See how forward-thinking finance teams are future-proofing their organisations through AP automation.

Fill out the form to get your free eBook.

Today, the finance function has more responsibilities than ever. In high-growth businesses, every operation—both front and back-office—is inexplicably tied to investment versus reward. To survive the uncharted road ahead, the modern, forward-thinking finance team has to future-proof their organization for success. Download the guide to discover: – The untamed wilderness of finance – How to forge an accounts payable path – How to strategize your next move – The ultimate accounts payable survival tool – How real-life survivalists scaled their businesses

Evolving regulations, heavier workloads, and limited resources are putting UK finance teams under real pressure.

Many companies outsource accounts payable (AP) processes to eliminate repetitive administrative tasks and shorten the procure-to-pay (P2P) cycle.

However, recruiting a third party is just one option and presents its own risks. AP automation helps businesses achieve similar cost and time savings with greater control and visibility.

This guide examines the benefits, challenges, and key considerations of AP outsourcing. Learn how outsourcing works and why automation provides a simpler way to scale with confidence.

Key Takeaways

- AP outsourcing transfers time-consuming tasks, such as invoice processing and payment scheduling, to external providers.

- UK businesses outsource primarily to cut processing costs, access finance expertise, and ensure HMRC compliance without hiring specialist staff.

- Automation delivers similar benefits to outsourcing while maintaining operations, data, and compliance in-house, providing real-time visibility.

- Hybrid models combine selective outsourcing with in-house automation to strike a balance between control, scalability, and cost-effectiveness for UK finance teams.

What Is Accounts Payable Outsourcing (and How Does It Work)?

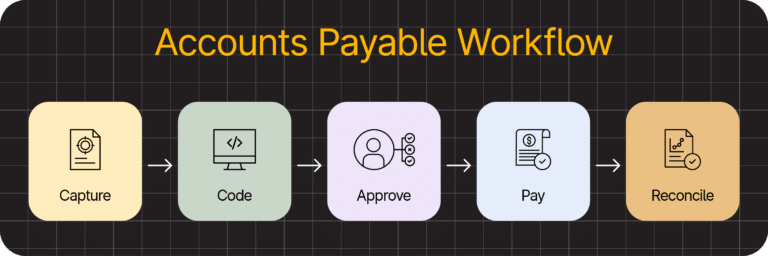

Accounts payable outsourcing is when a company uses a third-party provider to handle standard AP processes such as invoice, payment scheduling, and support with audit preparation.These processes usually follow a standard workflow, as shown here:

Parseq found that 29% of UK organisations outsourced accounting and finance work in 2024—more than any other business function. Small businesses (47%) are the most likely to seek external support for tasks like AP.

Some companies outsource their entire AP function. Others get support for the AP tasks they can’t handle in-house.

For example, a small business with no AP department might outsource most of its finance work. This would allow the team to focus on growing the business instead of organising financial data.

Meanwhile, a larger business might use a service provider for payment processing but hire an in-house team for financial reporting and analytics—retaining full visibility of those functions. This hybrid model of AP outsourcing is standard across mid-market finance teams.

Regardless of the scope, seeking external help raises important considerations. Outsourcing can improve productivity fast, but it also means having less direct control over data and compliance.

There’s no perfect catch-all solution. Balancing the benefits and challenges for your business is crucial in choosing the most effective option.

The Benefits of Outsourcing Accounts Payable

Outsourcing accounts payable functions is a fast way to reduce hiring costs and increase scalability, as you gain more AP capacity without increasing headcount.

However, there are also more finance-specific reasons outsourcing companies get help, including the following.

1) It Frees Time for Financial Strategy

With an accounting service handling the most repetitive tasks, skilled finance staff in AP and other teams can focus on work that needs their judgment.

After all, the longer in-house AP teams spend on manual data entry and other routine activities, the less time they have for high-value work that directly influences growth and profit.

High-value tasks include:

- Forecasting revenue to support resource management.

- Handling vendors’ queries to maintain satisfaction rates.

- Cash flow management to keep the business steady.

- Analysing financial data to find cost-saving opportunities.

- Using payment insight to help improve supplier relationships.

This better use of time makes the whole business more cost-effective. Skilled team members prioritise the work they’re paid for while general bookkeeping and admin happen off-site.

2) It Unlocks Skilled Finance Expertise

Financial services providers help to fill a significant skills gap. Their teams comprise trained professionals who understand UK accounting standards, VAT rules, and reporting requirements.

That matters, as over a third (34%) of UK employers struggle to recruit for finance and accounting positions, AAT reports.

