For mid-market companies that pay creators, affiliates, and gig workers—or handle supplier invoices across EU entities—managing VAT on cross-border payouts is a significant challenge.

As operations expand across more EU markets, maintaining accurate and properly documented payout data becomes increasingly challenging. Even well-run finance teams struggle to maintain consistent records, track evolving requirements, and produce documentation that withstands regulatory review.

This guide explains what EU VAT compliance means for businesses handling mass payments, and how automation tools like Tipalti make it easier to stay compliant and audit-ready at scale.

Key Takeaways

- VAT compliance is the process of applying the correct tax treatment to payouts made across EU countries.

- Non-compliance creates significant risk for companies handling mass payments, including penalties, delayed payouts, and added scrutiny from tax authorities.

- Cross-border payouts increase this risk because VAT obligations vary by jurisdiction and can change over time, making it harder to treat each payout correctly at scale.

- Automation platforms like Tipalti support mass-payment operations by validating VAT information, applying the correct treatment for each payout, and creating compliant e-invoices that help finance teams stay accurate and audit-ready.

What is EU VAT Compliance?

Value Added Tax (VAT) is an indirect tax applied to most goods and services across the European Union. Registered businesses are responsible for charging VAT on eligible transactions and recording the VAT they pay on their purchases.

EU VAT compliance involves applying the correct VAT treatment to payments, maintaining accurate transaction records, and fulfilling each country’s specific filing and documentation requirements. These obligations vary by market, so companies must follow the rules of every jurisdiction where they make payouts.

The challenge isn’t only the tax rules themselves. It’s the growing administrative burden of maintaining complete, accurate, and aligned payout data with each market’s expectations.

When companies issue hundreds or thousands of cross-border payments each month, manual checks, rate application, and invoice generation quickly become unmanageable.

Note: The European Commission is modernising EU VAT through its reform initiative, VAT in the Digital Age (ViDA), which will introduce new e-invoicing and real-time tax reporting standards. These changes will significantly increase the volume and frequency of VAT data companies must submit, making well-structured, automated records even more important.

Common VAT Compliance Obligations

Companies in the EU must stay up-to-date with several recurring VAT requirements. Here’s what compliance involves at a high level:

| VAT Obligation | What it Involves |

|---|---|

| Registration | Submitting the required documentation to legally account for VAT after reaching the registration threshold specified by the local authority. |

| Reporting and filing | Submitting accurate VAT returns—typically on a monthly or quarterly basis—that reflect all taxable transactions. |

| Record-keeping | Maintaining detailed, audit-ready transaction records to support VAT filings and potential refund claims. |

| Cross-border considerations | Applying the correct VAT rates and reporting obligations for intra-EU and non-EU transactions. |

Managing these obligations helps companies maintain consistent VAT processes across different markets.

Why EU VAT Compliance Matters for Mid-Market Companies

For mid-market companies operating across Europe and beyond, global VAT compliance is a core part of doing business.

Cross-border transactions between EU countries trigger additional VAT obligations, while payments to non-EU countries bring about further regulatory requirements.

Different types of payees come with varying VAT obligations and risks. The table below highlights common scenarios companies encounter when making mass payments across the EU.

| Payee Type | Typical VAT Status | Common Compliance Risk |

|---|---|---|

| Freelancers/contractors | Often VAT-registered, usually in the home country | Misclassification, incorrect VAT rate, reporting errors. |

| App or content creators | Often VAT-registered, usually in the home country | Applying wrong country’s VAT, missing registration requirements. |

| Affiliate marketers | VAT-registered or individuals | Under or over-charging VAT, inconsistent reporting. |

| Gig workers (e.g., delivery drivers) | Often not VAT-registered | Assuming VAT exemption incorrectly results in manual reconciliation errors. |

When a company scales across European markets, compliance becomes more demanding. For example, a business paying 800 creators across France, Germany, and Spain faces multiple VAT rule sets, thresholds, and mixed registration statuses.

Failing to comply with EU VAT rules isn’t simply a paperwork issue. It can have real business consequences. Non-compliance can lead to financial penalties, the risk of VAT fraud, and increased scrutiny from tax authorities.

For mass-payment operations, even a single misclassification can impact large volumes of payouts, distorting reports and increasing audit exposure.

Understanding VAT Obligations Across Jurisdictions

Each EU member state maintains its own VAT system, with specific rates, thresholds, and exemptions.

Here are three key obligations mid-market businesses paying creators, freelancers, or partners across Europe need to manage across jurisdictions.

