Ready to get more out of your Sage Intacct software? Explore Tipalti’s custom-built AP automation integration and transform your payables strategy.

Fill out the form to get your free eBook.

Sage Intacct is essential for tracking finance and accounting. It functions as an essential record system that collects, stores, manages, and monitors vital business data. But for accounts payable, Sage Intacct is more of a map than a vehicle. ERPs cannot handle in-depth execution and process-heavy operations like payables. As a result, companies backfill AP with staff.

In The Last Mile of Sage Intacct, learn how companies are bridging the gap between their ERP and AP processes, including:

- Dealing with global payment challenges

- Avoiding exposures to risk

- Finding strategic opportunities

Sage Intacct is a powerful financial management platform, but its true potential is unlocked when connected with specialised automation tools. See how their marketplace works and how to unleash all the benefits for your organisation with key out-of-the-box Sage Intacct integrations.

Key Takeaways

- Sage Intacct is a leading ERP system with an open API that allows UK businesses to build a custom ecosystem of best-in-class software instead of relying on a single, monolithic system.

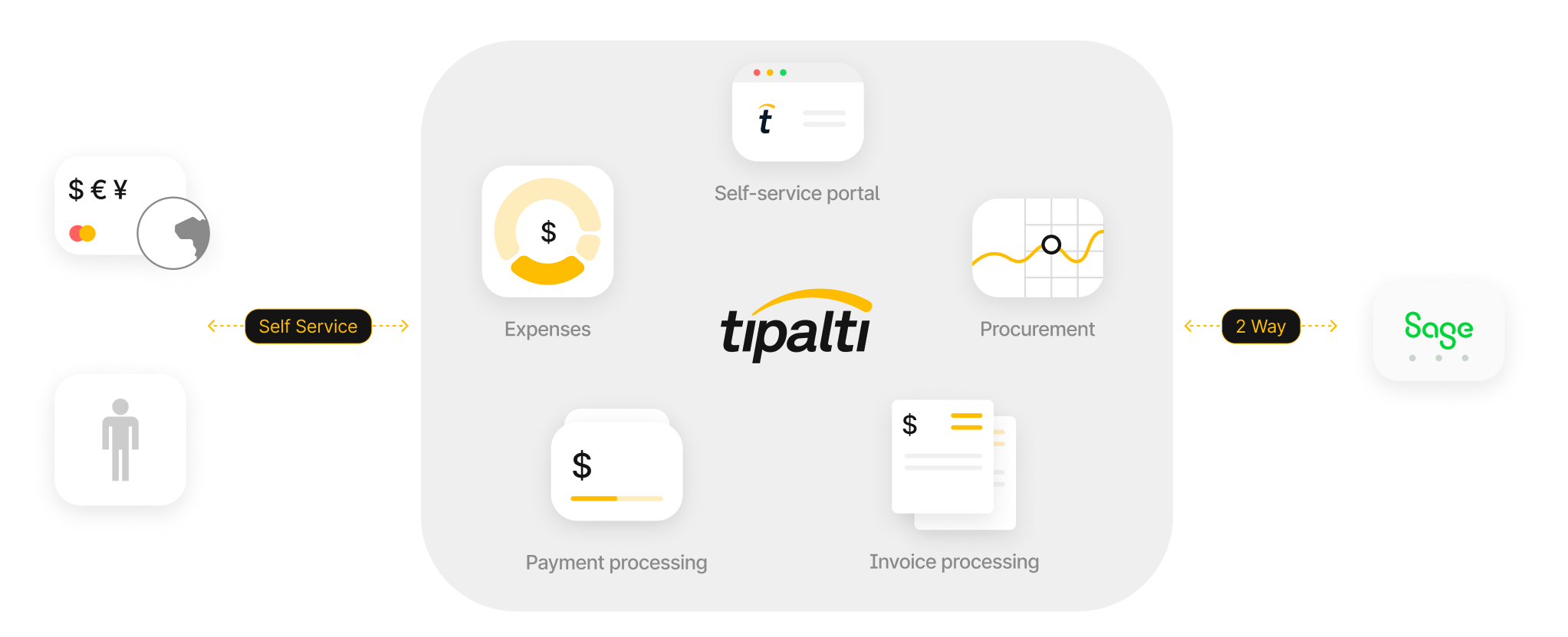

- On their marketplace, a suite of pre-built, bi-directional apps turns it into something bigger. For example, you can automate the entire accounts payable lifecycle from procurement to payment, saving significant time and providing real-time financial visibility across both platforms.

