Tackle Tax Compliance Like a Pro

Our automated tax compliance solutions give you confidence and efficiency as your business scales across borders.

Tax Compliance Features

Cut Tax Risks and Automate Your Filing Process

Collect and validate—without the stress. With global tax capabilities, you can confidently navigate complex regulations and simplify your year-end process.

Be Fully Compliant and Slash Tax Risks

Tipalti’s tax solution simplifies the process and helps your company comply with tax provisions. You can require all payees to fill out tax forms or provide their VAT/local tax ID as part of self-registration on the Tipalti portal. You can rest easy knowing your payment operations are always up-to-date with the latest tax laws.

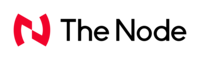

Digitise Tax Form Collection and Validation for Ease of Use

Tipalti’s guided tax form wizard helps suppliers choose the correct form based on country and business structure. Once the correct tax form is selected, Tipalti digitises documents and applies 1,000+ rules, to ensure the proper data has been provided. At year-end, Tipalti generates tax preparation reports and calculates any necessary withholdings.

- Tax IDs are collected digitally and optimised for electronic signatures

- Verification ensures tax information is complete and helps protect from tax penalties

Go Global With International Tax Capabilities

For non-US payers, local and VAT tax ID collection is available. For European countries, we also support document collection so payees can provide additional information when needed and self-billing invoices where payees must approve invoices before payments can be processed.

- Collecting and validating local & VAT tax IDs in 60+ countries.*

- Built-in tax engine validates against 3,000+ rules to help prevent ID errors and issues.

*Supported countries are: Argentina, Australia, Austria, Azerbaijan, Brazil, Bulgaria, Canada, Chile, China, Colombia, Costa Rica, Croatia, Cyprus, Czech Republic, Denmark, Dominican Republic, Estonia, Finland, France, Germany, Greece, Honduras, Hong Kong, Hungary, India, Indonesia, Ireland, Israel, Italy, Japan, Kuwait, Latvia, Lithuania, Luxembourg, Malta, Malaysia, Mexico, Netherlands, New Zealand, Paraguay, Peru, Philippines, Poland, Portugal, Romania, Russia, Saudi Arabia, Singapore, Slovakia, Slovenia, South Africa, South Korea, Spain, Sweden, Switzerland, Thailand, UAE, Ukraine, United Kingdom, Uruguay, Vietnam.

Simplify Your Tax Filing

Save time and improve efficiency with our e-filing integrations. Give your team the tools they need to avoid the end-of-year crunch and get your tax filings completed and out the door before deadlines.

DAC7 Tax Rules for Digital Platforms

Tipalti collects the necessary payee data, executes your global payments, and produces tax preparation reports to save you time complying with the EU’s DAC7 reporting obligations for digital platforms.

DAC7 features can be enabled alongside Tipalti’s IRS and international tax capabilities for seamless multijurisdictional tax compliance in a single solution. The solution is also suitable for compliance with the UK Platform Operators Regulations.

Integrations

Pre-built connections to extend automated workflows

Easily extend and simplify your workflows with pre-built integrations and powerful APIs for your ERPs, accounting systems, performance marketing platforms, HRIS, SSO, Slack, credit cards, and more.

Customer Stories

Don’t just take our word for it,

see what our customers are saying

Transparent, Scalable Pricing

Our flexible pricing adapts to businesses of all sizes. Pay only for what you use—no extra costs, no client-based fees. Simple, predictable, and budget-friendly.

Industries

Deep industry expertise,

tailored to your needs

Adtech

Pay publishers, affiliates, writers, and content creators anywhere in the world.

Affiliate and Influencer Networks

Send cross-border payments to your global ad network. Scale globally with multi-brand and multi-language capabilities.

Gaming

A white-label, scalable, automated solution for a seamless, secure and reliable payment experience that makes both you and your gamers happy.

Gig Economy

Freelancers can log into your custom web portal to make tax compliance a breeze.

Music Royalties

Our fast, secure, cost-effective payments help you attract and retain the best talent and improve the quality of your network.

Video Media

Pay your creators effortlessly with our automated solutions. No more delays, errors, or high fees—just smooth and secure payments.

Get Up and Running in Weeks, Not Months

Book a demo to get started today and take control of your finance operations with Tipalti.

Tax Compliance FAQs

What types of tax obligations stem from payments to suppliers, contractors and other types of payees?

Payments to suppliers, contractors, and other types of payees or partnerships come with a variety of tax obligations, which differ depending on factors like the payee’s status, the nature of the services, and the country in which the transactions take place.

The following are some of the key tax obligations that businesses may need to consider when making payments to these entities:

Withholding Taxes

For suppliers and contractors, companies may be required to withhold a portion for tax purposes. Tax codes will differ based on the region and tax compliance processes.

- Independent Contractors: For domestic workers, organisations may have to report payments for services provided. However, direct withholding is not typically required.

- Non-Resident Withholding Tax: Payments to foreign contractors may trigger withholding tax obligations from that region’s tax department. This process ensures that taxes are collected from non-residents who earn income within a country.

