AP Automation for Educational Institutions

Keep operations lean by tracking cash flow in real-time, streamlining payments, and cutting costs. And we’ll help you stay compliant, too.

Education Features

Supercharge Finance and Scale Your Impact

Supporting research, programs, and student services requires automated workflows. Whether you support standard suppliers or 1099 contract workers, we’ll simplify and optimise your expense and procurement process—without having to add extra staff.

Cut Costs, Grow Admissions

Lean education operations are the key to growing your student community. Our automated AP solutions keep costs low, while also minimising errors.

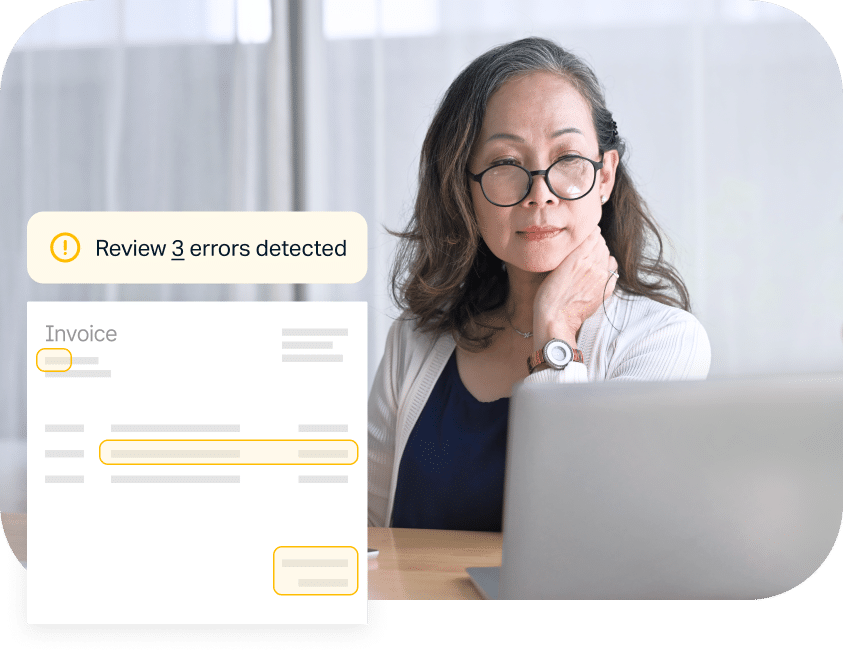

Automated Compliance

Digitally collect and verify payee VAT IDs across 49 countries. Collect data and produce DAC7 reports to eFile during tax season.

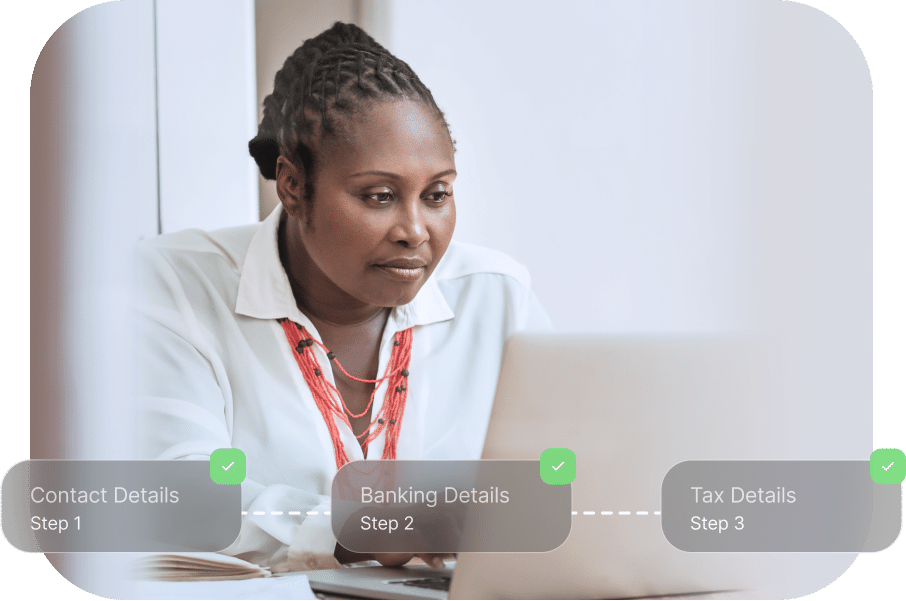

Personalized Onboarding

A user-friendly, customisable system for seamlessly bringing new suppliers on board.

Proactive Supplier Communications

Automated payment updates keep your instruction partners informed, minimising finance team calls.