- Integrating a dedicated AP automation solution like Tipalti transforms Sage Intacct from an ERP to a fully fledged finance solution, including AP automation and global payments with multi-entity management.

What is Sage Intacct, and What Are Its Integration Capabilities?

Sage Intacct is a leading cloud-based financial management solution trusted by thousands of organisations, helping them simplify accounting processes, improve reporting, and gain real-time financial insights. Its adoption in the UK is growing rapidly, with revenue from Sage Intacct in the UK and Ireland increasing by over 60% in the first half of 2025, according to Sage’s Half Year Results.

Extend Sage Intacct’s Power Through Integrations

The platform’s open API is a core feature designed to allow seamless Sage Intacct integration with hundreds of other business-critical applications.

This approach means that instead of a single, monolithic system, companies can build a customised ecosystem of tools tailored to their unique needs.

The Sage Intacct Marketplace lists over 350 integration partners, offering solutions for everything from customer relationship management (CRM) and inventory management to AP automation.

For finance teams, this means you can extend Sage Intacct’s power to automate areas it doesn’t cover natively. Integrations with third-party platforms like Tipalti are popular for automating data flow and eliminating manual data entry, which can create bottlenecks and lead to errors.

A powerful AP automation integration doesn’t just sync data; it transforms the entire payables process within the Sage Intacct environment.

Why UK Businesses Need More from Their Sage Intacct Integration

As your business scales, simply having a cloud accounting system or ERP like Sage Intacct alone isn’t enough. The complexities of UK and international operations demand more.

Here’s why a dedicated AP automation integration like Tipalti, which is available via the marketplace, is crucial:

Multi-Currency and Global Payments

If your industry operates globally, you deal with suppliers and payments in EUR, GBP, USD, and other currencies. Manually managing these within your ERP may lead to costly FX conversions, complex reconciliations, and payment delays. An automated solution streamlines these cross-border payments.

HMRC Compliance (Making Tax Digital)

Making Tax Digital (MTD) is a key HMRC initiative requiring businesses to keep digital records and submit VAT returns using compatible software. While Sage Intacct is MTD-compliant, an advanced AP solution enhances this by helping to automate UK VAT number validation and maintain digital records for all supplier invoices, ensuring you are prepared for HMRC requirements.

Scaling Multi-Entity Operations

Many UK firms have complex structures with multiple entities. A basic ERP setup can make it difficult to manage payables across these entities while maintaining a clear, consolidated view at the headquarters level. An integrated AP platform allows you to configure entity-specific workflows while providing consolidated visibility.

Handling UK-Specific Payment Methods

Paying UK-based suppliers requires efficient processing of domestic payment schemes. A generic global system might not be optimised for local methods like BACS and Faster Payments, which are essential for timely and cost-effective supplier management.

How APIs and Web Services Enable Seamless Integration

A basic understanding of the technology that drives Sage Intacct integration is beneficial for understanding its power. The platform’s success is built upon a flexible and robust architecture that uses APIs and web services to communicate with other software, creating a truly connected ecosystem.

At the heart of this is the Sage Intacct API (Application Programming Interface).

How does the Sage Intacct API work?

Any API functions like a digital handshake or a secure communication channel between two software applications. It defines the rules and protocols for how other systems can request information from or push information into your Sage Intacct account. This structured communication is what enables seamless integration.

Sage Intacct uses a comprehensive set of web services to expose its powerful functionality; there are specific services to handle journal entries, manage customer data from a CRM, create purchase orders from a procurement system, or post till receipts from an eCommerce site.

This modular approach ensures that an integration solution can perform highly specific tasks efficiently and securely. Whether pulling a list of suppliers or creating hundreds of bills, the API calls the appropriate web service to complete the action.

This powerful framework supports two primary methods of integration:

1) Pre-built Connectors

For widely-used applications like Tipalti, Salesforce, or major eCommerce platforms, partners provide a pre-built connector. This is a ready-made integration solution that uses the API to link the two systems with minimal technical work required. It’s designed to be a ‘no-code’ or ‘low-code’ solution, expertly configured to sync the right data fields (like vendors, invoices, and payments) between the two platforms. A good connector from an authorised business partner is the fastest and most reliable way to achieve a seamless integration.

