Platform-based businesses thrive on strong partners—see how mass payments tech streamlines operations, reduces risk, and boosts partner retention.

Fill out the form to get your free eBook.

Digital companies that rely on platform-based models know how important their partners are. See how mass payments technology can improve operations and cut down on risks, all while helping you attract and keep those key partners.

UK businesses that manage mass payouts face tighter value-added tax (VAT) compliance standards today than they did just a couple of years ago.

Published in 2024, HMRC’s Guidelines for Compliance 8 (GfC8) recommend documented processes, preventive controls, and digital record-keeping across every payment cycle.

A tight control framework is key to reducing payment errors and avoiding non-compliance penalties.

This guide explains what strong VAT compliance involves for UK companies in 2026 and how automation helps finance teams maintain government-set standards.

Key Takeaways

- HMRC expects documented risks, preventive controls, clear ownership, and digital audit trails under 2024’s Guidelines for Compliance 8 (GfC8).

- Manual processes create compliance pitfalls through data entry errors, version control issues, and payee misclassification.

- Automation prevents errors, maintains audit trails, ensures data consistency, and adapts to regulatory changes with minimal human effort.

- Building automated controls using the right software—such as Tipalti—now prepares finance teams for evolving UK VAT requirements.

What VAT Compliance Looks Like for UK Businesses Today

Compliance with value-added tax (VAT) today means more than periodic reporting. Modern businesses must demonstrate process integrity, documentation, and accountability across every payout cycle.

HMRC’s recent guidance (GfC8) doesn’t replace VAT law, but instead lays out a “recommended approach” to accounting for all VAT-registered businesses in the UK.

General VAT rules still apply under Making Tax Digital (MTD). This includes accurate VAT treatment of services (e.g., digital services), filing returns on time, and paying what’s owed to HM Revenue & Customs.

However, HMRC now also expects companies to show stronger governance through:

- Understanding VAT risks and mitigation measures.

- Clear internal accountability for all VAT processes.

- Preventive, automated controls where practical.

- Digital VAT records stored in line with MTD rules.

- A consistent approach to VAT rules across entities, systems, and payout operations.

For example, HMRC specifically states that risks should be “identified and documented,” and that every VAT-relevant process should have a clear owner (you’ll learn how to do both shortly).

These tighter VAT compliance requirements rely on having easy access to accurate financial data and a workflow that minimises the risk of human error.

Note: VAT is a form of indirect tax, meaning businesses collect and remit it on behalf of taxpayers. Other indirect taxes include sales tax in other countries. Direct taxes are those that taxpayers pay directly to HMRC, such as income and corporation tax.

Common Gaps Undermining UK VAT Compliance

Even the best-intentioned businesses can struggle to stay VAT compliant if they don’t manage the following challenges.

Manual Data Entry Causes Errors

Finance teams collect large amounts of information when onboarding new payees at scale.

It’s easy for errors to slip in when that data is entered manually, which can lead to applying the wrong VAT treatment to transactions, resulting in an incorrect amount of VAT charged.

These errors often cascade across thousands of transactions, increasing correction workload and slowing VAT return preparation.

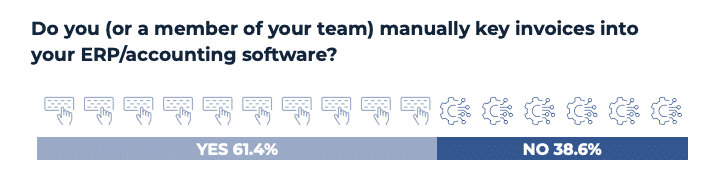

Despite the error risks, the Institute of Financial Operations & Leadership (IFOL) found that over half of accounts payable (AP) departments still input payment data into accounting and ERP software manually:

Common errors made more likely by manual data entry include:

- Incorrect or missing VAT numbers.

- Payees selecting the wrong business status—for instance, sole trader instead of VAT-registered company.

- Country codes entered incorrectly for cross-border transactions.

- Outdated exemption details, such as a payee exceeding the VAT registration threshold.

- VAT indicators that don’t match the service type (e.g., digital services vs. gig-economy jobs).

The stakes are high, especially for small businesses tight on resources. When mass payouts happen at scale, a single incorrect detail early in the process can impact thousands of transactions, draining time and energy across the team.

According to Tipalti’s 2025 Global Finance Outlook survey, 29% of UK finance teams report errors in finance deliverables, while 40% say they spend too much time resolving those errors.