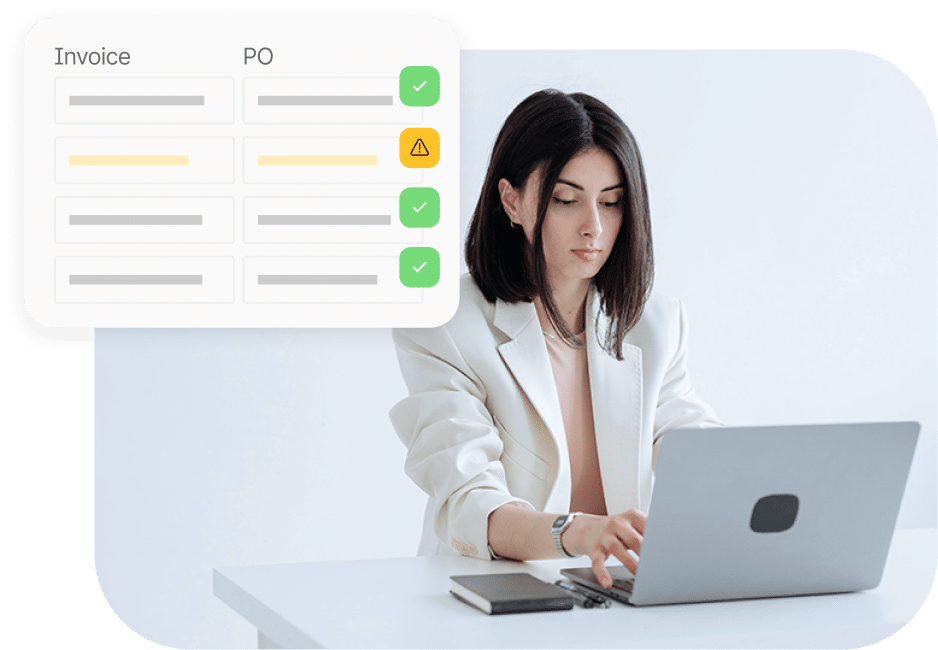

Stay on Top of PO Matching

Say farewell to overpayments. Two and three-way PO matching slashes waste, eliminates fraud, saves time, reduces bottlenecks, and ensures you’re audit-ready.

Pay Anyone, Anywhere

Pay suppliers in 200+ countries and territories using 120 currencies, and across 50+ payment methods in a matter of clicks, mitigating currency volatility risk.

Connect to Existing Systems

Connect other systems to your payments engine—including ERPs like NetSuite, Sage Intacct, Microsoft, and Xero, or accounting software.

Customer Stories

Don’t just take our word for it.

See what our education customers are saying.

How It Works

Up and Running in Weeks, Not Months

Collaborative customer support with personalised assistance to get you operational quickly.

Step 1

Plan

Kickstart your success with a comprehensive setup call that reviews your manual AP workflow, outlines the onboarding plan, validates technical configurations, and prepares for training.

Step 2

Configure

Tipalti’s implementation experts set up your hosted portal, create sample payment files, configure payment options and email integrations, and establish ERP integrations using our pre-built solutions.

Step 3

Deploy

In-depth training for AP staff on the Tipalti Hub and the end-to-end AP automation functionalities, ensuring thorough knowledge transfer to turbocharge your successful launch.

Step 4

Adopt

Support user adoption and change management during launch while guiding suppliers through onboarding. Once set, you’ll be ready to execute your first payment run and officially launch Tipalti.

Step 5

Optimise

Continued technical support by phone, and email. Our customer success team learns your goals and offers solutions to reach them

Integrations

Pre-Built ERP Connections to Extend Automated Workflows

Easily extend and simplify your workflows with pre-built integrations and powerful APIs for your ERPs, accounting systems, performance marketing platforms, HRIS, SSO, Slack, credit cards, and more.

Products

Everything you need to control spend

Tipalti’s connected finance automation suite ensures you get the visibility and control you need across accounts payable, global payments, and procurement to run your business more efficiently and drive growth.

Education Payment Solutions FAQs

What is AP automation for education?

AP automation for education uses technology to optimize and streamline the accounts payable processes within educational institutions. These systems automate tasks like invoice processing, payment approvals, and reporting. This reduces manual efforts while increasing efficiency.

Key components of an accounts payable automation system for the education sector include:

Invoice Processing and Data Capture

An AP automation solution for education should have optical character recognition (OCR) and other electronic tools to convert paper invoices into digital formats.

Accounts payable automation software also includes invoice approvals for financial processes. Then, invoices are routed to the appropriate parties based on custom rules preset for the approval process.

Payment Processing

A good system should also help AP teams facilitate payments through various methods, such as ACH, wire transfers, and virtual cards. This eliminates the need for paper cheques and helps strengthen vendor relationships through on-time payments.

