Automated Royalty Payouts to Nurture Artists

With our automated end-to-end payments solution, labels, distributors, and music businesses can concentrate on signing new talent, enhancing artist relationships, and expanding their reach.

Music and Artist Features

A Rock Solid Royalty Payments Process

Take the pain out of manual payouts with automated onboarding, payments, tax compliance, fraud prevention, and reconciliation— with a best-in-class experience for your artist network.

Pay Anyone, Anywhere

Send cross-border payments to your global artists, labels, publishers, and distributors to 200+ countries and territories in 120 currencies via 50+ payment methods, including PayPal and global ACH.

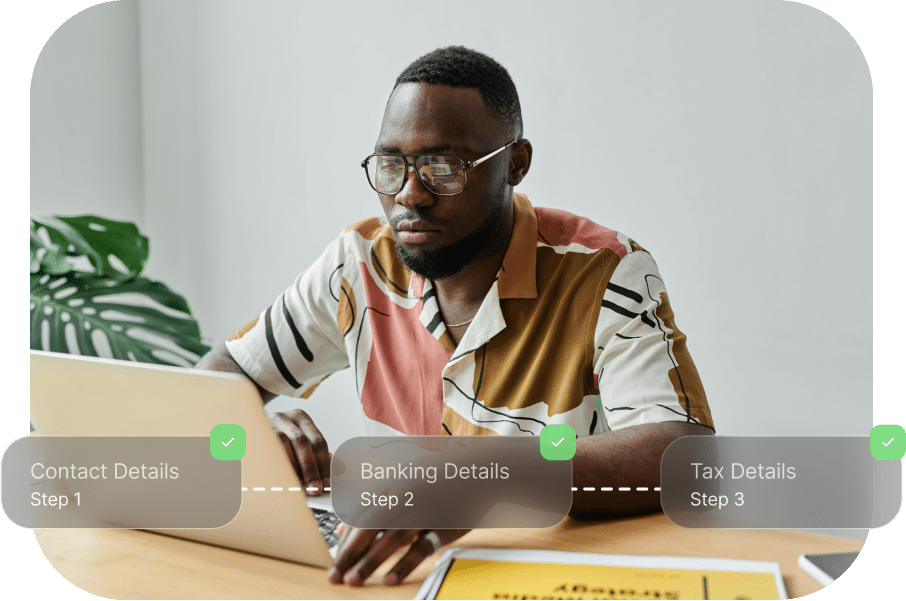

Self-Service Onboarding

A fully customisable onboarding system designed to provide a user-friendly experience that helps attract and retain artists.

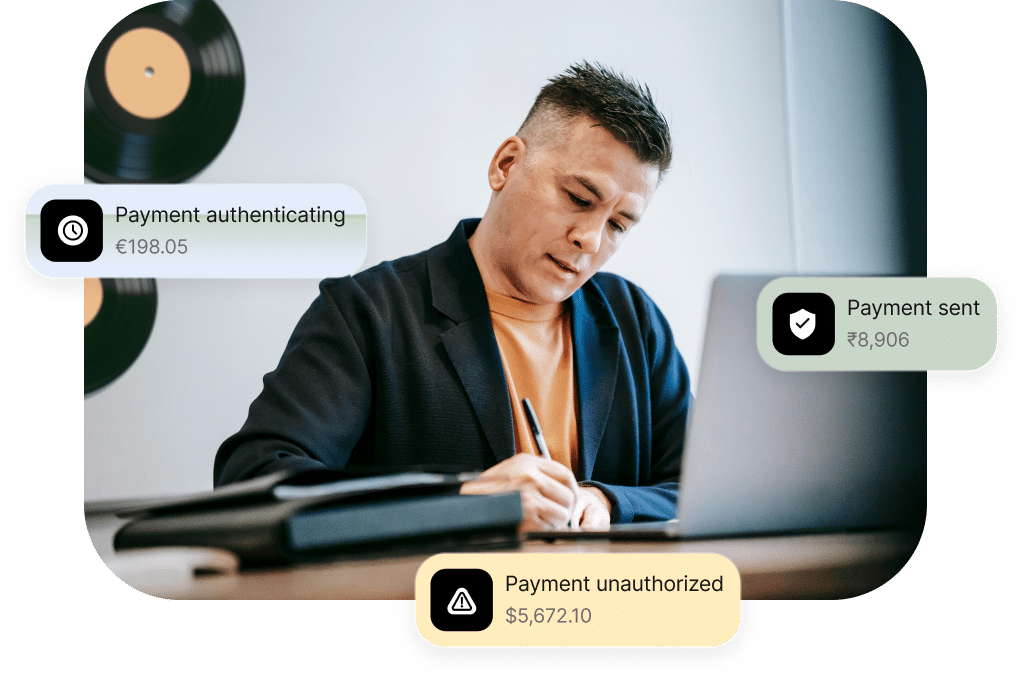

Reduce Royalty Payment Risks

Built-in OFAC screening, enterprise-grade platform security, and advanced fraud controls ensure every payment is checked for legitimacy and legality.

