Improving the Partner Experience by Improving the Payment Experience

More than a few factors have led businesses to start relying more heavily on the gig economy model. It’s become a favored strategy among many executives, with 75% of business leaders planning to leverage digital platforms and ecosystem capabilities by 2025, according to IDC. Some will rely on gig ecosystems to fill critical roles; others will strike up partnerships to build brand awareness. You need only look to the creator economy for evidence of that, with brand after brand realizing the influence and reach this space holds.

With the competition for these partnerships increasing, businesses are no longer in control. The giggers, creators, and other ecosystem partners hold all the cards. They know their worth. They also know that another business is likely waiting in the wings to establish a relationship. So, the question then remains…

Apart from a check, what could you be doing that competing businesses are not?

Your Payment Experience

A large part of the partner experience often hinges on the payment experience, which goes well beyond just paying partners on time. It involves:

Automating the payment process with enhanced technology doesn’t just ensure satisfaction on your partners’ end or improve the retention of partners. It also allows you to build a better, more robust payment infrastructure.

Your Improvements to Global Payments

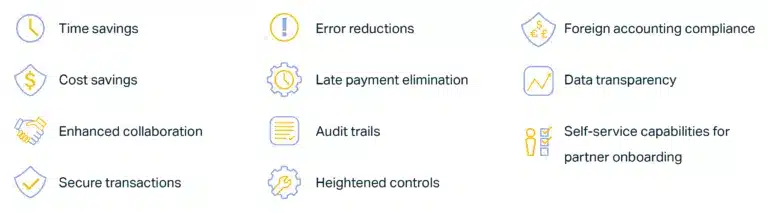

Though popular opinion might say otherwise, automation doesn’t replace employees. It can add even greater value to your organization in a number of ways:

The list of benefits goes on and on. But the real advantage of implementing a technology solution to automate the payments process comes down to one thing…

Your Position in the Partner Ecosystem

The digital economy is only set to grow over the next few years, and your business—be it large or small—should be preparing for the future of working with partners. Providing them with a seamless payment experience is expected these days, but it comes with the added bonus of saving time and money.

Why Payments Are Critical to Creators and Influencers

Businesses that rely on the digital economy must prioritize the satisfaction of their influential partners.