2) Custom Web Services Integration

For bespoke, in-house systems or niche applications, companies can use Sage Intacct’s web services to build their own custom integrations. This provides ultimate flexibility, allowing developers to create highly specific workflows that cater to unique business processes. This method requires technical expertise but means that virtually any external system can be connected to Sage Intacct’s financial management core.

The UK AP Automation Landscape for Sage Intacct

While many AP automation solutions integrate with Sage Intacct, a business should look for one specifically designed to handle UK complexities. The Sage Intacct Marketplace lists certified partners providing these solutions.

A truly comprehensive solution will offer an end-to-end approach that unifies global payments, real-time sync, and compliance within a single native platform.

Tipalti, for example, delivers a seamless, bi-directional integration with Sage Intacct that is designed to automate the complete accounts payable workflow. This advanced connectivity elevates your ERP from a system of record into a command centre for streamlined financial operations, ensuring everything from vendors and bills to purchase orders (POs) and international tax IDs is always consistent between both platforms.

How Tipalti’s Sage Intacct Pre-Built Connector Solves Manual Integration Challenges

Using Tipalti’s pre-built connector with Sage Intacct, you do not need to build any manual API connection or customised software. It simply integrates seamlessly, delivering a bidirectional integration designed to automate the entire accounts payable workflow.

This out-of-the-box connectivity transforms Sage Intacct from an ERP system of record into a hub for streamlined financial operations. The integration syncs everything from vendors and bills to purchase orders (POs) and international payments, ensuring data is always consistent between both platforms.

Specifically, Tipalti enhances your Sage Intacct environment in many ways

End-to-End AP Automation for UK Firms

By automating the entire payables lifecycle, Tipalti can save you up to 80% of your processing time. The process begins with a self-service supplier portal where vendors onboard themselves, providing all necessary details and tax information. From there, AI-powered Smart Scan technology captures invoice data, eliminating manual entry. Two- and three-way PO matching ensures spend control, while smart approval routing sends invoices to the right people, who can approve them directly from an email.

Seamless Multi-Currency and Global Payments

Tipalti transforms Sage Intacct into a global payments engine for GBP and other global currencies. You can execute payments to over 200+ countries and territories in 120+ currencies using a choice of over 50 payment methods, including BACS and Faster Payments for UK suppliers. This automated system minimises the complexities of managing different banks and currencies. Regulated in the UK as an Electronic Money Institution by the Financial Conduct Authority (FCA), Tipalti ensures that your global payment operations are secure and compliant.

Unified Multi-Entity Management

For UK firms with multiple business units and locations or those looking to grow, Tipalti can consolidate AP from all areas of the business into one central repository.

From this central dashboard, you can manage payables for each unit. It also lets you control different local brands and varying local approval processes.

The system provides the finance team with an overview of cash flow across the entire organisation, while making sure that all transaction details sync back with the correct sub-ledgers in your accounting setup, eliminating the need for manual data entry.

Built-in UK Tax and Regulatory Compliance

To help meet HMRC’s digital record-keeping mandates, Tipalti’s platform includes features designed for VAT compliance. This functionality digitises invoices and includes functionality for capturing and storing UK VAT numbers from suppliers during onboarding. This not only supports MTD for VAT but also strengthens financial controls and simplifies audit processes.

Make Sage Intacct HMRC-ready and AP-efficient

See how UK finance teams are enhancing Sage Intacct with seamless AP automation. From VAT-ready workflows to faster payments, learn how to maximise performance and simplify compliance.

Customer Spotlight — Spitfire Audio

Spitfire Audio, a renowned UK-based music technology company, uses Sage and Tipalti integration to manage its complex royalty payments. Before automation, their finance team spent four to six weeks on manual statements and payments.

It took us four to six weeks of solid work to do all the statements and payments, whereas now, it’s 30 minutes of solid work. We were spending a long time trying to get royalty payments done, and now we’re ahead.

– Shahid Khalid, Head of Finance, Spitfire Audio

By implementing Tipalti, Spitfire Audio automated more than 1,500 global payouts and drastically reduced its payment processing workload, saving an estimated ten weeks a year. This freed up their finance team to move beyond manual work and focus on more strategic, value-adding activities.

