Check Out the Future of Retail Payables Automation

Handle complex payment flows effortlessly, freeing you to focus on delivering exceptional retail experiences and driving business growth without the headaches of manual processes.

E-commerce Features

Automated Workflows From Start to Finish

With solutions that span accounts payable, mass payments, procurement, and expenses, we can help you manage global supplier payments, enforce compliance, and scale supplier operations without adding headcount.

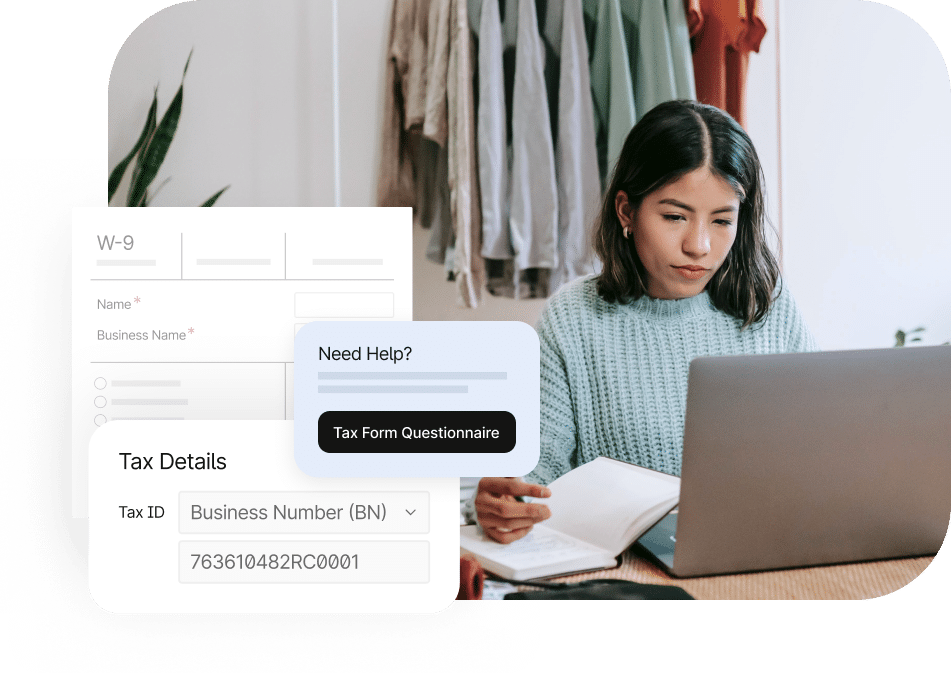

Hassle-Free Tax Processes

Digitally collect and verify payee VAT IDs across 49 countries. Collect data and produce DAC7 reports to eFile during tax season.

Lightning-Fast Payments

Quick and easy payments across 200+ countries and territories in 120 currencies and 50+ different payment methods. Proactively eliminate payment errors with 26,000+ built-in rules.

Personalised Onboarding

Our fully customisable, self-service onboarding system is designed to provide a user-friendly experience for vendors.

Simplified Multi-Entity Payables

We make it easy for businesses with multiple subsidiaries and units to manage their accounts payable by providing a single, unified platform.

Never Miss an Invoice

Process more invoices in less time using OCR. Our automated alerts and notifications inform stakeholders about pending approvals and due dates.

Customer Stories

Don’t just take our word for it,

see what our e-commerce and retail customers are saying

How It Works

Up and Running in Weeks, Not Months

Collaborative customer support with personalised assistance to get you operational quickly.

Step 1

Plan

Kickstart your success with a comprehensive setup call that reviews your manual AP workflow, outlines the onboarding plan, validates technical configurations, and prepares for training.

Step 2

Configure

Tipalti’s implementation experts set up your hosted portal, create sample payment files, configure payment options and email integrations, and establish ERP integrations using our pre-built solutions.

Step 3

Deploy

In-depth training for AP staff on the Tipalti Hub and the end-to-end AP automation functionalities, ensuring thorough knowledge transfer to turbocharge your successful launch.