1) VAT Registration Across EU Member States

Companies must register for VAT in every country where they have taxable activities. They may also need to obtain a VAT number for that jurisdiction. For example, a company in France charging VAT to a company in Austria may need to obtain an Austrian VAT number.

For cross-border payments, the requirement to register for VAT in another country typically depends on the location of the payee’s establishment. It also depends on that country’s threshold for VAT registration: the amount of turnover that requires a business to register for VAT and start following the rules.

Note: Companies in non-EU countries that make taxable supplies in an EU country may need to appoint a fiscal representative to register for VAT there. A fiscal representative is a local agent responsible for handling the VAT registration process with the relevant tax authorities.

2) EU VAT Rates, Exemptions, and Special Rules for Digital Services

Each EU member state sets its own standard VAT rate, reduced rates, and exemptions for specific goods and services.

For example:

| VAT Treatment | Typical Use Cases |

|---|---|

| Standard rate | Usually applies to most professional services (e.g., design, consulting, or software development). |

| Reduced rate | May apply to certain goods and services, such as books, online publications, or cultural events. |

| Exempt from VAT | May cover sectors like education and healthcare. |

To apply VAT correctly for mass payouts, companies must determine the right rate for each payee based on their country and type of service.

Digital services follow additional rules depending on the payee’s location and volume of sales, with an EU-wide threshold of €10,000 for total cross-border sales:

- If sales fall below this threshold, EU digital service providers can apply their home country’s VAT rules.

- If their sales exceed the threshold, they must register for VAT in the EU and follow the destination country’s rules.

Companies distributing digital content or affiliate commissions can use the EU VAT One Stop Shop (OSS) scheme to simplify reporting and manage EU-wide VAT from a single registration.

For example, an app platform paying developers in France, Germany, and Spain can use the OSS scheme to report VAT for all three countries through one central filing, reducing administrative work and helping ensure correct VAT treatment for each payout.

3) VAT Returns and Reporting

Once VAT is collected, registered businesses must file periodic returns—typically monthly or quarterly—that accurately summarise all their taxable transactions. These VAT reporting obligations also differ depending on the country and the nature of the transaction.

Businesses that trade goods above certain thresholds within the EU are also required to make Intrastat declarations, which track goods or digital services traded between member states.

Because these filings rely on detailed transactional data, compiling VAT information manually across hundreds or thousands of payees becomes time-consuming and prone to errors, increasing the risk of penalties and audits.

Make EU VAT Compliance Effortless for Mass Payouts

Tipalti centralises EU VAT compliance for mass payments, automating validation, reporting, and e-invoicing. Scale without complexity and ensure audit-ready operations without increasing headcount.

6 Common VAT Compliance Challenges for Mid-Market Companies

Failing to comply with VAT obligations can have serious legal, financial, and reputational consequences for mid-market companies making high-volume payments. Manual processes don’t scale, and mistakes can result in serious repercussions.

Here’s how Tipalti addresses the most common challenges of EU VAT compliance.

1) Navigating Cross-Border VAT Across the EU and Beyond

When creators, freelancers, or digital service providers sit across multiple markets, finance teams have to keep track of several tax rule sets at once.

For example, a digital marketing platform paying affiliates in the UK, Germany, and France must apply different VAT treatments based on each payee’s location and taxable status as a business or individual.

Software with multi-jurisdiction support like Tipalti simplifies the requirements of cross-border VAT by automating registration tracking, rate calculations, and tax record management.

2) Misclassification and Inaccurate Reporting

Misclassifying a payee can result in under- or overpayment of VAT, as well as inaccuracies in VAT reporting. Common errors include:

- Treating a VAT-registered freelancer as exempt, such as assuming VAT shouldn’t be applied to their payments when the freelancer is actually registered in their country.

- Applying a reduced rate instead of the standard rate, such as charging a reduced rate for goods or services that should incur the standard VAT.

- Misclassifying digital services, such as failing to apply the rate of VAT in the payee’s country for SaaS, streaming, or other online services.

For companies handling thousands of payments manually, these classification mistakes become increasingly likely.

To simplify validation, Tipalti automatically flags invalid VAT IDs, applies the correct tax treatment, and generates consistent reports for each jurisdiction.

This type of automation saves time and reduces the risk of discrepancies in VAT reporting.

3) Handling VAT Refunds Across Multiple Jurisdictions

Businesses that overpay VAT or incur deductible VAT in multiple countries must claim refunds through each tax authority. However, the manual refund tracking process is slow, error-prone, and poses the risk of missed deadlines.

Tipalti streamlines VAT refund management by consolidating documentation and tracking claims across countries. It centralises cross-border VAT refund processes and provides real-time claim tracking.

