Forms 1099-NEC and 1099-MISC are IRS information return tax forms for payers to report non-employee compensation of at least $600 and other miscellaneous income and information.

Form W-9, prepared by the payee, furnishes their non-employee and other payee information, including TIN (taxpayer ID number), required by businesses to complete and file the relevant 1099 forms with the IRS.

The IRS uses Form 1099-NEC and Form 1099-MISC information by comparing them to a payee’s federal income tax returns for a tax year.

For specific miscellaneous information and amounts to report on IRS Forms W-9, 1099-NEC, and 1099-MISC, refer to the IRS instructions for each tax form.

What’s the Difference Between W9 Form & 1099 Form?

The main differences between W-9 and 1099 tax forms are that a W-9 is filled out by the independent contractor to provide their tax and payment information for the employer, whereas 1099 forms are provided by the employer to document the contractor’s earnings from that employer after business has been done, which is then used to file taxes.

Businesses use W-9 forms submitted by some U.S. suppliers and independent contractors to complete IRS forms 1099-NEC and 1099-MISC. W-9 forms are also required for other transactions besides reporting self-employed contractor income on 1099-NEC or 1099-MISC.

According to the IRS, a W-9 form is required from a payee for:

- “Income paid to you

- Real estate transactions

- Mortgage interest you paid

- Acquisition or abandonment of secured property

- Cancellation of debt

- Contributions you made to an IRA”

The payer receiving the W-9 form from the payee uses the payee’s information to complete a 1099 information return or other IRS tax form if required.

The above list for W-9s may not be all-inclusive but represents transaction examples requiring W-9 form submission to payers by payees.

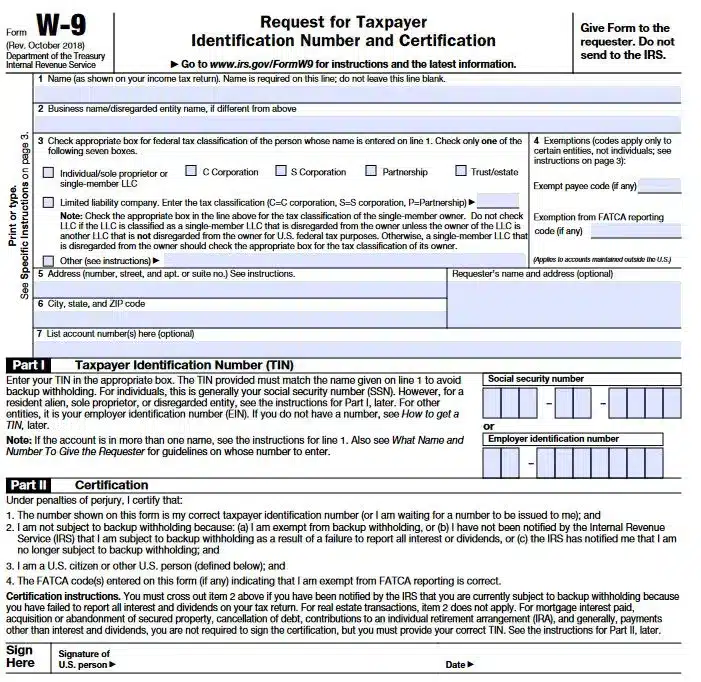

IRS Form W-9

The image of an IRS Form W-9 follows:

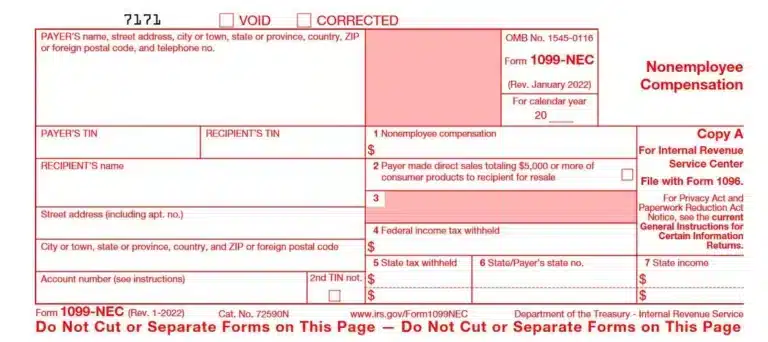

IRS Form 1099-NEC

The image of an IRS Form 1099-NEC for Nonemployee Compensation reporting by payer follows:

