From Chaos to Clarity

Exceptional service is your calling card. Our finance automation tools remove all the headaches and hassles of manual payment workflows so you can focus on making your customers happy.

Business Services Features

Reduce Costs, Scale Infinitely

Simplify the complexity of supplier onboarding, speed up payments, and build predictable cash flow with accounts payable, mass payments, expenses, and procurement tools designed for your specific needs.

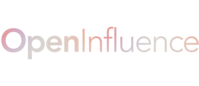

Self-Service Onboarding

Our fully customisable onboarding system is designed to take the work out of your hands and provide a user-friendly experience for your suppliers.

Pay Anyone, Anywhere

Scale anywhere with cross-border payments to 200+ countries and territories in 120 currencies via 50+ payment methods and built-in multi-entity and multi-language capabilities.

Never Miss an Invoice

Process more invoices in less time using AI smart OCR. Our automated alerts and notifications inform stakeholders about pending approvals and due dates.

Protect Against Fraud

Built-in OFAC screening, enterprise-grade platform security, and advanced fraud controls ensure every payment is checked for legitimacy and legality.

Connect With Existing Systems

Keep your financial data more accurate and consistent by integrating with other key systems, such as accounting software or ERPs from NetSuite, Quickbooks, Sage Intacct, Microsoft Dynamics, Acumatica, and Xero.

Customer Stories

Don’t just take our word for it, see what our business services customers are saying.

How It Works

Up and Running in Weeks, Not Months

Collaborative customer support with personalised assistance to get you operational quickly.

Step 1

Plan

Kickstart your success with a comprehensive setup call that reviews your manual AP workflow, outlines the onboarding plan, validates technical configurations, and prepares for training.

Step 2

Configure

Tipalti’s implementation experts set up your hosted portal, create sample payment files, configure payment options and email integrations, and establish ERP integrations using our pre-built solutions.

Step 3

Deploy

In-depth training for AP staff on the Tipalti Hub and the end-to-end AP automation functionalities, ensuring thorough knowledge transfer to turbocharge your successful launch.

Step 4

Adopt

Support user adoption and change management during launch while guiding suppliers through onboarding. Once set, you’ll be ready to execute your first payment run and officially launch Tipalti.

Step 5

Optimise

Continued technical support by phone and email. Tipalti customer success team learns your goals and offers solutions to reach them.

Products

Everything you need to control spend

Tipalti’s connected finance automation suite ensures you get the visibility and control you need across accounts payable, global payments, procurement, and employee expenses to run your business more efficiently and drive growth.

Business Services Payment Solutions FAQs

What is vendor payment automation?

Vendor payment automation is the process of using technology to optimise and streamline the payment of invoices to vendors, suppliers, and service providers. Instead of time-consuming, manual processes, companies can utilise AP automation software to speed up workflows.

Here are some key components of vendor payment automation:

- Invoice processing: B2B payments software can automatically capture, validate, and code invoices, reducing the need for manual tasks and minimising errors.

- Approval workflows: route invoices to the appropriate parties for approval, speeding up the AP process and ensuring less time is wasted.

- Payment execution: the system can automatically schedule and execute payments based on the contract terms. Payments can be made through various methods, including ACH transfers, wire transfers, electronic payments, or virtual cards.

- Reconciliation: the programme will automatically reconcile invoice payments, updating financial records in real-time and ensuring accurate tracking.

- Reporting and analytics: vendor payment automation systems will provide detailed reporting and analytics, offering insights into available cash flow, payment timing, and vendor relationships.

How do I integrate a supplier payments solution like Tipalti into my existing accounting software?

Integrating a supplier payments solution like Tipalti into your existing accounting workflows involves several steps to ensure a seamless connection between the two systems.

Here’s a quick guide:

Step #1) Review Compatibility

Check if your existing systems have pre-built integrations or APIs that work with Tipalti. Common platforms like QuickBooks, NetSuite, or Xero often have existing connectors.

Then, identify the bottom line. What are the specific features and data points you need from the integration? Is it payment approvals, purchase order matching, reconciliation, vendor management, or a combination of functions?

Step #2) Set Up Tipalti

Set up an account with Tipalti and configure the dashboard to your business needs. The platform is highly customisable with tailored payment workflows, approval processes, and vendor onboarding. Define your payment methods, currencies, and any specific tax or regulatory requirements.

Step #3) Integrate Tipalti with Existing Systems

If your accounting software offers a direct integration with Tipalti, follow the setup guide provided by both platforms. This usually involves:

- Enable the integration within your pre-existing systems

- Provide the necessary credentials for authentication

- Map data fields between the two programmes

If there is no direct integration, a business may need to consult additional developers, use middleware, and even run tests to ensure data flows are perfected.

Step #4) Data Migration

Time to move your current vendor and payment data into Tipalti. Set up regular data syncs between Tipalti and your accounting software to keep everything up to date. This could be real-time or scheduled (like daily or weekly).