Consider a mid-market digital marketing company that overpays VAT on hundreds of affiliate payments across Spain, Germany, and Poland.

Claiming refunds manually usually involves:

- Submitting documentation to multiple tax authorities

- Tracking multiple deadlines

- Reconciling hundreds of transactions

With Tipalti, the company tracks and documents VAT refunds centrally, ensuring the business completes its cross-border claims accurately and on time.

4) Manual Tracking of Transactions and VAT Obligations

High-volume payout operations generate large amounts of VAT-related data. When records are scattered across systems or spreadsheets, inconsistencies can appear and complicate reporting. It can also make preparing accurate VAT returns a challenge.

Automation platforms provide a solution by offering end-to-end visibility of VAT transactions. Tipalti automatically tracks VAT amounts for each transaction and maintains digital records for audits. It also integrates with ERP systems and accounting software like QuickBooks and Xero for real-time updates.

This helps teams maintain reliable VAT records without relying on time-consuming, manual reconciliation.

5) VAT Challenges for Digital Services and E-Commerce Models

New EU requirements under ViDA introduce real-time reporting and e-invoicing obligations for digital platforms such as app stores, marketplaces, and creator platforms. Attempting to manage these requirements manually could lead to errors and breaches in VAT compliance.

To reduce this risk, use a platform that incorporates new digital service VAT rules automatically as regulations evolve. For example, Tipalti supports VAT scenarios for digital services, automatically applying location-based rates and issuing compliant invoices for each transaction.

This functionality ensures payouts to all digital service providers in the EU are fully compliant, from game developers in Italy to live streamers in Spain.

6) VAT Fraud Risks and Managing Local Tax Authorities

High-volume, cross-border payments can expose companies to VAT fraud risks, including false VAT registrations or inaccurate declarations from external partners.

When tax authorities identify discrepancies, they may request additional documentation or launch audits. Responding to these reviews requires complete and accessible records.Tipalti’s real-time monitoring and reporting tools help detect irregularities early, flag suspicious transactions, and ensure complete audit trails.

This automation ensures finance teams can respond quickly when tax authorities request information.

How Compliance Automation Like Tipalti Streamlines VAT Compliance

As payout volume grows across multiple EU countries, VAT compliance becomes increasingly complex. Automation simplifies that workload and reduces the effort required from finance teams.

Here are some of the ways Tipalti strengthens and streamlines EU VAT compliance.

Automated VAT Calculation and Validation

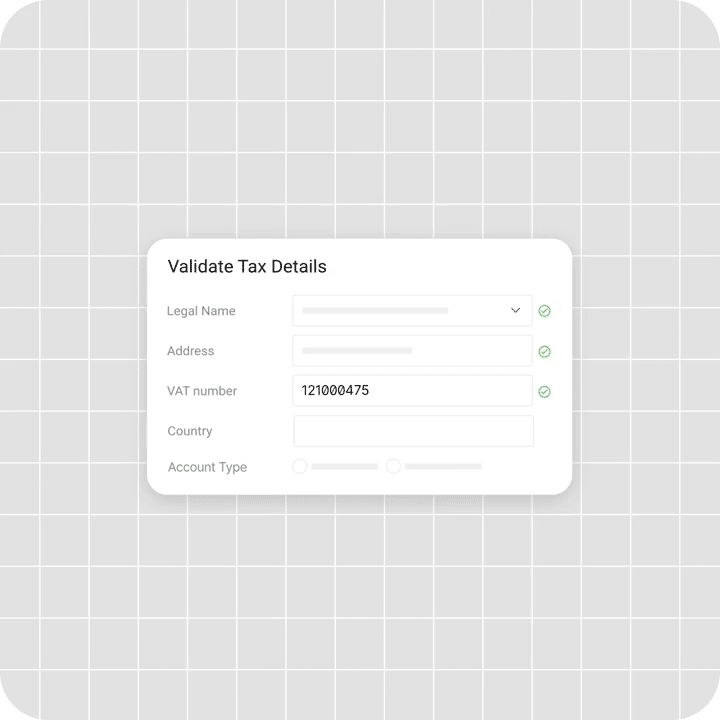

Tipalti’s Tax Form Scan Agent embeds VAT logic directly into the platform’s mass payout workflows.

It automatically calculates VAT and validates payee tax information for outbound payments across the EU, covering more than 60 countries, including UK VAT numbers.

When paying creators across several EU countries, this prevents common mistakes such as applying outdated rates or accepting invalid VAT details. These errors create inconsistencies in VAT reports if they aren’t caught early.

