Efficient invoice management keeps your suppliers happy, ensures cash flow is under control, and maintains HMRC compliance stress-free.

However, many UK businesses struggle with higher invoice volume as they grow. Manual entry quickly overwhelms accounts payable teams, leading to increased data errors and reconciliation delays.

In this guide, you’ll learn what invoice management is and how to overcome challenges with automation. You’ll also get tips for choosing the right automated invoice management solution for your needs.

Key Takeaways

- Invoice management involves receiving, validating, approving, paying, and reconciling invoices to ensure accuracy, compliance, and optimal cash flow.

- Manual processes lead to delays, errors, and poor visibility, resulting in strained supplier relationships and increased compliance risks.

- Invoice management automation reduces errors, accelerates approvals, enhances cash flow visibility, and lowers processing costs.

- Invoice management automation software enhances data capture and integrates with ERP systems to automate payments and provide real-time insights.

What Is Invoice Management?

Invoice management is the process of tracking and paying invoices from vendors or suppliers.

It involves collecting, processing, and storing invoice information for accurate record keeping, verification, and approvals.

Good invoice management (also called invoice processing) keeps accounts payable (AP) running smoothly, strengthening supplier relationships while maintaining your company’s financial health.

Streamlining invoice workflows doesn’t just speed up the payment process and reduce errors. It helps you comply with UK HM Revenue & Customs (HMRC) tax requirements.

Accurate data also provides a clear picture of your cash flow, enabling you to manage financial obligations effectively and make informed decisions.

What Does the Invoice Management Process Look Like?

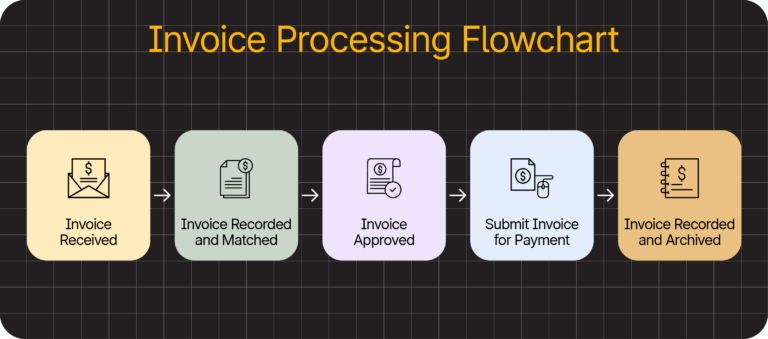

Invoice management is a multi-stage process that typically involves receiving, approving, paying, and archiving invoices.

Each step requires speed and accuracy to pay suppliers correctly and on time.

Here’s how a typical invoice workflow looks:

1. Receive Invoice and Extract Data

Your vendor or supplier sends an invoice digitally (e.g., a digital invoice or PDF) or on paper.

Traditionally, accounts payable staff manually enter invoice details into your enterprise resource planning (ERP) system. A faster approach is capturing data using AI-driven optical character recognition (OCR) invoice processing software.

Data extraction efficiency and accuracy ensure processing isn’t disrupted.

In fact, many growing businesses use modern AP software to automatically capture purchase order (PO) numbers, supplier information, VAT rates, and invoice amounts, saving time and reducing errors. We’ll chat more about this later.

2. Record and Match Invoice Details

AP ensures your invoice is accurate and legitimate by verifying and validating data. This includes checking invoice details, line items, VAT, and totals for errors and consistency with past records.

Exact details are critical for prompt payments, which can make this part of the process time-consuming for teams working manually.

Automating invoice processing speeds things up by intuitively comparing historical data and identifying mismatched information to prevent mistakes and duplicates.

For example, AP software uses 3-way matching to compare invoices against POs and goods receipt notes (GRN), automatically flagging inconsistencies before an invoice is approved.

On the other hand, running these checks in a paper-based system can be laborious and resource—intensive, especially as invoice volume increases.

3. Approve Invoice

A validated invoice now goes to the appropriate personnel for approval. Depending on your process, the invoice may go to the buyer for review before moving on to a manager or finance lead.

A manual process involves AP clerks sending invoices with supporting POs and receiving documents via paper or email. In an automated workflow, software routes invoices automatically to reduce bottlenecks.