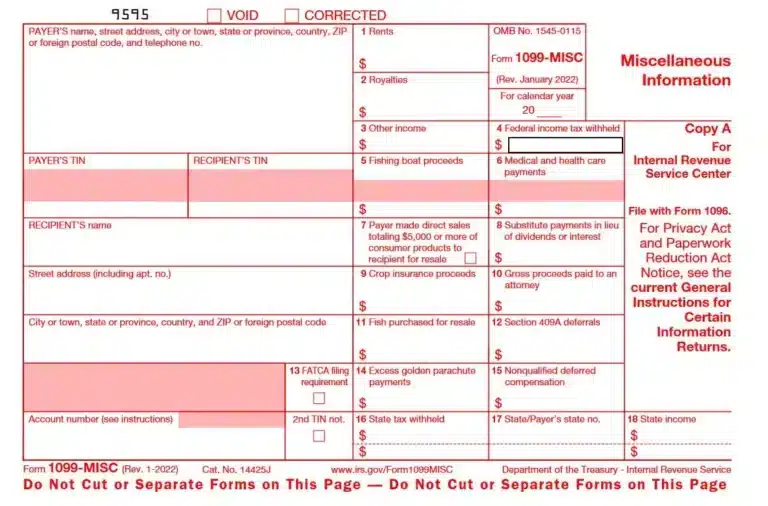

IRS Form 1099-MISC

The image of an IRS Form 1099-MISC for Miscellaneous Information reporting by payer follows:

Who Gets W-9 and 1099 Forms?

Certain suppliers like independent contractor small business owners that are U.S. citizens or resident aliens meet the qualifications for completing a W-9 form. Payees also submit W-9 forms to payers for other types of payments received for transactions requiring W-9 filing.

Payees submit a W9 that includes their taxpayer ID number (TIN) to the businesses from which they receive payments (payers). As their TIN, individuals may use a social security number (SSN) or an employer identification number (EIN) for form W-9. The IRS issues EIN numbers after approving applications for EIN.

Special rules in Parts I and II of the Form W-9 Instructions related to TINs and certifications apply to:

- disregarded entities

- resident aliens

- pending applications related to a request for taxpayer identification number and backup withholding rules.

A business paying independent contractor suppliers will complete Form 1099-MISC and the 1099-NEC form with total calendar year payments by category for each relevant supplier. In a Tipalti guide, we explain the use of IRS tax forms 1099-NEC vs. 1099-MISC.

Payers should file Form 1099-NEC (nonemployee compensation) for business payments to persons other than employees who have been paid at least $600 for services. Businesses also file 1099-NEC for cash payments for fish (or other aquatic life) purchased from anyone in the trade or business of fishing (fishing boat proceeds) and certain payments to an attorney.

And businesses file Form 1099-NEC if they have withheld any backup withholding for federal income tax.

Regarding who gets a Form 1099 and how to complete the forms, consult linked Tipalti articles related to Forms 1099-MISC and 1099-NEC or the IRS instructions for the forms.

Businesses submit 1099-MISC and 1099-NEC forms in batches to the IRS for payee federal tax verification purposes. Besides reporting payments to the IRS, companies or organizations send copies to the non-employee payees and tax authorities in states with income taxes.

Does your business comply with supplier tax requirements?

Download our “Executive Summary: KPMG on AP Tax Compliance” to learn about global supplier tax compliance rules.