Goods and Services Tax (GST), Sales Tax, and Value-Added Tax

When making payments to suppliers, companies may be obligated to pay or collect consumption tax. Regulations include:

- Sales Tax: For U.S. businesses, sales tax must be paid on the purchase of certain goods and services. Typically at the point of sale.

- GST/HST: In Canada, companies may be required to pay the Goods and Services Tax.

- VAT: In Europe and other regions, businesses may need to charge VAT on sales and remit it later on.

Cross-Border Payments and Transfer Pricing

Payments to foreign suppliers may trigger cross-border tax obligations. This trigger is especially the case concerning transfer pricing rules.

- Transfer Pricing: Payments between related entities in different countries must adhere to certain principles to prevent profit shifting. Transfer pricing ensures appropriate taxation in each tax jurisdiction, keeping tax authorities happy.

- Tax Treaties: Double taxation treaties between two countries may reduce withholding tax rates or clarify which country has taxing rights over specific payments.

What are the benefits of automated tax compliance?

Automated tax compliance offers several benefits. It streamlines the complex and time-consuming tasks involved in complying with tax regulations. Below are just a few:

Reduced Errors and Increased Accuracy

Automated tax SaaS helps eliminate spreadsheets and manual data entry. The software can also automatically update tax rates and rules more accurately to validate tax data.

Time and Cost Efficiency

Automation speeds up repetitive tasks and reduces labour costs. Cloud-based tax technology also enables businesses to manage an increasing volume of transactions and e-invoicing without spending more money.

Simplified Compliance

For organisations that operate in multiple regions, tax software can manage the various local and international laws for when you file returns. It will automatically apply the correct rates depending on the jurisdiction, reducing complexity.

Improved Reporting

Automated tax compliance software can generate real-time reports, providing greater insights into tax liabilities, payment statuses, and upcoming deadlines. All tax-related data is centralised and easily accessible. Some programmes might also offer certificate management for exemption certificates.

Additional Benefits

- Enhanced regulatory compliance

- Reduced risk of penalties

- Seamless integration with ERPs and financial systems

- Better cash flow management

- Customisation and scalability

How does Tipalti support IRS-compliant tax reporting at year-end?

Tipalti supports IRS-compliant tax reporting at year-end by automating collecting, validating, and filing tax forms. This ensures businesses comply with U.S. tax regulations, reduce manual errors, and avoid penalties.

Here’s how Tipalti facilitates IRS-compliant tax reporting:

Automated Tax Form Collection

Tipalti automatically collects the right tax forms (e.g., W-8, W-9) from suppliers, contractors, and other payees during onboarding. The system determines the correct form to collect based on the payees’ country of residence and tax classification.

Validation of Tax Data

Tipalti integrates with the IRS’s Taxpayer Identification Number (TIN) matching service. The TIN matching service integration helps validate the accuracy of the TINs provided by U.S. payees. It also ensures that the tax identification numbers submitted are correct, reducing the risk of mismatches that could trigger IRS penalties.

Year-End Tax Form Generation

At the end of the year, Tipalti generates IRS-compliant tax forms, including:

- Form 1099: For reporting payments to U.S. individuals and contractors.

- Form 1042-S: For reporting payments made to foreign entities or individuals subject to withholding.

IRS E-Filing

Tipalti is a compliance platform that can electronically file forms directly with the IRS, reducing the need for manual tax return filing. Our solution streamlines the workflow of submitting the required forms, ensuring compliance with IRS deadlines.

Additional Ways Tipalti Supports Year-End Filing

- Batch filing for bulk tax forms

- Automated withholding calculations

- Apply relevant tax treaty benefits

- Compliance alerts and notifications

- Global tax compliance

How does Tipalti handle tax form validation and verification?

Tipalti handles tax form validation and verification by automating the collection, validation, and verification process for various tax forms. The validation ensures that the data provided by payees is compliant with tax regulations.

Here’s how:

Real-Time Validation

Tipalti validates the data provided by payees in real time. As payees fill out their tax forms, the system checks the data for completeness and correctness, reducing the chances of missing or inaccurate details that could lead to compliance issues.

Automated Tax Form Collection

The system collects the necessary tax forms from suppliers and other payees during onboarding. Based on the payee’s residency and tax classification, Tipalti determines the type of tax form they will need to complete.

Error Notifications

It automatically flags the issue if the system detects invalid or incomplete data, such as incorrect or missing information on a tax form. These notifications prompt the payee or the AP team to correct the information before payment processing.

Withholding Tax Calculations

Based on the verified tax data, Tipalti will automatically calculate the applicable withholding tax rate for payees. This includes applying the correct rates for reporting. Tipalti applies withholding taxes for international payees based on the relevant tax treaties.

Additional Ways Tipalti Handles Tax Validation

- Securely store all tax forms and verification data

- Comprehensive audit trail of all tax form submissions

- Any required withholding taxes are applied according to tax authority guidelines

How does Tipalti support with DAC7 tax reporting requirements in the EU?

Tipalti collects the necessary payee data, executes your global payments, and produces tax preparation reports to save you time complying with the EU’s DAC7 reporting obligations for digital platforms.

DAC7 features can be enabled alongside Tipalti’s international tax capabilities for seamless multijurisdictional tax compliance in a single solution. The solution is also suitable for compliance with the UK Platform Operators Regulations.

Recommendations