Ineffective Version Control Creates Discrepancies

Poor or inconsistent financial records make it hard to reach sound VAT decisions or support those decisions during HMRC checks.

Records tend to become inconsistent when companies keep them in separate systems without effective version control.

HMRC calls out this issue in its guidance:

A risk area for VAT exists where data is transmitted across system interfaces and loss or change can occur.

For example, a payee might show as VAT-exempt in your invoice management spreadsheet and VAT-liable in your accounting system. With no clear audit trail or change log, the finance team can’t know which record to trust.

HMRC doesn’t rule out using spreadsheets but recommends linking them to one another to enable automatic updates.

Even then, version control procedures are essential to stop outdated files from being used.

The time and organisation that manual version control requires is why many business owners have swapped spreadsheets and disconnected systems for mass payment automation software.

Misclassification of Payees Skews VAT Returns

If a payee provides inaccurate or incomplete information during onboarding, it can cause incorrect VAT treatment for the entire pay cycle.

The longer errors go unnoticed, the further they spread through your system and the harder they are to fix. Ultimately, they can be filtered through to your VAT returns, trigger HMRC inquiries, and hinder your cash flow.

Common misclassification errors include:

- Individuals marketing themselves as businesses.

- VAT-registered payees selecting “non-VAT” or “exempt.”

- Incorrect country details for cross-border services.

- Payees passing the VAT registration threshold (£90,000 currently) without updating their information.

The risk here isn’t self-service itself, but disorganised, unbranded onboarding processes that confuse or rush contractors into providing poor master data when starting new partnerships.

An intuitive supplier hub can help remove friction, making it easy for freelance workers to provide the correct information from the start and update it autonomously as needed.

That data then flows into accounting and ERP software to keep all records consistent.

Let Mass Payment Automation Handle VAT Processes Securely and Efficiently

Tipalti Mass Payments fits seamlessly into your tech stack, turning complex global payout processes into smooth workflows that automate tax compliance, deliver seamless payee experiences, and scale as you grow.

How to Build a Robust VAT Control Framework in 4 Simple Steps

HMRC’s expectations under GfC8 are more manageable once translated into practical, repeatable steps.

Building strong VAT controls involves taking a systematic approach across 4 key areas.

Step 1) Assess and Document Risks

Start by mapping where VAT errors are most likely to happen across your payment operations. Then you’ll know where to focus your risk management efforts.

Common risk areas for teams managing mass payouts include:

- Payee onboarding, where the chances of misclassification are highest.

- Payment processing, where VAT codes are often misapplied.

- Cross-border transactions, where country codes and different exemptions can cause confusion.

However, don’t stop there. There may be other risks more specific to your business, including services falling under mixed VAT treatments (e.g., digital services that change VAT treatment based on buyer location).

Maintain a VAT risk register that details each risk’s likelihood, potential impact, and the controls in place to prevent it (covered in the next step, followed by ownership and accountability).

Here’s a simple example of what you might include in a VAT risk register:

| Risk Area and Description | Likelihood | Potential Impact | Control(s) in Place | Owner |

|---|---|---|---|---|

| Payee onboarding: Wrong business status selected | Medium | Wrong VAT treatment applied | Automated VAT/tax data capture | Finance Ops |

| VAT numbers: Invalid or outdated VAT number | Medium | VAT reclaimed or charged incorrectly | Real-time number validation | Tax Manager |

| Digital services: Service type misidentified | Low | Incorrect place-of-supply rules | Mandatory service-type selection | Compliance Lead |

Review your risk register quarterly to account for significant business changes, such as launching in new markets (e.g., other EU member states) or changing payment systems.

For example, global expansion adds new risks to mitigate, as it involves dealing with different local tax authorities. Implementing a new mass payment system could eliminate some of these issues. Either way, an up-to-date register helps ensure nothing is overlooked.

Step 2) Design and Test Controls

Design preventive controls that address your documented risks at the source.

Otherwise, you’ll end up catching the errors those risks cause downstream, where they may cause disruption and penalties.

Automation shines here. With the right tools in place—such as Tipalti—you can set up automatic checks for:

- Verifying VAT numbers against HMRC databases during onboarding.

- Flagging when a freelancer’s turnover crosses the £90,000 VAT-registration threshold.

- Detecting duplicate payment submissions before they’re processed by cross-referencing invoices against existing records in real time.

While it’s the most efficient option, not every VAT control needs automation.

HMRC states that “automated control is preferred over manual control,” but also that “simple control is preferred over complex control where available.”