Use AP automation software to automate global supplier payments tracking during the year using W-9 information submitted before the first payment, verify suppliers and TINs, reduce fraud, and make tax compliance more efficient.

What Constitutes an Independent Contractor?

An independent contractor is a self-employed worker offering business or professional services. The independent contractor is paid for results, not how and what work is performed. Independent contractors may be service professionals, like accountants or dentists, or perform project work as freelancers.

Contractor vs. Employee

An employer hires and pays W-2 employees via payroll and controls their work. The business tells employees what work to perform, how to perform it, and the need to follow company policies. If a self-employed individual doesn’t meet the requirements for an independent contractor, that individual may be reclassified by IRS as an employee.

On the IRS website, the Internal Revenue Service defines an independent contractor:

“The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. The earnings of a person who is working as an independent contractor are subject to Self-Employment Tax.

If you are an independent contractor, you are self-employed.

You are not an independent contractor if you perform services that can be controlled by an employer (what will be done and how it will be done). This applies even if you are given freedom of action. What matters is that the employer has the legal right to control the details of how the services are performed.

If an employer-employee relationship exists (regardless of what the relationship is called), you are not an independent contractor and your earnings are generally not subject to Self-Employment Tax.

However, your earnings as an employee may be subject to FICA (Social Security tax and Medicare) and income tax withholding.”

Independent contractors pay business taxes, including self-employment tax that is contractor tax equivalent in amount to the combined employer and employee share of payroll taxes on business income after tax deductions.

Does a 1099 Require a W2?

No. Form 1099 doesn’t require a W2. Although 1099 and W2 are IRS forms, 1099 requires a W-9 or comparable form (like W-8 from foreigners) instead of W2. 1099-NEC reports non-employee compensation. W2 is used to report employee compensation.

When to Request or Issue a W9 and 1099

In the case of an independent contractor supplier, it’s best to require the payee that will receive at least $600 for services income to submit a W9 form to the payer when initially onboarding (and definitely before receiving the first payment). The payer can deduct backup withholding from payment if required and have the W-9 on file in time to complete 1099 information returns by the deadline.

The contractor fills in Form W-9 by supplying the required contractor’s information, including their legal name, a taxpayer identification number, and contact information, and certifies that they are exempt from backup withholding and have provided accurate information, including their taxpayer identification number (TIN). The payer keeps W9 forms received but doesn’t file them with the IRS.

Besides providing instructions for payees completing form W-9, the IRS also offers Instructions for the Requester of Form W-9 on its irs.gov website.

According to the IRS instructions for the Requester of Form W-9, the payer should request Form W-9 from each U.S. person required to submit a W-9 to them. According to these IRS instructions:

“For federal tax purposes, a U.S. person includes but is not limited to:

- An individual who is a U.S. citizen or U.S. resident alien;

- A partnership, corporation, company, or association created or organized in the United States or under the laws of the United States;

- Any estate (other than a foreign estate); or

- A domestic trust (as defined in Regulations section 301.7701-7).”

Note that a foreign person, including a non-resident alien, may be required to complete a Form W-8 or other required information tax form issued by the IRS.

IRS Tax Deadlines for Forms W9,1099-NEC, and 1099-MISC

The IRS sets different information return deadlines for tax forms W-9, 1099-NEC, and 1099-MISC. When a tax deadline falls on Saturday, Sunday, or a legal holiday in the

District of Columbia or where the return is to be filed, the due date is the next business day.

Form W9 Tax Deadlines

The IRS doesn’t provide a deadline for submitting Form W-9. However, the payee should submit the W-9 before receiving the first payment. The payee needs to submit a W9 by the end of the year (on a calendar-year basis), so the requester can complete the 1099 forms and submit them to the IRS by the deadlines.

Form 1099-NEC Tax Deadlines

Form 1099-NEC is due on January 31, after the end of the calendar year for both paper and electronic filers. The PATH Act eliminated the option to file a 30-day extension for filing Form 1099-NEC.