4. Submit Invoice for Processing and Payment

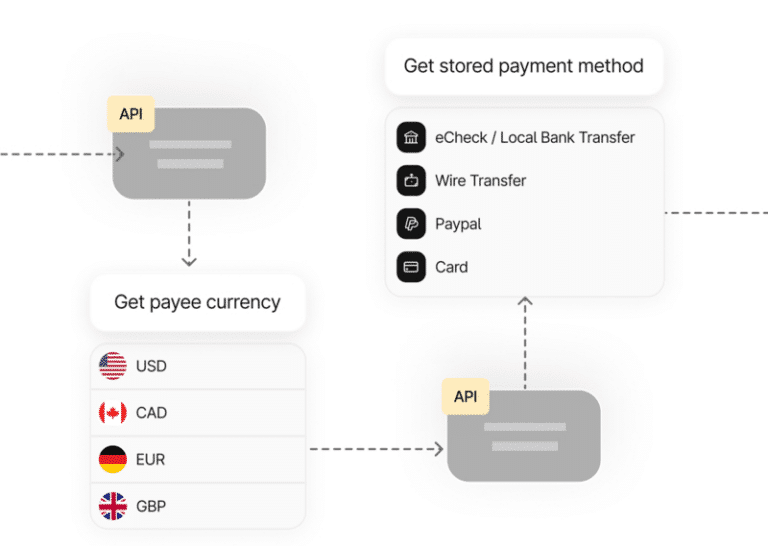

Next, the invoice reaches your ERP or accounting system for processing. You can schedule and execute payments to settle with suppliers on time.

AP teams using an invoice management system can automatically import data and trigger payments. This smooth operation lets you comply with UK invoice payment terms and capitalise on early payment discounts.

Here’s what automated payments look like:

Alternatively, you can manually enter information. As with approval, this method lacks the efficiency of automation software for growing vendor or supplier lists.

5. Record and Archive Invoice

After paying invoices, store them to comply with HMRC tax rules and regulatory audits.

AP automation software maintains digital invoice data, syncing with your ERP system for electronic archiving and easy referencing.

In a paper-based system, you’ll need an effective filing system for simple retrieval (e.g., invoices stored by category and alphabetical order). UK Making Tax Digital (MTD) rules mean you’ll also need to maintain a digital record of all invoices (more on this soon).

Accurate record-keeping protects your business against discrepancies and promises fewer headaches during audits.

The Challenges of Invoice Management in Accounts Payable

Problems in invoice management typically arise from inefficiency, lack of control, and poor visibility.

These issues are often linked to growth. As AP demands increase, pressure builds, and traditional accounts payable processes crack.

Here are some common invoice management challenges that accounts payable teams face.

Too Much Manual Data Entry Slows Everyone Down

Typing invoice details into spreadsheets or accounting software is a time-consuming and laborious process.

In fact, too much manual data entry is the number one challenge AP teams face, according to IFOL research.

The biggest problem with manual processes is that they’re hard to scale. As invoice volume increases, the workload becomes difficult to manage without hiring and training new staff.

The result? Process delays and stressed teams. The knock-on effect impacts everything from supplier relationships to record-keeping.

Invoice Errors Cost Your Business Money

Manual data entry doesn’t just waste time—it invites errors, penalties, and potential fraud.

Fatigue, boredom, distractions, or misreading all contribute to errors in repetitive tasks.

With an average human error rate of 1%–5% (depending on task, stress, environment, etc.), you can face a dozen or more mistakes in every 1,000 invoices.

A wrong purchase order number or line item typo can mean:

- Spending more time and money correcting errors

- Account reconciliation delays

- Duplicate payments

- Processing fraudulent invoices (e.g., false suppliers or payment details)

- Late payment penalties

- Reputational damage in your supply chain

- Incorrect records for VAT and income tax returns

Put simply, invoice errors affect your bottom line.

Approval Delays Hold Up Payments

Routing invoices to the wrong approver or going back and forth fixing discrepancies impacts your business in two ways:

- Paying suppliers late puts strain on your relationships. Businesses rely on prompt payments to manage cash flow and operations, and often reward providers for settling early (e.g., a 2% discount for payment within 10 days). Invoice approval delays mean missing out on these discounts. More importantly, it can make you unreliable, reducing your chances of establishing lasting partnerships.