Step 4

Adopt

Support user adoption and change management during launch while guiding suppliers through onboarding. Once set, you’ll be ready to execute your first payment run and officially launch Tipalti.

Step 5

Optimise

Continued technical support by phone and email. Tipalti customer success team learns your goals and offers solutions to reach them.

Integrations

Pre-Built ERP Connections to Extend Automated Workflows

Easily extend and simplify your workflows with pre-built integrations and powerful APIs for your ERPs, accounting systems, performance marketing platforms, HRIS, SSO, Slack, credit cards, and more.

Products

Everything you need to control spend

Tipalti’s connected finance automation suite ensures you get the visibility and control you need across accounts payable, global payments, and procurement to run your business more efficiently and drive growth.

Get Up and Running in Weeks, Not Months

Book a demo to get started today and take control of your finance operations with Tipalti.

Ecommerce Payment Solutions FAQs

What is retail accounts payable automation?

Retail accounts payable automation is an advanced technology used to streamline and manage a retailer’s AP process. Capabilities include automating the tasks involved with paying money owed to suppliers for goods or services purchased on credit.

An AP automation solution helps retailers improve cash flow, drive efficiency, reduce manual data entry, and avoid late payments.

Smart AP automation software offers the following modules:

Invoice Automation

Invoice data is captured electronically through optical character recognition (OCR). The AP department can also facilitate invoice capture through electronic data interchange (EDI) or email.

During the touchless process, the system will pull all relevant data, such as invoice number, date, amount, descriptions, etc. Invoice management often takes advantage of advanced tools like artificial intelligence and machine learning. Enabling finance teams to better automate accounts payable.

PO Matching

Accounts payable automation software for retail can perform PO matching. This is where automation matches the supplier invoice with the corresponding purchase order and other relevant documents, like a shipping receipt or inspection report (3-way matching and 4-way matching).

Approval Workflow

AP automation systems will also mechanize the invoice approval process, quickly routing invoices to the appropriate parties based on pre-defined rules and thresholds. This helps eliminate the time-consuming manual process of approving paper invoices.

Payment Processing

Once invoices are approved, an AP automation platform can schedule and process payments automatically using various methods, such as wire transfers or ACH. This helps businesses make timely payments, take advantage of early payment discounts, and significantly reduce processing times.

Reporting and Analytics

AP software solutions do more than process invoices. This technology can use artificial intelligence to report on trends and provide real-time visibility into the supply chain. Advanced reporting can identify disruptions, potential savings, and areas for improvement, significantly adding to your bottom line.

Vendor ManagementSuccessful AP systems for the retail industry can also empower suppliers with a portal that offers a self-service dashboard. Here, vendors can update their tax details, upload current invoices, and check on statuses, all without one call to the AP team.

How can I implement accounts payable automation in my retail business?

Implementing an accounts payable automation system for your retail business can significantly enhance efficiency, improve financial management, and boost profitability. Here are a few quick steps to follow:

Step 1: Assess Current Needs

Document your ongoing AP processes, identifying inefficiencies, bottlenecks, and error-prone areas or formats. Understand the current challenges and processing costs.

Step 2: Set Clear Goals

Determine precisely what you want to achieve by implementing an AP automation solution for retail. This can include enhancing supplier relationships, strengthening the audit trail, improving accuracy, or building working capital.

Establish clear key performance metrics (KPIs) to measure the success of automation on your manual tasks.

Step 3: Choose the Best Solution

Evaluate features based on integrations, cost, and scalability. Request demos and free trials to better understand the solution and assess suitability. Research case studies and online reviews. Choose a vendor that aligns with your business needs and offers robust training and support.

Step 4: Plan for Integration

Ensure the AP system you select can seamlessly integrate with your existing ERP system (like NetSuite or SAP) and any other tools the payable department uses. Plan for any data migration and work with the vendor for any custom solutions you may need.

Step 5: Implement Automated Workflows

Design your automated workflows for invoice capture, approval, matching, and payment processing. Define approval hierarchies and rules to ensure invoices are always routed to the right place. Thoroughly test the workflows to identify any issues before going live.