Integrate With Existing Systems

Connect your workflows to boost visibility into your payment process. Sync global payments using our API, documentation, and developer hub for greater productivity.

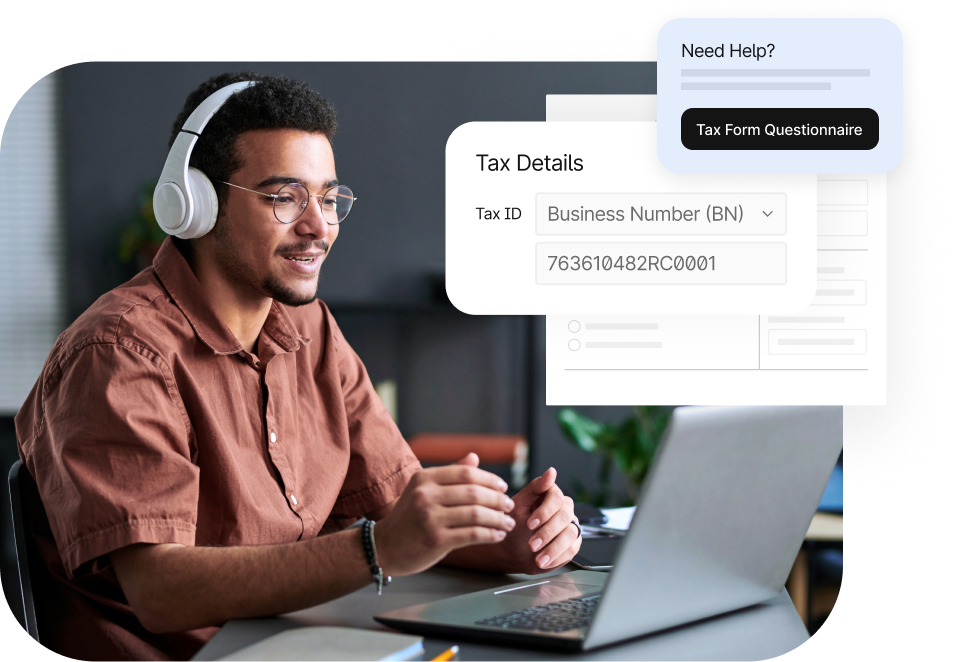

Hassle-Free Tax Processes

Digitally collect and verify payee VAT IDs across 49 countries. Collect data and produce DAC7 reports to eFile during tax season.

Customer Stories

Don’t just take our word for it,

see what our music customers are saying

How It Works

Up and Running in Weeks, Not Months

Collaborative customer support with customised onboarding to get you operational quickly

Step 1

Plan

Kickstart your success with a comprehensive initial call to align on goals, scoping, and technical configurations for your setup and to prepare you for training.

Step 2

Configure

Tipalti’s implementation experts set up your hosted portal, create sample payment files, configure payment options and email integrations, and establish ERP integrations using our pre-built solutions.

Step 3

Deploy

In-depth training on the Tipalti Hub and end-to-end payment automation functionalities will ensure thorough knowledge transfer to turbocharge your successful launch.

Step 4

Adopt

Support user adoption and change management during launch while guiding suppliers through onboarding. Once set, you’ll be ready to execute your first payment run and officially launch Tipalti.

Step 5

Optimise

Continued technical support by phone and email. Tipalti customer success team learns your goals and offers solutions to reach them.

Products

Everything you need to control spend

Tipalti’s connected finance automation suite ensures you get the visibility and control you need across accounts payable, global payments, procurement, and employee expenses to run your business more efficiently and drive growth.

Recommendations

You may also like

Royalty Payment Solutions FAQs

What is a royalty disbursement?

A royalty disbursement (also called royalty payment) is a form of payment made to individuals or entities, such as musicians and artists, to use their intellectual property (IP), like music, books, and digital content.

Royalty rates are typically calculated as a percentage of the revenue generated from the use, sale, or licensing of IP. One example of royalty income is the licensing fee songwriters and artists receive for putting their music on streaming services like Spotify. Another would be publishing royalties paid for a book, sound recording, or musical composition.

Factors that can influence royalty disbursements include:

- Licensing agreement terms, including the royalty rate and frequency

- Fluctuations in revenue for the use of the IP

- Geographic scope and where the IP is being used

- Usage type (live performance, digital, etc.) and contract terms

Automated royalty management software is the best way to streamline royalty payments. This specialised software helps everyone from the music industry and record labels to TV shows, radio stations, composers, music publishers, and artists efficiently manage royalty calculations, reports, and disbursements.

What is royalty payment software?

Royalty payment software is specialised technology designed to manage and automate royalties’ calculation, tracking, reporting, and distribution. This includes payments made to individuals or entities for use of their IP.