Step #5) Change Management

Ensure that finance teams are effectively trained on using both systems, including how to approve payments, manage vendors, and reconcile accounts. If needed, create documents for the specific integration setup, including troubleshooting steps, case studies, and contact points for support.

Step #6) Continuous Monitoring

Periodically check that all integrations are functioning correctly and that data is accurate. Also look for opportunities to optimise payment workflows or improve efficiency.

Always stay current. Keep the accounting software and Tipalti updated to the latest versions to avoid compatibility issues and take advantage of new features.

How can a supplier payment solution like Tipalti help improve my business cash flow management?

A supplier payment solution like Tipalti will significantly improve a company’s cash flow management in several ways:

Enhanced Vendor Relationships

Paying people on time strengthens relationships and can lead to better contract terms, early payment discounts, and priority service. Timely payments help to improve cash flow by reducing costs and ensuring a steady supply chain. Tipalti makes it easier to take advantage of discounts and rebates from early payments.

Automated Payment Processing

Tipalti is an end-to-end solution that automates the entire payment process, from invoice capture to payment execution. This reduces manual errors and delays, ensuring that payments are made on time, which helps to maintain a steady cash flow.

You can also schedule payments to align with cash flow projections, helping you avoid unnecessary cash outflows during low-revenue periods.

Expedited Global Payments

Tipalti supports multi-currency payments, allowing you to manage global payments without worrying about currency conversion issues. This helps avoid costly delays and ensures funds are available when needed.

Optimised Compliance and Risk Management

The Tipalti suite of solutions ensures all payments are compliant with tax and regulatory laws, reducing the risk of fines and penalties that disrupt your cash flow. The platform also includes fraud detection tools that prevent unauthorised payments, protecting your cash reserves.

Additional Benefits

- Cash flow forecasting into outstanding payments and obligations

- Spend management to identify trends, manage budgets, and adjust schedules

- Reconciliation with automatic PO matching and updates in real-time

- Reduced processing times between invoice receipt and payment

- Customised approval workflows for proper authorisation and to avoid duplicate payments

How secure is Tipalti’s vendor payment solution?

Tipalti is designed with multiple layers of security to protect financial data and ensure that payments are safely processed.

Here’s an overview of the key security features Tipalti offers:

Data Encryption

Tipalti uses strong encryption protocols to protect your financial data both in transit and at rest. This ensures payment details and personal data cannot be intercepted or accessed by unauthorised parties. All data transmitted between users and Tipalti’s servers is secured with SSL/TLS encryption (the standard for secure internet communication).

Industry Compliance

The Tipalti system is certified under the SOC 2 Type II standard, which assesses the effectiveness of a company’s security controls over time. This certification demonstrates the brand’s commitment to maintaining a secure environment when handling financial transactions.

Fraud Detection

The Tipalti solution supports multi-factor authentication (MFA). This requires users to provide two or more verification factors to gain access to the system. Security features like this reduce the risk of unauthorised access—even if login credentials are compromised.

The system employs advanced algorithms to detect and flag suspicious activities, such as unusual payment patterns or login attempts. This helps to prevent fraudulent transactions before they occur. The payment system also screens vendors against global sanctions lists to ensure nothing is blacklisted.

User Permissions and Access Controls

Using Tipalti, a business can set up role-based access controls (RBAC). This means only authorised personnel have access to sensitive information and critical payment functions; which minimises the risk of internal fraud.

Tipalti also maintains detailed audit logs of all actions taken, providing total transparency and accountability. These logs can be reviewed anytime to detect unauthorised or suspicious activities.

Additional Security Features

- Self-serve supplier onboarding with bank account validation and vendor verification

- Regulatory compliance with General Data Protection Regulation (GDPR) and the Office of Foreign Assets Control (OFAC)

- Regular third-party security audits to identify and address potential vulnerabilities

- Continuous updates with security patches and improvements against latest threats

- Business continuity plan with data redundancy and regular backups

What are the best practises for implementing a supplier payments solution in a small business?

Implementing a supplier payments solution will streamline your payment processes, improve cash flow management, and enhance vendor relationships.

Here are some best practises for small businesses:

- Assess your business: identify specific challenges and look for payment solutions that fit your company size and needs.

- Engage key stakeholders: Involve everyone from the finance team to IT and other relevant departments.

- Integrate with existing systems: verify that the system you choose integrates seamlessly with legacy programmes.

- Customise workflows: tailor workflows to match operational structure, including multi-level approvals for larger payments or automating smaller, recurring payments.

- Establish RBAC: assign appropriate access levels to users based on their roles.

- Provide training: offer guidance to the finance team and cover essential functions like payment approvals, vendor management, and reporting.

- Track performance: monitor the performance of the supplier payment solution, keeping an eye on metrics like payment processing times, error rates, and cash flow impact.

- Plan for growth: choose a solution that will evolve and grow with your business, including increased transaction volumes and more complex payment workflows.

Recommendations