Step 6: Monitor and Optimize

Watch closely and track KPIs to measure the solution’s success. Gather feedback and make necessary adjustments as needed. Doing this before rolling it out to the entire organization is wise.

Additional Steps to Consider

- Comprehensive training sessions for the AP team

- Gradual implementation with a phased approach

- Ensure regulatory compliance and data security

- Empower suppliers with self-service onboarding

How does retail accounts payable automation improve invoice processing efficiency?

Retail accounts payable automation improves invoice processing efficiency through various factors (like data capture) that optimize, accelerate, and streamline the entire AP workflow. Here are a few ways in which it enhances efficiency:

- Eliminates manual data entry using OCR technology and invoice capture

- Accelerates invoice matching and automates the entire approval process

- Improves payment scheduling while offering a variety of payment methods

- Automatically detects and flags errors for immediate review

- Real-time dashboards provide visibility into payment statuses and approvals

The right AP automation system will also facilitate compliance and policy enforcement. It will safeguard your retail business from auditing, reduce paper processes, and ensure more timely supplier payments. This technology can also improve business relationships, leading to early payment discounts and better contract terms.

How can AP automation improve vendor relationships in retail?

The faster you make payments, the happier the vendors. AP automation software for retail works to improve transparency, enhance communication, drive efficiency, and strengthen reliability. Here’s how:

Timely Payments

Prompt payments are crucial for maintaining healthy business relationships. This helps vendors better manage their own cash flow and builds trust.

Fewer Errors

Automation reduces the likelihood of errors, such as duplicate or missed payments. This ensures vendors receive accurate payments when they are due.

Enhanced Transparency

Supplier portals empower vendors to take control of their own invoice and payment management. It enhances visibility and transparency, reducing uncertainty and fostering trust.

Dispute Resolution

Accounts payable software streamlines dispute resolution, reducing the time vendors spend on follow-up. It also automates many processes and accelerates communication.

Cost Savings for All

AP automation doesn’t just help a retailer save on processing costs. By eliminating the need to submit paper invoices, suppliers can save on their own administrative costs. This becomes a win-win situation for all parties involved!

Additional Factors

- Vendors can rely on consistent payment schedules so they can better plan

- Reduced processing times, from receipt to payment

- Enhances collaborative partnerships and leverages custom solutions

- Provides detailed insights and analytics on vendor performance

- Retailers can establish performance-based incentives to reward top vendors

How do e-commerce or retail brands use affiliates or influencers to increase sales volume?

e-Commerce and retail brands use affiliates and influencers to boost sales in various ways. By harnessing the credibility and reach of these partners, companies can drive traffic, enhance brand awareness, and increase sales. Here’s how:

Affiliate Marketing

This involves partnering with individuals or companies that will promote your product/service in exchange for a commission on the sales generated from referrals. Here’s how affiliates are used to drive sales:

- Affiliate networks that provide tracking tools and payment processing

- Commission-based incentives that drive conversions and sales

- Custom promotional materials like product links, banners, and codes

- Targeted affiliate campaigns focused on specific products or promos

- Advanced analytics tools to monitor performance and track sales

Influencer Marketing

Influencer marketing involves collaborating with individuals who have built a significant following on social media. These influencers leverage their credibility and reach to promote a company’s product and/or services. Here’s how influencers are used to drive sales:

- Influencers post product reviews and endorsements to build trust

- Brands collaborate with influencers to launch new products and events

- Sponsored content is where influencers are paid to create and share media

- Influencers use affiliate links and promo codes for follower discounts

- User-generated content (UGC) provides social proof and drives sales

Integrated Strategies

Some brands use a combination of affiliate and influencer marketing to amplify their sales. For example:

- Integrated campaigns with cross-promotion of content to drive sales

- Collaborative campaigns that involve influencers and affiliates

- For major launches, brands may use both to maximize exposure

Cross-Promotions

Brands may work with both affiliates and influencers to create integrated campaigns. Affiliates can promote influencer content, while influencers can use affiliate links or promo codes to drive sales.

Recommendations