Those same employers also indicated increased pressure on existing employees, reduced productivity, and reduced quality of work as the biggest impacts.

By enlisting help—even with a hybrid approach—companies can ensure that timely payments continue (preventing late fees) without investing to recruit in a competitive space.

3) It Can Support Compliance Efforts

Reputable accounts payable outsourcing providers help clients adhere to AP-related UK record-keeping and VAT regulations.

For example, HMRC requires suppliers to keep digital invoice records for at least 6 years and store all VAT evidence in a format that can be produced on request.

That support saves finance leaders—and small business owners with many other responsibilities—from constantly checking regulatory updates.

Instead, managers can prioritise broader business operations. All while knowing their AP outsourcing provider will stop invoice discrepancies from causing late payments and auditing issues.

Compliance is a primary concern for UK businesses. Only 15% of UK firms responding to a SteelEye survey reported no significant compliance challenges in 2024.

However, not every accounts payable outsourcing service fulfills expectations.

A lack of direct control and visibility of record-keeping is one of the few reasons many companies turn to accounts payable automation solutions instead.

Automate UK AP Workflows with Full Visibility and Zero Outsourcing Risks

Tipalti’s automation platform keeps your finance team efficient and in control by streamlining accounts payable, vendor management, and global payments in one system.

The Challenges of Outsourcing Accounts Payable: Reasons to Be Careful

Despite the benefits, handing critical AP processes to a third party also has drawbacks.

Before outsourcing, consider whether the following risks could negatively impact your operational costs and vendor relationships.

Reduced Visibility and Control

An outsourcing partner will follow their own internal processes, within the boundaries of the agreed controls. It’s harder for your team to see what’s happening in real time, and that can delay key decisions.

Despite committing to due dates and promising HMRC-compliant records, external parties may fall behind or make errors.

Those issues can quickly become your responsibility, adding to your workload and making it more challenging to obtain accurate, timely financial insights. It’s the opposite of what you set out to achieve.

How to reduce the risk: Ask potential partners to show you their actual reporting dashboards and escalation routes, so you know how you’ll monitor activity day to day.

Integration and Communication Gaps

Most outsourcing partners use their own tools and systems, and these won’t always connect with your own ERP or accounting software.

That disconnect makes it harder to share updates or track invoice progress. It can even lead to discrepancies in financial data.

Siloed systems are less of an issue if you outsource your entire AP function. However, if you keep some tasks in-house, smooth integration is crucial to keep records consistent.

What to check: Confirm whether the provider integrates with your ERP and clarify how they share updates, reconcile data, and handle approval queries.

Security and Compliance Risks

Allowing financial records to leave your internal systems increases your risk exposure.

Your data and your vendors’ could be exposed if the provider suffers a breach. You also can’t choose who the firm hires or how consistently they apply data-protection policies.

If a breach or compliance issue occurs, UK GDPR and HMRC record-keeping rules make your business accountable, not the provider.

For every short-term challenge outsourcing solves, there’s a new risk or drawback to consider. It’s why many UK finance teams find automation to be an ideal blend of efficiency and control.

Due diligence tip: Review the provider’s security certifications, data-handling policies, and past audit results. Confirm who is responsible for meeting UK GDPR and HMRC requirements.

Why Automation Is a Smarter Alternative to AP Outsourcing

AP automation provides finance teams many of the same benefits as outsourcing without the security, privacy, and communication challenges.

Accounts payable software works as an add-on to your ERP or accounting system, streamlining back-office AP workflows to help keep the whole business running smoothly.

With little or no human intervention, AP automation software:

- Captures invoice data accurately using OCR scanning.

- Screens documents for fraud and duplicate payments.

- Directs invoices through automated approval workflows.

- Creates real-time payment reconciliation reports.

Here’s how Tipalti fits into the workflow between your suppliers and employees and your ERP (Oracle NetSuite in this example):

It’s not just NetSuite, either—Tipalti integrates natively with other popular ERPs like Sage, Xero, and QuickBooks, so your finance data stays synchronised without the manual rework that is common with outsourced partners.

Routing critical business processes through software rather than an external AP service means:

- Fewer errors, as the software can’t become tired or distracted during repetitive work.

- Reduced overhead costs, as software licences tend to cost less than outsourcing, and scale without significant investment.

- Improved visibility and security measures, as financial information stays in your accounting system.

For example, because Tipalti stores AP records in structured digital formats, finance teams stay audit-ready for HMRC’s Making Tax Digital and GDPR requirements.

