Table of Contents

Routing vs Account Number

A routing number is nine digits that identify the financial institution that holds your account, while an account number is the unique 9 to 12 digit number that identifies your specific account within that financial institution.

These two pieces of information are used to identify customers in a variety of transactions that take place every day. They are assigned when you open an account at a bank and can be found at the bottom of paper checks.

These numbers are used for everything from setting up direct deposit to ordering online and mobile apps. The bank’s routing number and personal account number are two unique identifiers that should be kept in a safe space.

Main Takeaways

- A routing number represents the bank where an account is held

- An account number is a unique identifier at that bank

- Both numbers are required to complete a variety of basic transactions

- Accounting and routing numbers both identify exactly where to put money

- It’s important to safeguard an account number as it’s unique to the account holder

- Don’t share your bank data with anyone and avoid writing things down

What is a Routing Number?

The routing number (also referred to as an ABA routing number or routing transit number) is a nine-digit sequence that is used by banks to identify specific financial institutions within the U.S.

Think of it like the digital latitude and longitude of the bank, or a physical IP address. It tells digital systems exactly where the bank is located, and then prompts the bank to send the money there.

The routing number proves that the bank/credit union is a federal or state-chartered institution, and maintains an account with the Federal Reserve. The “ABA” refers to the American Bankers Association which is the company that assigns these numbers.

Routing numbers are only used within the United States and in most cases, banks only have one. Some large national and multi-national brands may have multiple routing numbers based on where you live or hold an account. This is typically done by the state.

It should be noted that the routing numbers used for domestic and international wire transfers are not the same as the ones listed on your paper checks. However, they can easily be obtained by calling the bank.

What is an Account Number?

An account number is the first thing a bank gives you when an account is opened. It can be a savings account or a checking account. An account number is required for every type of banking transaction, whether it’s within the branch itself or between two financial institutions.

The bank account number is typically an 8 to 12 digit number that identifies an individual account within the bank’s system. Much like the routing number is used to specify the bank location, the account number is what is attached to you, the account holder.

In most cases, if you hold more than one account at the same bank, the bank account numbers will be different but the routing number won’t change.

Since a personal bank account number provides direct access to funds, it’s critical the information is guarded and kept safe. Keep it a secret, much like you would a PIN code or social security number.

Importance of Routing Number and Account Number

Account numbers are as unique as your fingerprint and hold the passcode to your finances. It is vital this data is protected. The importance of a routing number and account number is that it unlocks the potential for so many types of transactions.

These numbers were designed to indicate exactly where your funds are located. It tells the system where the money is coming from and where it is going. Both numbers are integral in making sure the money is deposited in the right place, at the right time. Any mistake in providing exact numbers can result in delays and costly fees.

It’s also important to keep this information close to the chest. It is possible for someone to get money from your account if they have access to that data. It can be done through ACH transfers and fraudulent checks. Thus, these numbers are important and should only be used to set up new transaction scenarios.

Example of Routing Number vs. Account Number

There are many scenarios in which you may need to provide a bank routing number and account number, so it’s important to have this information on hand. The most common method people use to find these numbers is on their paper checks.

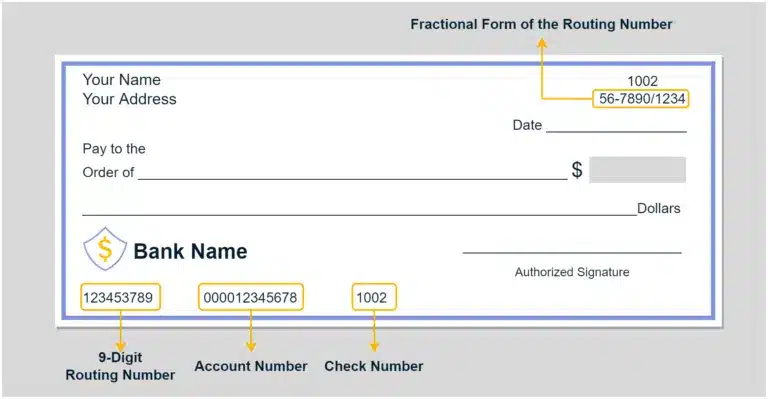

At the bottom left of each check is a set of three numbers. The first sequence represents your routing number (nine digits), the account number comes second, and the final number is a repeat of the check number above it.

These series of numbers are coded with magnetic ink known as the check’s MICR (Magnetic Ink Character Recognition) line. This enables the banks’ digital processing equipment to scan account data.

It should be noted that in some cases, like an official bank check, the numbers will appear in a different sequence.

If you don’t have paper checks, the routing number and account number can be found through a password-protected online banking site or you can look up the bank and location on Google. It can also be obtained by calling the bank’s customer service line.

Power your entire partner payouts operations

98%

Customer Satisfaction

$60B+

Annual Transactions

4M+

Partners

4,000+

Customers

99%

Customer Retention

How to Find Your Routing and Account Numbers

To locate your routing number, you can either find it on the far left bottom of your paper check, or log in to your banking online portal. You can find your account number as the “middle” set of numbers on your paper check, between the routing number and check number. Or, you can also log into your online banking portal.

Since account numbers identify whole banking institutions, they aren’t as unique or private as a routing number, so sometimes you can even Google search to find your bank’s account number.

When to Provide a Routing Number and Account Number

In the modern money market, there are a variety of scenarios in which you may be prompted to provide a routing number and account number. This includes:

- Receive a direct deposit from an employer

- Send or receive a wire transfer or electronic funds transfer (EFT)

- e-commerce and online shopping

- Receive a tax fund or stimulus check

- Schedule an electronic ACH (automated clearing house)

- Receive a direct deposit of government benefits

- Pay mortgage and online bills

- Ordering checks again from your bank

- Link bank accounts to a financial app

- Mobile banking

- Send or receive money to friends and family

- Financial app and wealth management

The most critical transactions that require bank data are ACH transfers. There is a lot of information and protection needed for these types of wires.

Always remember to double-check all data when providing it to third parties. This ensures a seamless transaction that avoids delays and charges.

How to Manage Routing Numbers vs. Account Numbers

As the message is clear, protecting these numbers should be your top priority. If you’re not sure exactly how to do that, here are some tips for managing the data securely:

- Destroy voided checks. Don’t just throw these checks away. Destroy them.

- Avoid writing things down. Similar to a social security number or debit card PIN, these numbers are not something you want to write down. Commit them to memory instead.

- Don’t share your data. Giving out your bank account number and routing number to third parties can be risky. First, verify that the request is coming from a trusted source.

- Be selective about apps. Personal finance apps often ask for these details when setting up an account. However, they can also be the target of hackers who use phishing to steal money and data.

Be sure to always enter these numbers correctly. One mistake and the cash could be transferred to the wrong account.

The Bottom Line

The routing number and bank account number are essential for a multitude of transactions. These should be kept on hand in a secure location, but easy to find. It’s best that you commit them to memory, much like other important numbers such as an SSN.

Although it’s easy to locate the ABA routing number of a bank, your personal bank account information is a lot harder to find. You will need to go through a series of questions to prove your identity if the number is ever lost.

As technology continues to evolve, these two numbers will be another unique way to identify an individual. It also opens the gateway for international business and high-quality ecommerce.