiveness. Crucially, whichever path you choose, you must ensure the solution is fully compatible with NetSuite OneWorld if your business manages multiple subsidiaries globally.

Why UK Businesses Choose to Use SuiteApp Integrations with NetSuite

When your enterprise software and specialised software connectors work together, that’s best. Some of the benefits of NetSuite integrations can include:

- Automation of manual processes: SuiteApps removes slow and mistake-prone tasks like manual data entry and invoice processing, setting finance teams free for more vital work.

- Global growth opportunities: For businesses using NetSuite OneWorld, it helps to control multi-entity finances, simplifying global payments, and managing cross-border compliance.

- To address UK-specific compliance: The right integration provides built-in support for UK regulations like Making Tax Digital (MTD) for VAT and automates domestic payment schemes such as BACS and Faster Payments.

- To create a single source of truth: A deep, bi-directional integration ensures that NetSuite remains the undisputed system of record, providing a complete and accurate view of the business for smarter, data-driven decisions.

- To improve supplier relationships: Integrated tools like self-service portals give suppliers 24/7 visibility into invoice and payment statuses, which reduces administrative queries and strengthens partnerships.

How to Set Up a NetSuite Integration

Setting up an integration begins with a NetSuite administrator granting the necessary permissions for the new connection. From there, the process depends on the type of integration you choose.

According to NetSuite’s documentation, in the ‘Setup’ tab, an administrator can create a user account and grant access to the right permissions.

If you are building a custom solution, your developers will use NetSuite’s tools like SuiteTalk (for web services) and SuiteScript to write the code.

However, a more common and straightforward approach for most businesses is to install a certified SuiteApp. This typically involves installing the application from the NetSuite marketplace and following a guided setup and configuration process. A critical part of this setup, especially for businesses using NetSuite OneWorld, is correctly mapping data fields and workflows to your various subsidiaries to ensure the integration functions properly on a global scale.

How to Choose the Best Integration for Your Business

Picking a suitable integration or SuiteApp starts with spotting the specific needs regarding your current NetSuite processes. Once you know what specific business case you’d like to solve (e.g., AP automation), you can evaluate potential solutions as follows:

- Is the integration or SuiteApp certified ‘Built for NetSuite’? Selecting a certified app from NetSuite’s official marketplace ensures it meets Oracle’s top standards for safety, reliability, and performance with a deep, two-way integration, not just a surface-level connection.

- Does it support NetSuite OneWorld? This becomes crucial if your firm has multiple subsidiaries or branches. The best apps work seamlessly inside the NetSuite OneWorld environment, automating processes at the entity level and providing a consolidated view without manual workarounds.

- Does it handle UK-specific needs? A generic tool won’t work for UK enterprises. Check that the app has features for specific needs, such as Making Tax Digital support, and can handle local payments through BACS and other payment routes.

- How will it scale with your business? The right integration should solve today’s needs and back future expansion. Check its ability to manage rising deal volumes, extra users, and possible global expansion needs.

- What is the total cost of ownership? Look past any starting fee. Add setup costs, training, etc., to help grasp the true price. A simple system your team can adopt quickly usually yields an ideal cost-benefit.

See How End-To-End AP Automation Can Transform Your Financial Processes

ERP implementation has led to significant business process improvement for many businesses. Yet, to realise the full potential, you need the right integrations to keep things moving.

If you lack in-house technical expertise, think about a mature, feature-packed SuiteApp or tool to help with the task. An integration with a software like Tipalti will boost your NetSuite setup by helping automate processes, smoothing workflows, and give you access to live data for sharper, strategic decisions.

Tipalti helps finance leaders eliminate manual payables tasks, increase their global reach, and confidently scale operations. Ready to learn more? Request a demo.

Frequently Asked Questions (FAQs)

What are the best NetSuite integrations for AP automation in the UK?

Some leading NetSuite link partners for accounts payable (AP) automation in the UK include Tipalti, Medius, Payhawk, Spendesk, and Yooz. The best choice hinges on your specific business needs, such as the complexity of your worldwide payments, multi-entity setup, and desired level of automated invoice processing.

How does a NetSuite integration help with UK tax compliance?

Special NetSuite integrations help UK firms with tax compliance rules by automating key tasks. For instance, they can have tools that check UK VAT numbers instantly and keep digital files and records in ways that back HMRC’s Making Tax Digital rules.

Why is the ‘Built for NetSuite’ certification important for an integration?

The ‘Built for NetSuite’ stamp means the app passed review by NetSuite. This approval ensures the app meets their tough standards for safety, speed, and quality, promising a solid and smooth data connection with your main ERP system.