By validating VAT details at onboarding and payout, Tipalti helps companies maintain accuracy throughout the entire payment cycle.

Key benefits include:

- Correct VAT treatment applied upfront

- Fewer classification and ID-validation errors

- Clean, reliable VAT data flowing into reports

Before processing payments, Tipalti’s tax engine validates each payee’s VAT status and applies the correct rate based on their jurisdiction, cross-referencing 3,000+ rules to do so.

Multi-Jurisdiction Support for Global Operations

Tipalti’s Tax Form Agent handles VAT rules across countries so mass payments scale globally while remaining compliant. For teams that pay creators or partners across multiple jurisdictions, staying aware of each rule change requires constant monitoring. Tipalti supports this by centralising VAT logic for all supported countries and updating it as regulations evolve.

By automatically applying the right treatment to every payout, Tipalti removes the need to track changes manually and ensures payouts follow the latest requirements—whether there are hundreds or thousands per cycle.

Streamlined E-Invoicing and Record-Keeping

High-volume payout models require thousands of compliant invoices and receipts each month, all of which must meet the standards of different local tax authorities.

Consider a European app platform paying 1,200 developers across Italy, France, and the UK. The company must generate compliant invoices for every payout, and each country has different requirements for invoice content, VAT rates, and reporting formats.

Handling this manually slows down payments and leaves the company vulnerable during audits if invoices are missing or incomplete.

Tipalti’s Invoice Capture Agent produces VAT-compliant e-invoices automatically and maintains a complete digital audit trail. This removes the risk of missing or incomplete documents and ensures companies always have accurate records.

This means:

- Every payout generates a compliant e-invoice or receipt

- Digital records are stored in Tipalti for audit-ready reporting

- Real-time dashboards provide full visibility into VAT liabilities across all payees

The functionality creates transparency for companies, payees, and regulators, while reducing manual work for finance teams.

Simplified VAT Reporting and Filing

Preparing VAT filings requires complete, well-structured data. When information sits across multiple systems and jurisdictions, compiling accurate reports can take weeks.

Tipalti’s Reporting Agent consolidates VAT-related data into a single source of truth and produces ready-to-file VAT reports automatically. Teams can file VAT returns faster and respond to audit requests more efficiently.

Outcomes include:

- Faster mass payouts with full compliance

- Lower risk of report inconsistencies

- Real-time visibility into VAT data baked into transactions

As a result, companies can scale operations globally, pay thousands of external partners efficiently, and maintain complete confidence in VAT reporting.

Customer Story: Automation Helps ITB-MED Manage Cross-Border Compliance

For European medtech company ITB-MED, processing supplier invoices and payments across several countries was slowing down day-to-day finance work. The team needed a way to manage growing operational demands without adding more headcount.

By implementing Tipalti and its ERP integration with NetSuite, ITB-MED was able to automate its accounts payable and procurement workflows end-to-end.

The results included:

- 500 hours saved annually

- 90% fewer errors

- A month-end close reduced from 30 days to 15

ITB-MED’s experience shows how greater process automation can free up finance teams to focus on higher-value work while maintaining reliable records across markets.

Tipalti has made our team think differently about scaling finance. It gives us confidence that we can support business growth without increasing headcount at the same pace. We now think strategically rather than just trying to keep up.

Anna-Karin Lindblad, Associate Director of Finance and Treasury, ITB-MED

Manage EU VAT Compliance More Efficiently With Tipalti

Handling VAT on mass payouts within the EU and beyond can be both complicated and overwhelming. VAT requirements change, payout models grow, and finance teams need systems they can depend on. Tipalti enables companies to keep pace with growth by integrating VAT processes directly into their payment operations and providing a clear view of their VAT position across all markets.

Instead of piecing together information from different sources, finance teams get organised records, consistent treatment, and a workflow that supports scale.

If you’re looking for a more predictable, manageable way to handle EU VAT, explore how Tipalti’s automated VAT and tax solution helps your team stay in control as payout volumes expand.

EU VAT Compliance FAQs

In the EU, is VAT a type of sales tax?

No. VAT is a type of indirect, consumption tax collected at each stage of the supply chain. Sales tax is only charged at the point of sale.

What’s the difference between local and international VAT obligations?

Local VAT rules apply within a single EU member state, while international VAT obligations are triggered by cross-border transactions.

Companies making mass payouts to freelancers, affiliates, or creators in multiple countries must follow both local and international rules to be compliant.

Do companies need to charge VAT on all payments to international payees?

Not always. The question of whether you should charge VAT depends on the payee’s location, registration status, and the type of service they provide.

Automation tools like Tipalti help determine the correct treatment for each payout.