- Late payments are penalised. If you agree on a payment date, you must pay within 30 days for public authorities and 60 days for business-to-business (B2B) transactions under HMRC rules. Miss a deadline, and a supplier can add 8% interest plus the Bank of England base rate for business transactions. The UK Government is also currently consulting on new proposals to tighten late payment regulations and improve current practices.

In short, AP efficiency saves money and credibility.

Pro Tip: A growing number of UK businesses are signing up to the Prompt Payment Code (PPC) to tackle poor payment practices. Read our complete PPC guide to learn why it’s important and how technology can help you adhere to it.

Disjointed Communication Leaves Teams Out of Sync

Poor communication in invoice management is not a lack of communication; it’s using the wrong channels at the wrong time.

Managing processes over email, spreadsheets, phone, chat apps, and paper risks losing or burying information.

The result is more of what we’ve touched on: payment delays, duplicate or missed payments, and compliance risks.

Inefficient Cash Flow Monitoring Causes Financial Headaches

When invoices live across several channels, there’s no real-time view of what’s happening in accounts payable. This creates two big problems for AP teams:

- Inconsistent data and poor visibility cause weak reports and leave no reliable audit trail for HMRC compliance.

- Unclear liabilities and a lack of payment optimisation make it harder to forecast liquidity for investment and payroll. Without clear numbers, it’s not just invoices that are impacted; it’s cash flow—the lifeblood of your business.

If you notice any of these challenges in your business, address them fast. If you don’t, you’ll overwhelm accounts payable, making growth hard to achieve.

Let’s take a look at a better way of managing invoices.

How to Effectively Manage Invoices

Your AP team exists to nurture partnerships, maintain supplier relationships, and capitalise on discounts.

To do more of this, they need to spend less time typing invoice details and fixing errors.

Effective invoice management requires two things:

- Cutting time-consuming and error-strewn manual data entry.

- Streamlining your workflow to improve invoice routing and communication.

How do you achieve this? The most efficient and cost-friendly solution is with AP automation.

AP automation uses invoice processing software to eliminate time-consuming tasks, detect errors, and automatically notify approvers.