That means checks can stay manual as long as they’re straightforward, documented, assigned to an owner, and performed consistently.

However you build controls into your VAT compliance workflow, test them periodically to make sure they work as intended. Identify recurring issues in exception reports, strengthening controls as you go rather than increasing manual checks or outsourcing the extra work.

Step 3) Document and Assign Ownership

Assign individuals or teams as owners of each VAT-relevant process to keep decisions consistent and traceable.

GfC8 requires this level of accountability because complex payout workflows often span several teams. Having defined owners stops responsibilities from becoming blurred and errors from going unnoticed.

Documented ownership also becomes valuable evidence in audits. It shows that you manage VAT processes systematically and are in control at your step of the supply chain.

Although exact workflows differ across businesses, key areas to allocate ownership to are:

- Payee onboarding

- Payment processing

- VAT indicator setup

- Exception handling

- VAT return preparation

For each area, document the process objective and steps involved, controls in place, the owner’s specific responsibilities (e.g., recurring deadlines), and review frequency. This establishes a clear framework for making VAT decisions.

It might be that not every step requires a different owner. The more centralised your processes are, the fewer people are needed to keep them running well.

For example, Tipalti’s mass payout and AP automation software can handle a significant portion of the heavy lifting, allowing one manager to oversee multiple steps as payout volumes grow, without requiring additional headcount.

However, if you’re working across different systems and spreadsheets, each part will demand closer attention.

How Tipalti supports VAT ownership: 20+ role-based permissions enforce segregation of duties by configuring who can initiate disbursements, fund accounts, create approval flows, run user and VAT reports, and more.

Step 4) Embed Automation Where Possible

Use automation to consistently enforce VAT controls across high-volume transactions, where manual checks are least reliable and don’t scale well.

HMRC recognises automation as good practice. However, you must ensure your application of it is considered, monitored, and documented.

Considered application means embedding automation in the workflow stages where mistakes are most likely to occur, such as:

- Data validation during payee onboarding.

- VAT code application during payment processing.

- Exception detection before payments are released.

- Audit trail generation for all VAT decisions.

The more complex your operations are, the more challenging it becomes to maintain manual controls without error rates climbing.

That’s where automation delivers the biggest ROI, by scaling your control framework without needing extra hires or straining existing staff. It’s so effective that 70% of finance professionals agree a lack of automation could limit their company’s ability to grow.

How Automation Strengthens UK VAT Compliance

Automating mass payouts—alongside AP processes where relevant—supports the VAT compliance principles that HMRC highlights in GfC8.

The right accounting automation tool applies tax rules accurately, offers clear VAT-compliance visibility via reports and dashboards, and connects to your tech stack.

Here are the main VAT compliance benefits to expect from well-designed automation.

Built-In Error-Prevention that Saves Stress and Money

Automation reduces errors by applying VAT rules at scale more consistently than any human team member could. It works on logic rather than judgement to validate payee data in real time and flag anomalies early, strengthening your control environment.

Automated VAT number checks, country-code validation, and service-type classification reduce the need for manual correction later. They save staff time, freeing them to focus on complex tasks that demand their direct attention.

An example of how Tipalti reduces costly errors: The software screens all payments against OFAC, EU, and HMRC blocklists before processing them. Meanwhile, it continuously monitors for fraud, flags suspicious activity, and blocks high-risk payees.

Clear Visibility and Audit Trails for Smooth HMRC Checks

Every VAT accounting action gets logged automatically in mass payments and AP software. The records include who makes each decision and when, improving audit-readiness with minimal effort.

With clear visibility of in-house VAT compliance processes in dashboards, reports, or both, you can spot recurring issues quickly and find opportunities to strengthen controls even further.

Meanwhile, HMRC gets the traceability it expects without your finance team spending hours every week maintaining change logs.

An example of how Tipalti increases visibility: User activity reports provide a complete audit trail of each user’s actions taken within Tipalti. The user permissions report offers a complete view of user roles and permissions across your tax system.

System-Wide Data Consistency for Informed VAT Decisions

Automation tools with ERP and accounting integrations eliminate the need to copy VAT-related data manually between systems, or to import and export CSV and XML files—even though that functionality exists when the right integration isn’t available.

The effortless flow of payment data through your business saves teams from switching systems (i.e., paying the “toggle tax”), while reinforcing governance by ensuring every team works from the same VAT information.

It ultimately reduces discrepancies and supports GfC8’s requirement for accurate data transmission across interfaces.