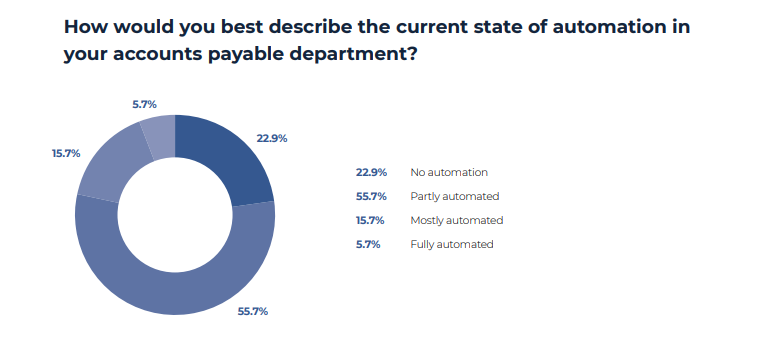

Rewards like these help explain why nearly 77% of finance leaders told a global IFOL survey that their AP department uses some level of automation.

IFOL also found that the most commonly automated financial processes include core AP tasks such as invoice and purchase order (PO) processing, along with expense management.

Meanwhile, AP software gives suppliers a better experience, too. Modern automation tools like Tipalti provide self-service portals that vendors can use to update details and share documents.

Tipalti’s AP Automation in Action: How Plentific Reduced Payment Errors Without Outsourcing

Plentific is a London property operations software firm that handles hundreds of invoices every month across 21 countries.

As the team’s manual approach struggled to scale with company growth, leadership set out to find a better way to handle rising invoice volumes without hiring or outsourcing.

It settled on combining Tipalti Procurement and Tipalti Accounts Payable to automate the whole P2P process—with a self-service supplier portal for smoother vendor management.

Tipalti’s AP automations keep Plentific’s financial transactions transparent.

For example, the team has implemented spend management controls where invoices over £500 are only accepted if the PO has previously been approved. That measure is easy to set up in a modern automation tool, but more difficult to arrange with a third party.

Plentific achieved a 90% reduction in manual workload, eliminating 108 days previously spent on invoice and payment processing.

Moreover, it accelerated its monthly financial close by 23 days, giving the team more time for strategic and growth initiatives.

[Tipalti automation] takes that manual burden away from us so we can concentrate on more exciting things and adding value to the business rather than day-to-day tasks.

Alun Davies, Finance Director, Plentific

Outsource, Automate, or Both: What’s Right for Your Business?

Outsourcing and automation both help UK finance teams reduce manual work, but they simplify accounts payable processes in different ways.

Outsourcing works well for businesses with small in-house teams (i.e., 1–5 employees) that want short-term relief from high invoice volumes.

Its quick efficiency gains are countered by reduced visibility, which could slow your decisions. Effectiveness depends heavily on your chosen partner’s systems and service levels.

Automation provides the same cost and time savings while maintaining in-house or secure cloud-based control over AP workflows, record-keeping, and compliance.

It’s a better fit for companies that want long-term scalability and real-time insights without depending on external teams.

| Outsource accounts payable if: | Automate accounts payable if: |

|---|---|

| You need short-term relief from rising invoice volumes and prefer having a human contact to help with issues.You run a microbusiness, and financial involvement could distract you from other core business activities.You’re comfortable trading some visibility and control for quick efficiency gains. | You want long-term scalability without hiring or spending a large portion of your budget on contracts.You need real-time visibility, control, and audit-ready records, but don’t want to handle every admin task.You prefer to keep financial data and compliance in-house or in a secure cloud system. |

Remember, you can blend both outsourcing and automation to fit your business needs by taking the hybrid approach to AP.

For example, you might automate core AP tasks like processing invoices, approvals, and payments, while outsourcing occasional work like supplier onboarding or exception handling.

These tasks are often handed to external teams because they can be time-consuming, but modern AP automation tools increasingly support them too, giving finance leaders flexibility in how they design a hybrid model.

The Future of AP Efficiency in the UK

Outsourcing is a proven and effective way for busy teams to ease workloads and save time.

But it isn’t always the most effective option.

As UK finance teams continue to face tighter deadlines, stricter regulations, and rising volumes, the smartest path forward is the one that keeps your data close and your workflows consistent.

Research shows that for most modern finance teams, that path is automation.

See how Tipalti makes accounts payable automation smooth, simple, and cost-effective—with flexible pricing and clear dashboards to help you make better strategic calls. It’s the easiest way for UK finance teams to scale confidently, without the risks associated with outsourcing.