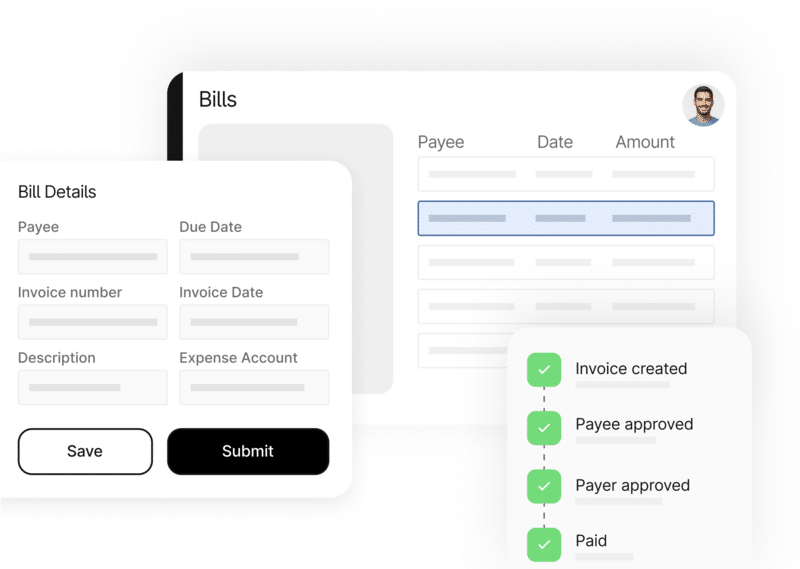

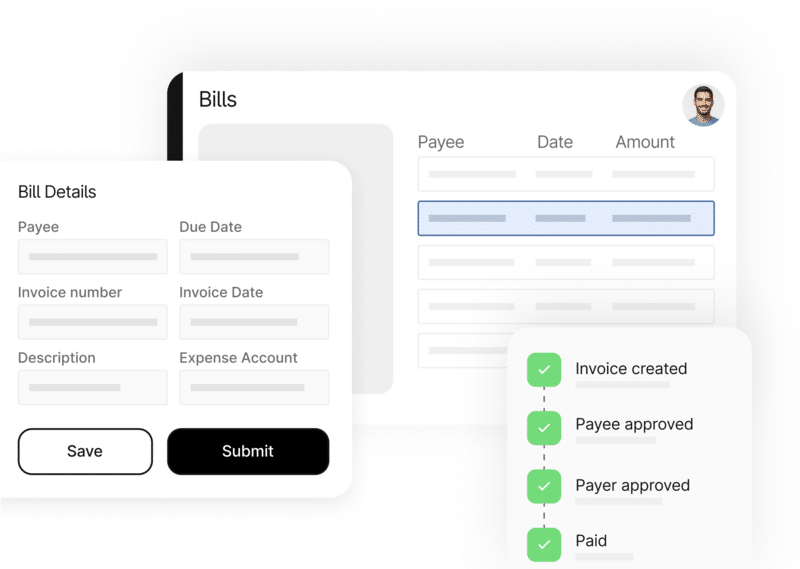

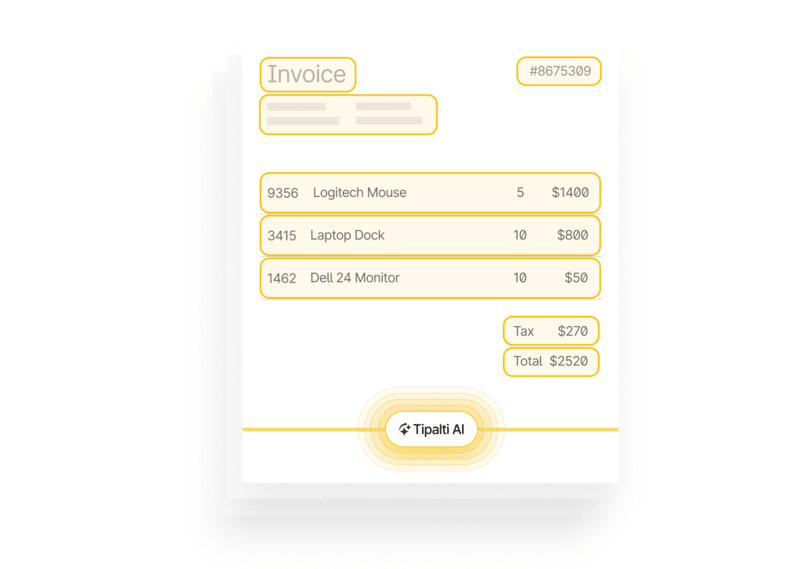

For example, Tipalti strips the redundancy from AP workflows. Rather than receiving paper or electronic invoices, entering data into spreadsheets, emailing approvals, and chasing updates by phone, suppliers simply upload invoices to a secure Supplier Hub:

Once uploaded, AP software:

- Captures invoice supplier details, PO and invoice number, line items, VAT information, and price totals.

- Codes invoice line items using the general ledger (GL) line of accounts.

- Routes the invoice to the correct approver.

- Pays the supplier via their chosen payment method (e.g., BACS or SEPA).

- Reconciles the invoice in your ERP system.

Not only does it streamline AP workload, it does so without adding staff or extra resources.

Here’s how AP automation compares to manual invoice management:

| Aspect | Manual Invoice Management | Invoice Management Automation |

|---|---|---|

| Invoice capture | Paper/email invoice details are hand typed. Risk of mistakes due to human error. | Accurate digital capture with AI-Driven OCR and machine learning (ML) format and pattern recognition. |

| Approval workflow | Invoices are passed via email or paper. Prone to delays, bottlenecks, and poor visibility. | Automated routing for clear approvals, timely reminders, and fast turnaround. |

| Data accuracy | Prone to human error and duplication. | Automatic validation, duplicate detection, and rule-based coding. |

| Processing time | 17.4 days per invoice, on average. | 3.1 days per invoice, on average. |

| Fraud and compliance | Weak audit trails and higher fraud risk due to ineffective approval and reconciliation. | Built-in security controls, audit logs, and tax compliance support. |

| Visibility | Difficult to track invoice status in real time. | Full visibility across the invoice lifecycle. |

| Cash flow forecasting | Inaccurate numbers due to scattered or siloed data. | Real-time data supports reliable forecasting. |

| Scalability | Requires additional staff and resources to manage high volume. | Scales easily without extra headcount. |

| Vendor relationships | Strained by payment delays and disputes. | Strengthened by prompt, accurate payments and full transparency. |

The table makes it clear: for productivity and efficiency, automation offers everything traditional invoice management fails at. Let’s take a closer look at the benefits.