Form 1099-MISC Tax Deadlines

Form 1099-MISC is due on February 28, after the end of the calendar year, but the deadline for electronic filers is March 31 instead.

Penalties for Forms W9 or 1099

Form W9 IRS Penalties

If required payees don’t submit a form W-9, they are not furnishing their tax ID number (TIN) to the requester. The penalty for not furnishing a TIN is $50 per occurrence unless it’s a case of reasonable cause rather than willful neglect.

Besides the $50 IRS penalty for failing to submit a TIN to a requester, the requester must deduct backup withholding of 24% from the payment and submit that tax withholding amount to the IRS.

The IRS regulations include a civil penalty of $500 when a W-9 filer provides false information that results in no backup withholding.

The IRS imposes criminal penalties for willfully falsifying certifications or affirmations. Criminal penalties include fines and prison terms for offenders.

Conversely, if a W-9 with a payee’s TIN is submitted to the requester, the IRS imposes penalties for requesters disclosing or misusing payee TINs as a violation of federal law. Penalties for requesters are civil and criminal.

Form 1099-MISC and Form 1099-NEC IRS Penalties

IRS penalties for information returns are the same for Form 1099-NEC and 1099-MISC.

IRS penalties assessed differ for large businesses with gross receipts of more than $5 million and non-federal government entities vs. small businesses with gross receipts up to $5 million. To measure gross receipts for 1099 information return penalties, use the average annual gross receipts for the most recent three taxable years.

For 1099 information returns due in calendar 2020, we show IRS penalties in the table below.

| Timelines for penalties | Penalty amount per return or statement | Maximum penalty amount |

| Large businesses (over $5 million gross receipts) and non-federal government agencies: | ||

| Not more than 30 days late | $50 | $556,500 |

| 31 days late to August 1 | $110 | $1,669,500 |

| After August 1 or not at all | $270 | $3,339,000 |

| Intentional disregard | $550 | No limitation |

| Small businesses (up to $5 million gross receipts): | ||

| Not more than 30 days late | $50 | $194,500 |

| 31 days late to August 1 | $110 | $556,500 |

| After August 1 or not at all | $270 | $1,113,000 |

| Intentional disregard | $550 | No limitation |

Use Form W-9 to Complete Forms 1099-NEC and 1099-MISC

Form W-9 is prepared by a required U.S. person, as defined by the IRS. We have included the IRS definition of a U.S. person. The U.S. person may be a sole proprietor with a legal form of sole proprietorship, corporation (including LLC), partnership, or estate or domestic trust.

Generally, an independent contract worker or freelancer who received at least $600 in compensation for services must file Form W-9. Some other transactions specified by the IRS also require filing a W9 form.

The payer receives W-9 forms (or W-8 or equivalent forms from foreign persons and non-resident aliens) from payees and keeps these W9 forms. W-9 forms may be either paper forms or electronic forms.

From the W-9 forms, the payer prepares information tax return Form1099-NEC (nonemployee compensation) and Form 1099-MISC (miscellaneous information). These 1099 tax forms include the business name, payee name, contact information, and required tax information.

The payer deducts 24% of the amount from a payee’s payment for backup federal income tax withholding when the payee is not exempt from the backup withholding. A payer files a 1099-NEC form for any amount of backup withholding taken during the tax year.

The payer submits a copy of the 1099 forms to the payee. The payer also sends a copy of the 1099s with a transmittal form as a tax filing to the IRS and states with income taxes.

Summary

A W-9 form is completed by each supplier, which may be a seller of goods or services from which your company purchases. IRS W9 forms provide name, contact information, and TIN information to the buyer paying for these goods or services. The payer uses supplier-submitted IRS W9 forms to prepare the required 1099 forms for their calendar year payments to achieve IRS tax compliance. To understand supplier tax compliance issues, get Executive Summary: KPMG on AP Tax Compliance.”