Royalty accounting software is particularly useful for industries where IP is a primary asset and revenue stream.

Key features of a royalty management solution include:

- Royalty calculations: It automates complex royalty processing based on predefined partnerships and contracts. The platform should support royalty structures, like percentages based on sales data, fixed rates, sliding scales, and tiered payments.

- Contract management: A system that will manage and store royalty agreements, ensuring compliance with terms and conditions, as well as the rights of copyright holders, licensors, and franchisors.

- Reporting and analytics: Royalty payment software tracks sales and usage data from various channels and generates royalty reports on earnings, payments, net revenues, and obligations.

- Payment processing: The software should easily facilitate the disbursement of royalty payments to payees (including royalty interest). This covers global payments and mass payments with advanced multi-FX solutions.

- Top integrations: The solution should integrate with other popular accounting and enterprise resource planning (ERP) systems to streamline payment processing. Royalty payment software will aggregate data sources into a single dashboard, eliminating the need for Excel spreadsheets.

Royalty payment software provides insight into royalty statements, trends, and performance. It helps rights holders and businesses make more informed decisions based on real-time royalty data. It also ensures compliance with industry regulations and standards, supporting tools that create a robust audit trail.

Can I automate global royalty disbursements?

Using tools like royalty payment software, you can automate global royalty disbursements. These solutions are designed to manage the complexities of global payments, from currency conversions to tax regulations, compliance requirements, and everything in between.

Here are five ways these tools facilitate global royalty disbursements:

- Multi-currency support: These tools streamline transactions in multiple currencies and run conversions based on real-time exchange rates.

- Tax compliance: Royalty payment software manages tax obligations according to local regulations and generates the necessary forms for different jurisdictions.

- Automated payment processing: These tools integrate with global payment gateways and banks, supporting many payment methods, including Automated Clearing House (ACH), bank wires, PayPal, and other electronic systems.

- Regulatory compliance: Royalty payment systems ensure compliance with global regulations, such as the General Data Protection Regulation (GDPR) for data protection and Anti-Money Laundering (AML) laws. They also provide robust audit trails and compliance reports.

- Critical integrations: It’s easier to automate global royalty disbursements with tools that seamlessly integrate with what you’re already using. Top tools connect with ERPs, accounting, and financial tools for accurate tracking and reporting.

Can I pay artists in local currencies?

Yes, paying artists in local currencies is possible if you have the right tools. Advanced royalty payment software is designed to handle multi-currency transactions, ensuring payments to artists are made most efficiently for them (preferred payment methods and local currencies).

Look for the following features to support local currency royalty payments:

Multi-Currency Support

The software must support different types of royalties in various currencies and automatically convert the payment amounts based on real-time exchange rates.

Integrations with Global Systems

The royalty payment software you choose should integrate with various global payment gateways and financial institutions and support a variety of payment methods, such as ACH, electronic funds transfer (EFT), PayPal, and other local payment solutions.

Currency Conversion and Exchange Rates

The best royalty payment providers feature accurate currency conversion rates in real-time. Options to lock in exchange rates to avoid fluctuations may also be available.

Localised Compliance

These royalty payment systems are designed to manage tax forms and compliance for different countries and run reports in accordance with local regulations.

Contract Management

Consider a system that offers robust contract management in the pricing. This ensures the correct application of royalty rates and terms based on the currency and region.

Which payment software integrates best with royalty accounting systems?

Choosing the best payment software that integrates well with royalty accounting systems depends on a few factors, such as:

- Specific business needs and goals

- Complexity of royalty payment structures

- Existing legacy systems in use

Look for a solution that offers a comprehensive suite of tools for royalty management, including automated payment processing, multi-currency support, international compliance, and detailed reporting.

Tipalti is a leading global payables automation platform that integrates well with royalty accounting systems. It’s designed to streamline the accounts payable (AP) process, including managing and disbursing royalty payments.

Here’s how Tipalti integrates with royalty accounting systems:

AP Automation

Tipalti automates the entire AP process, reducing the manual effort and errors associated with managing performance and music royalties.

Multi-Currency and Multi-Method Payments

The comprehensive Tipalti solution supports payments in 120+ currencies and multiple payment methods, including ACH, wire transfers, PayPal, and cheques. This ensures artists and rights holders always receive payments in their preferred currency and method.

Tax Compliance and Reporting

Tipalti streamlines the tax compliance process, including collecting tax forms (W-8, W-9, etc.). It will automatically generate and file necessary tax reports, ensuring compliance with international regulations.

Payment Reconciliation

The Tipalti solution seamlessly integrates with top-tier accounting systems to automate royalty payment reconciliation. All royalty payments are accurately recorded and matched with the corresponding documents.

Real-Time Reporting and Analytics

Tipalti provides real-time insights into payment statuses, cash flow, and AP performance metrics. It will run detailed reports on royalty disbursements, helping companies stay more informed and compliant.