Ready to Optimise Your Invoice Management?

See how Tipalti helps you automate your invoice management process to cut AP workload by up to 80%, from capture to payment.

The Benefits of Invoice Management Automation for UK Businesses

AP automation helps UK businesses scale operations efficiently. By replacing disjointed processes, you can make work easier for AP teams, while keeping suppliers and key stakeholders happy.

Here’s how implementing AP software makes a difference to your invoice processing workflow.

1. Cut Costs by Reducing Manual Work and Invoice Mistakes

Invoice automation software automatically performs tasks that delay manual workflows and cost you money.

Processing an invoice can cost anywhere from £5 to £20. Where your invoices land on that scale depends on your efficiency.

In other words, the longer it takes to key, review, route, remit, and reconcile invoices, the more money you’ll waste. So, streamlining your operations pays.

For example, managing invoices with Tipalti can reduce payment errors by up to 66% and accelerate financial close by up to 25%.

What’s more, storing invoices in a cloud-based system cuts labour and paper costs. If you process hundreds of invoices a month, these savings can amount to tens of thousands of pounds each year.

2. Free Up Time for More Valuable Tasks

Fifty percent of AP teams spend over 10 hours a week processing invoices and administering payments, IFOL research shows. Invoice management software like Tipalti automates up to 80% of this workload, so staff can focus on strategic work like:

- Cash flow forecasting

- Scenario planning

- Identifying early payment discounts

- Negotiating better supplier terms

- Building strong vendor partnerships

Shifting focus from repetitive data entry to more meaningful work can also create happier employees.

Eighty-nine percent of full-time workers are more satisfied with their job due to automation, according to Salesforce research. Additionally, 91% say automation saves them time and offers a better work-life balance.

3. Capture Accurate Invoice Data Consistently

Automation software with AI-Driven OCR typically achieves 98%–99% invoice processing accuracy, keeping data moving efficiently across your system.

But, unlike humans, OCR software isn’t affected by fatigue or distractions, so results stay consistent.

Thanks to machine learning (ML) models, it’s also capable of understanding and improving.

Here’s a quick explanation of how OCR used to work and the improvements AI makes:

| Old Approach |

|---|

- Data capture software compares invoice fields against set templates.

- The software struggles to match invoices if a supplier changes their system or uses a new format without a template.

| AI-Driven OCR Approach |

|---|

- Doesn’t rely on templates.

- Cleans and transforms invoice scans or digital uploads into text.

- Uses pattern recognition and named entity recognition to convert marks into computer-readable numbers, words, and symbols.

- Uses natural language processing to read the words, while machine learning understands the semantic meaning—much like you do.

And here’s Tipalti’s AI Smart Scan in action:

AI Smart Scan knows when a PO doesn’t match a goods receipt number (GRN) and automatically recognises if an invoice has already been processed. Better still, the more it processes, the smarter it gets—becoming more efficient with every invoice cycle.

To AP teams, this means:

- Less need for human oversight

- Automatically catching exceptions for review

- Better fraud protection

- Virtually eliminating duplicate and overpayments

With few opportunities for mistakes, reporting, cash flow analysis, and auditing are accurate and easier to manage.

Pro Tip: E-invoicing mandates are currently optional for UK B2B businesses. However, they are compulsory for public entities.

Learn what this means for your company in our e-invoicing guide.

4. Keep Records Tax-Ready for MTD and HMRC

Automation software integrates with Making Tax Digital (MTD) compatible ERP systems like NetSuite, Sage Intacct, and QuickBooks to reduce close cycles and improve record-keeping.

This is what the NetSuite integration looks like in Tipalti:

As part of HMRC’s plan to digitise the tax system and make tax returns simpler, UK businesses must:

- Keep digital records of your income and expenses.

- Prepare VAT returns using the information maintained in your records.

- Submit quarterly VAT and income tax data to HMRC (via a MTD compatible system).

