Unicorn Hunting

A ‘unicorn’ is a term used in the business world to describe a privately owned startup that is worth more than $1 billion. At the time of writing, there are over 1,000 Unicorn companies in the world; including SpaceX, Monzo, Opensea, and Tipalti. We joined the list in 2020, and currently rank 74th with a value of $8 billion.

In late 2020 we brought you a report on the Unicorn Companies around the world, but since then there have been many changes. Many companies have joined the Unicorn club in the past two years, while others have left to become public (such as Airbnb which ranked 5th in 2020, before going public).

As we pass the halfway point of 2022, we want to reveal the newest additions to this elite billion-dollar club. Additionally, we will dive into the list of unicorn companies to reveal the countries and industries which produce the most Unicorn companies.

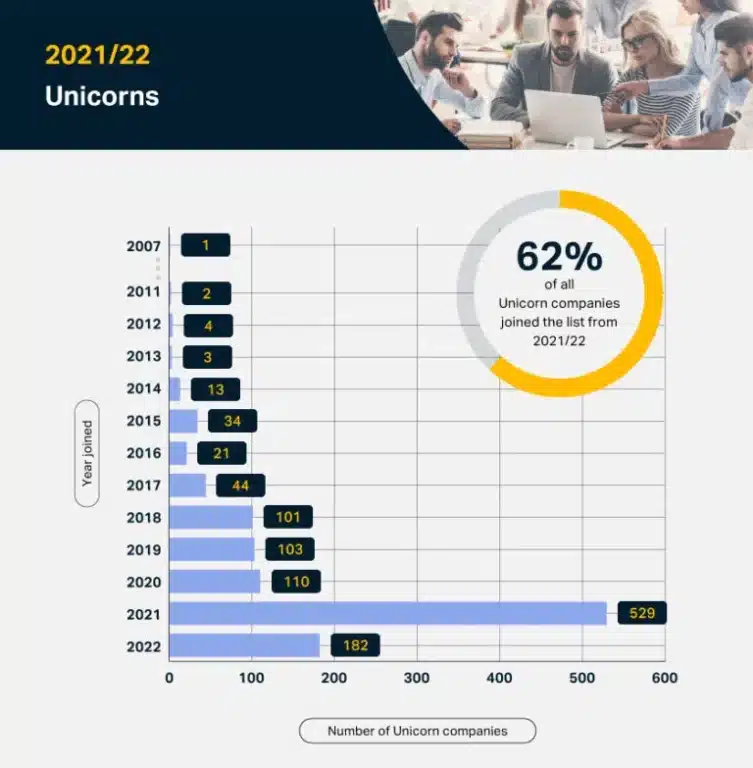

2021/22 Unicorns

In the past year and a half 711 companies have joined the Unicorn list, meaning that new entries account for almost 62% of all Unicorn companies. Thirteen of these can also call themselves ‘Decacorn’ companies, meaning they have a value of over $10 billion.

FTX is the most valuable new Unicorn company, valued at $32 billion. The Bahamas-based cryptocurrency exchange joined the Unicorn club just under a year ago in July 2021. Cryptocurrency companies account for some of the newest Unicorns, as OpenSea, KuCoin, and Alchemy all rank in the top 15 most valuable new Decacorn companies.

The Countries with the Most Unicorns

The majority of the new Unicorns are from the United States, as 424 or just under 60% are American, which is higher than the 53% of companies that are American in the all-time list of Unicorns. Contrastingly, Chinese companies make up around 15% of all Unicorn companies, but less than 7% of the new additions.

In the previous Unicorn companies report, the US companies made up just under half (48%) of the list, but now they are the majority, as around 54% of the companies are American. 16 of the top 30 largest companies are from the US, including SpaceX, Stripe, and Instacart.

China still has the second-highest percentage of Unicorn companies, but its share of the total has dropped from 24.30% to 15.17%. This is because there have only been 55 new Chinese companies joining the club since the start of 2021. Two of the three Hectocorn ($100 billion) companies are Chinese, with Bytedance and SHEIN ranking 1st and 3rd.

The number of countries which have companies on the Unicorn list has also increased, with 31 countries featuring in late 2020. This has increased to 47 today, but only 11 of them account for more than 1% of the total number of Unicorn Companies.

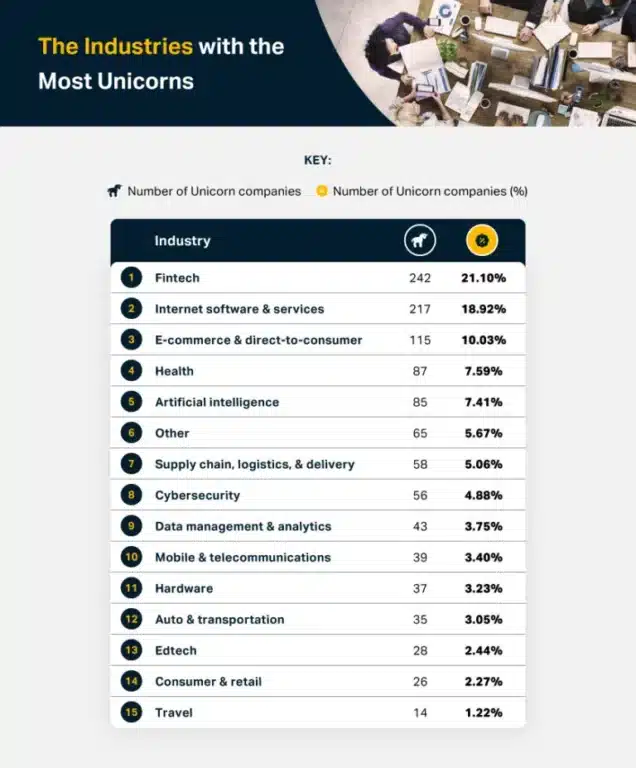

The Industries with the Most Unicorns

The vast majority of Unicorn companies are involved in some form of the technology industry, although there are companies from a massively varied number of sectors.

Fintech is still the industry with the most Unicorn companies, however, there are now 242 rather than 70. This means that 21.1% of all Unicorn companies are involved in Fintech.

Internet software & services companies now account for the second-largest amount, with 217 (18.92%) of all Unicorns. E-commerce companies now only have the third-largest percentage of unicorn companies, with 10.03%, down from 14.3% two years ago.

The World’s Most Valuable Unicorns

The average value of all 1,147 Unicorn companies is $3 billion. There are just 59 of them who fall into the decacorn club with values of over $10 billion, and just three hectocorns with values over $100 billion.

1 – Bytedance, valued at $140 billion:

Bytedance has held its value since two years ago, and is still the most valuable company on the list, although its lead is dwindling. The Chinese tech company focuses on artificial intelligence and created the global social media giant TikTok.

2 – SpaceX, valued at $125 billion:

SpaceX has leapt up in value over the past two years, previously it was just $46 billion, but now it has increased by just under $80 billion. It has moved up from third place to second in the rankings and is still the most valuable American unicorn company.

3 – SHEIN, valued at $100 billion:

Another Chinese company is the only other with a 12-figure valuation, fast-fashion retailer SHEIN has jumped from 11th to 3rd place in the most valuable rankings.

Methodology

All figures sourced from CB Insights’ Complete List of Unicorn Companies and are correct as of 30/6/2022.