An example of how Tipalti enhances data quality: Integrations with Sage, Xero, QuickBooks, NetSuite, and more sync VAT data across your stack. When you or a payee updates information, the change flows to all connected systems.

Full Compliance Support, Now and in the Future

Automation makes it easier to update VAT regulations, onboard new payees, and apply consistent treatment across new markets or service types—all critical growth activities.

Many companies need this simplicity to stay prepared for future regulatory changes.

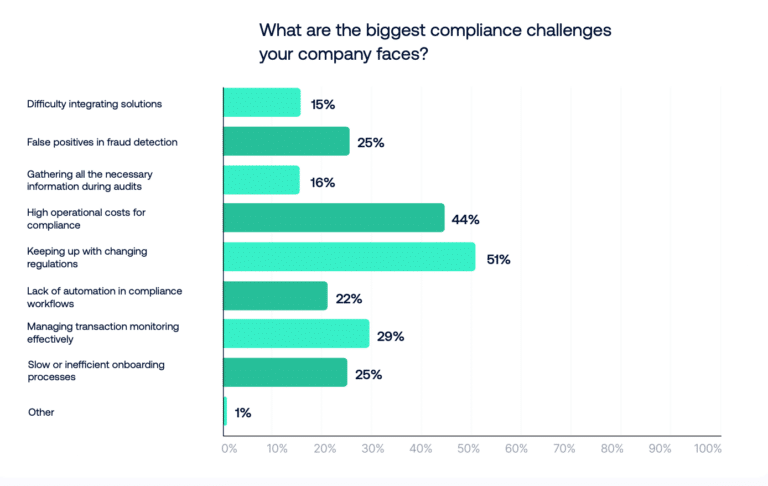

A SumSub study found keeping up with changing regulations to be the biggest compliance challenge of European finance teams.

More than one-fifth of respondents to the same survey said the lack of automation was a key challenge.

As HMRC updates guidance or thresholds, you can use centralized automation software to adjust VAT logic centrally rather than rebuilding entire manual workflows.

The same applies to global VAT changes—what would have been several repetitive tasks becomes a single, straightforward action.

An example of how Tipalti scales with business growth: Centralized VAT logic adapts to markets and regulatory changes without manual updates. Tipalti effortlessly handles cross-border payments, digital services rules, and threshold monitoring as your operation expands.

Tipalti in Action: How Spitfire Audio Streamlines Global Royalty Payments

Spitfire Audio faced a common issue during its international expansion.

Managing over 1,500 music royalty payouts with spreadsheets and manual data entry drained its finance team’s time cycle after cycle, while also increasing compliance risks.

These were the main issues:

- Processing statements and payments took 4–6 weeks of solid work.

- Version control across siloed systems created compliance risks.

- Manual VAT classification for global composers made expensive errors all but inevitable.

It was very manual processing, in terms of global payments and also with reporting. We wanted to get that time down so that we could stop doing manual work and spend more time on value-adding activities.

Shahid Khalid, Head of Finance, Spitfire Audio

Everything changed when Spitfire Audio implemented Tipalti’s Mass Payments solution to automate payouts and simultaneously strengthen compliance checks.

The software simplifies payments to payees in multiple countries and currencies, like this:

The platform’s onboarding portal enables composers to submit their own VAT information with ease, and can display Spitfire Audio’s branding for a smooth, consistent payee experience.

Meanwhile, automated validation ensures accurate classifications, while seamless Sage integration maintains consistent payee data across Spitfire’s tech stack.

Payment processing time dropped from 4–6 weeks to just 30 minutes, saving 10 weeks of payment workload per year.

The results were so impressive that they prompted Spitfire to also move its AP and procurement management over to Tipalti.

Note: Learn more about how Tipalti Payables Automation works, including topics like implementation, security and infrastructure, reporting, and compliance policies, on our FAQs page.

Stay Audit-Ready and Future-Proof

HMRC’s push for stronger VAT controls won’t stop at GfC8.

The recent consultation on e-invoicing signals that the UK may adopt EU-style digital reporting requirements, following the trajectory set by MTD.

Finance teams that build automated control frameworks now put themselves ahead of regulatory change. That’s because when new requirements arrive, systems update centrally rather than requiring process overhauls or staff retraining.

The question isn’t whether to automate VAT compliance: it’s whether to do it before or after payment volumes make manual processes unsustainable.

See how Tipalti Mass Payments helps UK finance teams maintain strong VAT controls while scaling operations.