The MTD initiative already applies to VAT-registered businesses and will be in place for all businesses by the 2026 to 2027 tax year.

Accurate records are crucial for accurate returns, as well as regulatory audits. For VAT purposes, you must keep all business records for at least six years. You may need to keep other records you use for tax purposes for longer.

HMRC can ask to see your records at any time, so details in your records must match those on incoming invoices. This includes:

- VAT numbers

- Line items and totals

- Supplier details

- Business ID numbers

- Dates

- Discounts

HMRC discovering an error before you’ve had a chance to report it can result in a penalty fine of up to 30% of potential lost revenue.

Using AP software to match invoices from capture to reconciliation gives you a clear audit trail. It also replaces slow manual searches with easy-to-find invoice data for resolving queries and internal analysis.

Pro Tip: If you run a platform selling or renting goods, services, or property, you must file reports to HMRC under DAC7 rules.

Learn more in our comprehensive DAC7 compliance guide.

What to Look For in an Invoice Management Automation Solution

Invoice management automation software should offer features to help AP teams optimise invoices from end to end.

Here are the key features to look for when choosing a tool and why they matter:

| AP Software Feature | Feature Benefits |

|---|---|

| AI-powered invoice capture | Eliminate manual data entry and improve data accuracy across e-invoice, PDF, and paper invoices. |

| Customisable workflows | Set up custom approval processes and rules that match your operational needs (e.g., single vs. multi-layer approval). |

| ERP and accounting system integration | Sync invoices for faster reconciliation, accurate records, and MTD compliance with native and API integrations. |

| Payment automation | Send fast, secure payments via BACS or SEPA, Wire, Global ACH, or PayPal in multiple currencies. |

| Built-in collaboration tools | Bring communication between suppliers, AP teams, and key stakeholders into a single platform to reduce bottlenecks and support data visibility. |

| Compliance with UK laws and regulations | Maintain accurate, easily accessible records in a system that supports VAT, e-invoicing, and MTD. |

| Data security protocols | Protect suppliers and users with features such as AES encryption, multi-factor authentication, role-based access, and GDPR safeguards. |

| Supplier management | Save time by allowing suppliers to easily onboard and set their own payment preferences. |

| Real-time monitoring and reporting | Consolidate spend management with user-friendly dashboards and insights for smart decision-making. |

The right AP software provider will seamlessly integrate with your current finance systems and replace the manual processes holding you back.

Use customer stories, reviews, and personalised demos to understand how a solution can benefit your business.

Case study: Outset Global Reduces AP Closing Time by 50% with Tipalti

UK-based pure-play trading solution Outset Global serves over 200 institutions with a team of 15 frontline traders. While the company continued to enjoy success, its reliance on manual invoice processing was creating bottlenecks and impeding growth.

Case Study: Outset Global Reduces AP Closing Time by 50% with Tipalti

UK-based pure-play trading solution Outset Global serves over 200 institutions with a team of 15 frontline traders. While the company continued to enjoy success, its reliance on manual invoice processing was creating bottlenecks and impeding growth.

A cost analysis showed its current AP and accounting functions were unsustainable:

You’re at a point where you can no longer grow without having to hire a ton of people or a team with the processes in place.

Cristina Escalante, Global COO, Outset Global

To overcome its challenges and improve efficiency, Outset Global implemented Tipalti accounts payable software, integrating it with QuickBooks for seamless invoice management.

The outcome? Complete accounts payable workflow automation and a 50% reduction in AP closing time. Plus, improved data flow and financial reporting to support strategic decision-making. The company hasn’t looked back:

Just do it. Don’t wait to implement this solution until you have to and then you’re firefighting. If you do a simple cost analysis, it’s a no-brainer.

Cristina Escalante, Global COO, Outset Global

Future Proof Your Invoice Management

As your business grows, manual invoice management processes start to interfere. What starts as extra work for AP teams can quickly spiral into payment delays and unreliable records that compromise supplier relationships and HMRC compliance.

Fortunately, the fix isn’t complicated. Investing in AP automation software eliminates manual data entry, routing, and reconciliation—so you can scale faster and work more efficiently.

Ready to optimise your accounts payable process? See how Tipalti’s Invoice Management solves manual stresses.