How to Set Up Your Sage Intacct Integration

Tipalti offers a structured and collaborative implementation process. A dedicated team will work with you to prepare, implement, train, and launch a system configured to your specific workflows.

The process ensures a solid foundation for long-term success, with key steps including:

- Preparation: The process starts with a comprehensive setup call to review your workflows, devise a project plan, and validate technical requirements. You’ll also receive user experience training and an overview of the technical integration.

- Implementation: This stage involves the technical integration, configuring your banking details, email settings, and connecting to Sage Intacct. A bidirectional sync is established for vendor information, invoices, payments, and custom fields between the two systems.

- Training and Launch: Before going live, your team receives in-depth training on all finance functions and workflows. Tipalti offers adoption support as you invite your suppliers to onboard themselves onto the new platform.

- Optimisation: After your first payment run, Tipalti offers ongoing support to ensure you get the most out of the platform and achieve your long-term goals.

Choosing the Right Path: Implementation, Challenges, and ROI

Even with clear automation advantages, any project requires careful planning. Selecting the right technology and the right implementation partner is critical for a successful outcome. Sage itself works closely with a network of authorised UK partners who are experienced in customising and extending the platform.

When newcomers are evaluating potential AP automation partners for Sage Intacct, UK decision-makers should use the following checklist:

- Does the platform have demonstrable UK-specific expertise?

Ask for experience with HMRC’s MTD for VAT, UK payment schemes (BACS, CHAPS, Faster Payments), and local data regulations. - How seamless is the technical integration?

An important question is whether the partner offers real-time, bidirectional synchronisation with Sage Intacct or relies on periodic batch uploads of data files. Real-time data is key for an accurate, up-to-the-minute financial overview. - Can the solution scale with my business?

The platform must be able to handle today’s volumes and allow you to grow as you expand into new markets or add entities. - What does ongoing UK support look like?

Look for partners who offer comprehensive implementation training and have a local team to provide ongoing support post-launch.

It’s Time to Maximise Your Investment

For UK businesses that run on Sage Intacct, achieving true efficiency means looking beyond the core ERP and creating an ecosystem of best-in-class tools.

By integrating Tipalti with Sage Intacct, you equip your finance team to handle multi-currency payments, streamline invoice processing, and assist HMRC compliance while scaling the business. This approach automates manual tasks and empowers your team to become a strategic partner in the company’s growth.

Ready to see how you can transform your payable operations?

See how Tipalti extends Sage Intacct with automated payables, cross-border payments, and real-time visibility—so your finance team can scale with control.

Frequently Asked Questions (FAQs)

What exactly is Sage Intacct?

Sage Intacct is a cloud-based financial management and accounting software solution designed for small—to medium-sized businesses and growing organisations. Unlike entry-level systems, it is a modular ERP system with powerful core functionality, including a multidimensional General Ledger, automated Accounts Payable and Accounts Receivable, inventory, and order management.

Is Sage Intacct considered an ERP?

Yes, Sage Intacct is considered a cloud ERP Financials platform. While it doesn’t cover every operational aspect like a full manufacturing ERP system, its strength lies in providing a best-in-class financial core. This can be extended with other best-in-class applications through pre-built connectors and its open API, covering everything from CRM to procurement.

How does a Sage Intacct integration actually work on a technical level?

Integrations use Sage Intacct’s API and web services platform. Third-party applications like AP automation solutions or CRMs send machine-readable requests to Sage Intacct’s API to perform actions such as creating suppliers, posting invoices, or generating reports. This ensures constant, seamless communication between systems and keeps data synchronised.

How does Tipalti integrate with Sage Intacct?

Tipalti integrates with Sage Intacct through a prebuilt API integration that automates supplier onboarding, invoice processing, and payment reconciliation, saving time and reducing errors. It is available via the Sage Intacct marketplace. Tipalti thereby extends Sage Intacct’s capabilities by offering real-time multi-entity reconciliation, fraud detection, and multi-currency support.

What should I look for in a third-party integration solution in the Sage Intacct Marketplace?

Look for an approved business partner with the Sage Recommended Solution designation, which signifies that the integration has been carefully vetted by Sage for quality, reliability, and security of its API connection. You should also check for UK-specific customer reviews and case studies that demonstrate success in your industry.