Integration with Existing Systems

AP automation software seamlessly integrates with accounting software, ERP systems like SAP and Oracle, or specific educational management software.

Reporting and Analytics

Automation software gives the AP department real-time visibility into data on AP status, outstanding invoices, and payment histories. Detailed reports can be generated to analyse spend patterns and identify opportunities for cost savings.

How does AP automation improve efficiency in educational institutions?

AP automation will significantly improve efficiency in educational institutions by reducing manual tasks, streamlining processes, and enhancing accuracy. Here are the ways it will achieve these improvements:

Faster Processing Times

Through e-invoicing, educational institutions eliminate the need for paper-based invoices. Invoice automation also reduces the time spent on data entry.

Automated approval workflows and payment methods (like ACH transfers and virtual cards), will accelerate the payment process, ensuring suppliers are promptly paid.

Enhanced Accuracy and Reduced Errors

By reducing the need for manual data entry, AP automation minimizes the risk of human error. Automated systems can also apply validation rules to ensure that all required data is correct before processing.

Cost and Time Savings

Automation will reduce the cost per invoice (and processing costs in general) by reducing paper usage and eliminating manual handling. Staff are freed up to focus on higher-value tasks instead of repetitive data entry and manual processing, leading to increased productivity and cash flow.

Improved Transparency and Visibility

Stakeholders will have access to real-time data like payment schedules, invoice status, and financial metrics, leading to more informed decision-making. Automated systems are designed to generate detailed reports, providing insights into spend patterns and budget adherence.

Greate Compliance and Controls

Using an AP automation solution, every transaction is automatically logged. This provides a comprehensive audit trail that simplifies compliance and ensures policies are consistently applied. This reduces the risk of non-compliance.

Improved Supplier Relationships

Automated scheduling enables institutions to optimize payment timings, take advantage of early payment discounts, and avoid late fees. This helps to maintain good supplier relationships.

Certain systems, like Tipalti, can offer enhanced supplier management, including a self-service supplier portal for educational institutions. Vendors can electronically submit invoices and cheque on payment status, significantly reducing communication delays.

Can AP automation integrate with existing educational ERP systems?

Yes, AP automation can integrate with existing educational ERP systems. This is critical for ensuring a seamless data flow and maintaining consistency across various financial and administrative processes.

Here’s how AP automation integrates with educational ERP systems:

Data Import/Export

Batch processing allows data to be exported from an AP automation system and imported into the ERP system in batches, which can be scheduled to run at regular intervals. Using standard data formats like CSV, XML, or JSON ensures compatibility between systems.

APIs

Application Programming Interfaces (APIs) can enable real-time data exchange between the AP and ERP systems, ensuring that data is always relevant and up-to-date.

APIs also allow for custom integrations that can be tailored to specific workflows and requirements of the educational institution.

Direct Database Access

In some cases, the AP automation system and the ERP system may share a common database, allowing for direct data access and synchronization.

Middleware Solutions

Middleware and other types of integration platforms will facilitate the connection between the AP automation system and the ERP, streamlining data transfers and routing.

How can AP or payment automation help me manage 1099 contract workers, such as substitute teachers, consultants, or service providers?

Accounts payable automation can significantly streamline the management of 1099 contract workers, such as substitute teachers, consultants, and service providers. Here’s how:

Advanced Onboarding

Automation simplifies the onboarding process by collecting relevant tax forms and verifying contractor details. It also establishes a place where contractors can take control of their own data, cheque on payment history, and even set up notifications.

Efficient Invoicing

Automation leads to faster invoice processing with fewer mistakes. Contractors can submit invoices electronically, which are then automatically matched with the corresponding documents (like purchase orders, receipts, and inspection reports). You can also set up automated approval workflows to speed up the review process.

Tax Compliance

A business can use AP automation to simplify tax reporting and compliance. Automatically generate and send 1099 forms, track payments, and stay within regulatory compliance with the IRS and other global firms.

Timely Payments

AP automation can ensure timely and accurate payments, with scheduled payments and direct deposit. A business will use the system to notify contractors when payments are processed and when to expect the funds to drop.

Enhanced Reporting

Automation software gives companies better financial visibility and control. It tracks expenses and payments to contractors in real time and generates custom reports for insights into spending and budgeting. A business can also ensure compliance with detailed tax reports.

Reduced Administrative Burden

Free up time and resources with AP automation software that helps you manage all contractor-related tasks from a single platform. Minimize human errors through automated processes, reduce admin tasks, and eliminate extra paperwork.

AP and payment automation will significantly improve 1099 contractor management by reducing administrative workload, ensuring timely and accurate payments, and maintaining compliance with tax regulations. Choosing the right automation tools streamlines your processes and helps a business focus more on growth.

Recommendations